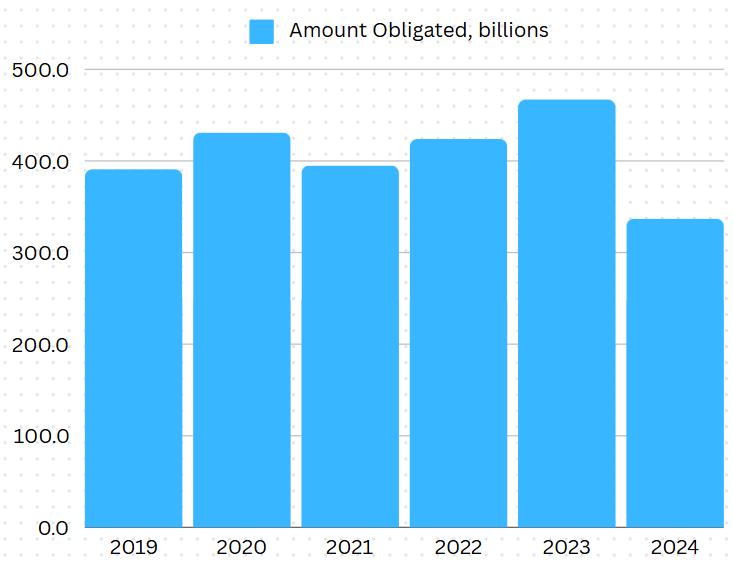

Keeping track of awarded government contracts is essential to assessing the financial health of companies operating in the defense sector. While current economists’ consensus is that the world economy will avoid a hard landing (the IMF projects 3.2% world GDP growth in 2024, U.S. growth seen at 2.8%, higher than the Federal Reserve's 2% forecast), government contracts could prove to be a lifeline to companies should their commercial business take a hit.

Figure 1. Contract awards by the U.S. Department of Defense, 2019-2024

Source: TenderAlpha.com

The article looks at the four largest defense suppliers in the US - Lockheed Martin, Boeing, RTX Corporation (formerly Raytheon Technologies), and Booz Allen Hamilton in respect to their latest quarterly and annual results, and the significance of government procurement for their revenue.

Find out how to leverage government contracts data to capitalize on defense spending increase

Lockheed Martin (NYSE: LMT)

Lockheed Martin 2024 Q3 Results Overview

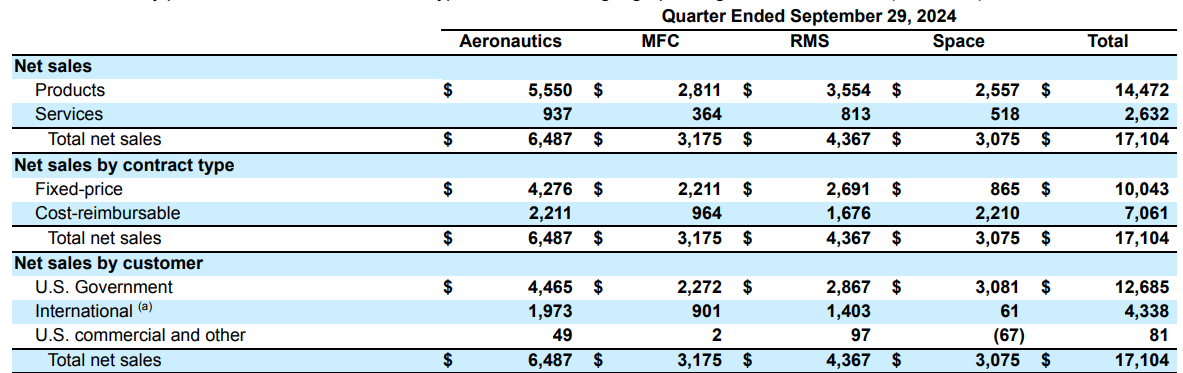

Lockheed Martin reports results in four key segments, namely Aeronautics at 38% of Q3 2024 net sales, Missiles and Fire Control (MFC) at 18.5%, Rotary and Mission Systems (RMS) at 25.5%, and Space at 18% of Q3 2024 net sales:

