Key points:

* AmerisourceBergen has won nearly $1.5bn in government contract awards in 2022 up until the end of Q3

* 21.3% Y/Y adjusted EPS growth in Q3 2022 driven by strong operating performance & M&A

* Fiscal 2023 adjusted EPS growth seen between 1% and 8%, dependent on COVID-19 earnings decline

* Germany-based PharmaLex acquisition/March closing expected/ to contribute $0.15 in adjusted EPS for fiscal 2023, around $0.26 in fiscal 2024

* Long-term growth in Adjusted EPS seen in the range of 8-12% per year.

AmerisourceBergen Q3 2022 Sales Breakdown

The drug wholesale company AmerisourceBergen is known to be advancing the development and delivery of pharmaceuticals and healthcare products, while also providing consulting related to medical business operations and patient services.

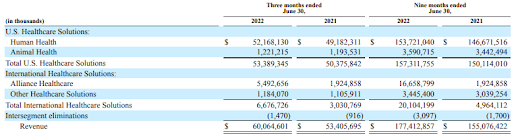

Looking at its financials, the company reports results in two large segments, namely U.S. Healthcare Solutions at 89% of Q3 2022 sales and International Healthcare Solutions at 11% of Q3 2022 sales. When looking at the figures, we should bear in mind that AmerisourceBergen has a fiscal year ending on September 30th.

Figure 1. AmerisourceBergen Sales Breakdown Q3 2022

Source: AmerisourceBergen Form 10-Q for Q3 2022

AmerisourceBergen Q3 2022 Results Overview

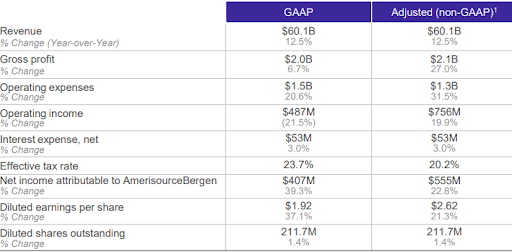

Overall revenue jumped by 12.5% Y/Y, driven by 6% growth at U.S. Healthcare Solutions (increased volumes in mail order and growth in sales to specialty physician practices, offset by lower revenue from commercial COVID-19 treatments) and 120.3% growth at International Healthcare Solutions (primarily due to the June 1, 2021, acquisition of Alliance Healthcare):

Figure 2. AmerisourceBergen Results Overview Q3 2022

Source: AmerisourceBergen Results Presentation for Q3 2022

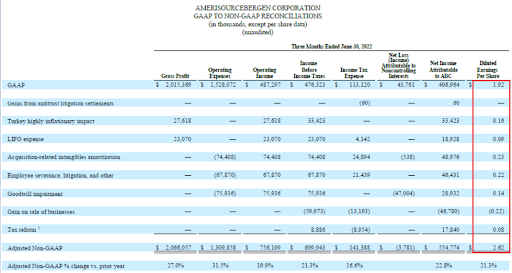

Looking at the bottom line, adjusted diluted EPS grew 21.3% to $2.62/share with both segments contributing to the result. The bridge between GAAP and Adjusted Non-GAAP EPS shows the biggest negative factors were "Acquisition-related intangibles amortisation" & "Employee severance, litigation and other", offset by "Gain on sale of businesses":

Figure 3. AmerisourceBergen GAAP to Non-GAAP EPS Bridge Q3 2022

Source: AmerisourceBergen Results Presentation for Q3 2022

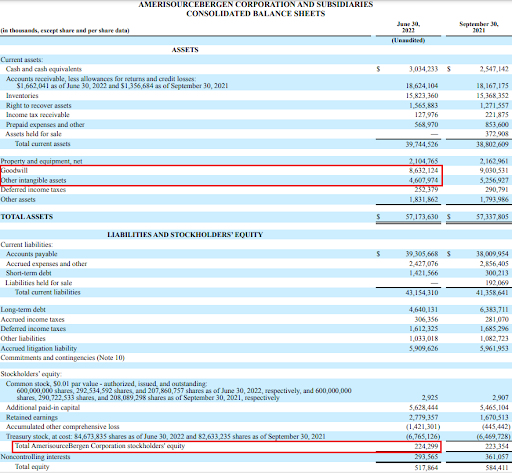

Turning our attention to the company's balance sheet, we see that AmerisourceBergen had circa $13.2bn of intangibles on its balance sheet as of June 30th, implying significant negative tangible shareholders’ equity:

