It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Oshkosh recently reported its Q1 2023 results and below we will provide a brief analysis of the company’s performance in the first 3 months of the year.

Key points:

* Defense accounted for 22.6% of Q1 revenues, with performance set to accelerate in 2024 on NGDV program for the U.S. Postal Service;

* Q1 revenue up 16.6% Y/Y. 2023 outlook boosted to +4.2% on strength in Access Equipment and Defense;

* Q1 Adjusted EPS of $1.59/share. 2023 outlook boosted to $6/share;

* 4.7% Q/Q backlog growth to $14.8 billion, with supply chains still a drag on operational output;

* Despite loss of JLTV contract Oshkosh remains active on the government procurement front, vying for programs such as the OMFV and RCV.

Oshkosh Q1 2023 Results Overview

We originally covered Oshkosh's Q4 2022 results as part 9 of our Top Government Contractors series here. Below, we will highlight the progress achieved by the company in Q1 of this year.

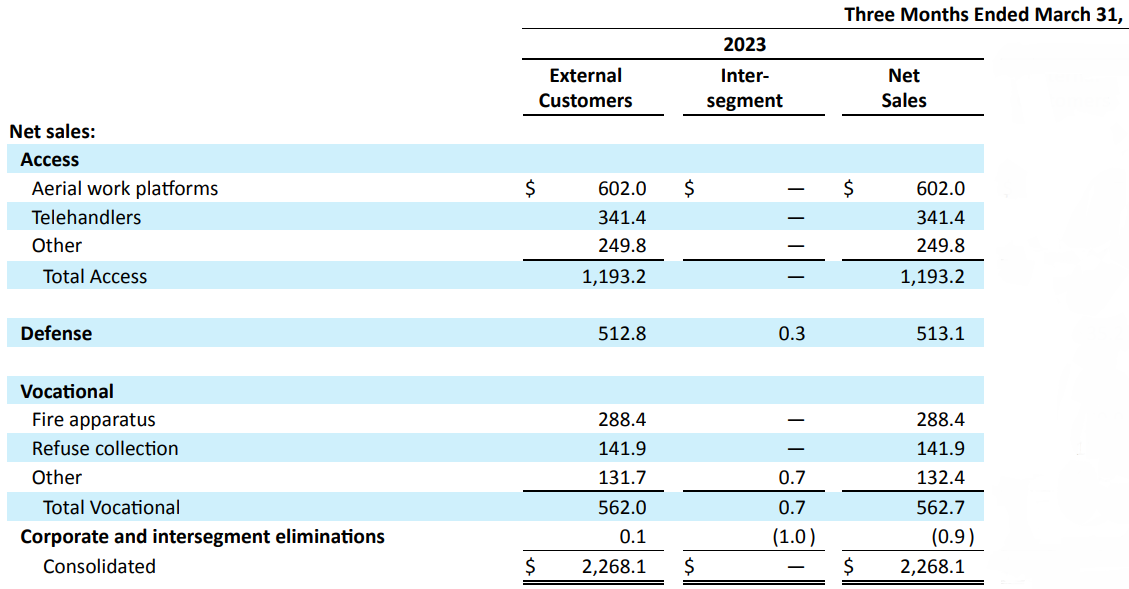

Oshkosh reports results in three main segments, namely Access Equipment at 52.6% of Q1 2023 revenues, Defense at 22.6% and Vocational (combined the former Fire & Emergency and Commercial segments) at 24.8% of Q1 2023 revenues:

Figure 1: Q1 2023 Oshkosh segment revenues

Source: Oshkosh Q1 2023 Form 10-Q

Operational Overview

Access Equipment was the best performer in Q1, with net sales up 35.1% Y/Y (2022: +18.9%). The operating income margin was 11.3% (2022: 8%). The strong numbers were the result of both increased volumes as well as supply chain improvements.

Defense was the only segment to register a revenue decline in the quarter, -4.2% Y/Y (2022: -14.6%). The weakness was driven by lower volumes on the Joint Light Tactical Vehicle, JLTV, program (as a reminder, Oshkosh lost the post-2024 contract to competitor AM General and is now appealing, with a decision expected in mid-June). The operating income margin was only 0.5% (2022: 2.4%) on materials cost inflation.

Vocational's inaugural quarter as a standalone segment saw sales increase of 6.3% Y/Y. The operating income margin was 7.8%. Full run-rate synergies from the business combination are expected in 2024.

On a consolidated basis, revenues increased 16.6% Y/Y in Q1 (2022: +4.1%). The adjusted operating income margin was 6.5% (2022: 4.6%). Adjusted EPS was $1.59/share (full year 2022: $3.46/share).

2023 Outlook

Given the stronger-than-expected start to 2023, Oshkosh boosted its 2023 outlook:

- Revenue of 8.65 billion, + 4.2% Y/Y.

- Adjusted EPS of $6/share, +73.4% Y/Y.