Figure 2. Lockheed Martin 2024 Q3 Net Sales Breakdown

Source: Lockheed Martin Form 10-Q for Q3 2024

Lockheed Martin recorded a 1% Y/Y increase in sales in Q3 (2023: +2.4%), driven by strength in MFC and RMS. Backlog developments were even more robust - the total backlog was up 6.2% Y/Y to $166 billion, with a book-to-bill ratio of 1.3 in Q3 2024.

From a profitability perspective, adjusted EPS was $6.80/share in Q3, up 1% Y/Y (2023: $27.82/share), with the operating margin improving to 12.5%, up 0.4% Y/Y. Free cash flow was $4.8 billion year-to-date, up 6.1% Y/Y (2023: $6.2 billion).

Turning to the 2024 outlook, the company expects 5.4% higher sales, flat free cash flow, and 3.3% lower earnings, impacted by higher pension contributions and tax rates.

Lockheed Martin Government Revenue Share

In Q3 2024, the U.S. government accounted for 74.2% of Lockheed Martin’s sales. That said, no detailed update was released on international government exposure with the set of Q3 2024 results, but as per the company’s annual report, in 2023, government customers accounted for about 92.5% of Lockheed Martin’s revenue, including:

- 73% to the U.S. government

- 19.5% to international governments

International commercial customers made up 6.5% of total sales, while U.S. commercial customers accounted for just 1% of total company revenue.

Boeing (NYSE: BA)

Boeing 2024 Q3 Results Overview

Boeing reports results in three main segments, namely “Commercial Airplanes” (BCA) at 41.6% of Q3 2024 revenues, “Defense, Space & Security” (BDS) at 31%, and “Global Services” (BGS) at 27.4% of Q3 2024 revenues:

Figure 3. Boeing revenue breakdown between segments

Source: Boeing Form 10-Q for Q3 2024

Boeing recorded a 1.7% Y/Y sales drop in Q3 2024 (2023: +17%), impacted by the strike at the Commercial Airplanes division. Margin performance was equally bleak, driven by charges at BDS on fixed-price contracts and the aforementioned strike. As a result, the Core loss per share was $10.44/share in Q3 (2023: $5.81/share). Free cash flow was negative at $10.2 billion year-to-date (2023: +4.4 billion).

On a more positive note, the total backlog grew 9% Y/Y to $529 billion at the end of Q3 2024, putting the company on a sustainable growth trajectory once production picks up in the Commercial Airplanes division.

The focus remains on quality improvements, with operational performance likely to stabilize in Q4 2024 as the workers’ strike in BCA is now over. The company also raised $21 billion in fresh equity in a bid to shore up its investment-grade credit rating.

Boeing Government Revenue Share

Boeing defense contracts account for a substantial amount of Boeing government contracts. Government orders are booked primarily through the BDS division, as well as the BGS services business to a lesser extent.

Following the 5.5% Y/Y drop in BCA revenue in Q3 2024, the relative importance of government contracts for Boeing has increased. In Q3 2024, a combined 36.4% of Boeing's revenue came from the U.S. government alone. Quarterly company disclosures, as noted above for Lockheed Martin, are not detailed enough to conclusively compute the exact government exposure to non-U.S. sources. That said, our estimates show that an additional 2.9% of Q3 2024 revenue was derived from non-U.S. government sources As a result, the cumulative government revenue exposure of Boeing was 39.3% in Q3 2024.

