It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at the first company covered in this series. IBM recently reported its Q2 2023 results and below we will provide a brief analysis of the defense contractor’s latest performance.

Key points:

* Revenue down 0.4% Y/Y in Q2, with poor performance in Infrastructure due to a strong prior year-quarter. 3-5% growth outlook for the full year maintained;

* Software segment annual recurring revenue up 0.8% Q/Q and 7% Y/Y. Consulting segment book-to-bill of 1.10 over the past year;

* Free cash flow of $3.4 billion YTD, up $0.1 billion Y/Y. $350 million spent on 6 smaller M&A deals and $3 billion on dividends;

* Full year free cash flow outlook of $10.5 billion intact, up $1 billion Y/Y;

* Apptio, which serves half of Fortune 100 companies, to boost IT automation offering. The $4.6 billion deal is set to close later in 2023.

IBM Q2 2023 Results Overview

We previously covered IBM's Q1 2023 results in part 32 of our Top government contractors series here. Below we will highlight the progress achieved in Q2 of this year.

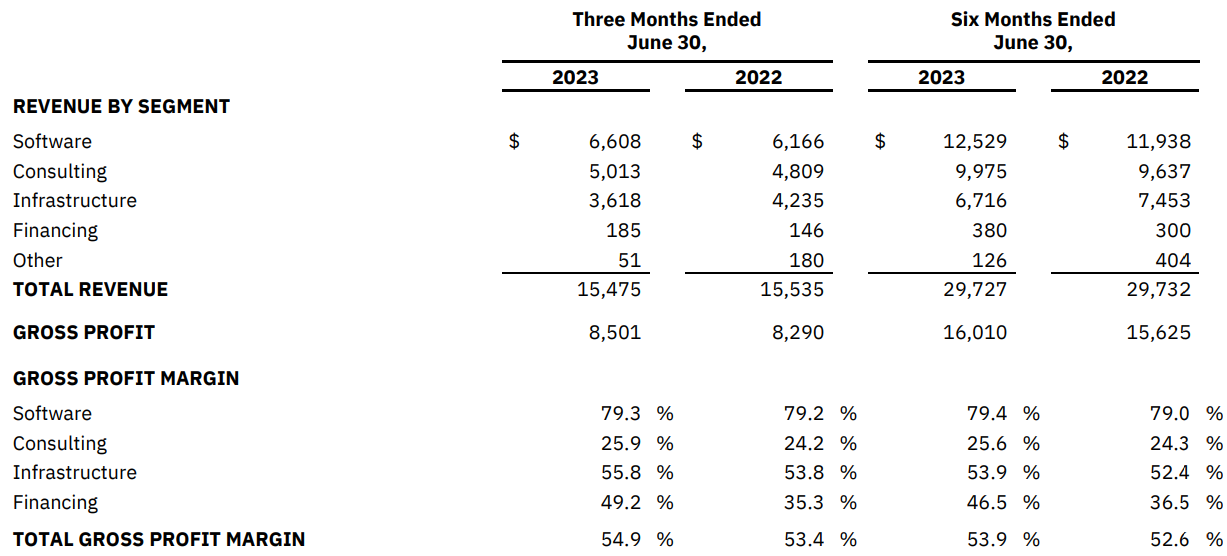

IBM reports results in three main segments, namely Software (includes Hybrid Platform & Solutions, Transaction Processing) at 42.7% of Q2 2023 revenues, Consulting (includes Business Transformation, Technology Consulting and Application Operations) at 32.4% and Infrastructure (includes Hybrid Infrastructure and Infrastructure Support) at 23.4% of Q2 2023 revenues:

Figure 1: IBM Q2 Results by Segment

Source: IBM Q2 2023 Results Press Release

Operational Overview

Software was the strongest segment in the quarter, with revenue up 7.2% Y/Y in Q2 (2022 +6.9%). Red Hat, Data & AI and Transaction Processing were the main sales drivers. The gross profit margin improved as well, gaining 0.1% Y/Y to 79.3%.

Consulting was the other growth segment in Q2 as sales increased 4.2% Y/Y (2022 +7.1%). Revenue growth was broad-based, with Application Operations the best performing division. The gross profit margin improved markedly by 1.7% Y/Y to 25.9%.

Infrastructure suffered poor top-line results in Q2 as sales cratered 14.6% Y/Y (2022 +7.8%). The weakness was driven by the Hybrid Infrastructure sub-segment, with the launch of the z16 mainframe last year creating tough year-over-year comparisons. Margins performance defied all odds as the gross profit margin improved by 2% Y/Y to 55.8%.

