Key points:

* Elliot Investment Management manages almost $70 billion in assets across various strategies;

* In June 2024 the activist investor revealed a ~11% position in Southwest Airlines;

* Elliot’s criticism focuses on recent operational performance and lack of board expertise diversity;

* Elliot reached a settlement with Southwest’s board and will name six new directors.

Elliott Investment Management Overview

After examining activist investor D.E. Shaw’s activist campaign at Air Products and Chemicals, we now turn our attention to Elliot Investment Management and its activist campaign at Southwest Airlines.

Elliot Investment Management was founded by Paul Singer in New York in 1977 but has recently relocated its headquarters to Florida, a trend also observed at other Big Apple investment firms.

The company manages almost $70 billion in assets with a staff of 570 employees. The investments are spread across several strategies including equity-oriented strategies, private equity and private credit, distressed securities, non-distressed debt, arbitrage trades, real estate-related securities, commodities trading, and portfolio volatility protection.

Within the equity-oriented strategies, the focus is on positions uncorrelated with the risks and expected price movements of equities generally, or where value and protection against risk can be enhanced by the firm’s manual efforts.

Southwest Airlines Overview (NYSE: LUV)

Southwest Airlines operates a fleet of 817 aircraft serving 117 airports across 11 countries. Passenger revenue accounts for 91% of all revenue but the company also derives 9% of its topline from co-brand credit cards.

The airline is heavily unionized, with 83% of its staff part of a union. Southwest Airlines boasts a strong balance sheet with a net cash position of $1.4 billion, earning it a BBB credit rating, the highest in its peer group.

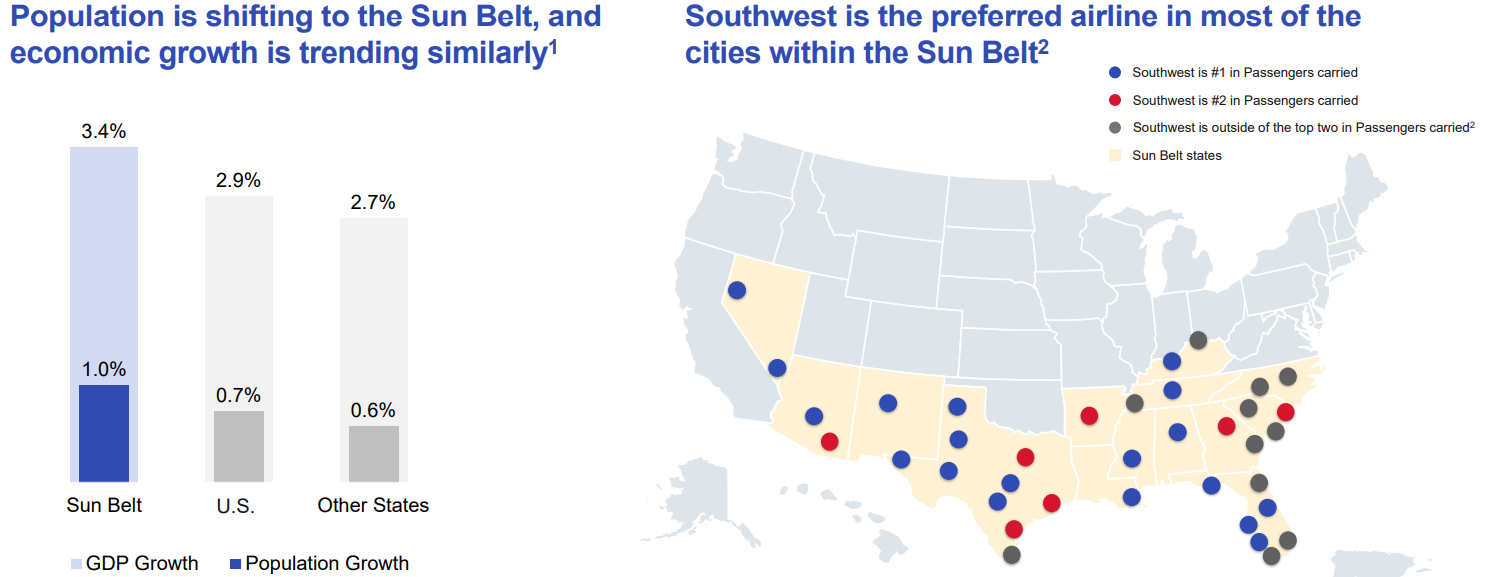

The company is headquartered in Texas and is well-positioned to benefit from population and GDP growth in the Sun Belt which outpaces the rest of the United States:

Figure 1: Southwest Airlines’ competitive strength in the Sun Belt region

Source: Southwest Airlines 2024 Investor Day Presentation

Elliot Investment Management’s Activist Campaign

In June 2024 Elliot Investment Management sent a letter to Southwest Airlines’ board. In it, the investment manager disclosed a ~11% position in the airline.