- Free cash flow of $300 million

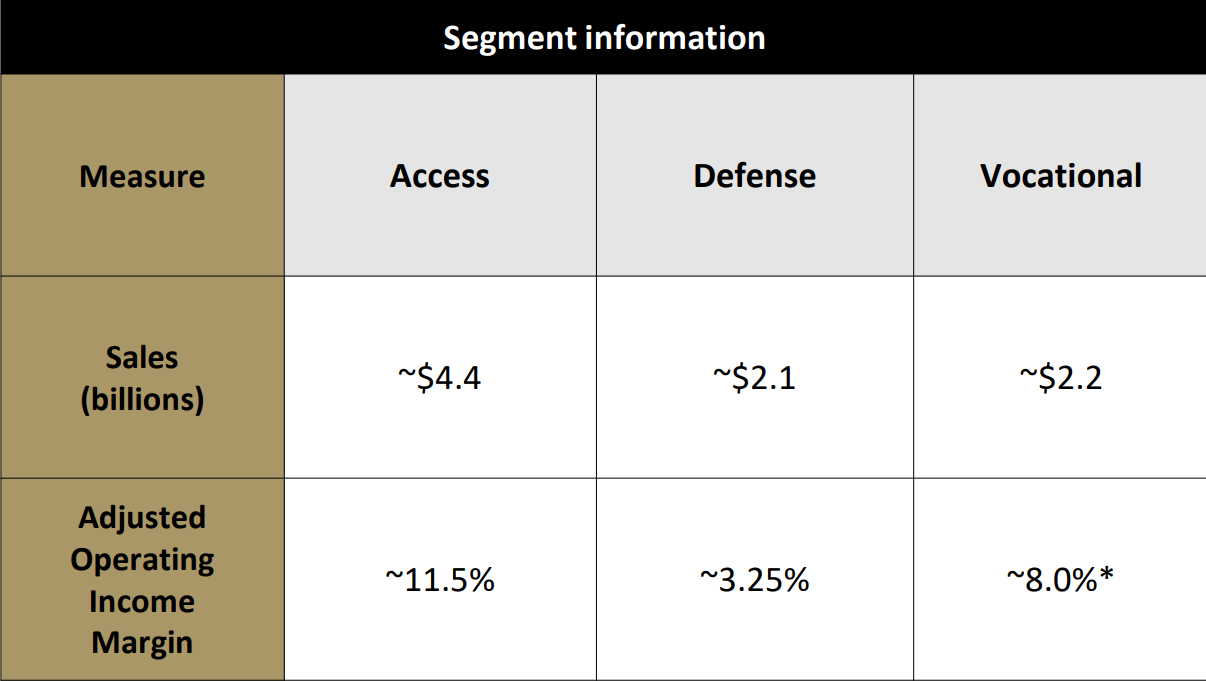

Relative to initial 2023 expectations, higher sales are expected across Access & Defense. Profitability is also seen higher at Access and Vocational, while Defense underperforms:

Figure 2: Oshkosh updated segment outlook for 2023

Source: Oshkosh Q1 2023 Results Presentation

Q2 and Q3 results are expected to be in-line with Q1 in terms of revenue and adjusted EPS, reflecting similar supply chain dynamics. Q4 performance is set to be the weakest of the year due to the typical lower number of production days.

Backlog

Total backlog grew 4.7% Q/Q to $14.8 billion, driven by the Access equipment segment as well as a $591 million order for the Next Generation Delivery Vehicles (NGDV) from the U.S. Postal Service. 42% of all backlog is expected to be delivered in 2023, with the company noting that despite progress made on supply chain issues, production will remain constrained in 2023.

Capital Structure

Given the cyclical nature of Oshkosh's business, a capital structure with a low debt mix is highly preferable. The company ended Q1 with a net debt position of $60 million and is ideally prepared to weather any economic downturn in 2023 and beyond.

In Q1, Oshkosh completed the acquisition of Hinowa, an Italian manufacturer of compact crawler booms and tracker equipment, bolstering the Access segment.

Conclusion

Oshkosh remains optimistic about current market conditions:

We view construction markets as strong, particularly with the large number of mega projects around the country. In fact, metrics for the vast majority of construction categories point to continued growth for the foreseeable future. The access equipment fleet age remains elevated and new use cases continue to grow beyond construction.

Despite improvements in supply chains, the Access segment performance is still hampered by part delays, against the backdrop of strong customer demand:

Demand exceeds by a wide margin what our supply is right now. So, we're essentially delivering everything we're producing. So, I would expect that, it -- really the revenue cadence is going to be fairly flat.

The Vocational segment should benefit both from cost synergies as well as higher prices as Oshkosh works through the backlog in 2024 and beyond. The operating margin is seen in the double digits next year.

The margin profile of the Defense segment is also expected to improve in 2024, helped by the ramp-up of the NGDV program.

Even though Oshkosh lost the JLTV program, the company remains active on the government procurement front:

With the tactical wheeled vehicle market under pressure, we continue to focus our efforts on more fruitful product categories such as combat and delivery. We have won some outstanding contracts and are vying for others. The DoD's down-select decision for the next phases of the Optionally Manned Fighting Vehicle or OMFV program is expected this summer.

We are confident that our proposed solution delivers a high level of innovation and technical capability, which we believe places us in a strong competitive position for the program. Awards are expected to be announced for three competitors with a value for each bidder expected to be $886 million over a 54-month period. We are also competing for other attractive programs such as the Robotic Combat Vehicle or RCV.

Considering the huge importance government tender wins, as well as losses, can have on stock performance, monitoring the company’s public procurement activity remains a smart move that can provide key insights into Oshkosh’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Oshkosh or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.