TenderAlpha is thrilled to announce the launch of the Pension Funds Stock Ownership Data Feed! This new data solution is tailored to meet the growing demand for insights into the investment activities of pension funds worldwide.

As a derivative of our larger institutional ownership data product, this feed offers a more focused view specifically on pension funds. The data is available at the individual manager level, allowing users to gain a more detailed and nuanced understanding of how these funds allocate their assets.

Updated monthly, the data feed provides a comprehensive view of the minority holdings of pension funds in publicly traded companies with a market capitalization exceeding $100 million.

With historical data available since 2022, users can track ownership trends over time, which serves as a foundation for long-term analysis and forecasting, given the regular ongoing updates.

Additionally, the feed offers access to over 20 key data points per fund, covering essential metrics such as stock positions and ownership percentage changes, enabling users to conduct thorough analyses of pension fund activities.

Key Features of the Pension Funds Stock Ownership Data

- Ticker-Mapped Data for Stock Ownership: Gain access to investment-manager-level data for over 350 pension funds globally, providing clear insights into how pension funds allocate their investments.

- Global Market Coverage: The feed includes ownership information on more than 5,000 publicly-listed companies.

- Monthly Updates: Fresh data is made available every month, allowing users to track the latest trends and changes in pension fund holdings.

- Data Since 2022: A historical dataset that enables tracking of ownership trends, providing a foundation for long-term analysis and forecasting.

- Comprehensive Metrics: Access over 20 key data points per fund, covering stock positions and ownership shifts.

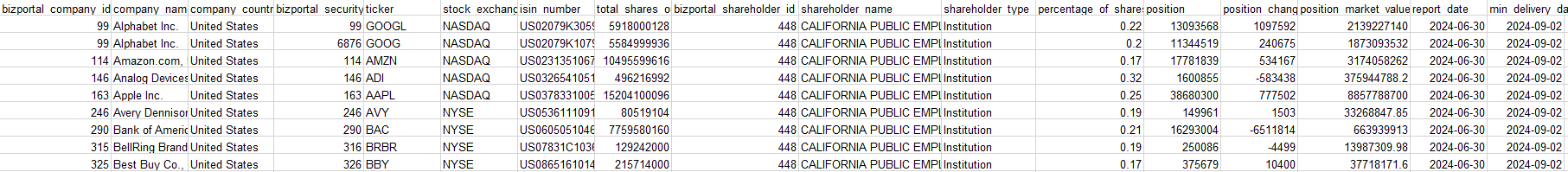

*Sample lines

Use Cases for Pension Funds Stock Ownership Data

- Detecting Market Trends from Ownership Shifts: Investors can monitor the buying and selling activities of pension funds to boost their ticker analysis and uncover emerging market trends. A rise in ownership of a specific company by pension funds could signal growing confidence in that company’s performance.

- Assessing Company Stability: Pension funds are often long-term, conservative investors, so analyzing their stock holdings can reveal companies that are considered stable and reliable. For instance, a company with increasing pension fund investments might be seen as low-risk by these institutions.

- Analyzing Investment Strategies: By observing pension funds' allocation patterns across various industries or regions, asset managers can mirror or avoid certain strategies depending on their own goals.

Unlocking New Insights by Combining Datasets

Since the Pension Funds Stock Ownership Data Feed is a subset of TenderAlpha's broader ownership data solution, it becomes even more valuable when combined with alternative datasets. The synergy between pension fund ownership data and alternative data, like government contracts and trade flows, can reveal hidden insights into a company’s performance and future potential.

Overlaying Pension Fund Data with Government Contracts

Government contracts can be a key indicator of a company's financial health and stability. By analyzing pension fund ownership alongside government contract data, investors can assess whether consistent contract wins are driving institutional confidence. A company securing large, recurring government contracts might attract more pension fund investments due to predictable revenue streams.

Using Pension Fund Data with Supply Chain Analysis

Understanding a company’s supply chain can also be critical for institutional investors. When pension funds invest heavily in companies with efficient and transparent supply chains, it often signals low operational risk. By integrating supply chain data with pension fund ownership, users can identify companies that pension funds favor due to their operational resilience and low risk of supply chain disruptions.

Adding Trade Flows to the Mix

Trade flows data provides crucial information about a company’s global exposure and potential geopolitical risks. Investors can evaluate pension fund investments in companies that have significant international trade activity. A company with heavy reliance on trade with regions experiencing political unrest may carry additional risk, which pension funds may react to by adjusting their positions.

Conclusion

TenderAlpha’s Pension Funds Stock Ownership Data Feed offers a deep dive into the investment patterns of pension funds across the globe. With extensive coverage, regular updates, and detailed ownership data, this feed provides invaluable insights for investors, portfolio managers, and financial analysts.

As a subset of our larger institutional ownership dataset, it offers focused insights into pension funds while maintaining the same robust and reliable framework. By integrating it with alternative data sources like government contracts and trade flows, users can gain a multi-faceted view of potential risks and opportunities, enhancing decision-making processes.

Interested in learning more about how the Pension Funds Stock Ownership Data Feed can improve your investment strategies? Contact TenderAlpha today to get started!