Key points:

* Cevian Capital is an activist investor focused on European companies.

* The company revealed a stake in UK-based medical technology producer Smith & Nephew but has since kept a low profile as to its future plans for the company.

* Smith & Nephew has seen decelerating sales growth this year and cut its 2025 margin outlook.

* Key points of weakness are China sales and the US Reconstruction market.

Cevian Capital Overview

After examining some of the largest activist investors in the US such as D.E. Shaw and Elliott Investment Management, we now turn our attention to an activist investor focused on Europe, Cevian Capital, and its activist campaign at Smith & Nephew.

Cevian Capital was founded in 2002 and is focused on acquiring significant minority ownership positions in European public companies, working as an owner to create long-term value.

The firm targets companies with a leading market position, strong cashflows, and benefitting from robust long-term demand dynamics. Cevian’s own team members have joined the boards and/or nominating committees of around 75% of all portfolio holdings.

At any given time, Cevian is active in approximately 10-15 publicly-listed companies, with the activist investor commonly the largest or second-largest owner.

The firm typically invests €0.5-1.5 billion in a single stock and often remains invested for over 5 years.

Smith & Nephew Overview (NYSE: SNN)

Smith & Nephew is a medical technology company, constituent of the UK’s FTSE 100 index, but also traded in the US via American depository receipts.

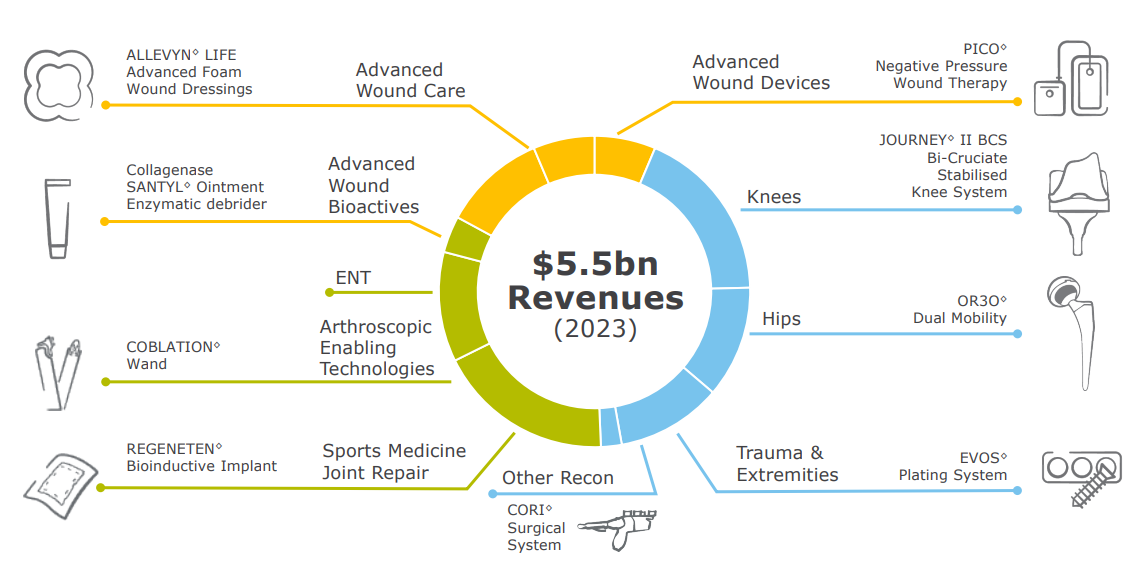

The company reports results in three main segments - Orthopaedics at 39% of Q3 2024 revenue, Sports Medicine & Ear, Nose and Throat (ENT) at 31%, and Advanced Wound Management at 30% of Q3 2024 revenues.

Figure 1: Smith & Nephew’s medical technology offering

Source: Smith & Nephew July-September 2024 Investor Presentation

Cevian Capital’s Activist Campaign

In July 2024 Cevian Capital revealed it had acquired a 5.11% stake in Smith & Nephew, making it the third largest shareholder behind UBS and BlackRock which hold 6.3% and 5.2% respectively. Since then, Cevian Capital has not revealed its activist objectives with regards to Smith & Nephew. Keeping a low profile is typical for Cevian, distinguishing it from other activists such as Elliott Investment Management, which even started a podcast and created a dedicated website for its Southwest Airlines campaign.