RTX Corporation (NYSE: RTX)

RTX 2024 Q3 Results Overview

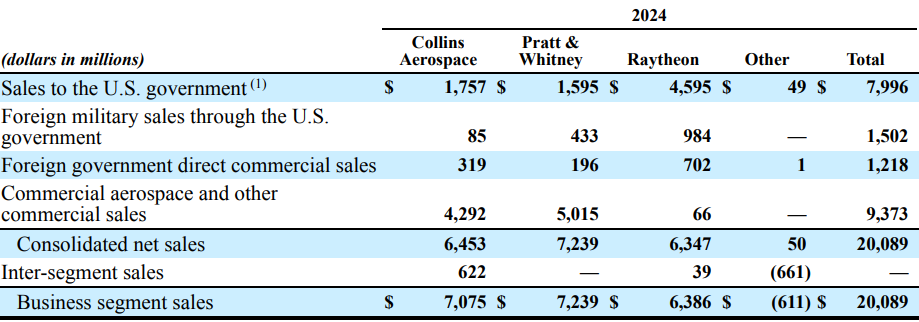

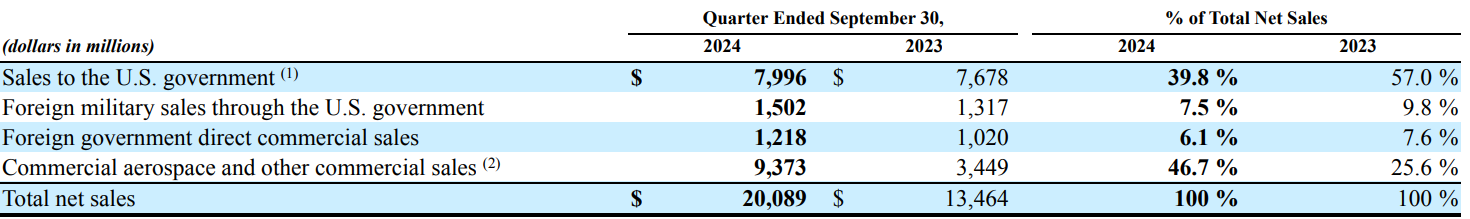

RTX Corporation, previously known as Raytheon, reports results in three main segments, namely Collins Aerospace at 32% of Q3 2024 revenue, Pratt & Whitney at 36%, and Raytheon at 32% of Q3 2024 revenue:

Figure 4. RTX Corporation revenue breakdown between segments

Source: RTX Q3 2024 Results Presentation

RTX delivered 8% Y/Y organic revenue growth in Q3 2024 (2023: +3%), driven by growth across all three segments. Adjusted EPS increased 16% Y/Y to $1.45/share (2023: $5.06) helped by a 1% margin expansion to 16%. Free cash flow totaled $4 billion year-to-date (2023: $5.5 billion).

RTX’s results look particularly impressive given that the company managed to grow its backlog by 16.3% Y/Y to a record $221 billion (book-to-bill ratio of 1.8), driven by both commercial and defense businesses.

The stellar performance prompted RTX to increase its adjusted EPS forecast to $5.54/share, up 9.5% Y/Y. The organic sales outlook was unchanged at 8-9%. Likewise, there was no update to the free cash flow outlook of $4.7 billion.

RTX Government Revenue Share

RTX Corporation conducts government business primarily (but not limited to) through its Raytheon segment. In Q3 2024, government orders accounted for 53.3% of RTX’s revenues, with the U.S. government the largest single customer, at 39.8% of all Q3 2024 sales:

Figure 5. RTX Corporation customer breakdown Q3 2024

Source: RTX Corporation Form 10-Q for Q3 2024

The cumulative government exposure of 54.9% in Q1 2024 is down from the 59% share government business had in RTX’s 2023 topline, indicating the increased significance of the commercial business for RTX in recent quarters.

Booz Allen Hamilton (NYSE: BAH)

Booz Allen Hamilton 2025 Q2 Results Overview

Booz Allen Hamilton has a fiscal year ending in March. The company recorded 18% Y/Y revenue growth in Q2 of fiscal 2025, with adjusted EPS of $1.81/share, up 40% Y/Y.

