It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. L3Harris Technologies recently reported its Q1 2023 results and below we will provide a brief analysis of the company’s performance in the first 3 months of the year.

Key points:

* 77% of Q1 revenue from U.S. government;

* 9% revenue growth in Q1 (2022 -4.2%). 2023 outlook confirmed at +2.9%, with room for improvement should current trends persist;

* Q1 margin weakness set to fade into H2 2023. Acquisition synergies to materialize in 2024;

* Net-debt-to-adjusted EBITDA ratio, at 2.4 currently, set to rise to about 4.0 post Aerojet Rocketdyne purchase, exceeding the 3.0 threshold above which company will prioritize debt repayments;

* Book-to-bill ratio of 1.3 in Q1 (2022: 1.08). Backlog expanded 10.4% Q/Q to $24.5 billion.

L3Harris Technologies Q1 2023 Results Overview

We originally covered the Q4 2022 results of L3Harris Technologies in part 11 of our Top Government Contractors series here. Below we will highlight the progress achieved by the company in Q1 of 2023.

L3Harris Technologies reports results in three main segments, namely Integrated Mission Systems (IMS) at 37.6% of Q1 2023 revenue, Space & Airborne Systems (SAS) at 36.6% and Communication Systems (CS) at 25.7% of Q1 2023 revenue:

Figure 1: Q1 2023 L3Harris segment revenues

Source: L3Harris Q1 2023 Investor Letter

Operational Overview

Integrated Mission Systems was the weakest performer in Q1, growing revenues 2% Y/Y (2022 -1.8%). Sales growth was driven by the Intelligence, Surveillance and Reconnaissance sub-segment, which is traditionally lower margin. As a result, Q1 operating income was down 26% Y/Y, impacted by Estimate at Completion (EAC) adjustments.

Space & Airborne Systems registered the second-best segment performance, growing revenues 9% Y/Y in Q1 (2022 +1.6%). The increase was driven by the Space Systems and Mission Avionics sub-segments. Operating income increased 6% Y/Y in Q1 as Space Systems growth consisted of lower-margin development programs.

Communication Systems was the top performer in the quarter, increasing revenues 21% Y/Y, or 12% excluding the Tactical Data Link acquisition (2022 -1.6%). Growth was evenly split between Broadband Communications and Tactical Communications. Q1 operating income increased 16% Y/Y, impacted by the Integrated Vision Solutions sub-segment.

On a consolidated basis, revenue increased 9% Y/Y in Q1 (2022 -4.2%), however the segment operating margin of 14.3% was down both Y/Y and relative to 2022 /15.4%/. Adjusted EPS was $2.86/share, down 9% Y/Y, impacted by lower pension income and higher interest rates (2022 $12.9/share). Free cash flow was $314 million in Q1 (2022 $2 billion).

