It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

In Part 20 of our blog series, we will present you the latest results of AECOM.

Key points:

* Revenue up 3.5% Y/Y in Q1, after 3% growth in fiscal 2022. Performance driven by the Americas segment (+4.7% Y/Y).

* EPS of $0.86/share in Q1 (-3% Y/Y). Target of $3.55-3.75/share in fiscal 2023 confirmed (+5.2% Y/Y).

* Book-to-burn of 1.3 in Q1 and 1.2 in fiscal 2022. 9% Y/Y backlog growth to a record $19.9 billion.

* Net debt of $1.1 billion. 80% fixed rate with no maturities until 2027.

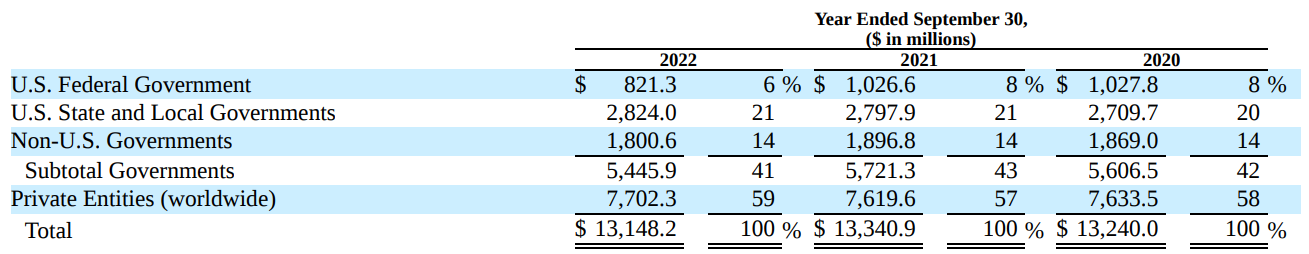

* 41% of revenue came from government customers in fiscal 2022, split by U.S. State and Local (21%), Non-U.S. Governments (14%) and U.S. Federal Government (6%).

AECOM Q1 2023 Results Overview

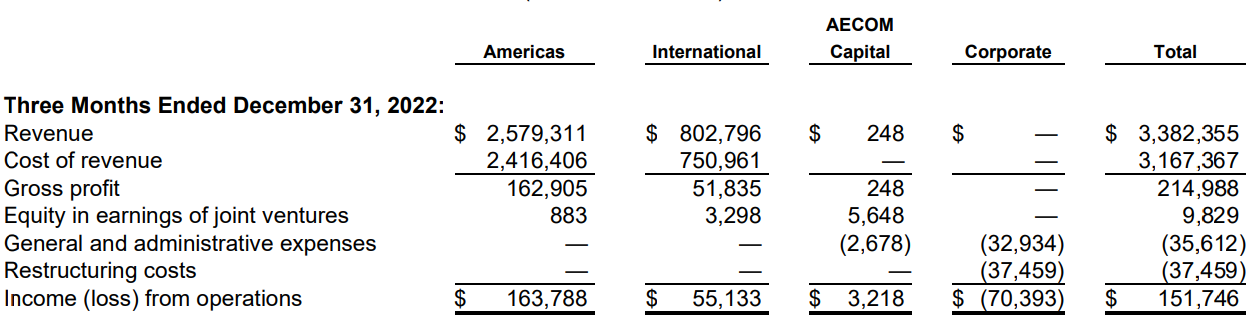

Infrastructure consultant AECOM has a fiscal year ending on September 30. Thus, we will highlight the company's results for the period ending December 31, which is the first quarter of fiscal 2023. AECOM reports results in three main segments, namely Americas (services in U.S., Canada and Latin America) at 76.2% of Q1 2023 revenue, International (services in Europe, Africa, Asia and Oceania) at 23.7% of Q1 2023 revenue and AECOM Capital (develops real estate projects) which brings in 2.1% of income from operations thanks to equity stakes in joint ventures:

Figure 1: AECOM segment revenues, $ in thousands

Source: AECOM Q1 2023 Earnings Press Release

Operational Overview

Americas saw revenue growth of 4.7% Y/Y in Q1 of fiscal 2023, an improvement to the 2.8% decline observed in fiscal 2022. The gross profit margin improved to 6.3% from 6.1% in the prior year quarter (however below the 6.4% for fiscal 2022).

International revenue was flat Y/Y in Q1, underperforming the 3% growth rate observed in 2022. Nevertheless, the gross profit margin marked an 0.3% Y/Y increase to 6.5% (6.4% in fiscal 2022).

On a consolidated level, revenue was up 3.5% Y/Y in Q1, outperforming the 3% growth achieved in 2022. The gross profit margin was 6.4% in the first quarter, in line with the result achieved in fiscal 2022. Free cash flow was $84 million in Q1 ($586 million in 2022). Adjusted EPS was $0.86/share ($3.47/share in 2022), down 3% Y/Y, with a higher tax rate, foreign exchange and interest rate headwinds offsetting organic growth.

