Key Points:

- The last U.S. recession lasted just 2 months but saw 14.7% unemployment and a 19.2% GDP contraction;

- With a shrinking FED balance sheet and rapid rate rises, many economists and models prescribe an elevated recession probability in the next 12 months;

- The U.S. budget deficit hit 15% in 2020 and 12.1% in 2021, levels unlikely to be reached in a potential recession given the high inflation backdrop;

- Government contractors are likely to outperform in a recession, thanks to stable revenues and the ability to absorb resources freed from the private sector in distress;

- Some government contractors, such as those operating in infrastructure or green technologies, may actually grow during a recession.

Current Background

The United States is currently in an economic expansion that started with the end of the last U.S. recession in April 2020, which was arguably an outlier:

- It lasted between February and April 2020, the shortest recession ever.

- GDP declined by 19.2%, the second largest contraction after the Great Depression.

- Unemployment peaked at 14.7% in April 2020, the highest in a U.S recession since 1945.

The recession was cut short by a record amount of government spending, with the U.S. budget deficit at 15% in 2020 and 12.1% in 2021. Going back to 1929, U.S. deficits were larger only during World War II.

The response from monetary policy was equally robust, with the Federal Reserve balance sheet expanding from $4.2 trillion to $7.2 trillion between February and June 2020, before peaking at almost $9 trillion in April 2022.

Is a New Recession Around the Corner?

With the Federal Reserve currently shrinking its balance sheet (it is down 8% from its peak to $8.3 trillion) and embarking on one of the fastest rate hiking cycles, many economists wonder whether the US is on the cusp of another recession, this time driven by the Federal Reserve's efforts to contain inflation.

