Key points:

* The growth of passive investment strategies has resulted in more opportunities for activist investors.

* Pfizer reported declining government orders long before activist investor Starboard took a stake in the company.

* Combining ownership data with government contracting data can provide a comprehensive view of activist investor activity.

Introduction

After looking at the ways TenderAlpha’s ownership data can help you monitor the buying and selling activities of pension funds, we will now focus on another type of institutional investor, namely activist investors.

Hedge fund activist investors have grown in popularity in recent years. This is reflected in the assets under management /AUM/ allocated to activist hedge funds in recent years, with the Harvard Law School reporting that the top 50 activists ended 2023 with an AUM of $156 billion.

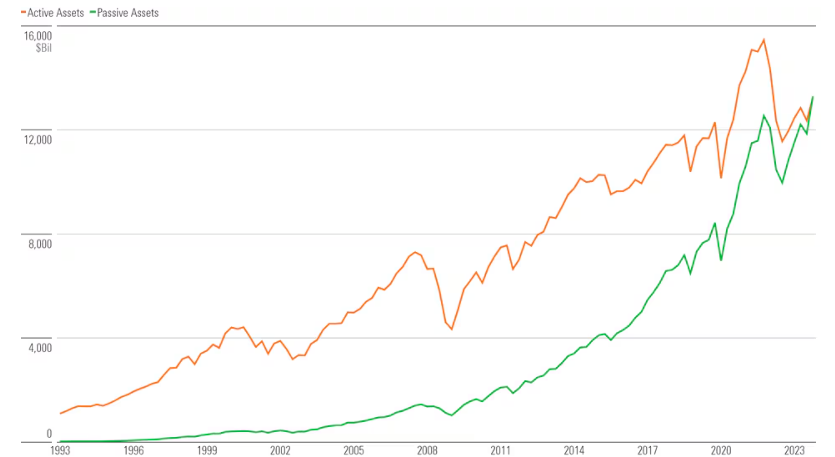

The institution further notes that global activism campaigns increased by 9% in 2023, building on the 38% increase achieved in 2022. In our view, these developments partially reflect the increased reliance on passive investment strategies such as exchange-traded funds /ETFs/, with Morningstar highlighting that at the end of 2023 passive strategies overtook active strategies (as measured by AUM) for the first time in the US history:

Figure 1: Historical Fund Assets: Active vs. Passive

Source: Morningstar

In the past, individual fund managers performed extensive due diligence before entering new positions in a company. Furthermore, they were more involved in the company’s corporate governance and kept close contact with management.

These active fund managers are now increasingly replaced by passive ETFs which usually invest in a company based on its size or other factors, with corporate governance and strategic policy not being a factor in the ETF’s allocation decisions.

This backdrop creates fertile ground for activist hedge funds which may identify companies with governance problems or propose ways to increase shareholder value. These may include business divestitures, capital allocation decisions, and changes in the company’s boardroom.

Where Does TenderAlpha’s Ownership Data Fit In?

TenderAlpha’s institutional ownership data covers over 28,000 public companies in North America, Europe, the UK, and the rest of the world, providing insight into the holdings of US-based & non-US based institutional and insider stakeholders. The data’s unique proposition lies in the aggregation of various data sources that allow for global coverage on both stakeholder and stock ownership level. The data is ticker-mapped and is updated monthly for US companies.

Monitoring ownership dynamics for activist investors is a powerful tool for spotting changes in company and industry performance. It is also a timely indicator of changes in investor sentiment towards a certain company, often before the market reacts to that switch. Ownership data can also provide valuable insights into the activist’s next move. For example, a lower reported ownership percentage may indicate the activist is losing confidence in the success of the activist campaign.

Likewise, a growing ownership percentage is indicative of the activist’s conviction of the success of the activist campaign. This understanding could in turn allow for better informed investment analysis and the uncovering and brainstorming of potential investment hypotheses.

Pfizer - Examining Activist Activity and Government Contracting Dynamics

As part of our Top Government Contractors series, we regularly examined Pfizer’s government contracting dynamics and operating performance. Most recently we reported on the company’s declining U.S. government contracting exposure when we reviewed Pfizer’s Q1 2024 results, a trend that continued into Q2 2024:

Figure 2: Share of U.S. government in Pfizer revenue

| Period | U.S. Government Revenue Share |

| H1 2024 | 7% |

| Q1 2024 | 10% |

| 2023 | 0% (partially due to revenue reversal of 2022 revenues) |

| 2022 | 23% |

| 2021 | 13% |

Source: Pfizer company filings

Increasing government orders are often a sign of stable revenue and earnings going forward. They also show that the company is competitive in the marketplace to win government contracts relative to other bidders. This in turn is indicative of its strong operating and governance performance.

Activist investors often focus on companies experiencing operating difficulties, which was clearly the case for Pfizer - in addition to slowing government contracting activity, the company was reporting lower revenues and profits as a result of waning demand for COVID-19 treatments and vaccines.

As such it is no surprise that Pfizer became the target of activist investors, with Starboard taking a $1 billion stake in the company and tapping former executives to help with its efforts.

While the main focus of TenderAlpha’s government contracting data is to identify resilient companies that can outperform over the long term thanks to their stable or even growing government exposure, the data can also be used to identify companies losing government contracts which are natural activist targets.

Going forward, TenderAlpha’s ownership data can help investors gauge Starboard’s conviction in its Pfizer activism campaign - should it continue to build its stake, chances are Starboard is confident in its success.

Conclusion

The ascent of passive investment strategies has opened a niche for activist investors which was previously occupied by active managers. In light of the sophisticated valuation methods and the extensive use of alternative data, activist investors attract significant attention.

TenderAlpha’s institutional ownership data can help identify activist investor campaigns in their early stages, as well as evaluate the conviction activist investors have in their success by monitoring the evolution of their holdings in the target company.

TenderAlpha’s government contracting data can help identify companies experiencing a decline in government contracting activity. Such a decline makes these companies prime targets for an activist campaign focused on an operational turnaround.

The case of Starboard’s $1 billion stake in Pfizer is a prime example of how government contracting data can identify a target company long before the activist investor reveals his intentions.

Interested in learning more about how the Institutional Ownership Data Feed and/or its Pension Funds Stock Ownership subset can improve your ability to track activist investor activity? Contact TenderAlpha today to get started!