Figure 4. AmerisourceBergen Balance Sheet Q3 2022

Source: AmerisourceBergen Form 10-Q for Q3 2022

The capital structure is fairly conservative, with net debt of around $3bn against a market cap of circa $28.5bn.

Highlights from the conference call include more options to market Pfizer's Paxlovid COVID-19 antiviral in pharmacies:

And importantly, we were pleased to see the U.S. FDA's revision to the Paxlovid EUA authorizing state licensed pharmacists to prescribe the COVID-19 antiviral to eligible patients.

This action by the FDA reflects the value that can be gained by the U.S. healthcare system if the role of pharmacists can be expanded. Americans rate pharmacies as the most accessible amongst health care destinations, including emergency departments and primary care physicians' offices, and many now have a pharmacy-first mentality when looking to improve their well-being. Pharmacies are providing 2 out of every 3 COVID-19 vaccine doses administered in America and 45% of pharmacy COVID-19 vaccination sites are reported to be in areas with moderate to severe social vulnerability. AmerisourceBergen is proud of our work to support independent pharmacies, including by advocating on their behalf for health equity policies that ensure access to their critical services.

Source: AmerisourceBergen Q3 2022 Conference Call

The company also provided an update on its COVID-19 therapy exposure:

As it relates to COVID therapy earnings impact, COVID therapies contributed $0.14 to the June quarter exactly half of the $0.28 contribution we called out on our May earnings call as remaining for the balance of our fiscal year in the U.S. healthcare solutions segment.

As a reminder, our full year estimate for COVID therapy contribution in the U.S. healthcare solutions segment is still approximately $0.60, $0.46 of which we have realized in the segment through our third quarter. If COVID therapy volume trends in July were to continue through August and September, we would expect to see a couple of pennies worth of decline in COVID therapy contribution sequentially but clearly in that $0.60 full year ballpark.

Source: AmerisourceBergen Q3 2022 Conference Call

AmerisourceBergen also reiterated its target of circa 8% EPS growth for 2023 (5% organic + 3% M&A/Buyback), as well as COVID earnings contribution:

While we are in the middle of our planning process for fiscal 2023, I want to repeat the earlier commentary that I gave at our Investor Day in June about our expected organic consolidated adjusted operating income and adjusted diluted EPS growth for fiscal 2023. If you exclude the contribution from COVID treatment distribution, our operating income growth should be in the 5% range and EPS growth in the 8% range, again, x COVID.

As it relates to the potential COVID contribution, trends and treatment utilization remain difficult to predict too far out but we continue to believe the contribution from COVID treatment distribution in 2023 could easily be less than half of the approximately $0.70 contribution included in our 2022 guidance.

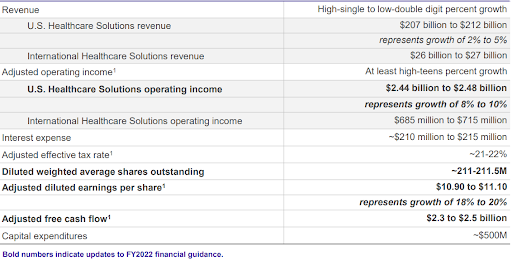

Finally, the company raised its fiscal 2022 adjusted EPS guidance from a range of $10.80 to $11.05 and to a new guidance range of $10.90 to $11.10 representing growth of approximately 18% to 20% from the prior fiscal year. The increased guidance reflects stronger-than-expected performance in several businesses and a lower-than-expected average diluted share count:

