It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Cardinal Health recently reported its quarterly results and below we will provide a brief analysis of the company’s performance between January and March of this year.

Key points:

* US pharmaceutical market up 7% compounded over the past 10 years in USD. Generic unit sales expected to increase 2-3% in 2023-2026;

* Revenue up 12.6% Y/Y in Q3, driven by the Pharmaceutical segment. Fiscal 2024 growth seen at 10% for Pharmaceutical and 3% in Medical;

* Q3 EPS of $1.74/share, up 20% Y/Y. Full year growth seen at 12.6% in fiscal '23 and 15% in '24;

* $0.7 billion in net debt and $5.85 billion in opioid liabilities to be paid over 17 years;

* Around $2 billion in free cash flow expected annually, with capex growing faster than sales.

Cardinal Health Q3 2023 Results Overview

We initially covered Cardinal Health's Q2 2023 results in part 18 of our Top Government Contractors series here. As the company has a fiscal year ending on June 30, below we will highlight the progress achieved in Q3 2023.

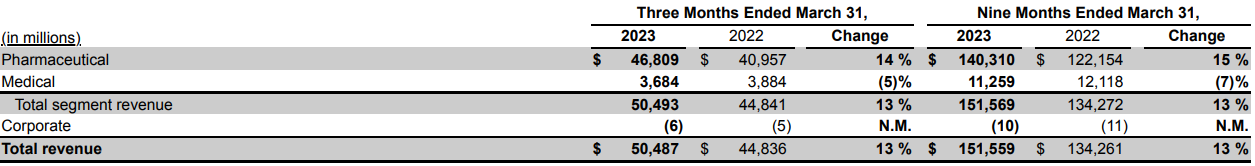

Cardinal Health reports results into two main segments, namely Pharmaceutical (covers branded and generic pharmaceuticals for the U.S. market, as well as a variety of pharma services) at 92.7% of Q3 2023 revenues and Medical (covers Cardinal Health branded products for U.S. and overseas markets, as well as medical and surgical products) at 7.3% of Q3 2023 revenues:

Figure 1: Q3 2023 Cardinal Health segment revenues

Source: Cardinal Health Q3 2023 Form 10-Q

Operational Overview

Pharmaceutical delivered 14.3% Y/Y revenue growth in Q3 (2022 +13.5%). Results were driven by branded and specialty pharmaceutical sales growth, mainly to existing customers. Margin performance was even stronger (+0.09% to 1.28% in Q3), resulting in a 23.2% Y/Y increase in Q3 segment profit, thanks to the generics program and an increased contribution from branded and specialty pharmaceutical products.

Medical saw its sales decline by 5.1% Y/Y in Q3 (2022 -4.8%). The weak performance was due to lower sales of personal protective equipment. Segment profit crashed 66.1% Y/Y in Q3 due to lower volumes and unfavourable product sales mix. The segment profit margin shed 0.98% to 0.54% in Q3.

