Key points:

* Anson Fund Management was founded in 2003 and currently operates offices in Toronto and Dallas.

* Lionsgate Studios went public in 2024 but recent share price and financial performance have disappointed investors.

* Anson believes the company can achieve a higher valuation if it finds an outside buyer thanks to its deep content library.

* Lionsgate is finalizing the spin-off of its Starz cable and streaming service.

Anson Fund Management Overview

After reviewing the somewhat unusual (for an activist investor) stake of ValueAct in Meta Platforms, we are back to a more traditional activist campaign, this time highlighting Anson Fund Management’s stake in The Hunger Games producer Lionsgate Studios.

Before we continue, let’s review Anson Fund Management’s background.

Anson Funds was founded in 2003 and now has offices in Toronto and Dallas, highlighting the company’s focus on the North American market.

The company’s Anson Investments Master Fund was launched in 2007, targeting low correlations with public equity markets while minimizing volatility. Core strategies include long-short equity, event-driven investing, merger arbitrage, capital structure arbitrage, private equity and private investment in public equity /PIPE/ investing.

Lionsgate Studios Overview (NASD: LION)

Lionsgate Studios boasts a long moviemaking history but has only been a public company since 2024, choosing to list via a special purpose acquisition company (SPAC). Despite being behind blockbuster movies such as The Hunger Games, The Twilight Saga, and La La Land, recent performance has been disappointing, with the company’s shares trading well below the IPO price.

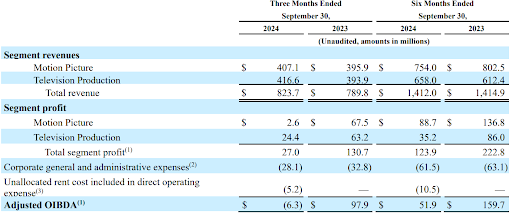

Lionsgate Studios has a fiscal year ending in March. The company reports results in two main segments, Motion Picture and Television Production, with both experiencing pronounced seasonality in their results.

That said, in the first half of fiscal 2025 the Motion Picture business accounted for 53% of the company’s revenue and 72% of segment profit.

Year-over-year comparisons are mixed, with a Q1 2025 revenue decline offset by a pickup in sales in Q2 2025. Overall though profitability remains weaker in the first half of fiscal 2025 relative to the prior year:

Figure 1: Lionsgate Studios segment results Q2 2025

Source: Lionsgate Studios Q2 2025 Results Press Release

To address weak profitability, Lionsgate is offering early retirement and severance packages to U.S. employees. The company reports that 8% of its eligible U.S. workforce took advantage of the offer after quarter end.

Anson Fund Management’s stake in Lionsgate Studios

In December 2024 several financial news sites reported that Anson Fund Management had initiated a position in Lionsgate Studios. Bloomberg cites Sagar Gupta, Anson’s head of activism and a portfolio manager at the firm:

“Anson believes Lionsgate Studios is undervalued and that the company should consider a range of options, including a potential sale, after it completes a separation from the Starz cable and streaming service”.

The Starz cable and streaming service is currently reported as part of the Television Production segment but is in the final stages of being separated.

The new standalone company /to be called Starz Entertainment/ will trade on the Nasdaq under the ticker STRZ. Such spin-offs usually strive to highlight the value of a firm’s separate businesses and to allow a more focused management approach.

Sagar Gupta further elaborates that Lionsgate’s “strong underlying revenue and deep content library would appeal as a takeover target to traditional and digital media companies, as well as to major technology and artificial intelligence players”.

Anson noted that other value-creation initiatives may include divesting its unscripted television and 3 Arts businesses.

The activist investor has already held constructive talks with Lionsgate Studios’ management and board. Ultimately Anson believes that the company may bridge the current valuation gap with larger peers such as Walt Disney and Warner Music Group.

Where Does TenderAlpha’s Ownership Data Fit In?

TenderAlpha’s ticker-mapped institutional ownership data helps monitor ownership dynamics, thus enabling spotting changes in company and industry performance. It is also a timely indicator of changes in investor sentiment towards a certain company, often before the market reacts to that switch.

Ownership data can also provide valuable insights into the activist’s next move. For example, a lower reported ownership percentage may indicate the activist is losing confidence in the success of the activist campaign.

Likewise, a growing ownership percentage is indicative of the activist’s conviction of the success of the activist campaign. This understanding could in turn allow for better informed investment analysis and the uncovering and brainstorming of potential investment hypotheses.

The data’s unique proposition lies in the aggregation of various data sources that allow for global coverage on both stakeholder and stock ownership level.

Conclusion

Anson Fund Management has launched a campaign at Lionsgate Studios which only went public in 2024 via a special purpose acquisition vehicle.

Despite disappointing recent financial results and share price performance, Anson believes that the company may attract the attention of traditional and digital media companies, ultimately achieving a higher valuation than the one currently implied by the market.

So far it is unclear whether Lionsgate will strive to find an outside buyer for its business. The company is however finalizing its Starz spin-off, which could simplify a potential deal in the future. Lionsgate is also reducing its workforce in a bid to improve profitability.

Investors will now monitor whether Anson maintains or even grows its position in Lionsgate Studios. Tools such as TenderAlpha’s institutional ownership data feed may help in tracking Anson’s position in the company.

Interested in learning more about how the Institutional Ownership Data Feed and/or its Pension Funds Stock Ownership subset can improve your ability to track activist investor activity? Contact TenderAlpha today to get started!