It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

In the fifth article of our new blog series, we will present you the Q4 results of General Dynamics.

Key points:

* Despite weak aircraft deliveries in Q4, General Dynamics targets 20.9% growth for its Aerospace segment in 2023; the other three divisions are seen returning to growth in 2024;

* Thanks to Aerospace strength, company revenue is seen increasing by 4.7% in 2023, faster than the 2.4% growth in 2022. Combat Systems may get a boost in H2 2023;

* 2022 free cash flow grew in line with sales at 2.4%. We expect an acceleration to about 6.8% growth in 2023 against a backdrop of moderating capital expenditures and higher net earnings conversion;

* Diluted EPS should grow by 3.6% in 2023 after a 5.5% increase in 2022;

* 2022 marks record backlog of $91.1 billion, up 4% Y/Y, while the book-to-bill ratio was 1.1. Aerospace saw strongest backlog growth of 19.6%.

General Dynamics 2022 Q4 Results Overview

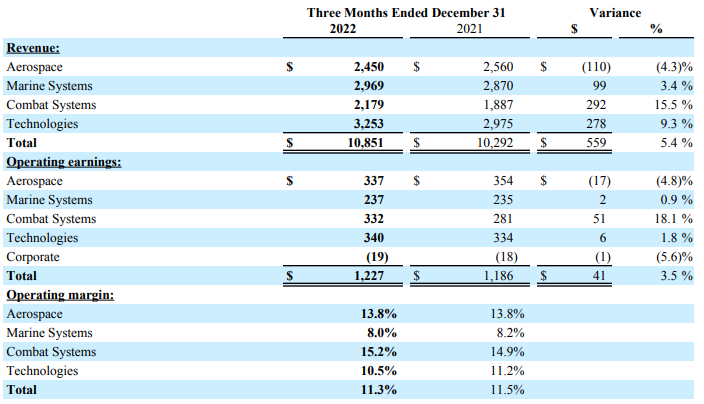

General Dynamics reports results in four main segments, namely Aerospace at 22.6% of Q4 2022 revenues, Marine Systems at 27.4%, Combat Systems at 20.1%, and Technologies at 30%:

Figure 1: General Dynamics Q4 Results by Segment

Source: General Dynamics Q4 Earnings Release

Operational Overview

Aerospace was the weakest segment in Q4, posting a 4.3% Y/Y sales drop due to aircraft deliveries slipping into Q1 2023. For the full year revenue growth was positive at 5.3%. The operating margin was flat Y/Y at 13.8% in Q4, ahead of the 13.2% for 2022.

Marine Systems saw revenue growth of 3.4% Y/Y in Q4, slightly worse than the 4.9% sales growth in the full year. The operating margin was down 0.2% Y/Y to 8%, worse than the 8.1% in 2022.

Combat Systems delivered the strongest quarterly revenue and earnings performance in over 10 years, with Q4 sales up 15.5% Y/Y. The result is a strong acceleration given the 0.6% drop for the full year. The operating margin was up 0.3% to 15.2% in Q4, again better than the 14.7% in 2022.

Technologies also had a strong Q4, with sales up 9.3% Y/Y, a significant acceleration to the 0.3% 2022 growth rate. The operating margin deteriorated by 0.7% Y/Y to 10.5% in Q4. Nevertheless, it was ahead of the 9.8% for the full year.

On a group level, sales grew 5.4% Y/Y in Q4, ahead of the 2.4% annual growth rate in 2022. The operating margin was down 0.2% Y/Y to 11.3% in Q4, again better than the 10.7% for the full year.

Diluted EPS was $3.58 a share in Q4, up 5.6% Y/Y, and $12.19 a share in 2022, up 5.5% Y/Y.

Free cash flow was the notable weakness in the quarter, at just $175 million compared to $1.3 billion in the prior-year quarter. Notwithstanding the year-end weakness, free cash flow was up 2.4% to $3.465 billion in 2022, a good result considering the 25.6% Y/Y rise in capital expenditures.

