Key points:

* Activist investor ValueAct has acquired a $1 billion position in Facebook parent Meta Platforms.

* The company’s Family of Apps segment has grown revenues and operating profit, reaping benefits of the 2022 restructuring.

* Meta has shown substantial operating improvement recently but its Reality Labs segment remains a drag on profitability.

* ValueAct has not publicly addressed its investment objectives in Meta despite its substantial size in the activist investor’s portfolio.

ValueAct Overview

As part of our coverage of activist investors and their campaigns at companies around the world, we have generally looked at firms that are experiencing difficulties which have resulted in poor shareholder returns. Furthermore, these companies tend to be under-the-radar small and mid-cap corporations.

Today’s article will be quite different as we will highlight ValueAct’s stake in Meta Platforms - one of the largest companies in the world to be targeted by an activist investor, as well as one of the best-performing stocks in recent years. Before we continue, let’s review ValueAct’s background.

ValueAct has been in business for over 22 years, making 100 core investments and earning a board seat at 47 public companies. The manager’s typical holding period is 3-5 years, but it can hold positions for over 10 years.

ValueAct is known as a collaborative activist investor, working closely with company boards to improve performance. The firm is focused on technology companies, with prior investments including Microsoft, Adobe, CBRE, Rolls Royce, Seagate, and 21st Century Fox.

Meta Platforms Overview (NASD: META)

Facebook changed its name to Meta Platforms in 2021 as part of an effort to emphasize the company’s push into the metaverse as well as to highlight that Facebook is just one of Meta’s services.

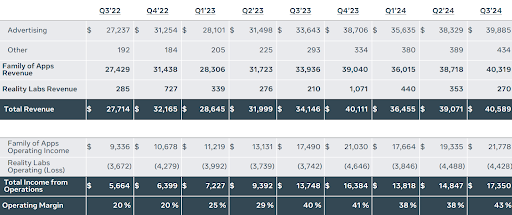

Nowadays the company reports results in two main segments - Family of Apps /FoA/ and Reality Labs /RL/. FoA encompasses results from Facebook, Instagram, Messenger, and WhatsApp, while RL includes Meta’s virtual, augmented, and mixed reality-related consumer hardware, software, and content.

Over the last two years, FoA’s revenue and operating income have grown significantly, while RL's revenue and operating income have shown little progress. As such RL remains loss-making and only accounts for less than 1% of Meta’s quarterly revenue despite reporting billions in operating losses since 2022:

Figure 1: Meta Platforms segment results Q3 2022-Q3 2024

Source: Meta Platforms Q3 2024 Results Presentation

Despite the poor RL performance, from Figure 1 we observe that Meta’s operating margin has improved from 20% in Q3 2022 to 43% in Q3 2024, indicating the company’s 2022 restructuring is bearing fruit.

As a reminder, Meta cut its workforce by 13% in 2022 as the company had overhired during the COVID-19 pandemic.

Looking ahead, the company is focusing on its open-source AI models and recently released the Llama 3.3 model which was positively received by the market.

ValueAct’s Stake in Meta

In November 2024 several financial news sites reported that ValueAct had acquired a $1 billion position in Meta Platforms. The activist investor’s 13-F filing for Q3 2024 only showed a $120 million stake, indicating the bulk of the purchase was done in Q4 2024.

Considering the recent uptick in Meta’s share price, we estimate Meta now accounts for close to a quarter of ValueAct’s portfolio, ahead of Insight Enterprises but behind Salesforce.

As is typical for ValueAct’s behind-the-scenes approach, the asset manager has not gone public with any demands for operational changes, nor has it proposed appointments to Meta’s board.

We reckon that ValueAct will focus on several areas with regard to Meta’s performance.

Firstly, the asset manager will strive to help Meta maintain its operating leverage, with revenue growth of 19% Y/Y in Q3 2024 outpacing expense growth of 14%, as well as the 9% headcount increase.

Secondly, ValueAct is likely to focus on RL’s performance and outlook which has failed to live up to expectations and remains a drag on profitability.

Last but not least, ValueAct may offer advice on monetizing Meta’s AI capabilities.

Where Does TenderAlpha’s Ownership Data Fit In?

TenderAlpha’s ticker-mapped institutional ownership data helps monitor ownership dynamics, thus enabling spotting changes in company and industry performance. It is also a timely indicator of changes in investor sentiment towards a certain company, often before the market reacts to that switch.

Ownership data can also provide valuable insights into the activist’s next move. For example, a lower reported ownership percentage may indicate the activist is losing confidence in the success of the activist campaign.

Likewise, a growing ownership percentage is indicative of the activist’s conviction of the success of the activist campaign. This understanding could in turn allow for better informed investment analysis and the uncovering and brainstorming of potential investment hypotheses.

The data’s unique proposition lies in the aggregation of various data sources that allow for global coverage on both stakeholder and stock ownership level.

Conclusion

ValueAct’s stake in Meta Platforms shows that even large-cap companies that have delivered robust operating performance and excellent shareholder returns can attract the attention of activist investors. It appears that the asset manager believes it can help Meta build on the success of its restructuring efforts that started in 2022.

So far, ValueAct has kept a low profile regarding its Meta stake and has not shared plans for operational improvement. We believe the activist investor’s efforts will focus on sustaining operating leverage in the Family of Apps segment and at the same time optimizing spending in the Reality Labs segment.

Investors will now monitor whether ValueAct maintains or even grows its position in Meta which by our estimates has reached a quarter of the asset manager’s portfolio. Tools such as TenderAlpha’s institutional ownership data feed may help in tracking ValueAct’s position in the company.

Interested in learning more about how the Institutional Ownership Data Feed and/or its Pension Funds Stock Ownership subset can improve your ability to track activist investor activity? Contact TenderAlpha today to get started!