It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Booz Allen Hamilton recently reported its Q1 2023 results and below we will provide a brief analysis of the company’s performance in the first 3 months of the year.

Key points:

* 97% of all sales to U.S. government; the company is the Federal government's biggest supplier of AI services, with the segment growing 20% Y/Y;

* Revenue up 8.7% Y/Y in Q4 and 10.7% in 2023; 9% growth expected for 2024, with strength in H1;

* Adjusted Diluted EPS of $1.01/share in Q4 (+17.4% Y/Y) and $4.56/share in 2023 (+8.3% Y/Y). 2024 forecast at about $4.88/share (+6.9% Y/Y);

* Free cash flow of $527 million in 2023, down 19.8% Y/Y. 2024 forecast at about $450 million (down 14.6%) on higher capex, cash taxes, interest expense and working capital build;

* 6.7% Y/Y backlog growth with a trailing twelve month book-to-bill of 1.18.

Booz Allen Hamilton Q1 2023 Results Overview

We originally covered Booz Allen Hamilton's Q3 2023 results (the company has a fiscal year ending in March) in part 12 of our Top Government Contractors series here. Below we will highlight the progress achieved in the last quarter of fiscal 2023.

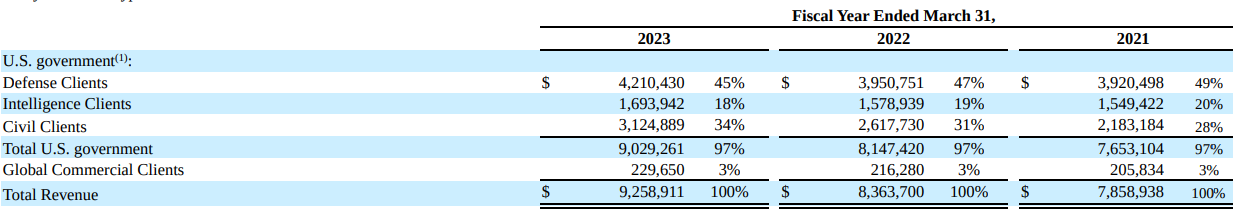

Booz Allen Hamilton reports revenues in three main customer segments, namely Defense Clients at 45% of 2023 revenue, Intelligence Clients at 18% and Civil Clients at 34% of 2023 revenue:

Figure 1: 2021-2023 Booz Allen Hamilton segment revenues. (All amounts in thousands.)

Source: Booz Allen Hamilton Form 10-K for 2023

Overall, 97% of sales were made to the U.S. government.

Operational Overview

Defense Clients was the weakest segment in fiscal 2023, growing revenues 6.6%. Its share of total revenues has declined from 49% in 2021 to 45% in 2023.

Intelligence Clients registered a sales increase of 7.3% in 2023. The segment has also seen its share of total revenues decline from 20% in 2021 to 18% in 2023.

Civil Clients was the top performing segment in 2023, registering a 19.4% revenue increase. Helped by M&A, the segment has grown dramatically, from just 28% of 2021 revenues to 34% in 2023.

Segment growth drivers were health and citizen services accounts, cyber and digital services offerings.

