It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

In Part 23 of our blog series, we will present you the latest results of Jacobs.

Key points:

* 31% of 2022 sales to U.S. government. $3.2 billion contract for 10 years at Kennedy Space Center re-awarded;

* Revenue up 12.3% Y/Y in Q1, ahead of the 5.9% growth in fiscal 2022. All segments except PA Consulting contributing to growth;

* Adjusted EPS increased 7% Y/Y to $1.67/share (2022 $6.93/share, up 10% Y/Y). 2023 range confirmed at $7.20-7.50/share (+6.1% Y/Y);

* Adjusted EBITDA of 339 million, up 9% Y/Y (2022 +11% Y/Y). 2023 range confirmed at $1400-1480 million (+5.6% Y/Y);

* Backlog up 1% Y/Y, softer than revenue growth. Margin profile improved by 1%. Book-to-bill of 1.1 (2022 0.97). Net debt of 2.3 billion, 60% floating rate.

Jacobs Q1 2023 Results Overview

Jacobs Solutions has a fiscal year ending on September 30. Hence, below we will highlight the company's Q1 2023 results for the period ending December 31. The first quarter of fiscal 2023 brought about organizational changes, as highlighted in the company's 10-Q report:

During the first quarter of fiscal 2023, the Company reorganized its operating and reporting structure to report results under a new operating segment, Divergent Solutions (DVS), in addition to the current operating segments...The formation of the DVS operating segment resulted in certain portions of our other businesses moving to the new segment to align with the Company's business strategy.

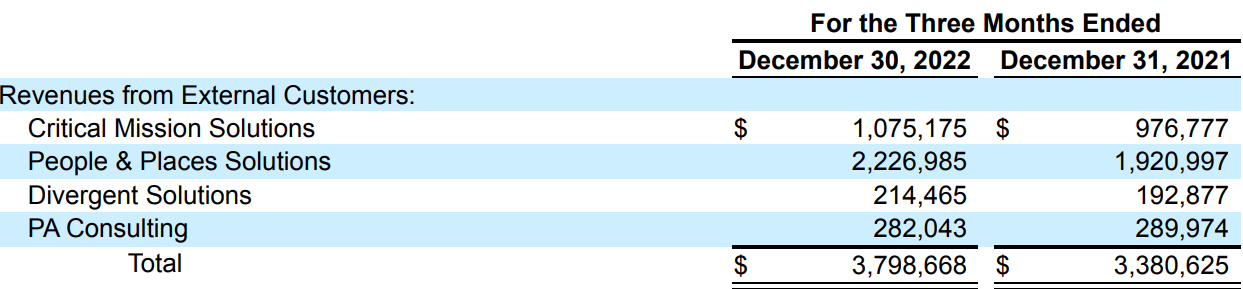

As a result, starting in Q1, the company reports results under four operating segments:

People & Places Solutions (energy, mobility services) at 58.6% of Q1 revenues, Critical Mission Solutions (IT services) at 28.3%, the majority investment in PA Consulting (public & private sector consulting) at 7.4% and the new Divergent Solutions segment (cloud & cyber services) at 5.6% of Q1 revenues:

Figure 1: Q1 2023 Jacobs Solutions segment revenues

Source: Jacobs Solutions Q1 2023 Form 10-Q

Operational Overview

People & Places Solutions was the strongest segment in the quarter, with revenue up 15.9% Y/Y, well above the 2.3% increase in fiscal 2022. The operating profit margin also came in strong, at 14.5% (2022 13.3%).

Critical Mission Solutions grew sales 10% Y/Y in Q1, again stronger than the 2.9% gain in 2022. Revenue growth was offset by margin softness, with the 7.6% operating margin below the 8.1% achieved for the full year. Revenue growth is expected to moderate somewhat in the remainder of the fiscal year.

PA Consulting was the only segment to register a revenue decline in Q1 at 2.7% Y/Y, a sharp drop from the stellar 78.4% growth in 2022. Margins were not a bright spot either, with the 18.1% print below the 20.7% achieved in the last fiscal year. That said, the margin is expected to move back towards 20% as the year progresses due to front-loading of hiring in 2022.

Divergent Solutions was the second-strongest performer in the quarter – sales were up 11.2% Y/Y. The operating margin deteriorated sharply however, at only 6% versus the 12.3% in the prior-year quarter. Revenue growth is expected to pick up in H2 2023.