Elliot focuses on the company’s poor operating performance in recent years, highlighting rising per-unit costs and revenues lagging peers. The firm also takes aim at the CEO Bob Jordan for poor execution and elevated compensation.

Elliot believes the board is staffed with executives coming predominantly from Southwest Airlines, resulting in little momentum for organizational improvement and change.

To remedy these shortcomings, Elliot has proposed eight executives to join Southwest’s board while also seeking a replacement for CEO Bob Jordan. The investment manager also proposed a comprehensive review of Southwest’s operations and an update to its information systems.

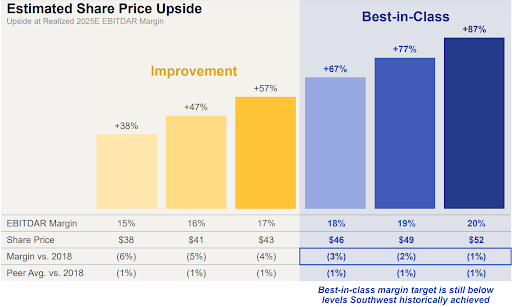

Elliot went to great lengths to publicize its activism campaign at Southwest, launching a dedicated website and podcast. The company estimates that if operations are improved, Southwest Airlines’ share price may increase up to $52. Even then its margins would likely be below peers and Southwest’s own result in 2018:

Figure 2: Potential for share price appreciation and improvement in operating performance

Source: Stronger Southwest June 2024 Presentation

Southwest Airlines Adopts Poison Pill Provision

In July 2024 Southwest Airlines’ board adopted a poison pill provision which will last one year and trigger if any shareholder increases its stake above 12.5%.

Under the provision, the other shareholders would be entitled to purchase shares at a 50% discount. This move severely limits Elliot’s ability to increase its direct share in the company, with the activist investor having to persuade other major shareholders to back its ideas for the company.

Eventually Elliot was able to reach a settlement with Southwest Airlines - the activist named six new directors to the company’s board but agreed to keep CEO Bob Jordan in place.

Where Does TenderAlpha’s Ownership Data Fit In?

TenderAlpha’s institutional ownership data covers over 28,000 public companies in North America, Europe, the UK, and the rest of the world, providing insight into the holdings of US-based & non-US based institutional and insider stakeholders.

The data’s unique proposition lies in the aggregation of various data sources that allow for global coverage on both stakeholder and stock ownership level. The data is ticker-mapped and is updated monthly for US companies.

Monitoring ownership dynamics for activist investors is a powerful tool for spotting changes in company and industry performance. It is also a timely indicator of changes in investor sentiment towards a certain company, often before the market reacts to that switch.

Ownership data can also provide valuable insights into the activist’s next move. For example, a lower reported ownership percentage may indicate the activist is losing confidence in the success of the activist campaign.

Likewise, a growing ownership percentage is indicative of the activist’s conviction of the success of the activist campaign. This understanding could in turn allow for better informed investment analysis and the uncovering and brainstorming of potential investment hypotheses.

Conclusion

Elliot Investment Management, one of the largest activist investors in the world, launched a new campaign at Southwest Airlines in June 2024. The activist investor takes aim at the company’s recent operational performance and sees significant upside in the share price if the company can improve its margin profile.

Furthermore, Elliot wants to see improvement in the firm’s governance and has nominated eight directors with industry experience to the company’s board.

Southwest’s adoption of a poison pill provision limits Elliot’s potential to increase its stake and the activist investor will have to negotiate with other shareholders and the company’s management to persuade them of the merits of its plan.

Eventually a settlement was reached, with Elliot placing six new directors on the company’s board but agreeing to keep CEO Bob Jordan. Investors will now monitor whether the new management team can bring operational improvement.

Interested in learning more about how the Institutional Ownership Data Feed and its Pension Funds Stock Ownership subset can improve your ability to track activist investor activity? Contact TenderAlpha today to get started!