It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Accenture recently reported its fiscal 2023 Q3 results and below we will provide a brief analysis of the company’s performance.

Key points:

* Around 13.1% of Q3 revenues awarded by public sector payers;

* Revenue up 2.5% Y/Y in Q3. Full year increase expected at 4-5%;

* Adjusted EPS of $3.19/share in Q3, up 14% Y/Y. Full year range seen at $11.52-11.63/share, up 8.1% Y/Y;

* Book-to-bill of only 1.00 in Q3, new bookings up 2% Y/Y;

* $8.5 billion net cash position and $8.1-8.6 billion of 2023 free cash flow expected, with capital deployment targeted at AI growth.

Accenture Fiscal 2023 Q3 Results Overview

Accenture delivers professional services in five main segments, called Industry groups. The company has a fiscal year ending on August 31. We originally covered Accenture's Q2 results in part 25 of our Top Government Contractors series. Below we will highlight the progress achieved in Q3 2023.

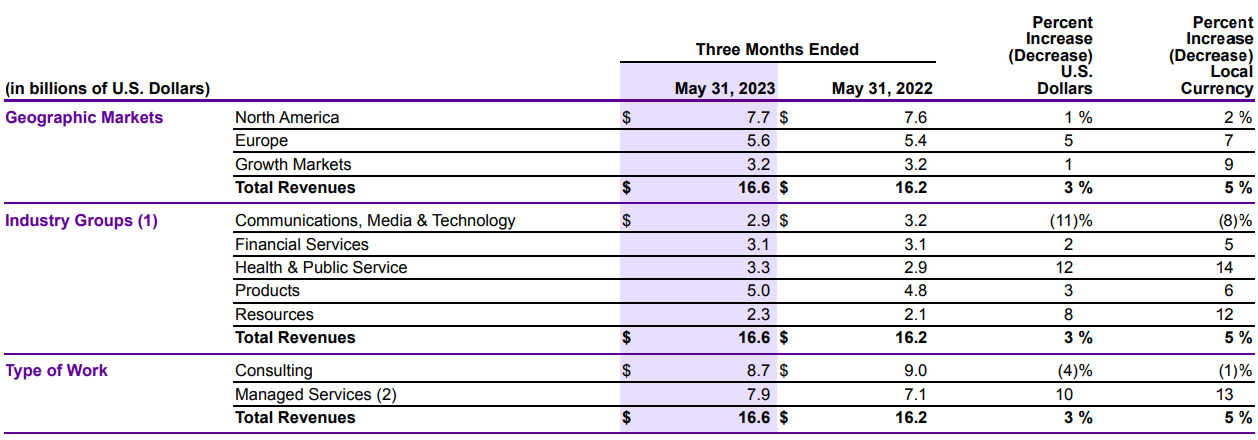

Ranked from largest to smallest, the Industry groups are Products (customers in consumer goods, industrial and life sciences) at 30.1% of fiscal Q3 2023 revenues, Health & Public Service at 19.9%, Financial Services at 18.7%, Communications, Media & Technology at 17.5% and Resources (customers in chemicals, natural resources, energy and utilities) at 13.9% of fiscal Q3 2023 revenues:

Figure 1: Fiscal Q3 2023 Accenture Industry group results

Source: Accenture form 10-Q for Q3 fiscal 2023

Within the Health & Public Service segment, some 66% of fiscal 2022 revenues were in the Public sector, while the rest were in the Health sector. As a result, around 13.1% of total Q3 2023 Accenture revenues were awarded by public sector payers.

Operational Overview

Looking at the five industry groups, reported results on a year-over-year basis were all negatively impacted by USD strength.

Products saw its sales increase 4.1% Y/Y in Q3 (2022 +27%).

Health & Public Service was the best performing industry group, increasing sales 13.8% Y/Y in Q3 (2022 +18%).

Financial Services revenue was flat Y/Y in Q3 (2022 +19%).

Communications, Media & Technology was the only contracting industry group in the quarter, down 9.4% Y/Y (2022 +24%).

Resources was the second-best performer in Q3, with sales up 9.5% Y/Y (2022 +18%).

On a consolidated basis, sales increased 2.5% Y/Y in Q3 (2022 +22%). Adjusted EPS was $3.19/share, up 14% Y/Y. (2022 $10.71/share). EPS outperformed sales thanks to a 0.2% operating margin gain. Free cash flow was $3.15 billion in Q3 (2022 $8.8 billion).

Updated 2023 Outlook

Given decelerating performance into year-end, Accenture cut its 2023 revenue outlook but notched up EPS and free cash flow expectations on fading dollar strength:

Revenue growth of 8-9% in local currency (previous 8-10%). Negative FX impact of 4% (previous 4.5%).

Adjusted operating margin 15.4%, up 0.2% Y/Y. (no change versus previous guidance)

Adjusted EPS of $11.52-11.63/share, up 8.1% Y/Y.

Free cash flow of $8.1-8.6 billion, down 5.1% Y/Y (previous guidance $8-8.5 billion).

New Bookings

Accenture marked new bookings in the quarter of $17.25 billion, down 21.9% Q/Q (Q2 was a record for the company) but up 2% Y/Y. As a result, the book-to-bill ratio was 1.00 in Q3 (2022 1.20).

Capital Structure

Accenture is sitting on a net cash position of $8.5 billion, making it one of the most conservative companies in our government contractors series. The market capitalization stands at $195 billion.

Year-to-date, the company has spent $3.3 billion on buybacks and $2.1 on dividends from $5.8 billion in free cash flow. Accenture also allocated $1.3 billion to 5 M&A transactions in strategic growth areas, as highlighted by CEO Julie Sweet:

We invested in cloud, data and AI with the acquisition of Nextira in North America, Objectivity in the U.K. and Einer in Norway. We also invested in sustainability with the acquisition of Green Domus in Brazil, and in modern ERP services with Bourne Digital in Australia. We continue to take market share, growing about 2 times the market.

Conclusion

Accenture is experiencing decelerating revenue momentum, with all Industry groups growing below 2022 levels. The silver lining is that outright declines are limited to the Communications, Media & Technology segment, with the rest of the company growing, in local currency terms, 7% in North America, 9% in Europe and 10% in Growth Markets (Asia Pacific, Latin America, Africa and the Middle East).

While underlying momentum is slowing, currency headwinds are abating as well, with 2.5% reported top-line growth marginally below the 5% constant currency rate.

Accenture estimates it is growing two times faster than its relevant public peer group, with Artificial Intelligence a key focus area (CEO Julie Sweet):

...Just as we have successfully done with cloud, we are investing to take an early lead, and position for the opportunity ahead. Last week, we announced a $3 billion investment in AI, a big step to accelerate our clients' reinvention journey, which includes us doubling our data and AI workforce from 40,000 to 80,000 strong, including the expansion of our center for advanced AI that today has over 1,600 generative AI experts...

In light of the fact that Accenture is an active player on the public procurement field, monitoring its activity remains remains a smart move that can provide key insights into the company’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Accenture or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.