Figure 5. AmerisourceBergen Updated Fiscal Year 2022 Guidance

Source: AmerisourceBergen Results Presentation for Q3 2022

Government exposure

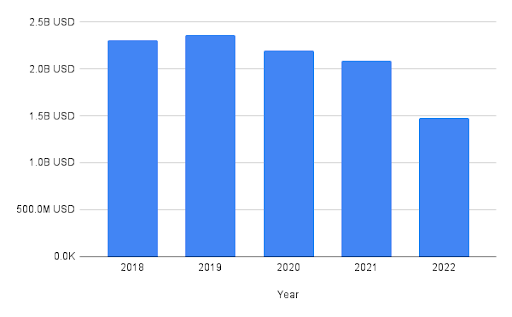

AmerisourceBergen's direct government procurement contract exposure peaked in 2019 and has been declining since, as TenderAlpha’s government contracts data can show:

Figure 6. AmerisourceBergen Government Procurement Awards, 2018-2022

Source: TenderAlpha.com

More recently, government COVID-19 treatments distribution had a circa 6.4% contribution to adjusted EPS in fiscal 2022. This is expected to diminish somewhat going into fiscal 2023, both due to decline of COVID-19 intensity as well as a move to commercial procurement for Pfizer's Paxlovid antiviral medication.

PharmaLex Acquisition

Building on its commitment to expand in biopharma services, AmerisourceBergen is buying PharmaLex Holding GmbH, a Germany-based firm that provides strategic guidance and regulatory support to biopharma companies throughout a product’s lifecycle. PharmaLex also provides tech-enabled services ranging from clinical development consulting to marketing authorization, enabling clients to efficiently bring products to global markets and diverse patient populations.

Source: AmerisourceBergen PharmaLex Acquisition Announcement

From a financial standpoint, the €1.28bn purchase should add some $0.15 to adjusted EPS for the last seven months of fiscal 2023 (which implies that once customary closing conditions are met, the deal should be finalized somewhere in March 2023). Hence, the full-year run-rate in fiscal 2024 should be around $0.26 in incremental Adjusted EPS, or a circa 2% boost to expected Adjusted fiscal 2023 EPS.

Aside from the strategic rationale, it is hard to assess the capital allocation trade-off since no significant financial details are disclosed, other than it being a cash acquisition. Currently AmerisourceBergen's 2047 bonds yield circa 6% to maturity, while the earnings yield on ABC stock is 7.8%.

Investor Day Highlights

AmerisourceBergen held its Investor Day on June 1st 2022. The company reaffirmed its long-term vision, namely "maintaining leading share of pharmaceutical distribution and best-in-class efficiency, while growing higher-margin and high growth businesses within our U.S. and International reportable segments."

The company highlighted that the outsourced biopharma manufacturer services market, currently at around $100bn, is growing at 5-10%.

Looking at the long-term expected growth rates:

Figure 7. AmerisourceBergen Outlook

Source: AmerisourceBergen 2022 Investor Day Presentation

We see that in fiscal 2023 Adjusted EPS growth, seen at up to 8% as explained above, should be at the lower end of the long-term growth range of 8-12%.

Conclusion

AmerisourceBergen will face tough Y/Y comps in fiscal 2023, driven mainly by the fading impact of COVID-19 on earnings. Nevertheless, growth should pick up in 2024 as the company operates in a fast-growing market, coupled with its active M&A strategy.

We think there is no immediate catalyst for the stock but accumulating a position on weakness should pay off as the company returns to solid earnings growth later on.

Monitoring the public procurement activity of AmerisourceBergen and other players in the pharmaceutical sector remains a smart, yet lesser-known move that can give an advantage when predicting the companies’ future performance.

This is exemplified by the latest contract award by the U.S. Department of Health and Human Services for the distribution of vaccines and treatments for Monkeypox, as well as examined in TenderAlpha’s ‘Government Receivables as a Stock Market Signal’ white paper.

Continued partnership with the government indicates that a business may enjoy the predictability of its own cash flow, which, in turn, will improve its prospects in the market as well as potentially increase its share price. Furthermore, should a recession start sometime in 2023, investors will appreciate the conservative nature of AmerisourceBergen's business.

To learn more about the ways in which TenderAlpha can provide you with insightful forward-looking public procurement data, get in touch now!