General Dynamics 2023 Outlook

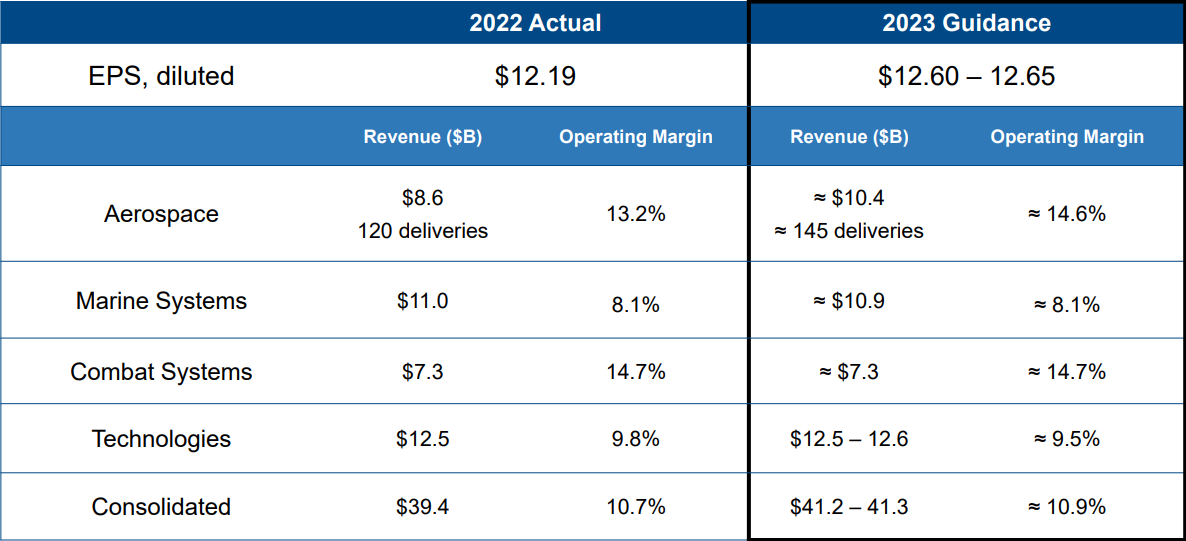

Given the positive momentum in Q4, the 2023 guidance envisages further improvement in company results:

Figure 2: General Dynamics 2023 Outlook

Source: General Dynamics Q4 Results Presentation

Revenue is seen increasing by 4.7%, which coupled with a 0.2% operating margin improvement to 10.9% should result in diluted EPS growth of 3.6%.

Looking across divisions, Aerospace should deliver 20.9% Y/Y growth with the other three segments stagnating. That said, Combat Systems may see H2 strength dependent on Ukraine developments. The company also expects capex to decelerate from the elevated Q4 level:

"Capital expenditures, as I noted, were elevated in the fourth quarter at $494 million or 4.6% of sales. That brings us to $1.1 billion for the full year. At 2.8% of sales, full year capital expenditures are slightly higher than our original expectation due strictly to timing. We expect capital expenditures to start to step back down below 2.5% in 2023 and continuing to trend towards historic levels."

Source: General Dynamics Q4 2022 Conference Call

Pension contributions are seen at $200 million in 2023 relative to $50 million in 2022.

All in all, free cash flow is also seen increasing in 2023, with cash conversion improving to 105% of net earnings from 102% in 2022. We estimate about $3.7 billion in 2023 free cash flow given the company's EPS guidance.

Backlog

General Dynamics finished Q4 with a record-high backlog of $91.1 billion, up 4% Y/Y, and a book-to-bill ratio of 1.1. While the company may further benefit from the 10% increase in the defence budget, the immediate focus is on executing the contracts which have already been secured.

Aerospace saw the strongest backlog growth of 19.6%, followed by Marine Systems with 1.8% growth. Combat Systems backlog was up 1.5% while Technologies saw a decline of 2%.

General Dynamics Capital Structure

The company ended 2022 with a net debt of $9.25 billion, down from $9.89 billion in 2021. Against a market capitalization of about $63.5 billion the debt position is manageable and fairly conservative. In 2022 General Dynamics spent $1.2 billion on buybacks, down from $1.8 billion in 2021.

Conclusion

In 2023 air travel is set to make a full recovery to 2019 levels. To meet buoyant demand, General Dynamics is increasing its deliveries target by 20% to 145 aircraft. Aerospace strength in 2023 will mark a smooth transition to 2024 when the other three segments of the company are set to deliver top-line growth, having overcome supply chain challenges.

Given the expected return of government-dependent businesses as drivers for company performance next year, monitoring public procurement activity remains a smart move that can provide key insights into the company’s financial health. To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy General Dynamics or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.