It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

In Part 14 of our blog series, we will present you the latest results of McKesson.

Key points:

* Sales increase of 2.7% Y/Y in the third quarter of fiscal 2023, and 5% Y/Y year-to-date. North America focus increased post Europe disposals.

* Adjusted diluted EPS of $6.90/share in the quarter, up 12.2% Y/Y, and $18.78/share YTD, up 5.2%. Full-year guidance boosted by 5.1% to $25.75-26.15/share.

* $1.9/share in COVID-19 exposure in EPS guidance, 7.3% of total. Absolute amount down 28% Y/Y.

* Net debt of just $3.7 billion at the end of 2022. $7.2 billion in opioid settlement liabilities.

* Strong free cash flow of about $1.9 billion expected for Q4 2023. $1.5 billion generated in the first three quarters.

McKesson Q3 2023 Results Overview

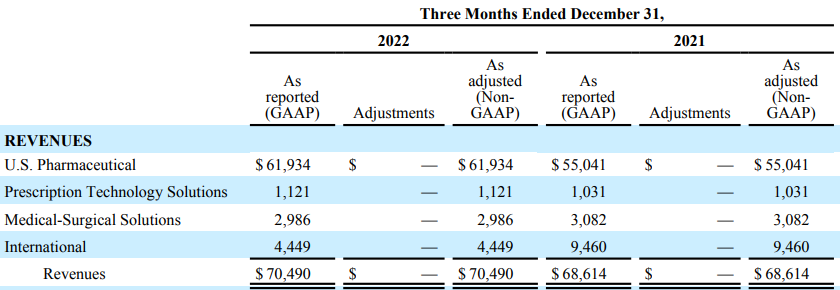

McKesson Corporation has a fiscal year ending in March. The company reports results in four main segments, namely U.S. Pharmaceutical at 87.9% of Q3 2023 revenues, Prescription Technology Solutions at 1.6% Q3 2023 revenues, Medical-Surgical Solutions at 4.2% of Q3 2023 revenues and International at 6.3% of Q3 2023 revenues:

Figure 1: Q3 2023 McKesson segment revenues

Source: McKesson Q3 2023 Earnings Release

Operational Overview

U.S. Pharmaceutical grew revenues 12.5% Y/Y in Q3, slightly below the 12.9% year-to-date growth rate in fiscal 2023. The company's largest segment benefited from increased volume of specialty products, including higher volumes from retail national account customers, branded pharmaceutical price increases and strength in oncology, which included increased patient visits, partially offset by branded to generic conversions.

Prescription Technology Solutions delivered revenue growth of 8.7% Y/Y in Q3, again a deceleration to the 12.7% YTD increase.

Medical-Surgical Solutions sales were down 3.1% Y/Y in the quarter, marginally better than the 3.6% decline in the first 9 months of the year. The weak results were on the back of reduced COVID-19 revenues.

International was the weakest segment in the quarter, with sales down 53% Y/Y in Q3. The YTD drop was 38% Y/Y. The declines are largely due to the ongoing exit from Europe, where 11 out of 12 countries have already been divested (only Norway remaining). Post disposals, Canada is the largest contributor in the International segment.

On a consolidated basis, revenues increased 2.7% Y/Y in Q3 and 5% in the first 9 months of the year. Adjusted earnings per diluted share were $6.90/share in the quarter, up 12.2% Y/Y, and $18.78/share YTD, up 5.2%. Free cash flow was $1.5 billion in 9M 2023, up 24.9% Y/Y, driven by higher operating activities cash flow.

McKesson 2023 Outlook Upgrade

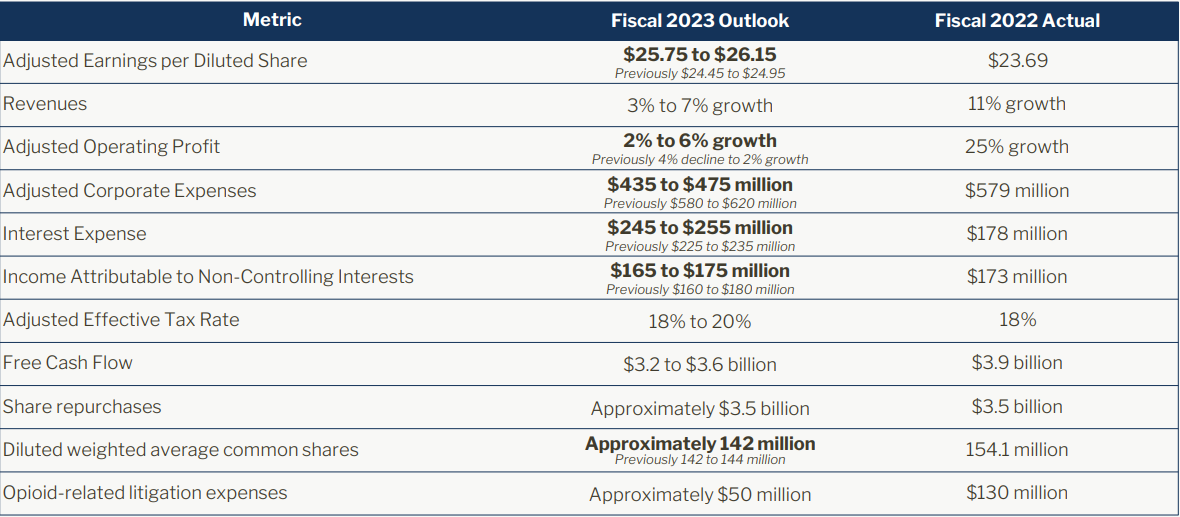

Given the strong momentum in the first 9 months of the year, McKesson boosted its Adjusted earnings per diluted share guidance to $25.75-26.15/share, up 5.1% from the previous range:

Figure 2: McKesson updated 2023 outlook

Source: McKesson Q3 2023 Earnings Presentation

The new EPS guidance includes about $1.9/share in COVID-19 vaccine and ancillary supplies distribution for the U.S.government. The amount represents 7.3% of total expected EPS and is down 28.8% Y/Y relative to fiscal 2022.

The company also expects strong free cash flow generation of about $1.9 billion in the final quarter of the fiscal year.

Capital Structure

McKesson ended 2022 with a net debt of $3.7 billion, very conservative against a market capitalization of $47.6 billion. It should be noted the company has $7.2 billion in litigation liabilities under a 2022 settlement regarding the distribution of opioids. The amount is to be paid over 18 years.

M&A Activity

On November 1, McKesson acquired Rx Savings Solutions (RxSS) for $600 million in cash and up to $275 million in contingent consideration. The variable component depends on operational and financial performance through calendar year 2025. The recorded liability relating to the contingent consideration is $92 million at the end of 2022.

RxSS is a prescription price transparency and benefit insight company that offers affordability and adherence solutions to health plans and employers.

McKesson also contributed $173 million in cash on October 31 to form an oncology research business partnership (51% McKesson share) with HCA Healthcare.

The European exit had a $1.4 billion negative impact in the first three quarters of the year due to weakness in pound and euro exchange rates.

Conclusion

The company continues to invest in automation and keeps adding new practices to its US Oncology Network. McKesson is successfully absorbing reduced COVID-19-related activity and continues to show top and bottom-line growth.

The company does not expect a material impact from the Inflation Reduction Act enacted on August 16, 2022. The small net debt position allows the company to meet opioid settlement expenses and to invest in both organic growth as well as selective M&A.

In light of the fading COVID-19 contribution to earnings, monitoring McKesson’s public procurement activity remains a smart move that can provide key insights into the company’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy McKesson or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.