It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

In Part 16 of our blog series, we will present you the latest results of AmerisourceBergen.

Key points:

* 5.4% Y/Y sales growth in Q1 (7.5% on a constant currency basis), driven by U.S. Healthcare solutions;

* Adjusted Diluted EPS of $2.71/share in Q1, up 5% Y/Y. EPS guidance boosted by 1.5% to $11.50-11.75/share on dollar weakness;

* PharmaLex acquisition for $1.44 billion to boost services business. Net debt of about $4 billion already reflects purchase;

* Adjusted free cash flow of $584 million in Q1. $2 billion target for the full year intact;

* COVID-19 contribution at about 2.4% of EPS for the full year.

AmerisourceBergen Q1 2023 Results Overview

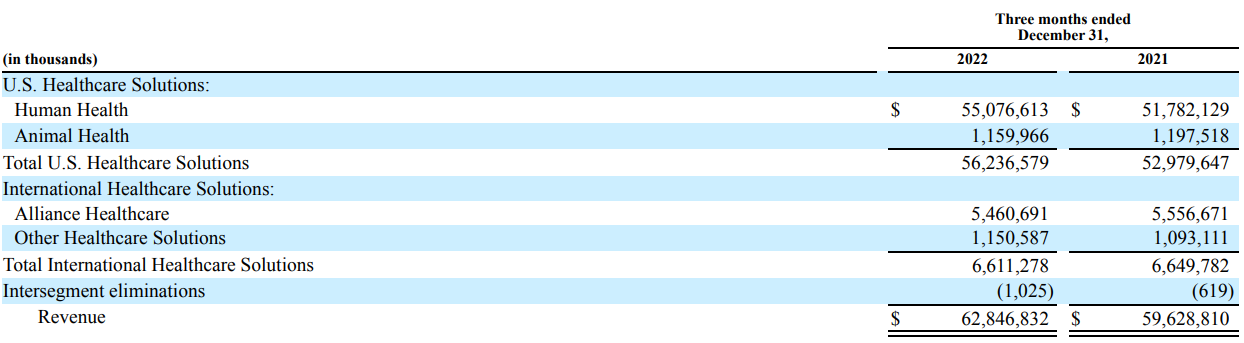

AmerisourceBergen, which is in the process of changing its name to Cencora, reports results in two main segments, namely U.S. Healthcare Solutions at 89% of Q1 2023 sales and International Healthcare Solutions at 11% of Q1 2023 sales. Below are the Q1 2023 figures as AmerisourceBergen has a fiscal year ending on September 30:

Figure 1: Q1 2023 AmerisourceBergen segment revenues

Source: AmerisourceBergen Q1 2023 Form 10-Q

Operational Overview

U.S. Healthcare Solutions grew sales 6.2% Y/Y in Q1, driven by the Human health division. Revenue growth was stronger than the 4.8% reported for fiscal 2022.

International Healthcare Solutions saw sales decline 0.6% Y/Y in Q1, well below the 129.8% fiscal 2022 growth rate which incorporated the Alliance Healthcare acquisition in June 2021. Reported results were negatively impacted by currency headwinds, with constant currency growth running at 17.7%.

On a consolidated basis, sales increased 5.4% Y/Y in Q1 (7.5% on a constant currency basis), below the 11.5% pace in 2022 which was boosted by M&A. Adjusted Diluted EPS was $2.71/share in Q1, up 5% Y/Y, below the 19.1% growth rate to $11.03/share in fiscal 2022. Adjusted free cash flow was $584 million in Q1. As highlighted on the conference call, the consolidated gross profit margin was flat Y/Y:

Consolidated gross profit was $2.1 billion, up 5% due to growth in the U.S. Healthcare Solutions segment. While each segment had better gross profit margins relative to the prior year quarter, consolidated gross profit margin was flat year-over-year as the foreign exchange impact on the higher-margin International Healthcare Solutions segment was a drag on margin growth at the consolidated level.

COVID-19 treatments contributed $0.12 (or 4.4%) to ABC's consolidated EPS compared to $0.14 in the first quarter of last year.