Backlog developments were equally robust as the total backlog reached $41.2 billion, up 17.9% Y/Y. The book-to-bill ratio reached 2.61x in Q2 2025, or 1.52x on a trailing twelve-month basis.

The excellent operating performance prompted the company to increase its full-year guidance, with revenue growth seen at 12% and adjusted EPS at $6.20/share, up 13%:

Figure 6. Booz Allen Hamilton fiscal 2025 guidance

Source: Booz Allen Hamilton Q2 2025 Results Presentation

Booz Allen Hamilton Government Revenue Share

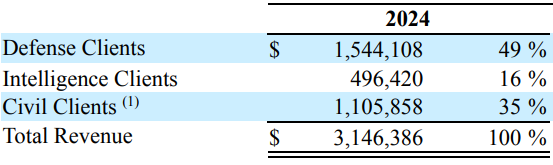

Booz Allen Hamilton is almost entirely dependent on the U.S. government for its business. The company now bundles its remaining non-government exposure in Civil Clients; hence an exact U.S. government exposure figure is no longer available. That said, previously Booz Allen Hamilton only reported 2% non-government revenue exposure. As a result, we can safely assume the U.S. government accounts for around 98% of the company’s top line:

Figure 7. Booz Allen Hamilton revenue by customer type

Source: Booz Allen Hamilton Form 10-Q for Q2 2025

Defense Sector Peer Analysis

After lackluster growth in the previous decade, the defense sector is poised for a comeback in the years to come. Against the backdrop of persistent geopolitical tensions and legislative uncertainty following the U.S. elections, some players such as Lockheed Martin and Booz Allen Hamilton are in a better position to weather economic headwinds.

The high proportion of government spending as a percentage of their revenues secures their position as it ensures the predictability of their cash flows. Of the four companies, Boeing remains a turnaround play and is the only company operating at a loss. RTX has seen its commercial business develop robustly and is also shielded from an economic downturn with its sound financial health and 53.3% government spending exposure.

Figure 8. Defense Suppliers Government Sales Share out of Total Sales (Q3 2024)

| Company | U.S. Government Sales %, Q3 2024 | Total Government Sales %, Q3 2024 | Forward Earnings Yield | Backlog change Y/Y, Q3 2024 |

| Lockheed Martin | 74.2% | ~93% | 4.7% | 6.2% |

| Boeing | 36.4% | -39.3% | N/A | 9% |

| RTX | 39.8% | 53.3% | 4.4% | 16.3% |

| Booz Allen Hamilton | ~98% | ~98% | 3.4% | 17.9% |

Source: Company 10-Q and 10-K filings

As shown in Figure 8, all four companies rely heavily on government sales. For Booz Allen Hamilton, U.S. government sales make up as much as 98% of the company’s revenue. For defense heavyweight Lockheed Martin Q3 2024 revenues from government tenders amounted to circa 93%, with 74.2% coming from sales to the US government alone.

Turning to the other two companies, Boeing and RTX are more dependent on commercial sales, with Boeing seeing its government business grow in importance after recent quality lapses in the Commercial Airplanes division. As a result, public spending accounted for 39.3% and 53.3% of Boeing and RTX revenue respectively.

We observe that relative to the prior year, order backlog increased at all four companies. Lockheed Martin trades at the highest earnings yield which appears justified given that it recorded the slowest backlog growth of 6.2%. RTX shares offer the second-highest earnings yield in our sample, with backlog growth of 16.3% marginally behind Booz Allen Hamilton which increased its backlog 17.9%, justifying its premium valuation.

In conclusion, we once again posit that monitoring the global public procurement activity of major players within the defense sector is worthwhile due to their well-documented dependence on government contracting. This holds particularly true in light of the relationship between government receivables and stock movement that we have discovered and discussed in one of our white papers. Learn more about our forward-looking government receivables data here.

This article was originally published in September 2022. Its current, updated version has been published in November 2024.