On a consolidated basis, revenues increased 12.3% Y/Y in Q1, ahead of the 5.9% growth in fiscal 2022. Adjusted EBITDA of 339 million, up 9% Y/Y (2022 +11% Y/Y). Adjusted EPS increased 7% Y/Y to $1.67/share (2022 $6.93/share, up 10% Y/Y). Overall, it is fair to say faster top-line growth did not translate into stronger bottom-line increases. Free cash flow was $270 million in Q1 (2022 $347 million).

Jacobs 2023 Outlook

Despite a strong start of the year, the company confirmed its initial fiscal 2023 outlook, with a lower share count, foreign exchange and tax rate tailwinds offset by interest rate headwinds. As a result, guidance remains unchanged:

Adjusted EBITDA is expected between $1400-1480 million (+5.6% Y/Y).

Adjusted EPS is expected between $7.20-7.50/share (+6.1% Y/Y).

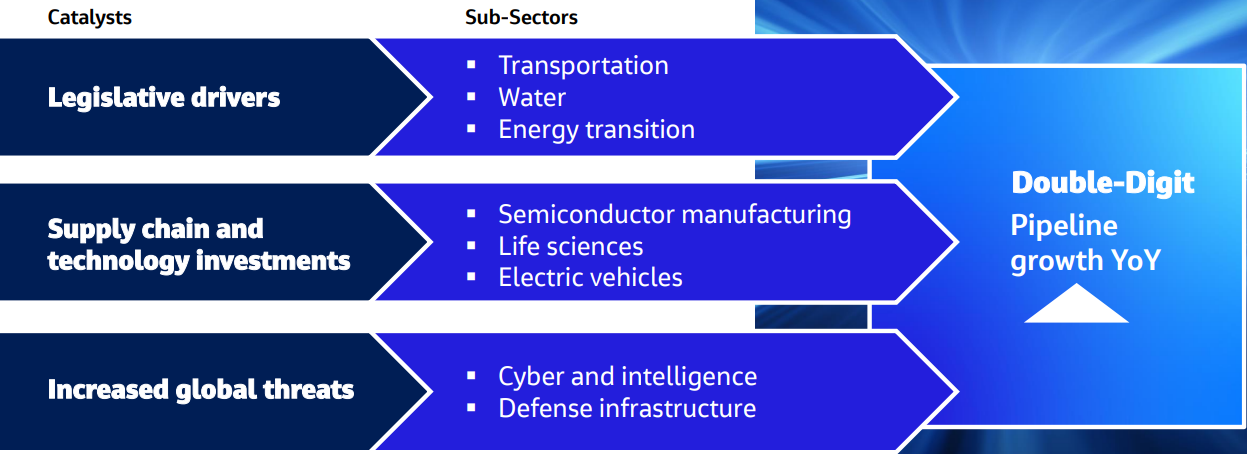

Longer term, the company expects double-digit pipeline growth, driven by secular tailwinds:

Figure 2: Jacobs Solutions growth drivers

Source: Jacobs Solutions Q1 2023 Earnings Presentation

Backlog

Backlog growth, at just 1% Y/Y, was weaker than revenue growth. The silver lining is that the margin profile of the backlog improved by 1% Y/Y as well. From a division standpoint, all segments except Divergent Solutions registered Y/Y growth. The book-to-bill ratio was 1.1, up from the 0.97 in 2022.

Capital Structure

Jacobs ended Q1 with a net debt of $2.3 billion, 60% of which is floating rate debt. Compared with its market capitalization of $14.3 billion, the company stands out as one of the more levered players in our list of top government contractors. Nevertheless, the company remains active on the share repurchase front, buying back $140 million in Q1 with a $1 billion authorization through January 2026.

The company remains committed to an investment grade credit rating and increased its quarterly dividend by 13% to $0.26/share.

Conclusion

Jacobs Solutions is set to see continued growth in fiscal 2023, with all segments except PA consulting contributing to the company's top-line. That said, the rate of bottom-line increase will be lower compared to 2022, largely due to higher interest rates on floating rate debt.

On February 24, Jacobs was re-awarded a $3.2 billion contract at Kennedy Space Center. The award covers launch infrastructure and ground processing over 10 years.

In light of the fact that 31% of sales were to the U.S. government in fiscal 2022, monitoring the Jacobs’ public procurement activity also remains a smart move that can provide key insights into the company’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Jacobs or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.