Key points:

* D.E. Shaw manages over $60 billion in various systematic and discretionary strategies.

* The manager recently launched an activist campaign at Air Products and Chemicals, taking aim at the company’s green hydrogen investments.

* The firm’s CEO Seifi Ghasem was also criticized for the lack of succession planning and excessive remuneration.

* D.E. Shaw expects material upside in the company’s share price and valuation if its proposals are implemented.

D.E. Shaw Overview

After examining activist investor Starboard Value’s campaign at one of the largest government contractors Pfizer, we now turn our attention to one of the titans in the activist investor world - D.E. Shaw.

From its humble beginnings in 1988 with just $28 million in capital and six employees D.E. Shaw has grown significantly, joining the ranks of the biggest active money managers in the world. Today the company employs over 2,500 people and manages over $60 billion in assets.

Its investment expertise includes:

- Alternative investments ranging from multi-strategy investment vehicles to more focused, strategy-specific investment products. The key focus is on absolute returns and low correlation with traditional assets such as equities.

- Long-oriented investments with a focus on major, tradeable asset classes. Here the focus is on customizing exposure to individual equity indices and a diversified exposure to global asset classes.

The company combines systematic (quant) strategies with discretionary input from its analysts. While D.E. Shaw is active across dozens of individual strategies, in our article we will focus on its discretionary Fundamental Equities strategy which includes traditional, activist, and event-driven investments covering a broad range of industry sectors across global markets.

D.E. Shaw recently started an activist campaign in gas giant Air Products and Chemicals which we will highlight next.

Air Products and Chemicals Overview (NYSE: APD)

Air Products and Chemicals is a company with a truly global footprint. Some 41% of its sales come from the Americas, followed by Asia at 26% of sales and Europe with a 23% contribution.

The company’s bread and butter are industrial gases which account for 90% of the firm’s revenue. At the same time, the company is focused on developing clean hydrogen projects which it hopes will drive future growth. The emphasis on future hydrogen investments stems from Air Products and Chemicals’ number one position in the supply of hydrogen worldwide but has also drawn criticism from D.E. Shaw as we will highlight in the next section.

Figure 1: Air Products and Chemicals company highlights

Source: Air Products and Chemicals website

D.E. Shaw’s Activist Campaign

In October 2024 D.E. Shaw sent an open letter to the Board of Directors of Air Products and Chemicals, calling for changes in the company’s operations in a bid to improve governance and returns. The activist firm’s proposals include:

- Accelerate efforts to de-risk existing large project commitments by signing offtake agreements at reasonable return hurdles;

- Publicly commit to tying future capital investment to offtake agreements, consistent with well-established practice in the industrial gas sector;

- Establish and publicly announce a new capital allocation framework whereby Air Products' CapEx levels will not exceed the mid-teens as a percentage of revenue beyond fiscal year 2026;

- Communicate a clear, credible, and transparent CEO succession plan;

- Refresh the Board with highly qualified, independent directors with relevant experience leading capital-intensive businesses and managing succession processes;

- Restructure executive compensation to improve alignment with strategy and performance; and

- Form one or more ad hoc Board committees to focus on and oversee these critical initiatives on behalf of shareholders.

In a nutshell, D.E. Shaw focuses on the company’s pivot to green hydrogen investments 82% of which have no signed off-take agreements. This in turn has created uncertainty as to the future returns of these projects, considering the project costs are upfront.

The combined effect is a lower valuation of Air Products and Chemicals relative to competitors Linde and Air Liquide, resulting in the company’s share price underperforming its peer group.

Last but not least, D.E. Shaw criticizes the 80-year-old CEO Seifi Ghasem for not having secured a successor and being overpaid relative to peers. For reference, most S&P 500 companies have a 75-year retirement policy in place.

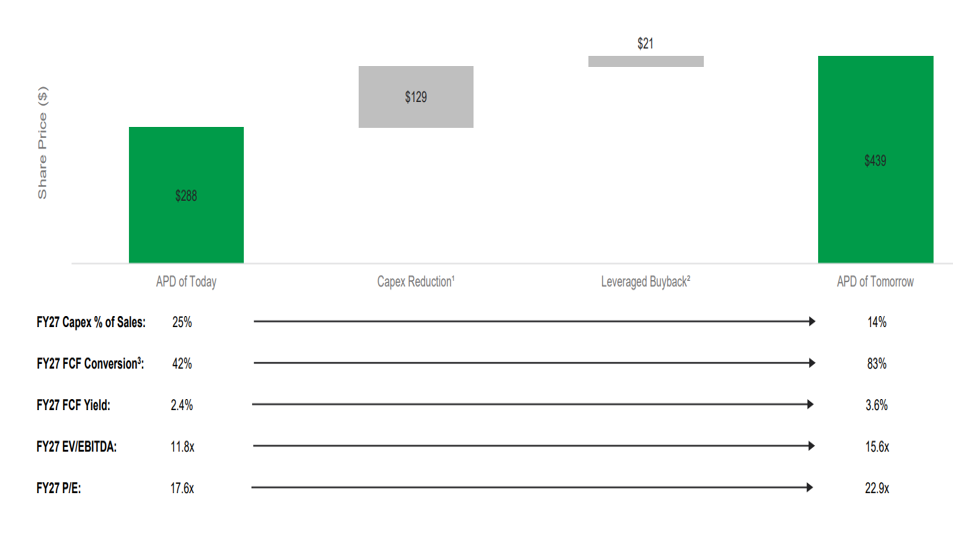

D.E. Shaw expects that if implemented, its proposals will lead to lower capex, higher free cash flows, and a higher overall valuation:

Figure 2: Potential for share price appreciation and improvement in operating performance

Source: D.E. Shaw Air Products and Chemicals letter

Where Does TenderAlpha’s Ownership Data Fit In?

TenderAlpha’s institutional ownership data covers over 28,000 public companies in North America, Europe, the UK, and the rest of the world, providing insight into the holdings of US-based & non-US based institutional and insider stakeholders.

The data’s unique proposition lies in the aggregation of various data sources that allow for global coverage on both stakeholder and stock ownership level. The data is ticker-mapped and is updated monthly for US companies.

Monitoring ownership dynamics for activist investors is a powerful tool for spotting changes in company and industry performance. It is also a timely indicator of changes in investor sentiment towards a certain company, often before the market reacts to that switch.

Ownership data can also provide valuable insights into the activist’s next move. For example, a lower reported ownership percentage may indicate the activist is losing confidence in the success of the activist campaign.

Likewise, a growing ownership percentage is indicative of the activist’s conviction of the success of the activist campaign. This understanding could in turn allow for better informed investment analysis and the uncovering and brainstorming of potential investment hypotheses.

Conclusion

D.E. Shaw, one of the largest activist shareholder activists in the world, launched a new campaign at industrial gases distributor Air Products and Chemicals. The activist investor claims that the company’s returns and valuation may improve if the firm dials back its green hydrogen investments.

Furthermore, D.E. Shaw wants to see improvement in the firm’s governance, specifically related to CEO Seifi Ghasem and his eventual successor.

While it is unclear how this activist campaign will develop, tools such as TenderAlpha’s institutional ownership data feed may help in tracking D.E. Shaw’s position in Air Products and Chemicals.

Interested in learning more about how the Institutional Ownership Data Feed andact its Pension Funds Stock Ownership subset can improve your ability to track activist investor activity? Contact TenderAlpha today to get started!