It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Pfizer recently reported its Q1 2023 results and below we will provide a brief analysis of the company’s performance in the first 3 months of the year.

Key points:

* Pfizer is buying Seagen in a $43 billion all-cash deal, expected to close later in 2023 or early 2024. 13.5% discount to offer price implies regulatory hurdles;

* 29% Y/Y revenue slump in Q1, driven by lower COVID-19 sales. 2023 outlook of 31.2% decrease confirmed;

* Adjusted EPS of $1.23/share in Q1, down 24% Y/Y. 2023 outlook of $3.35/share confirmed (down 49.1%);

* Current net debt of $15.9 billion set to swell to circa $50 billion once Seagen deal closes;

* Top-line revenue growth, coupled with margin expansion, set to return in 2024.

Pfizer Q1 2023 Results Overview

We originally covered Pfizer's Q4 2022 results in part 13 of our Top Government Contractors series here. Below we will highlight the progress achieved by the company in Q1 2023.

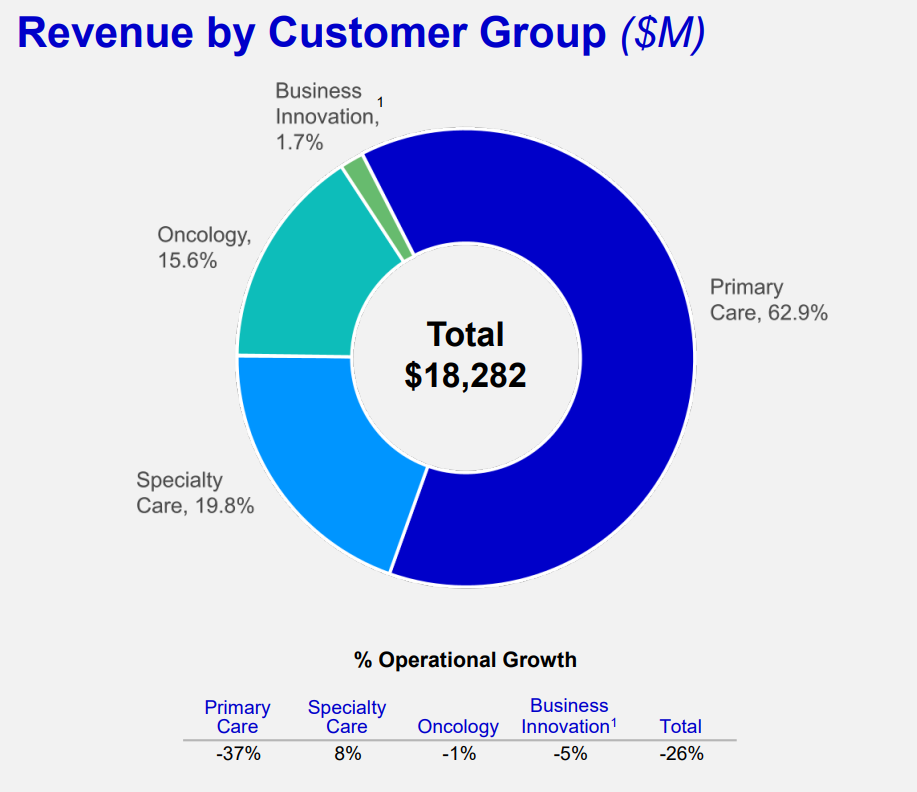

Pfizer reports results in three main segments, namely Primary Care (Internal Medicine and Vaccines, COVID-19 treatments) at 62.9% of Q1 2023 revenues, Specialty Care (Inflammation & Immunology, Rare Disease and Hospital) at 19.8% revenues and Oncology at 15.6% at of Q1 2023 revenues:

Figure 1: Q1 2023 Pfizer segment revenues

Source: Pfizer Q1 2023 Earnings Presentation

The three main segments above make up the Global Biopharmaceuticals business while the newly formed Business Innovation customer group (1.7% of total Q1 2023 revenues) encompasses the company's global contract development and manufacturing organization and supplies of specialty active pharmaceutical ingredients (formerly Pfizer CentreOne), as well as Pfizer Ignite, a new venture to deepen cooperation on R&D.

