Key points:

* Trian Fund Management is an activist investor experienced with consumer-oriented companies.

* In June 2024 Trian initiated a position in Rentokil Initial, the largest commercial pest control services provider in the world.

* The company’s business is growing internationally but performance in North America remains disappointing.

* Trian appointed a new board member to Rentokil Initial who will work alongside a new US management team to improve sales and margin performance in the US.

Trian Fund Management Overview

After examining Europe-focused activist investor Cevian Capital’s campaign at Smith & Nephew we are staying on the old continent by highlighting Trian Fund Management’s stake in Rentokil Initial.

Since its founding in 2005, Trian Fund Management has focused on combining concentrated public equity ownership with operational expertise. The firm seeks to identify high-quality but undervalued and underperforming public companies. Trian then takes a proactive approach, working with company management to executive organisational and strategic initiatives designed to deliver higher earnings and operational improvement.

Trian’s stake in Rentokil Initial is no surprise as the investment manager has vast previous experience working with consumer companies, including Unilever and Procter & Gamble.

Rentokil Initial Overview (NYSE: RTO)

Rentokil Initial is the largest commercial pest control services provider in the world. The company is based in the UK but its largest market (~60% of revenue following the 2022 acquisition of Terminix) is the US. As a result, starting in 2025 the company will report results in USD.

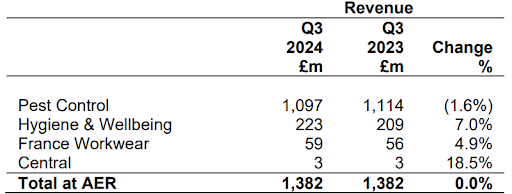

On a consolidated level, the Pest Control business accounts for 80% of the company’s revenue, followed by Hygiene & Wellbeing at 16% of sales (offered under the Initial brand), while the France Workwear business contributes 4%.

The company has an enterprise value of £13.3 billion, of which only 24% is funded with debt.

Figure 1: Rentokil Initial revenue developments by business line

Source: Rentokil Initial Q3 2024 Trading Update

Trian Fund Management’s Activist Campaign

In June 2024 Trian initially revealed its ownership interest in Rentokil Initial, telling CNBC the firm would engage with leadership “on ideas and initiatives to improve shareholder value”.

Trian has not elaborated on its investment objectives with regards to Rentokil Initial but the activist investor did manage to appoint Brian Baldwin to the company’s board effective October 1, 2024. Trian owned 2.26% of Rentokil Initial as of the date of the announcement.

From the remarks outlined in the press release, we observe that turning around the pest control business’s lacklustre performance in the US will be a key point of attention.

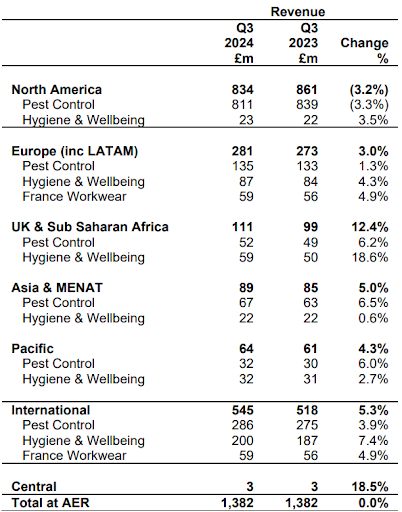

Indeed, if we look at Rentokil Initial’s sales development across the world, we observe that the North America pest control business is the only one to deliver lower sales, down 3.3%, which given its significance for the company ultimately resulted in flat Y/Y revenue growth:

Figure 2: Revenue analysis by business unit and geography

Source: Rentokil Initial Q3 2024 Trading Update

In a bid to improve performance in the North America business, Rentokil Initial has appointed a new Chief Marketing Officer, a new Chief Operating Officer, and is currently looking for a new Chief Financial Officer.

These and other organisational changes will delay the Terminix acquisition synergies initially planned for 2025 by 2-3 months, impacting next year’s margins.

Where Does TenderAlpha’s Ownership Data Fit In?

TenderAlpha’s ticker-mapped institutional ownership data helps monitor ownership dynamics, thus enabling spotting changes in company and industry performance. It is also a timely indicator of changes in investor sentiment towards a certain company, often before the market reacts to that switch.

Ownership data can also provide valuable insights into the activist’s next move. For example, a lower reported ownership percentage may indicate the activist is losing confidence in the success of the activist campaign.

Likewise, a growing ownership percentage is indicative of the activist’s conviction of the success of the activist campaign. This understanding could in turn allow for better informed investment analysis and the uncovering and brainstorming of potential investment hypotheses.

The data’s unique proposition lies in the aggregation of various data sources that allow for global coverage on both stakeholder and stock ownership level.

Conclusion

Trian Fund Management managed to secure a board seat in Rentokil Initial, the largest commercial pest control provider in the world. The company’s business is growing internationally but its performance in the US market remains disappointing following the 2022 acquisition of Terminix. This has led to Rentokil Initial lowering its 2025 margin outlook due to the later realization of Terminix synergies.

The focus of Trian-nominated new board member Brian Baldwin will be working alongside Rentokil Initial’s new management team in the US to improve sales and margin dynamics for the business.

Investors will now monitor whether Trian will bring about an operational improvement at Rentokil Initial’s North America business. Tools such as TenderAlpha’s institutional ownership data feed may help in tracking Trian’s position in the company.

Interested in learning more about how the Institutional Ownership Data Feed can improve your ability to track activist investor activity? Contact TenderAlpha today to get started!