Key points:

* Starboard Value has initiated a position in Kenvue, the consumer health company spun out of Johnson & Johnson in 2023.

* The activist investor highlights Kenvue’s strong brand portfolio and robust performance in the Self Care and Essential Health segments.

* Sales in the Skin Health and Beauty segment remain disappointing, dragging down Kenvue’s organic growth.

* To improve performance, Starboard Value makes the case for increased advertisement spending and better social media engagement.

Starboard Value Overview

We previously covered Starboard Value’s campaign at pharmaceutical giant Pfizer where we highlighted lower government contract wins as a telltale sign of future underperformance.

In today’s article, we will focus on Starboard Value’s recent campaign at consumer health company Kenvue. Before we continue, let’s review Starboard Value’s background.

Founded in 2002, Starboard Value is an investment adviser focused on investing in public companies where the firm can engage with management teams and boards to improve operating performance and unlock shareholder value.

Aside from Pfizer and Kenvue, in 2024 the company has been active at Algonquin Power & Utilities, Goddaddy, Autodesk, and Match Group.

Kenvue Overview (NYSE: KVUE)

Kenvue was spun out of Johnson & Johnson in 2023 encompassing the consumer health business of the second-largest US drug manufacturer.

Today Kenvue boasts an enterprise value of about $54 billion and reports results in the key segments - Self Care (includes pain care, cough, cold, allergy, digestive health, smoking cessation, and eye care) at 41% of Q3 2024 sales, Skin Health & Beauty (face and body care, hair and sun products) at 28%, and Essential Health (oral care, baby care, women’s health, and wound care) at 31% of Q3 2024 revenue.

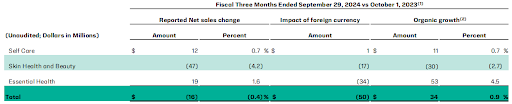

Sales decreased by 0.4% Y/Y in Q3 2024, impacted by a strong US dollar and poor performance in Skin Health and Beauty where revenue slipped 4.2% Y/Y. Excluding foreign exchange impacts, organic revenue growth stood at 0.9% in Q3 2024, with growth in Essential Health compensating for the decline in Skin Health and Beauty:

Figure 1: Kenvue revenue developments by segment

Source: Kenvue Q3 2024 Results Presentation

The poor Q3 2024 performance resulted in the company confirming its full-year 2024 outlook with the caveat that reported sales growth would be close to 1% in 2024, while organic growth which excludes foreign exchange impacts is seen at 2%, both at the lower range of initial guidance.

Starboard Value’s Activist Campaign

In October 2024 Starboard Value released a presentation highlighting its activist campaign at Kenvue.

Acknowledging the company’s well-established brands such as Tylenol, Zyrtec, and Listerine, the activist investor took aim at the company’s poor organic growth, which for 2023 stood at 5%, 1% below initial guidance.

As we have seen with the company’s Q3 2024 results, current growth rates are substantially lower.

Starboard Value examines the three business segments and finds that performance in the Self Care and Essential Health segments has been respectable (a trend that continued into Q3 2024).

As such, the asset manager sees the greatest room for improvement in the Skin Health and Beauty segment which drags down the company’s overall organic growth rate.

Most importantly, Starboard Value notes that this poor performance is not observed at Kenvue’s peers, indicating that the issue is specific to Kenvue.

The activist investor believes that the key factors driving underperformance in the Skin Health and Beauty segment are a lack of a marketing driven culture and insufficient advertisement spending on social media.

The activist investor believes that if the company manages to improve results in its Skin Health and Beauty segment to at least market growth rates of about 4.4%, its margins will recover and the company’s valuation will follow suit.

Kenvue currently trades at a substantial discount to peers, indicating significant room for multiple expansion if operating performance stabilizes:

Figure 2: Kenvue Price/Earnings multiple relative to peers

Source: Starboard Value Kenvue presentation, October 2024

Kenvue management is taking note of Starboard Value’s concerns and has increased its marketing efforts, with CEO Thibaut Mongon commenting on the Q3 2024 conference call:

“...we are on track to invest approximately 20% more than we did last year through advertising, healthcare professional engagement, in-store prominence and direct consumer engagement with an increasing focus on social media marketing powered by analytics and AI.”

In the coming quarters, investors will monitor whether these initiatives manage to turn around the performance in the Skin Health and Beauty segment.

Where Does TenderAlpha’s Ownership Data Fit In?

TenderAlpha’s ticker-mapped institutional ownership data helps monitor ownership dynamics, thus enabling spotting changes in company and industry performance. It is also a timely indicator of changes in investor sentiment towards a certain company, often before the market reacts to that switch.

Ownership data can also provide valuable insights into the activist’s next move. For example, a lower reported ownership percentage may indicate the activist is losing confidence in the success of the activist campaign.

Likewise, a growing ownership percentage is indicative of the activist’s conviction of the success of the activist campaign. This understanding could in turn allow for better informed investment analysis and the uncovering and brainstorming of potential investment hypotheses.

The data’s unique proposition lies in the aggregation of various data sources that allow for global coverage on both stakeholder and stock ownership level.

Conclusion

After initiating a position in pharmaceutical giant Pfizer activist investor Starboard Value is now active in Kenvue, the consumer health company spun out of Johnson & Johnson in 2023.

Kenvue has recently been plagued by poor organic growth, resulting in the company trading at a substantially lower price/earnings multiple relative to peers.

Starboard Value highlights the strong brands in Kenvue’s portfolio, arguing they do not warrant such a low valuation.

The activist investor makes the case for increased advertising spending, especially on social media. This should allow the company’s struggling Skin Health and Beauty segment to return to growth, ultimately resulting in a re-rating of Kenvue’s stock.

Investors will now monitor whether Kenvue will embrace Starboard Value’s proposals to boost advertisement spending and increase engagement with social media. This in turn may allow for a higher market valuation of Kenvue for the benefit of all shareholders.

Tools such as TenderAlpha’s institutional ownership data feed help in tracking Starboard Value’s position in the company.

Interested in learning more about how the Institutional Ownership Data Feed can improve your ability to track activist investor activity? Contact TenderAlpha today to get started!