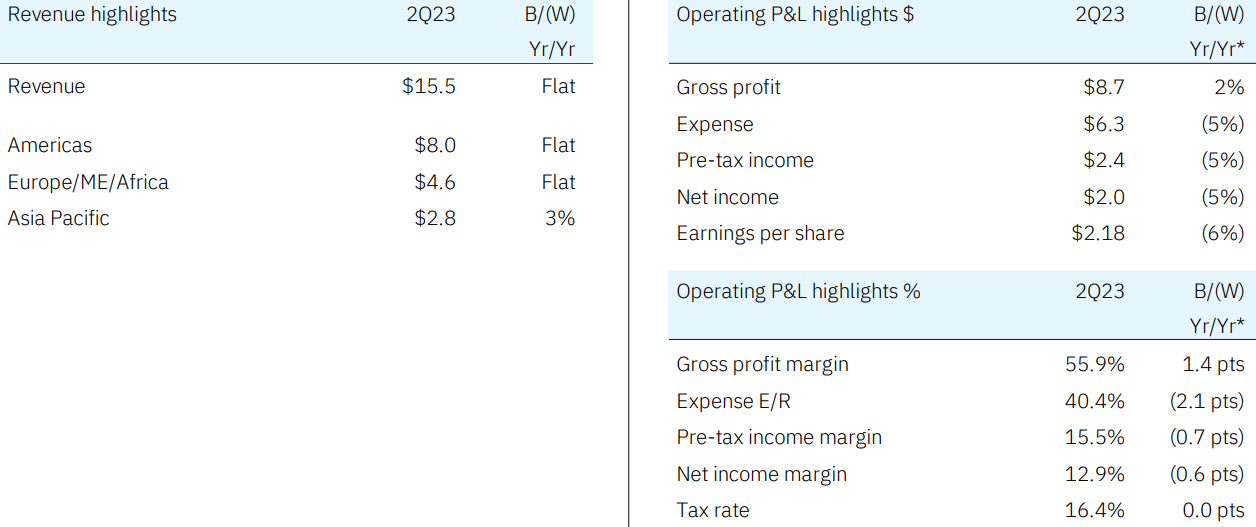

On a group level, sales dropped 0.4% Y/Y in Q2 (2022 +5.5%). The top-line drag from dollar strength was limited, with Q2 constant currency revenue up 0.4% Y/Y. Free cash flow was $3.4 billion year-to-date, up $0.1 billion Y/Y. Operating EPS was $2.18/share, down 6% Y/Y, as expenses increased 5% Y/Y driven by $115 million in workforce rebalancing in the quarter:

Figure 2: IBM Q2 Result Highlights

Source: IBM Q2 2023 Results Presentation

2023 Outlook

Despite decelerating performance into Q2, IBM reiterated its 2023 outlook:

Revenue Growth: IBM expects constant currency revenue growth of 3-5%. At current foreign exchange rates, the company anticipates currency to be neutral to revenue growth (in 2022 currency was a negative contributor at 6.3%).

Looking at performance over the first six months, cumulative revenue is largely flat Y/Y, implying a result closer to 3% growth should be expected.

Free Cash Flow: The company expects about $10.5 billion in consolidated free cash flow, up more than $1 billion year to year.

Revenue Resilience

The Software segment ended Q2 with $13.6 billion in annual recurring revenue, up 0.8% Q/Q and 7% Y/Y.

In Consulting the book-to-bill ratio was 1.1 for the past year.

Capital Structure

Net debt was up $0.1 billion Q/Q to $41.2 billion. Against a market capitalization of about $126 billion, IBM remains one of the most levered companies in our top government contractors list, notwithstanding that 18.4% of total debt is held in IBM Financing (the unit facilitates IBM clients’ acquisition of information technology systems, software and services through its financing solutions).

The company has made six acquisitions so far in 2023, bolstering its hybrid cloud and AI offering, for a total of $350 million.

The other main free cash flow deployment avenue were dividends, with $3 billion distributed year-to-date.

Apptio Purchase

Later this year, IBM expects the purchase of Apptio to close, boosting capabilities in IT automation, as highlighted in the press release:

Apptio is an established, growing and profitable technology business management and FinOps leader, with over 1,500 clients, serving more than half of the Fortune 100. Industry recognized, Apptio partners and integrates with leading companies such as Amazon Web Services, Microsoft Azure, Google Cloud Platform, Salesforce, ServiceNow, Oracle and SAP, consistent with IBM's commitment to an open partner ecosystem.

The $4.6 billion price-tag makes it the biggest purchase for IBM this year. IBM expects significant synergies and business growth opportunities to come from Apptio's acquisition, as highlighted by CEO Arvind Krishna:

Apptio's offerings combined with IBM's IT automation software and watsonx AI platform, gives clients the most comprehensive approach to optimize and manage all of their technology investments.

Conclusion

IBM's revenue decline in Q2 should be seen as idiosyncratic due to the base effects of a strong prior-year quarter severely impacting the Infrastructure segment. Underpinned by robust performance in the other two segments, IBM kept its 2023 outlook intact.

The Apptio purchase should bring year-to-date M&A spending to almost $5 billion, or roughly half of the company's 2023 free cash flow outlook. This will further boost results in 2024 when restructuring charges dragging performance in 2023 are set to decline.

Considering the substantial business IBM does with federal agencies, monitoring the company’s public procurement activity also remains a smart move that can provide key insights into its financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy IBM or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.