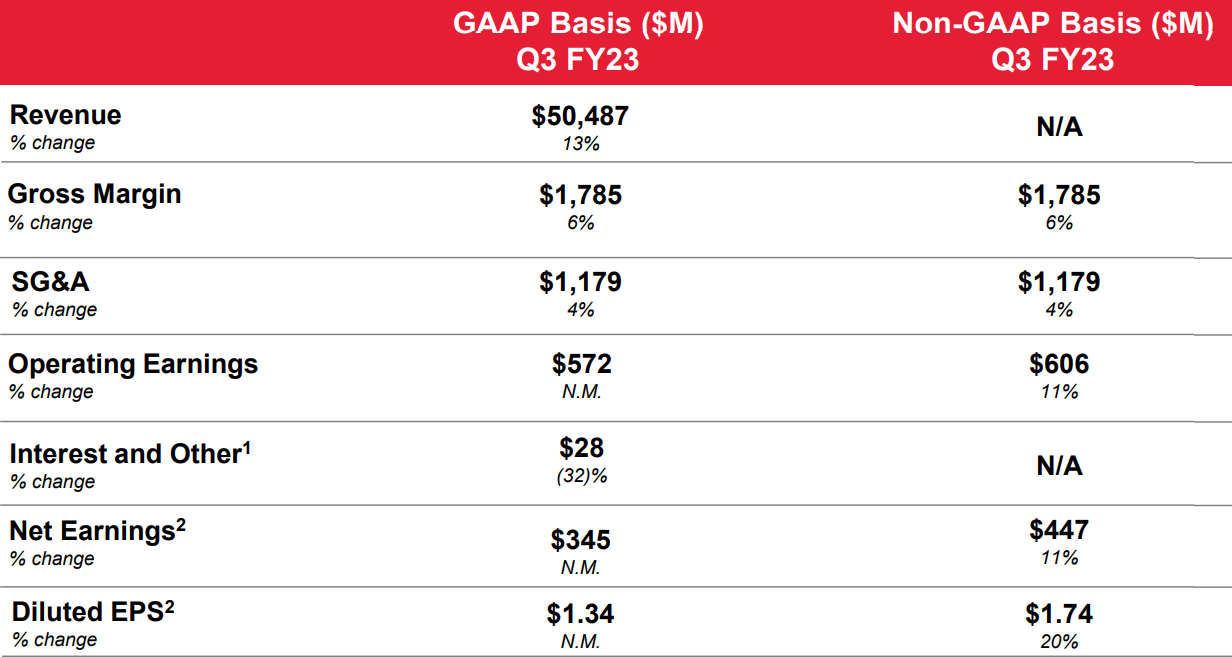

On a consolidated basis, revenues grew 12.6% Y/Y in Q3, slightly ahead of the 11.6% increase achieved in 2022. Non-GAAP diluted EPS was $1.74/share in Q3, up 20% Y/Y (2022 $5.06/share):

Figure 2: Q3 2023 Cardinal Health results summary

Source: Cardinal Health Q3 2023 Results Presentation

Adjusted free cash flow was $1.3 billion in Q3 and $2.1 billion in the first 9 months (FY 2022 total $2.3 billion).

2023 Outlook

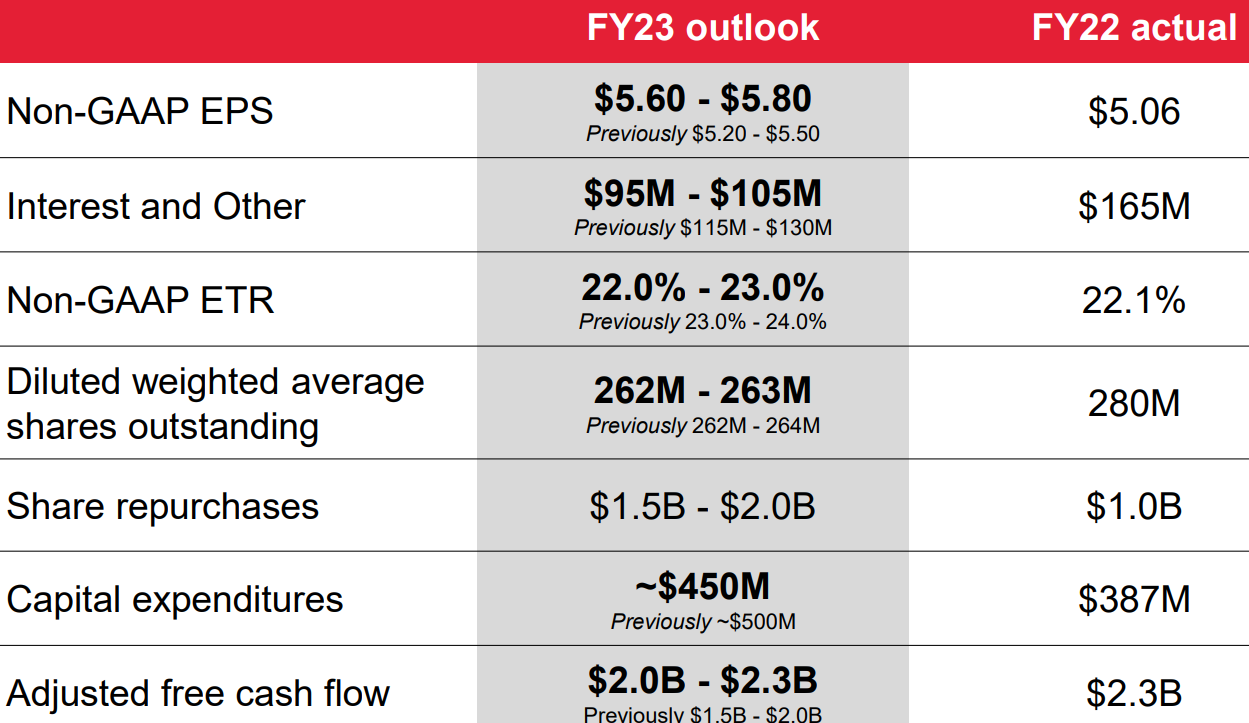

Thanks to strength in the Pharmaceutical segment, as well as a lower share count, Cardinal Health boosted its Non-GAAP EPS guidance to $5.60-5.80/share:

Figure 3: Cardinal Health updated 2023 outlook

Source: Cardinal Health Q3 2023 Results Presentation

The new EPS forecast is about 12.6% higher than the $5.06/share achieved in fiscal 2022.

Free cash flow guidance was also increased to about $2.15 billion, still down 6.5% Y/Y, helped by a smaller increase in capital expenditures.

2023 Investor Day

Cardinal Health also held its investor day on June 8. Here are our takeaways:

For the pharmaceuticals market as a whole:

- US pharma market grew 7% compounded (in USD) over the last 10 years;

- 2-3% generic unit market growth expected annually in 2023-2026;

For Cardinal Health on a consolidated level:

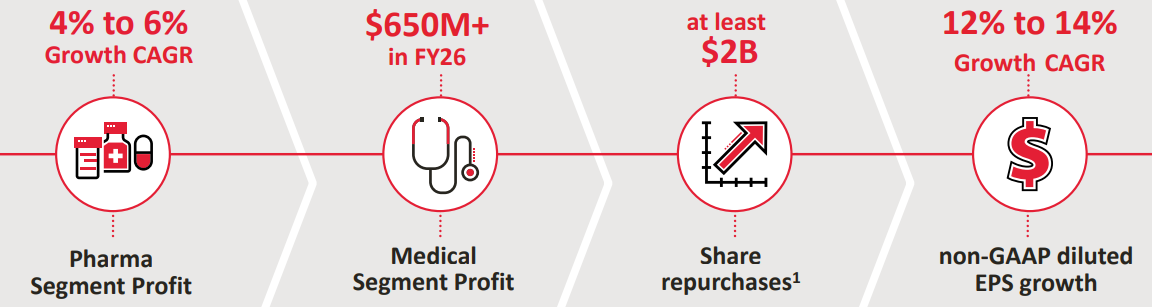

- EPS of $6.45-6.70/share expected in fiscal 2024, up 15% Y/Y; 12-14% EPS growth expected long-term.

- 4% decrease in shares outstanding in fiscal 2024.

- Fiscal 2024 free cash flow of $2 billion despite capex growth of 11%.

And across segments:

- In fiscal 2024, Pharmaceutical segment should grow revenues 10%, and segment profit 4-6%.

- In fiscal 2024, Medical segment should increase revenues 3%, with segment profit up fourfold over 2023 (from $100 to $400 million) - reaching 60% of 2026 target of $650 million.

Figure 4: Cardinal Health 2024-2026 targets

Source: Cardinal Health 2023 Investor Day Presentation

Capital Structure

Cardinal Health ended Q3 with a net debt of just $0.7 billion, a negligible amount considering the market capitalization of $24 billion and strong free cash flow generation. However, the company has an outstanding liability of $5.85 billion related to an opioid distribution settlement in 2022. The amount is to be paid over 17 years, with the latest annual payment totalling $372 million. For '24-'26, the company expects to spend $1.5 billion on litigation payments.

Cardinal Health allocated $1.5 billion to buybacks in the first three quarters, with a new $3.5 billion share repurchase authorization going into 2027. The company is also committed to continuing its 30-year track record of dividend increases.

Conclusion

Cardinal Health is running a very conservative capital structure which allows the company to allocate significant capital to share buybacks, at the same time servicing its opioid settlement liabilities.

Fiscal 2024 is set to be a peak year for EPS growth, given that 60% of the turnaround in the Medical segment will be complete, which will supplement the structural growth experienced in the Pharmaceutical segment.

The company is also making the necessary growth investments, with capital expenditures increasing at a rate faster than revenue.

Knowing Cardinal Health as a prominent government supplier, too, monitoring the company’s public procurement activity remains a smart move that can provide key insights into its financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Cardinal Health or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.