2023 Outlook

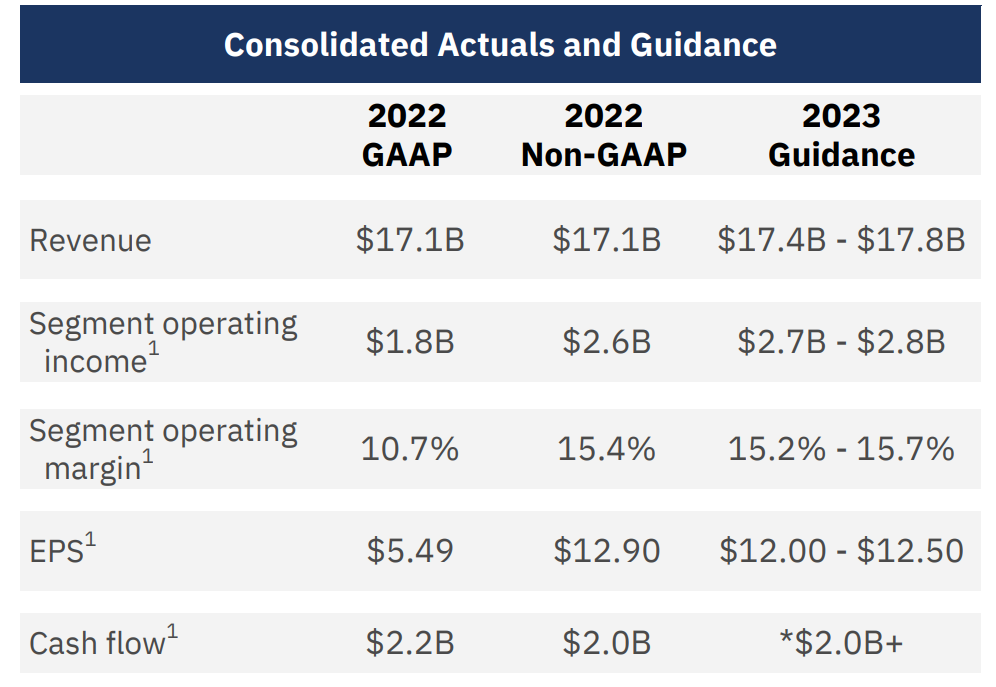

Relative to its 2023 outlook, L3Harris' Q1 performance was stronger on the top-line but weaker on margins. The company did not update its guidance and continues to expect stronger earnings in H2 2023:

Figure 2: L3Harris 2023 Outlook

Source: L3Harris Q1 2023 Investor Letter

Revenues are seen up 2.9% Y/Y (although management noted growth could reach as high as 4% given the strong sales performance and backlog, should current trends continue)

Segment operating margin is seen largely flat in 2023 (improvement expected in H2)

Free cash flow is seen at above $2 billion.

Non-GAAP EPS is expected to decline 5% to about $12.25/share.

Backlog

The book-to-bill ratio was 1.3 in Q1 (2022: 1.08). As a result, the total backlog expanded 10.4% Q/Q to $24.5 billion and is set to increase to over $30 billion following the Aerojet Rocketdyne acquisition.

The main driver behind the strong backlog performance was SAS, which had a book-to-bill of 2.0 in the quarter.

L3Harris Capital Structure

The company ended Q1 2023 with a net debt of $8.5 billion, while the current market capitalization is around $34.5 billion. The net debt position is set to increase further following the $4.7 billion acquisition of Aerojet Rocketdyne (AJRD). The deal is still set to close in 2023, although the market has grown somewhat skeptical on the transaction lately, increasing the discount to the $58/share acquisition price to 6.3% from around 2.6% through much of 2023. CEO Christopher Kubasik voiced confidence on the deal being finalized:

So, the reason I'm confident in the 2023 close, really comes down to the FTC's evaluation of this transaction. And when we look at it, we do not compete with Aerojet Rocketdyne. I mean plain and simple, they make rocket motors and rocket engines, and we do not. And that term is known as horizontal competitiveness, and there is none. We are not a customer of theirs, they are not a customer of ours, which is the term of art the FTC and lawyers use as vertical competition.

Given the rising debt level of the company, the metric L3Harris uses to steer its financial leverage is the net-debt-to-adjusted EBITDA leverage ratio. As of March 31, it stood at 2.4, while the level above which the company will prioritize debt repayments in 3.0. Post-acquisition, CFO Michelle Turner expects the ratio to reach 4.0.

In Q1 the company spent $220 million on dividends and $396 million on share buybacks, with about $100 million in share repurchases left to be executed in Q2-Q4.

Conclusion

Having closed on the Tactical Data Link acquisition in Q1, L3Harris is looking to finish the Aerojet Rocketdyne purchase as well, which should bring $40-50 million in run-rate synergies in its first full year. The transaction is set to be free cash flow accretive in its second full year.

Following the Aerojet Rocketdyne purchase the company is expected to organize an investor day and outline its plans for the combined entity.

Aside from being very active on the M&A front, L3Harris should benefit from improving bottom-line performance in the latter half of the year. This should provide a bridge to 2024 when acquisition-related synergies materialize.

In light of the rapidly evolving revenue and backlog profile of L3Harris post-acquisitions (77% share of U.S. government in Q1 revenue), monitoring the company’s public procurement activity remains a smart move that can provide key insights into L3Harris’ financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy L3Harris or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.