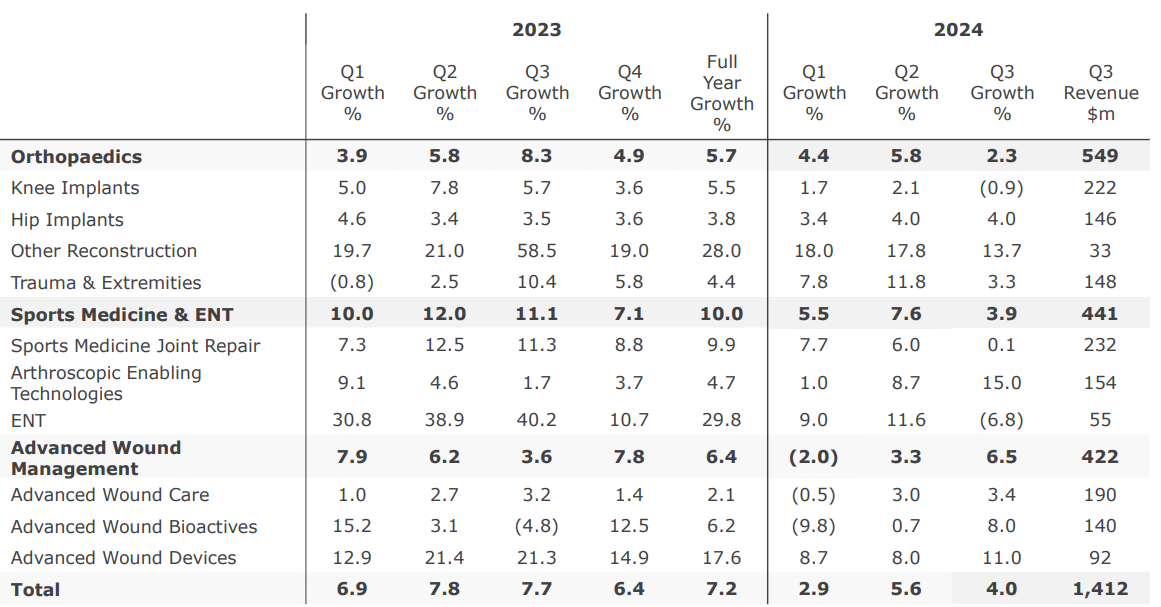

One area that has drawn investor attention is the reduced margin outlook for the company, seen at 19-20% in 2025 versus at least 20% previously. Another point of concern is that sales growth is moderating, reaching 4% Y/Y in Q3 2024 versus 7.2% for 2023. Here the weakness remains concentrated in the Knee Implants and ENT business units which are seeing lower sales relative to the prior year:

Figure 2: Revenue analysis by business unit

Source: Smith & Nephew Q3 2024 Results Presentation

On a consolidated basis, the slower sales growth was largely due to weakness in China, with the company’s sales increasing 5.9% Y/Y in Q3 2024 ex-China. The US Reconstruction market, especially US knee implants, is also underperforming, driving the Knee Implant business unit sales 0.9% lower Y/Y in Q3 2024.

Management expects China weakness to fade later in 2025 as inventories stabilize while US Knee implant sales should return to at least market growth in late 2025 as well.

Overall, given favorable aging trends throughout the world, healthcare spending should continue to outpace GDP growth.

The Peterson Foundation projects that National health expenditures (NHE) will reach almost 20% of US GDP in 2032, up from 17.6% in 2023.

Smith & Nephew is well-positioned to benefit from these secular tailwinds if it manages to stabilize operational performance.

Where Does TenderAlpha’s Ownership Data Fit In?

TenderAlpha’s institutional ownership data covers over 28,000 public companies in North America, Europe, the UK, and the rest of the world, providing insight into the holdings of US-based & non-US based institutional and insider stakeholders.

The data’s unique proposition lies in the aggregation of various data sources that allow for global coverage on both stakeholder and stock ownership level. The data is ticker-mapped and is updated monthly for US companies.

Monitoring ownership dynamics for activist investors is a powerful tool for spotting changes in company and industry performance. It is also a timely indicator of changes in investor sentiment towards a certain company, often before the market reacts to that switch.

Ownership data can also provide valuable insights into the activist’s next move. For example, a lower reported ownership percentage may indicate the activist is losing confidence in the success of the activist campaign.

Likewise, a growing ownership percentage is indicative of the activist’s conviction of the success of the activist campaign. This understanding could in turn allow for better informed investment analysis and the uncovering and brainstorming of potential investment hypotheses.

Conclusion

Cevian Capital, an activist investor focused on European companies, took a 5.11% stake in Smith & Nephew in July 2024 but has not elaborated on the firm’s plans for the UK-based medical technology company.

Key points of attention are likely to be Smith & Nephew’s sluggish sales growth and persistent margin weakness, resulting in the company cutting its 2025 margin outlook. This provides ample opportunity for Cevian Capital to create value against the backdrop of strong secular tailwinds driving healthcare spending growth throughout the world.

Investors will now monitor whether Cevian Capital will bring about an operational improvement at Smith & Nephew. Tools such as TenderAlpha’s institutional ownership data feed may help in tracking Cevian’s position in the company.

Interested in learning more about how the Institutional Ownership Data Feed and/or its Pension Funds Stock Ownership subset can improve your ability to track activist investor activity? Contact TenderAlpha today to get started!