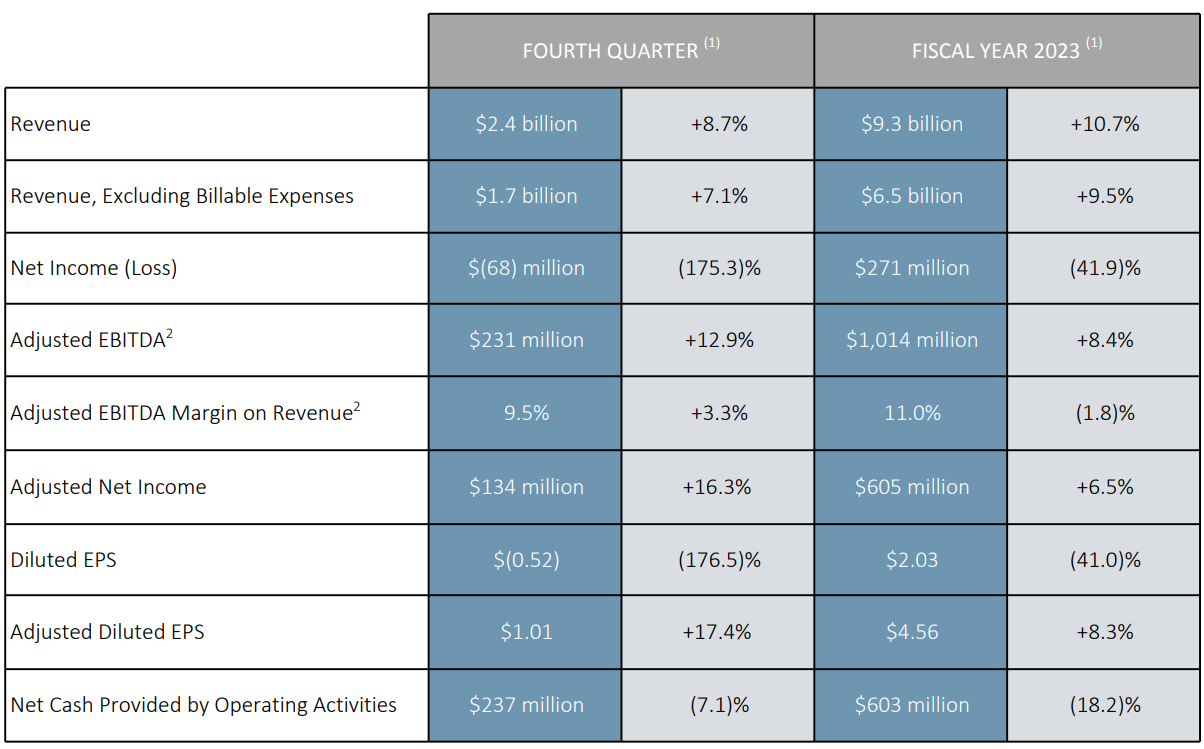

On a consolidated basis, sales increased 8.7% Y/Y in Q4 and 10.7% in 2023:

Figure 2: Booz Allen Hamilton Q4 and 2023 key performance indicators

Source: Booz Allen Hamilton Results Presentation for Q4 2023

Adjusted EBITDA grew 12.9% in Q4 and 8.4% in 2023.

Adjusted Diluted EPS was $1.01/share in Q4 (+17.4% Y/Y) and $4.56/share in 2023 (+8.3% Y/Y).

Free cash flow was $527 million in 2023, down 19.8% Y/Y, impacted by higher tax payments on R&D capitalization, higher interest rates and business investments.

Non-adjusted results were impacted by an additional $226 million provision for a U.S. Department of Justice investigation recorded in Q4. This brings the total provision to $350 million as the company seeks to reach a settlement for misconduct in the period 2011-2021.

2024 Outlook

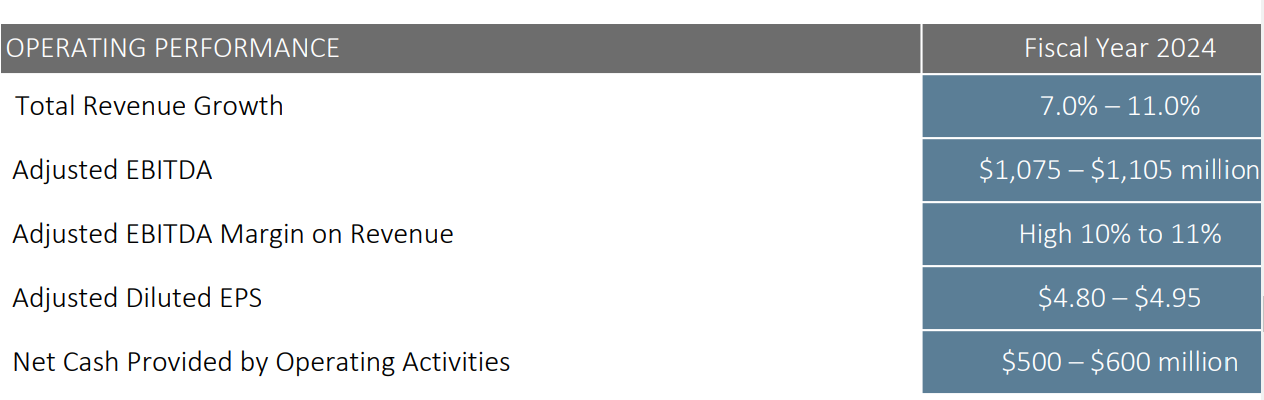

In line with the trend observed in Q4, Booz Allen Hamilton expects top-line growth to moderate in:

Figure 3: Booz Allen Hamilton 2024 Guidance

Source: Booz Allen Hamilton Q4 2023 Results Presentation

- Revenue is expected to increase by 9% Y/Y;

- Adjusted Diluted EPS is seen at about $4.88/share, up 6.9% Y/Y;

- Adjusted EBITDA is set to rise to $1,090 million, + 7.5% Y/Y, with a goal of $1,250 million in fiscal 2025;

- Net cash provided by operating activities is set to drop by about 8.8% to $550 million;

- Capital expenditures are seen at about $95 million, up 25% Y/Y;

- Free cash flow is seen at about $450 million, down 14.6% Y/Y, impacted by higher cash taxes, interest rates and working capital build.

Looking into Q1, the company expects revenue to be at or above the forecast yearly average increase.

Backlog

The backlog returned to growth in Q4, growing 4% Q/Q to $31.2 billion, with a book-to-bill ratio of 1.47 in the quarter. The backlog is up 6.7% Y/Y while the trailing twelve-month book-to-bill is 1.18.

Capital Structure

Booz Allen Hamilton ended Q1 with a net debt of about $2.4 billion. This compares with a market capitalization of $13.5 billion. Should a settlement with the Department of Justice be reached for around $0.35 billion, it would limit the company's ability to pursue selective M&A deals or share repurchases.

In fiscal 2023, discretionary capital deployment of $905 million consisted of:

- $445 million of M&A (EverWatch acquisition boosting classified software offering);

- $224 million in buybacks;

- $236 million in dividends

Contract varieties

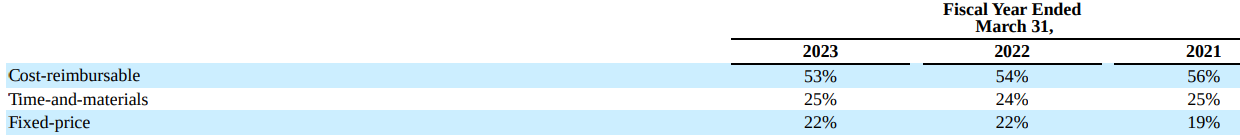

Following our deep dive into government contract varieties and their interaction with inflation (available to read here), below we highlight how Booz Allen Hamilton's business has evolved over the years from a contracting point of view:

Figure 4: Booz Allen Hamilton contract mix, 2021-2023

Source: Booz Allen Hamilton Form 10-K for 2023

Cost-reimbursable contracts, which are most protected from inflation and come with more reliable profits, have seen their share drop from 56% in 2021 to 53% in 2023.

Time-and-materials contracts, a fixed-price contract variety under which the company receives a fixed hourly rate for each direct labour hour expended, and is reimbursed for billable material costs and billable out-of-pocket expenses inclusive of allocable indirect costs, has had a stable contribution of about 25% over the past three fiscal years.

Fixed-price contracts, which are most sensitive to inflation and offer less visibility on contract profitability, have grown in importance - from 19% in 2021 to 22% in 2023.

Conclusion

Booz Allen Hamilton is making the necessary investments to reach its 2025 targets. Client staff is up 10.6% Y/Y, in line with revenue growth. Free cash flow generation is likely to trough this year before returning to growth in 2024.

Booz Allen Hamilton also boasted its position as the key provider of artificial intelligence services to the federal government, with the segment growing 20% in fiscal 2023.

In light of the fact that 97% of Booz Allen Hamilton sales are to the U.S. government, monitoring the company’s public procurement activity remains a smart move that can provide key insights into Booz Allen Hamilton’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Booz Allen Hamilton or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.