It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Humana recently reported its Q1 2023 results and below we will provide a brief analysis of the company’s performance in the first 3 months of 2023.

Key points:

* 85% government revenue exposure in Q1 2023, primarily though Medicare;

* 11.6% Y/Y revenue growth in Q1. Full year 2023 outlook boosted to $105.4 billion, some 13.5% higher relative to 2022;

* Q1 adjusted EPS increased 20.1% Y/Y to $9.38/share. Full year 2023 outlook boosted to at least $28.25/share, up 9.2% on 2022;

* $67 million in buybacks executed in Q1. $1 billion planned for the full year;

* 15.2% growth expected in Medicare Advantage users for 2023, with 50% of new customers coming from a competitor.

Humana Q1 2023 Results Overview

We originally covered Humana's Q4 results in part 15 of our Top Government Contractors series here. Below we will highlight the progress achieved by the company in Q1 2023.

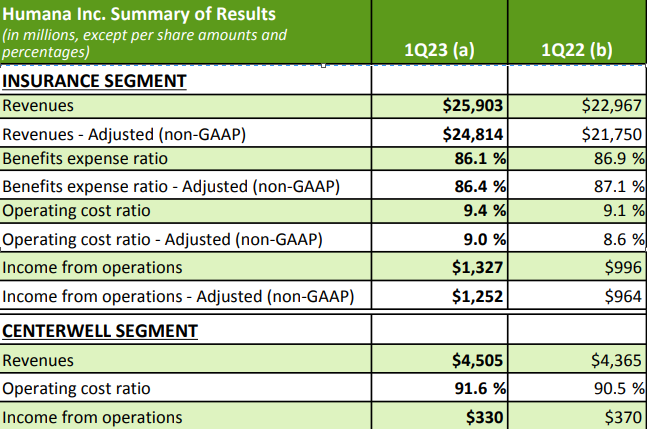

Humana reports results in two distinct segments, Insurance at 85.2% of Q1 2023 revenues (comprised of products serving Medicare and state-based contract beneficiaries sold on a retail basis to individuals including medical and supplemental benefit plans) and CenterWell at 14.8% of Q1 2023 revenues (incorporates payor-agnostic healthcare services offerings, including pharmacy dispensing services, provider services, and home services):

Figure 1: Q1 2023 Humana segment revenues

Source: Humana Q1 2023 Results Release

Operational Overview

Insurance was the best performing segment in Q1, growing revenues 12.8% Y/Y (2022 +9.8%). Momentum was driven by both individual Medicare Advantage and state-based contracts membership growth, as well as higher premiums. The benefits expense ratio (which shows insurance benefits paid in relation to insurance premiums received, i.e. lower is better) improved by 0.8% Y/Y to 86.1% (2022 86.6%).

CenterWell grew sales 3.2% Y/Y in Q1 (2022 +23.1%). The increase was due to higher pharmacy revenue, strength in the provider and Home solutions businesses. The operating cost ratio (same logic as benefits expense ratio above) deteriorated by 1.1% Y/Y to 91.6% (2022 91.5%).

On a consolidated basis, revenues increased 11.6% Y/Y in Q1 (2022 +11.8%). Adjusted EPS increased 20.1% to $9.38/share (2022 full year $25.88/share). The benefits expense ratio improved by 0.9% Y/Y to 85.5%, helped by a business divestment (2022 86.3%).

