It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. General Dynamics recently reported its Q1 2023 results and below we will provide a brief analysis of the company’s performance in the first 3 months of the year.

Key points:

* 82.2% of Q1 2023 sales to government customers in the U.S. and abroad;

* Q1 sales up 5.2% Y/Y, in line with 4.7% 2023 target. EPS of $2.64/share, +1.1% Y/Y, below 3.6% growth aspiration;

* Aerospace segment hampered by supply chain issues expected to continue into Q2 before abating in Q3;

* Strong performance across other segments compensating on the revenue side; earnings outlook more uncertain;

* Backlog down 1.4% Q/Q but up 3% Y/Y, with strength in Combat Systems.

General Dynamics Q1 2023 Results Overview

We originally covered General Dynamics' Q4 2022 results in Part 5 of our Top Government Contractors Series here. Below we will highlight the progress achieved by the company in Q1 of 2023.

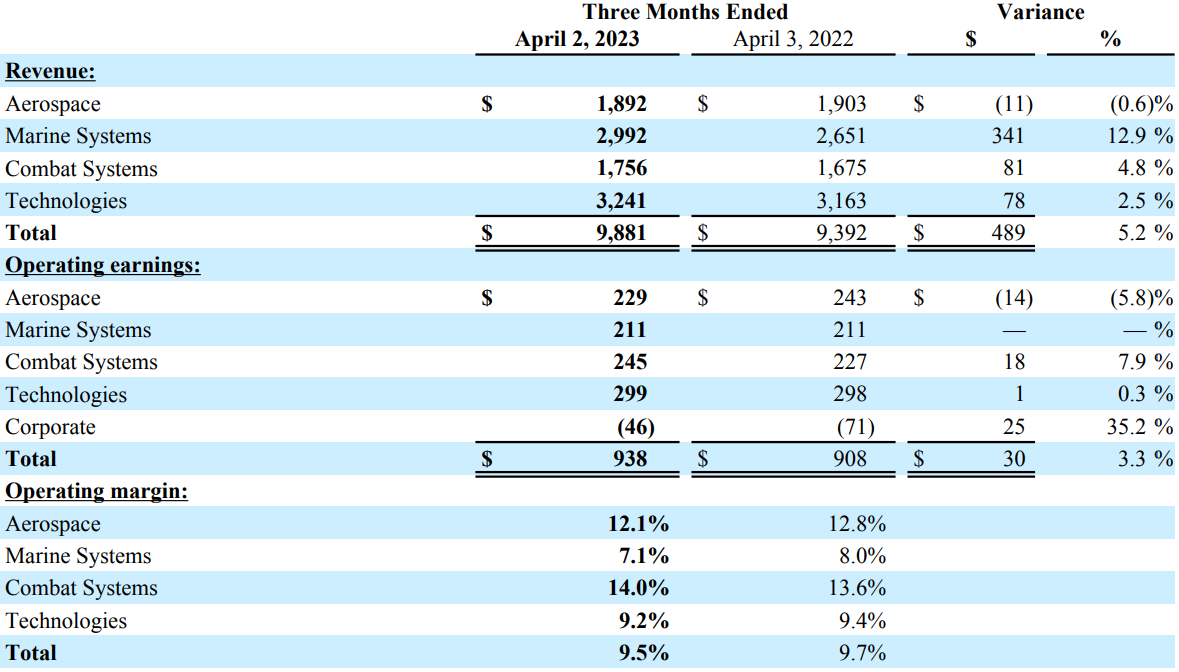

General Dynamics reports results in four main segments, namely Aerospace at 19.1% of Q1 2023 revenues, Marine Systems at 30.3%, Combat Systems at 17.8% and Technologies at 32.8% of Q1 2023 revenues:

Figure 1: General Dynamics Q1 2023 Results by Segment

Source: General Dynamics Q1 2023 Earnings Release

Operational Overview

Aerospace was the only segment to register a revenue decline in Q1, down 0.6 Y/Y, with supply chain issues slowing the deliveries of Gulfstream aircraft. This was only partially offset by strength in services. The operating margin was down 0.7% Y/Y to 12.1%, driving operating earnings 5.8% lower Y/Y. The weakness is Aerospace is a disappointment given the strong 2022 performance (2022 revenue up 5.3% Y/Y) and expectations for continued growth in 2023.

As discussed on the conference call, General Dynamics expects the vast majority of the supply chain issue to resolve early in the third quarter, except for two large suppliers who will take a little longer to work through the difficulties.

Marine Systems performance was somewhat mixed. On the one hand, Q1 revenue growth was strongest at 12.9% Y/Y (2022 +4.9%). On the other hand, the operating margin was down 0.9% Y/Y to 7.1%, resulting in flat operating earnings Y/Y.

Combat Systems performance was more balanced – sales grew 4.8% Y/Y (2022 -0.6%) and the operating margin improved by 0.4% to 14%. As a result, operating earnings were up 7.9% Y/Y.

Technologies delivered a 2.5% Y/Y revenue increase in Q1 (2022 +0.3%) while the operating margin declined 0.2% to 9.2%. This resulted in 0.3% Y/Y growth in operating earnings.

On a group level, Q1 sales were up 5.2% Y/Y (2022 +2.4%). EPS was $2.64/share, up 1.1%, impacted by lower margins and higher taxes. Free cash flow was very strong at $1.3 billion (2022 $3.5 billion) with 178% of earnings converted into cash, well above the long-term 105% target.

Capital expenditures were 1.6% of Q1 sales and should increase later in the year, towards the normal level of 2.5%.

2023 Outlook

Given the slow start in the Aerospace segment and ongoing supply chain issues, General Dynamics expects to front-load expenses in Q2. This will allow the Aerospace segment to recover in Q3 and Q4.

Combat Systems performance is making up for the weakness, as highlighted on the call:

Orders in the quarter are at their highest level in more than 8 years, evidencing the strong demand for munitions and international combat vehicles. There is clear upward pressure on our forecast for Combat Systems revenue and earnings in the year.

As a reminder, General Dynamics originally expected flat Y/Y revenue growth for Combat Systems in 2023, well below the 4.8% growth achieved in Q1, which was in itself impacted from USD strength on a Y/Y basis.

Marine Systems margins are expected to improve later in the year, albeit with Q2 weakness.

General Dynamics will give a detailed 2023 outlook update with the H1 2023 results.

Backlog

Backlog developments were more mixed when compared to revenue growth, as highlighted on the conference call:

We had a solid quarter from an orders perspective with an overall book-to-bill ratio of 0.9:1 for the company. Order activity was particularly strong in the Combat Systems group, which had a book-to-bill of 1.5x. We ended the quarter with total backlog of $89.8 billion, off 1.4% from the end of last year, but up 3% from a year ago.

Capital Structure

Owing to strong free cash flow generation, General Dynamics ended Q1 with a net debt of $8.5 billion, which puts it in the middle of our top government contractors in terms of leverage, considering its market capitalization of $57.2 billion.

In Q1, the company spent $90 million on stock buybacks.

Conclusion

Despite unexpected weakness in the Aerospace segment, General Dynamics appears on track to meet or even exceed its revenue outlook for 4.7% growth in 2023. The EPS expectation for an increase of about 3.6% appears more uncertain given the high operating margin in the Aerospace segment which is experiencing temporary difficulties.

In Q1 2023, 82.2% of General Dynamics revenue was derived from government contractors (U.S. and international). In Q1 of 2022, the figure was 80.9%.

Given the increased importance of government-dependent businesses as drivers for company performance, monitoring General Dynamics’ public procurement activity remains a smart move that can provide key insights into the company’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy General Dynamics or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.