AECOM 2023 Outlook

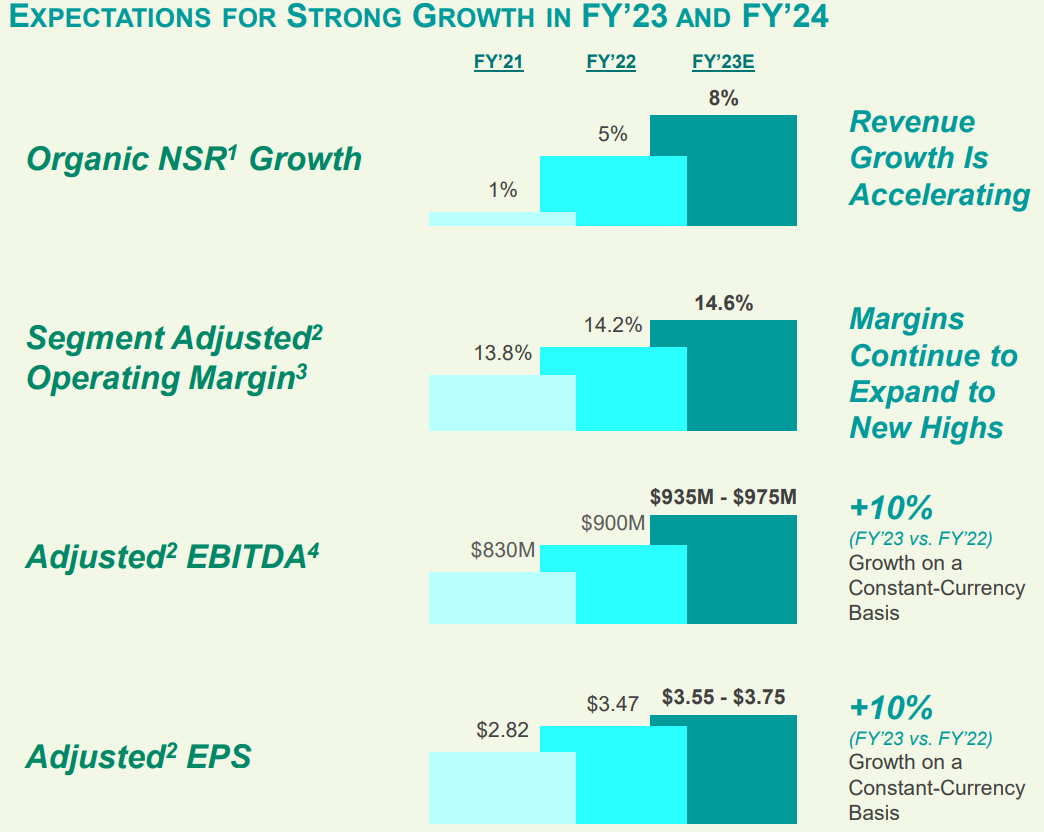

Following the strong start of the year, AECOM reiterated its 2023 outlook, with NSR (net services revenue) growth of 9% in Q1 in-line with the 8% target for 2023:

Figure 2: AECOM 2023 Outlook

Source: AECOM Q1 2023 Earnings Presentation

The segment operating margin was 14% in the quarter and is forecast to improve to 14.6% for the full year. In fiscal 2024, AECOM targets 15%.

Adjusted EBITDA and EPS are both forecast to increase by 10% Y/Y in constant currency. For reference, adjusted EBITDA increased 8% in Q1. While Adjusted EPS was down 3% Y/Y, the company expressed confidence in reaching its 2023 goal of $3.55-3.75/share, building on its target of $4.75/share in fiscal 2024.

Looking beyond 2024, AECOM targets further improvement - a segment adjusted operating margin of 17% and return on invested capital of 17%.

Backlog

AECOM's book-to-burn ratio was 1.3 in Q1 (defined as the dollar amount of wins divided by revenue recognized during the period, including revenue related to work performed in unconsolidated joint ventures), an improvement to the 1.2 recorded in fiscal 2022. As a result, the design backlog grew 9% Y/Y to a record $19.9 billion.

The company is not resting on its laurels, with bids submitted & proposals up 30% Y/Y in Q1. This should continue to underpin backlog growth in the coming quarters. What is more, the backlog is becoming more profitable, as discussed on the conference call:

And in terms of the margin profile and what we're winning, the margin profile continues to get better, which again, is part that gives us confidence in expanding margins as we move forward. If you go back a few years, the margins that currently exist in our backlog by comparison are up more than a few percentage points.

Capital Structure

AECOM ended Q1 with a net debt of $1.1 billion, a conservative amount against its market cap of about $11.6 billion and strong free cash flow generation. What is more, 80% of the debt is fixed or swapped with bond maturities until 2027.

Going forward, top priority for capital deployment will be organic growth, followed by dividends and share buybacks. Case in point, in January the company increased its quarterly dividend by 20% to $0.18/share.

Regarding M&A, CEO Troy Rudd highlighted the difficulty in finding assets at a reasonable price:

And when you contrast that to doing M&A, we just had a difficult time being comfortable, that doing transactions at 15x earnings in businesses that really have organic growth opportunities that are in the mid-single digits, or certainly, they can reach double digits at certain points in time, it is hard for that return on the capital being deployed at a 15x transaction to make sense.

Conclusion

As highlighted on the conference call, AECOM benefits from three secular megatrends:

- Growing global infrastructure investments

- Investments in sustainability and resilience

- Post-COVID supply chain and asset investments

With a solid financial footing and a robust organic pipeline, the company is making good progress on its 2023-2024 performance targets.

Figure 3: AECOM Customer Breakdown, 2020-2022

Source: AECOM Fiscal 2022 Form 10-K

In light of the fact that over 40% of AECOM sales were to the government buyers over the past three fiscal years, monitoring the company’s public procurement activity also remains a smart move that can provide key insights into Skanska’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy AECOM or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.