Updated 2023 Outlook

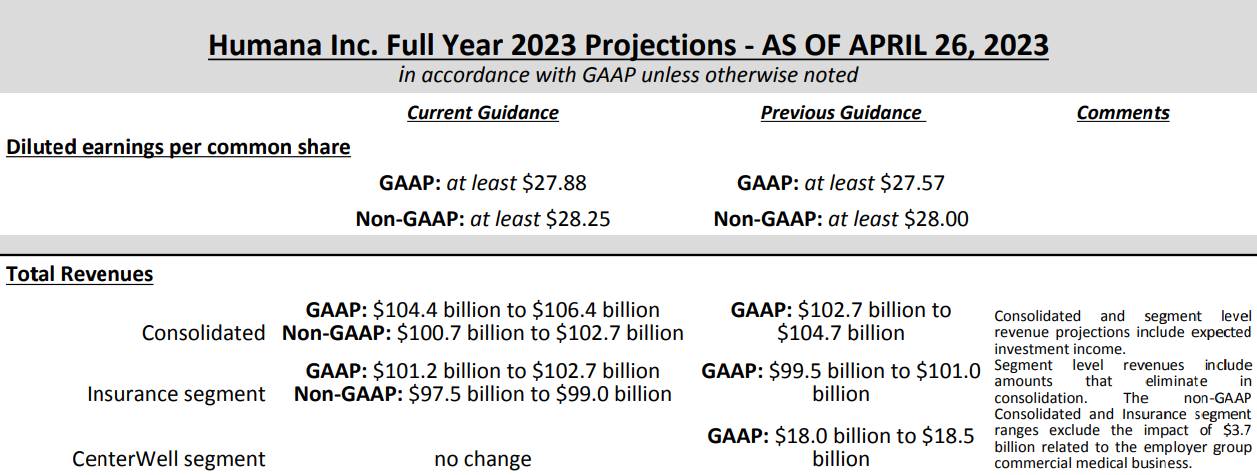

In light of the strong Q1 performance, Humana increased its Adjusted EPS outlook to at least $28.25/share, up 9.2% on 2022:

Figure 2: Revised Humana 2023 Outlook

Source: Humana Q1 2023 Results Release

The company also expects higher revenues, at about $105.4 billion, some 13.5% higher Y/Y. The increase was driven by strong performance in the insurance segment.

The rest of the outlook remains unchanged, with this caveat on the benefit expense ratio (2022 86.6%) from the conference call:

From a benefit ratio perspective, we reaffirmed our full year insurance segment guidance range of 86.3% to 87.3%. As previously shared, we expect the additional 150,000-member growth to impact the benefit ratio by approximately 10 basis points. As a result, we continue to be comfortable with our previous guidance range but now anticipate the full year benefit expense ratio to be biased towards the upper half of the range, which is consistent with the majority of analyst estimates today.

Capital Position

The debt-to-total capitalization ratio (which measures what percentage of the balance sheet is funded by debt as opposed to equity) improved by 0.9% Q/Q to 41.1% thanks to retained earnings as the company spent only $67 million on buybacks in Q1, or just 6% of adjusted earnings ($1.1 billion in Q1).

The remaining repurchase authorization, as of April 25 2023, was $2.8 billion. The company expects to repurchase shares worth $1 billion in 2023.

Government Contracting Exposure

Medicare products (primarily Medicare Advantage and Medicare Part D Prescription Drug Plan contracts with the federal government) accounted for 84% of all premium and services revenue in Q1 2023, up 2% relative to full-year 2022.

Military business, primarily through a regional contract covering 32 states, accounted for 1% of total premium and services revenue in Q1.

All in all, consolidated government exposure amounted to about 85% in Q1 2023.

From a Medicare mix perspective, Medicare Advantage plans (which come with a higher profit margin) now account for 66% of all Medicare membership at Humana, and are set to continue growing in 2024 at a high single digit pace. For 2023, the company expects to grow Medicare Advantage users by about 775,000, or 15.2% Y/Y.

Conclusion

Humana is on track to deliver close to double-digit top-and-bottom-line growth, driven by an expanding market and a competitive product offering – 50% of new Medicare Advantage members have switched to Humana from a competitor. This represents an increase relative to the traditional 30% rate.

While topline growth in 2023 will be unusually strong due to high interest rates, the company is on track to grow revenues at a high single digit rate in the future, with the ultimate goal of reaching $37/share in adjusted EPS as soon as 2025.

In light of the fact that 85% of Humana's total premiums and services revenue in Q1 2023 were derived from contracts with the federal government, monitoring the company’s public procurement activity remains a smart move that can provide key insights into Humana’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Humana or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.