It is now time for the TenderAlpha team to look again at a company we covered previously in the Top Government Contractors series in our blog. L3Harris recently reported its Q2 2024 results and below we will provide a brief analysis of the company’s recent performance.

Key points:

* 13% Y/Y revenue growth in Q2 2024, driven by Aerojet Rocketdyne and the Communication Systems segment;

* Full-year sales growth is seen at only 9%, consistent with the declining backlog on a quarterly basis;

* Margin and EPS outlook increased on strength in legacy segments;

* Good progress made on deleveraging as net debt to adjusted EBITDA reaches 3.2;

* The U.S. government accounted for 77% of L3Harris’s Q2 2024 revenue.

L3Harris Technologies Q2 2024 Results Overview

We previously covered L3Harris Technologies's Q1 2024 results in part 63 of our Top Government Contractors series here. Below we will highlight the progress achieved by the company in Q2 of 2024.

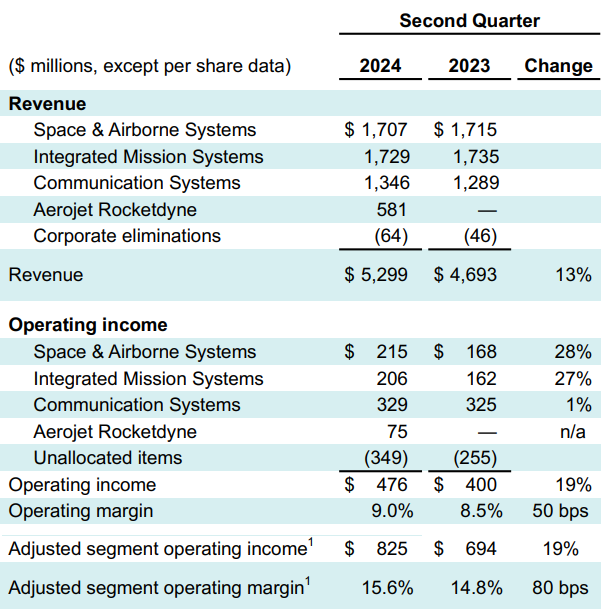

We will start with an L3Harris revenue breakdown. The company reports results in four main segments, namely Space & Airborne Systems (SAS) at 32% of Q2 2024 revenue, Integrated Mission Systems (IMS) at 32%, Communication Systems (CS) at 25%, and Aerojet Rocketdyne (AR) at 11% of Q2 2024 revenue:

Figure 1: L3Harris Q2 2024 Results Overview

Source: L3Harris Q2 2024 Results Press Release

Operational Overview

Space & Airborne Systems revenue was 0.5% lower Y/Y in Q2 2024 (2023: +7%), impacted by the antenna business divestiture. Adjusted for the disposal, revenues were 1% higher, driven by Space Systems and classified programs in Intel and Cyber. Margins were stronger, at 12.6% (2023: 11%), boosted by the effects of the LHX NeXt cost savings initiative and the absence of a non-cash charge that impacted prior year results.

Integrated Mission Systems sales were 0.3% lower Y/Y (2023: flat Y/Y), hampered by lower volumes in Commercial Aviation which is quite odd given the rebound other competitors have seen. Margins were a bright spot, at 11.9% in the quarter (2023: 6.9%), benefitting from LHX NeXt.

Communication Systems was the only legacy segment to record a revenue increase, at 4% Y/Y (2023: +20%), boosted by higher volumes in Broadband Communications and higher Department of Defense sales in Tactical Communications. Margin performance was marginally weaker Y/Y, at 24.4%, but ahead of the 24.2% 2023 average, impacted by higher domestic tactical radio mix and timing of software sales.

Aerojet Rocketdyne segment results were the result of program execution across Missile Solutions and Space Propulsion and Power Systems, with no prior year comparison provided by L3Harris. The operating margin stood at 12.9%, marginally lower than the 13.3% in Q1 2024.

On a consolidated level, Q2 2024 sales were 13% higher (2023: +14%), driven in large part by the Aerojet Rocketdyne acquisition in 2023. Reported operating margins were higher Y/Y, at 9%, but below the 2023 average of 11%, due to amortization of AR purchasing costs and restructuring expenses under the LHX NeXt efficiency plan. Adjusted for these effects, the operating margin stood at 15.6%. Likewise, adjusted EPS was $3.24/share, up 9% Y/Y, while free cash flow was $558 million year-to-date (2023: $2 billion).