AmerisourceBergen Updated 2023 Outlook

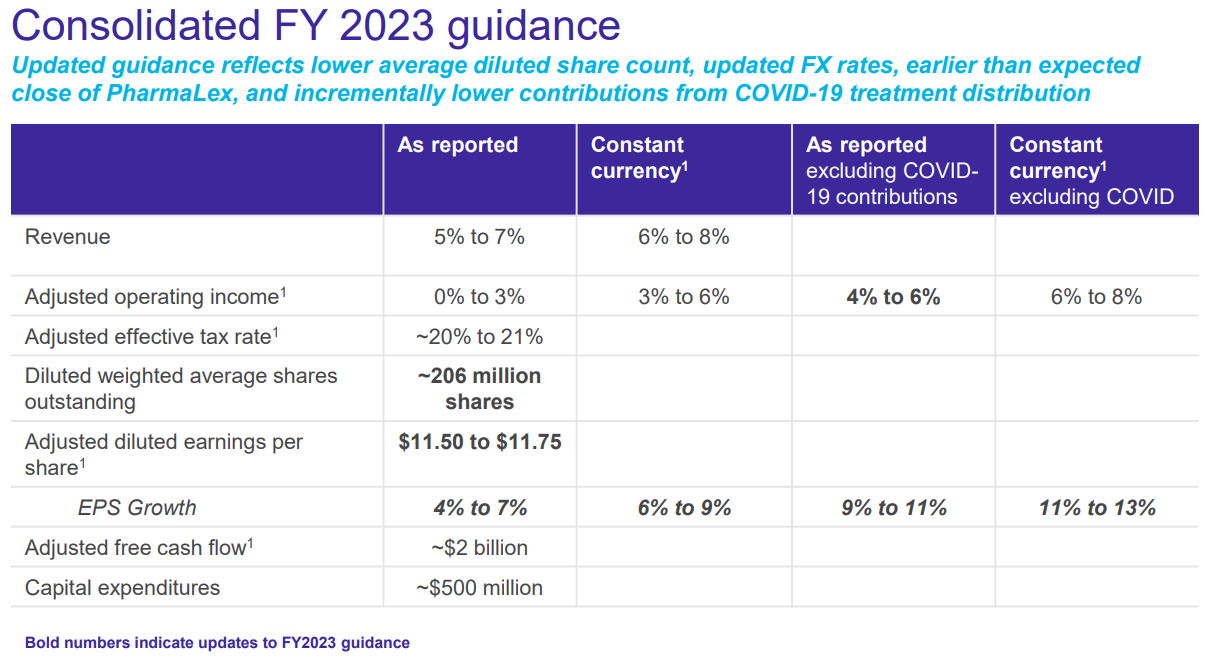

In light of dollar weakness since the initial 2023 guidance was unveiled, AmerisourceBergen boosted its Adjusted diluted EPS guidance by 1.5% to $11.50-11.75/share (from $11.30-11.60/share previously). Stronger non-COVID-19 performance was also a factor behind the increase:

Figure 2: AmerisourceBergen updated 2023 guidance

Source: AmerisourceBergen Q1 2023 Results presentation

From a division perspective, Adjusted operating income is seen slightly weaker in U.S. Healthcare Solutions and marginally stronger in International Healthcare Solutions than initially forecast.

Full year contribution from COVID-19 treatment distribution to be in the range of $0.25 to $0.30 (about 2.4% of total), down from our previous range of $0.30 to $0.35 provided in November.

The free cash flow target remains unchanged at $2 billion, down 32.8% versus the 3 billion achieved in fiscal 2022.

Cencora

As highlighted above, AmerisourceBergen intends to change its operating name to Cencora in the second half of calendar year 2023. The company remains focused on its core pharmaceutical distribution business, and at the same time increasing its presence in pharma and biopharma services.

PharmaLex

On January 1, 2023 AmerisourceBergen paid $1.44 billion to acquire PharmaLex, a leading provider of specialized services for the life sciences industry. PharmaLex's services include regulatory affairs, development consulting and scientific affairs, pharmacovigilance, and quality management and compliance. PharmaLex is headquartered in Germany and operates in over 30 countries.

The acquisition will boost ABC's presence in pharmaceutical development and commercialization services. PharmaLex will be a component of International Healthcare Solutions segment.

Capital Structure

AmerisourceBergen ended Q1 with a net debt of $4 billion,a conservative amount against its market capitalization of $30 billion and strong free cash flow generation. What is more, the PharmaLex acquisition was already prefunded and will not impact ABC's net debt position.

Diluted weighted average shares outstanding for the first quarter of fiscal 2023 were 206.3 million, a decrease of 4.8 million shares, or 2.3% versus the prior fiscal year first quarter primarily as a result of share repurchases.

Conclusion

The PharmaLex purchase is a continuation of AmerisourceBergen's drive to grow its services business, as well as its international presence. The new name Cencora reflects the company's ambitions.

ABC is enjoying strong underlying business momentum, which allows it to overcome challenges related to COVID-19 becoming endemic, as well as currency headwinds which are set to shift to tailwinds as the year progresses.

Given the evolving revenue outlook for AmerisourceBergen as it expands its presence in services, monitoring AmerisourceBergen’s public procurement activity remains a smart move that can provide key insights into the company’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy AmerisourceBergen or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.