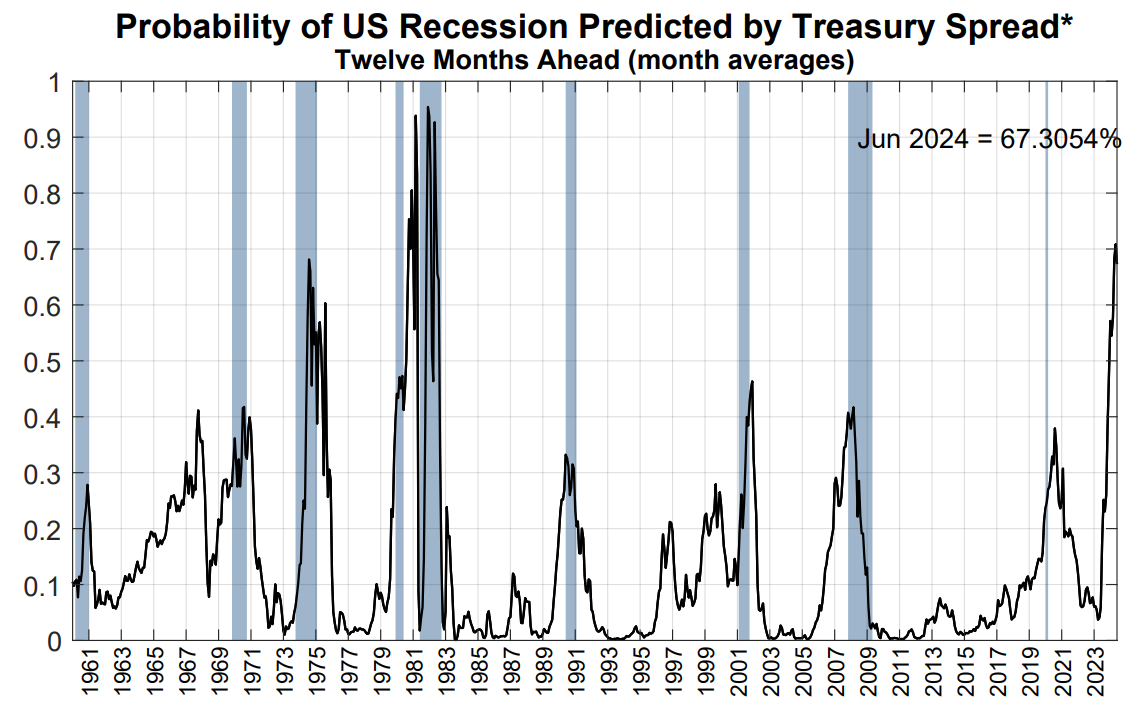

The Federal Reserve bank of New York publishes a recession probability indicator based on the difference between the 10-year and 3-month Treasury rates. The greater the inversion of the yield curve (i.e., 3-month rates are higher than 10-year rates), the greater the recession probability. The model currently prescribes a 67% recession probability in June 2024:

Figure 1: Recession odds, 1961-2024. Blue areas indicate recessions

Source: New York FED

Government Spending and Recessions

Recessions are typically associated with government stimulus spending to mitigate the effects of higher unemployment and reduced business investment.

However, given the current economic backdrop – high inflation driven by too much monetary and fiscal stimulus, it is fair to assume that should a recession strike in the next few quarters, government stimulus will be more limited in size.

Nevertheless, monitoring government spending trends can be a valuable tool when it comes to navigating a recessionary environment.

Safety in Government Contractors During a Recession

Government contractors are likely to go through a recession in better shape than their private sector counterparts. Government tenders are often multi-year, offering revenue reliability in an uncertain economic environment. What is more, government contractors may be able to attract valuable human resources laid off from the private sector – manpower is a key business constraint faced by many corporations currently.

Government contractors are also likely to benefit from stimulus spending, which may more than compensate the losses incurred from lower commercial sales to customers in the private sector.

Thus, it is fair to assume the combined effect of revenue and earnings reliability, coupled with exposure to stimulus spending, may result in government contractors emerging from a recession in better shape than their private sector counterparts.

How TenderAlpha Data Can Help

TenderAlpha offers company-specific procurement data on over 9,000 public companies. While some traditional government contractors, such as Lockheed Martin, Boeing or General Dynamics operate under multi-year contracts which are unlikely to grow during a recession (the silver lining is they will likely not be decreased either), other government contractors, such as infrastructure consultant AECOM or Sweden-based Skanska (which had 45% of its 2022 construction revenue in the U.S.), are in good position to benefit from elevated infrastructure spending during a recession.

Aside from infrastructure, green technologies are another likely government stimulus avenue, with the likes of General Electric and Siemens likely to be awarded government tenders.

Company Financials During a Recession

Private sector-focused companies usually experience reduced sales during a recession, straining their ability to pay dividends and service debts. On the other end of the spectrum, government contractors are likely to stay in good financial health throughout a recession, leading to share price outperformance in a likely bear market.

Thus. monitoring public procurement activity remains a smart, yet lesser-known move that can give an advantage when assessing the impact of new tender awards on public companies. This was examined in TenderAlpha's 'Government Receivables as a Stock Market Signal' white paper.

Conclusion

The last U.S. recession was very severe by historical standards, cushioned with a record amount of fiscal and monetary stimulus.

While economists and models such as the NY FED yield inversion tool prescribe a high probability of a U.S. recession in the next 12 months, forecasters agree that it should not be as severe as the one in 2020. At the same time, given the high inflation backdrop, stimulus is likely to be more limited in size as well.

Government contractors are more likely to survive a recession thanks to their stable markets and predicable revenues. Some may even emerge from a recession in a better shape than before thanks to targeted government stimulus in areas such as infrastructure and green technologies.

Recessions are typically associated with lay-offs, corporate restructuring and falling profits. At the same time, companies working with the government may enjoy cash flow predictability, which, in turn, will improve their prospects in the market as well as potentially increase the company's share price.

To learn more about the ways in which TenderAlpha can provide you with insightful forward-looking public procurement data, get in touch now!