Updated 2024 Outlook

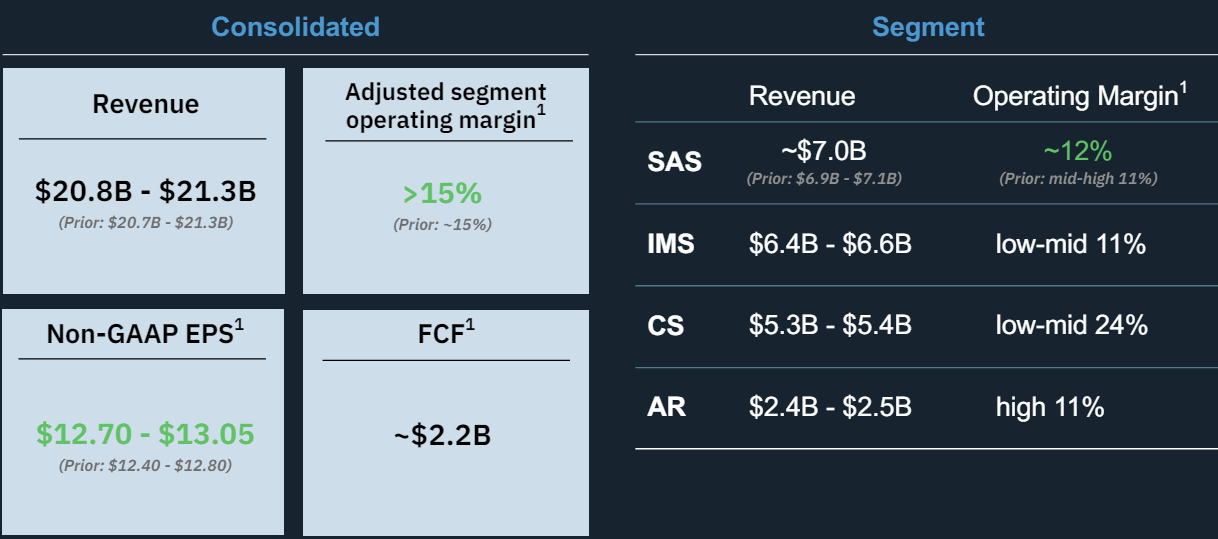

Better operational performance in the IMS and CS segments prompted L3Harris to increase its revenue, margin, and adjusted EPS outlook for 2024:

Figure 2: L3Harris Updated 2024 Outlook

Source: L3Harris Q2 2024 Results Presentation

- Revenue is now expected to increase by 9% Y/Y;

- The adjusted segment operating margin is now seen at circa 15.3%;

- Adjusted EPS is forecast at $13/share, up 5% Y/Y;

- Free cash flow is forecast at $2.2 billion, up 10% Y/Y.

Backlog

In line with the sluggish revenue growth outside Aerojet Rocketdyne, the book-to-bill ratio stood at 1.00 in Q2 2024. The company’s backlog ended Q2 2024 at $31.7 billion, up 27% Y/Y largely due to Aerojet Rocketdyne’s backlog addition. On a quarterly basis, L3Harris’s backlog was down 1% which again highlights the poor growth foundation of the legacy businesses.

It should be noted that L3Harris’s backlog is relatively short-term, with 45% expected to be realized over the next 12 months, and 30% over the following twelve months. Compared to the end of 2023, the proportion of near-term backlog (12 months) has increased from 40% to 45%, potentially indicating a slowdown in the company’s rate of contract awards, or alternatively, improved manufacturing processes allowing it to deliver goods and services to customers faster.

Capital Structure

L3Harris is making progress in lowering its leverage following the Aerojet Rocketdyne purchase in 2023. Net debt still accounts for 22% of the firm’s enterprise value, with the guiding metric for the company being its net debt to adjusted EBITDA ratio. In Q2 2024 the ratio stood at 3.2, with the target of below 3.0 increasingly within reach.

L3Harris Government Contracts Exposure

Following the Aerojet Rocketdyne acquisition, the U.S. government gained an even greater significance in L3Harris’s topline. As of Q2 2024, the U.S. government accounted for 77% of the company’s revenue (the amount includes foreign military sales):

Figure 3: Evolution of L3Harris U.S. government revenue exposure

| Period | Share of U.S. government in L3Harris revenue |

| Q2 2024 | 77% |

| 2023 | 76% |

| 2024 | 74% |

| 2021 | 75% |

| 2020 | 78% |

| 2019 | 77% |

| 2018 | 75% |

Source: Company filings

From the table above we can observe that the only period during which government contracts played a greater role for L3Harris’s revenue was during the 2020 COVID-19 pandemic, when the U.S. government had a 78% contribution to the company’s topline.

Conclusion

L3Harris delivered 13% Y/Y revenue growth in Q2 2024, although the performance of the legacy segments outside Aerojet Rocketdyne was less impressive. Even so, the company is already seeing results from its restructuring efforts, boosting its margin and EPS outlook for the full year.

Deleveraging remains the top priority for L3Harris in the near term while improving margins should accelerate the growth in free cash flow from 10% in 2024 to about 13% over the 2025-2026 period, ultimately reaching a free cash flow of $2.8 billion. The $23 billion 2026 revenue target appears quite ambitious considering poor backlog dynamics.

Following the Aerojet Rocketdyne purchase, the share of the U.S. government in the company’s revenue reached 77%. Given the short-term nature of the company’s backlog (45% is set to be realized over the next 12 months), monitoring the company’s public procurement activity appears to be a smart move that can provide key insights into its financial health.

To get a free sample of the government contracts awarded to L3Harris and other established government suppliers, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy L3Harris or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.