It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

In the sixth article of our new blog series, we will present you the latest results of CACI International Inc. – a renowned government supplier that had 95% of its revenues from the Department of Defense and federal civilian agencies in the past 3 years.

Key points:

* 95% of CACI's revenues over the past 3 years have been from the Department of Defense and Federal civilian agencies;

* Expertise revenue up 8% Y/Y in Q2, bucking a trend of sales declines in 2022 and 2021. Technology revenue up 13.5%;

* Overall sales up 11% Y/Y in Q2 (6% organic), an acceleration to 3% growth in 2022;

* 2023 Guidance confirmed with a $95 million reduction to free cash flow due to higher tax payments. Softer revenue growth expected in H2 2023;

* 2.1 book-to-bill ratio in the quarter; 1.5 for the past 12 months.

CACI 2023 Q2 Overview

CACI International has a fiscal year ending in June. Hence the current article highlights the company's Q2 of fiscal year 2023.

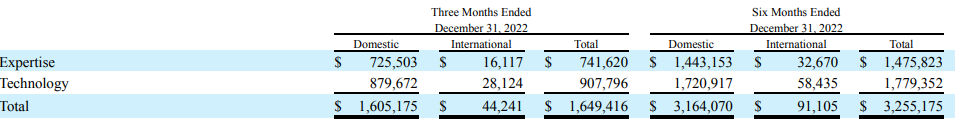

CACI reports results in two main business segments – Expertise (Consulting, Business analysis, Software development and Operations support) at 45% of Q2 2023 revenues and Technology (Data platforms, AI, Networks, Cyber security) at 55% of Q2 2023 revenues:

Figure 1: CACI Q2 2023 Results by Segment

Source: CACI International 10-Q Form Q2 2023

Operational Overview

Expertise revenue grew 8% Y/Y in Q2, reversing a trend of declines in 2022 (-3.5%) and 2021

(-1%).

Technology delivered 13.5% Y/Y revenue growth in Q2, an acceleration to growth in 2022 (8.5%) and 2021 (13%).

On a company level, sales rose 11% Y/Y in Q2 (6.2% organic excluding acquisitions), an uptick to the 3% increase recorded in 2022. The Adjusted EBITDA margin was 10.2%, marginally below the 10.3% in 2022. Adjusted diluted EPS were $4.28/share in Q2, down 2.5% Y/Y.

Free cash flow at just $9.1 million in the quarter was impacted by tax payments.

Progress on 2023 Outlook

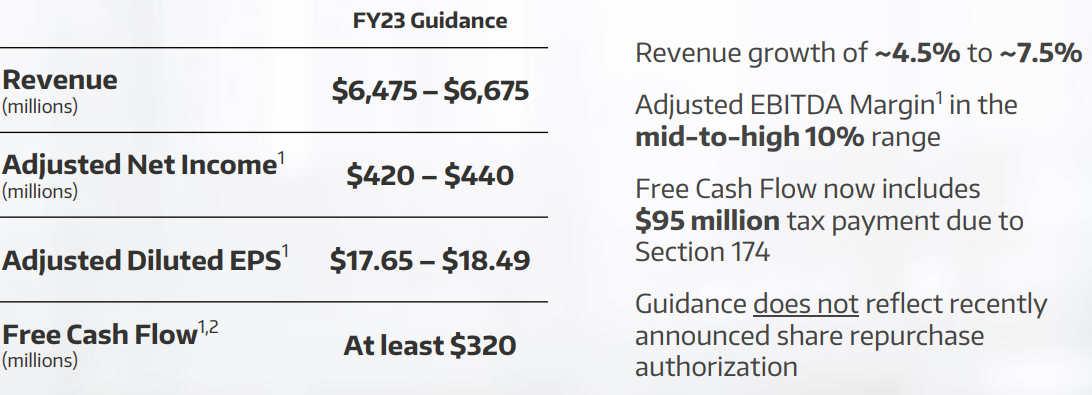

The company reaffirmed its 2023 guidance with the exception of free cash flow:

Figure 2: Updated CACI 2023 Guidance

Source: CACI International Earnings Presentation Q2 2023

The previous cash flow guidance was at least $415 million. As can be seen from Figure 2 above, the reduction of $95 million is due to a tax payment related to R&D expensing (R&D expenditures have to be capitalized on the balance sheet and amortized over time, resulting in upfront tax payments due to higher reported earnings).

Notwithstanding the cash flow update, the company is confident in meeting its revenue and adjusted EPS guidance. Revenue growth is seen decelerating slightly into H2 2023.

Backlog

The backlog grew 10% to $26.5 billion. With contract awards of $3.5 billion in the quarter the book-to-bill ratio was 2.1 in Q2 and 1.5 on a trailing 12-month basis.

65% of submitted bids pipeline is for new business. For the next two quarters 75% of submitted bids are expected to be for new business.

Capital Structure

CACI ended Q2 with net debt of around 1.45 billion which is still fairly conservative against a market capitalization of $6.95 billion. Case in point, the company allocated $250 million to buy back shares. This is part of a $750 million buyback authorization enacted on January 24th.

Conclusion

CACI enjoys a strong product pipeline and a swelling backlog. Even though a slowdown in sales growth is expected for H2 2023, management is confident in meeting the company's updated guidance. Furthermore, the company is strategically positioned to capture future growth drivers such as cyber security and space technologies.

In light of the fact that 95% of CACI's revenues over the past 3 years have been from the Department of Defense and federal civilian agencies, monitoring public procurement activity remains a smart move that can provide key insights into the company’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy CACI International or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.