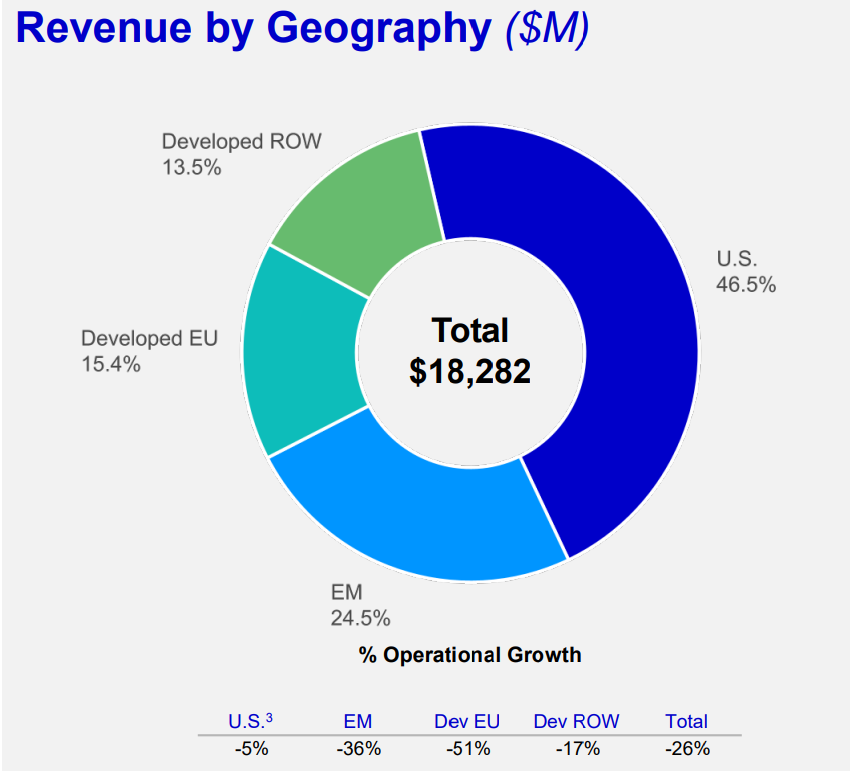

From a geographical perspective, the U.S. is the largest market at 46.5% of Q1 2023 revenues, followed by emerging markets at 24.5%:

Figure 2: Q1 2023 Pfizer revenue by region

Source: Pfizer Q1 2023 Earnings Presentation

Operational Overview

Primary Care was the weakest segment in the quarter, with sales down 39% Y/Y (2022 +40.4%). The slump was due to weakness in COVID-19 treatments, with the vaccine Comirnaty down 64% while the Paxlovid pill lost 58% of sales Y/Y.

Specialty Care was the top performing segment in Q1, growing revenues 3% Y/Y (2022 -9%).

Oncology sales were down 1% Y/Y in Q1 (2022 -1.6%).

On a consolidated basis, revenue was down 29% Y/Y (2022 +23.4%). Adjusted Diluted EPS was 1.23/share in Q1 , down 24% Y/Y (2022 $6.58/share).

Seagen Acquisition

In March, Pfizer announced an intention to purchase Seagen (ticker SGEN) at $229/share in a bid to strengthen its Oncology business (immediate impact of 20% sales boost). The deal is set to close later in 2023, or early 2024. That said, markets have grown weary of regulatory hurdles to the $43 billion all-cash deal, with Seagen stock currently trading at a 13.5% discount to the offered price.

As per the Q1 earnings release, the transaction is set to increase Pfizer's net debt position:

"Pfizer expects to finance the transaction substantially through $31 billion of new, long-term debt, and the balance from a combination of short-term financing and existing cash... When combining the expected strong growth trajectories for Seagen’s in-line medicines with candidates that could emerge from Seagen’s pipeline, subject to clinical and regulatory success, Pfizer believes Seagen could contribute more than $10 billion in risk-adjusted revenues in 2030, with potential significant growth beyond 2030."

Relative to the $10 billion 2030 revenue target, it is worth noting Seagen ended 2022 with revenues of just $2 billion, although sales did increase 22% Y/Y in Q1 2023. To achieve Pfizer's $10 billion target, Seagen needs to grow at the current pace throughout the decade.

2023 Outlook Confirmed

Given the robust start of the year, Pfizer confirmed its 2023 outlook, with revenue expected to drop around 31.2%:

Figure 3: Pfizer 2023 Outlook

Source: Pfizer Q1 2023 Results Presentation

Adjusted diluted EPS decline is expected to outpace revenues, dropping 49.1% to $3.25 – 3.45/share.

However, given the stronger Y/Y performance in Q1 and expectations for faster revenue growth in H2 2023, driven by new releases, we reckon the company may reach the high end of its revenue guidance.

A key near term factor to watch will be the take-up of the combined COVID-19/flu vaccine in the autumn. Currently, guidance incorporates a 24-25% COVID-19 vaccine take-up, a conservative amount relative to the usual flu take-up of 50%.

Capital Structure

Pfizer will take on the Seagen acquisition in strong financial health, with a net debt of just $15.9 billion against a market capitalization of $225 billion. Post-transaction, the net debt position should swell to around $50 billion, assuming retention of cash outside of dividend.

Current financial guidance anticipates no incremental share buybacks in 2023 as the company seeks to preserve liquidity.

Conclusion

Pfizer confirmed its outlook of 7-9% revenue increase outside of COVID-19 treatments. Coupled with the anticipated Seagen purchase, the company is set to return to strong top-line growth as soon as 2024. Management highlighted on the conference call that profit margins should improve in tandem:

"It is our expectation that as we integrate Seagen in either late '23 or '24. Early '24, we will begin to see margin improvement, and that will happen as we continue to improve our performance from a top line perspective. At the same time, we're going to be very efficient and really work to minimize our SI&A investments going forward. So, I think you should start to see that post the integration and the closing of the Seagen transaction."

In light of the rapidly evolving revenue outlook for Pfizer, monitoring the company’s public procurement activity remains a smart move that can provide key insights into Pfizer’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Pfizer or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.