It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

In Part 24 of our blog series, we will present you the latest results of Science Applications International.

Key points:

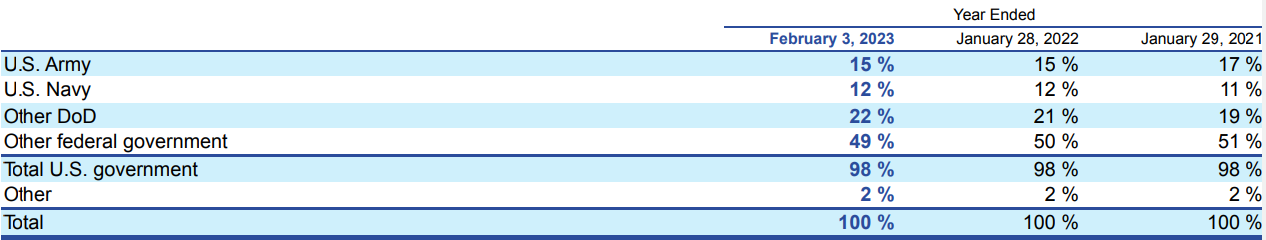

* 98% of revenue consistently comes from the U.S. government;

* 4% revenue growth in fiscal 2023. 2-4% organic revenue increase expected for the next three years;

* Adjusted EPS of $7.55/share in 2023, up 4% Y/Y. 4.4% compound annual growth expected going into fiscal 2026, albeit with a dip in fiscal 2024;

* Free cash flow of $457 million in fiscal 2023, down 2% Y/Y. 4.1% compound annual growth expected in the next three years;

* Logistics & Supply Chain management business sale closing expected in H1 fiscal 2024. Net debt set to be cut to $2 billion with a boost to margins.

Science Applications International Q4 Fiscal 2023 Results Overview

Science Applications International, which we will refer to as SAIC hereafter, provides technical, engineering and enterprise IT services primarily to the U.S. government, which accounts for 98% of SAIC revenues in the last three fiscal years:

Figure 1: Science Applications International customer breakdown, 2021-2023

Source: Science Applications International Q4 2023 Form 10-K

SAIC utilizes a 52/53 week fiscal year ending on the Friday closest to January 31. Thus, we will highlight the company's Q4 fiscal 2023 results for the quarter ending on February 3, 2023.

Operational Overview

Revenue growth accelerated into year-end, with Q4 growth of 10% Y/Y outpacing the 4% gain in fiscal 2023. Likewise, Adjusted EBITDA increased 17% Y/Y in Q4, again better than the 1% decline in 2023. Adjusted EPS gained 36% Y/Y in Q4 to $2.04/share, which helped push overall 2023 EPS to $7.55/share, up 4%. Free cash flow in 2023 was down 2% to $457 million despite exceptional Q4 cash flow generation (+57% Y/Y).

It should be noted that strong Q4 performance was partially due to five additional working days in the quarter. Adjusted for the extra working days, Q4 revenue growth was only 2% Y/Y.

Sale of Logistics & Supply Chain Management business

SAIC announced it would be selling its Logistics & Supply Chain Management business at 11.5x free cash flow for net proceeds of $270 million, with closing expected in H1 2024. The valuation appears broadly in-line with where SAIC stock is currently trading multiple-wise.

The transaction is expected to boost adjusted EBITDA margins by 30 basis points by 2025.

Science Applications International Updated Fiscal 2024 Outlook

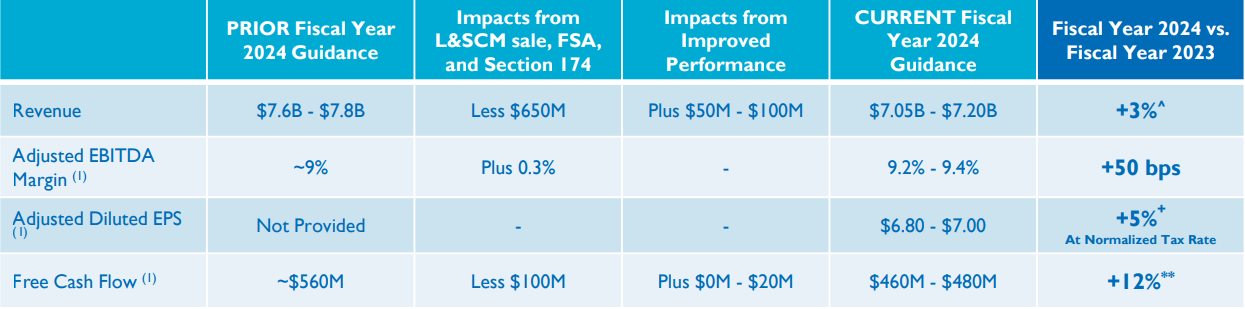

As a result of the divestment, the company provided updated fiscal 2024 guidance:

Figure 2: Science Applications International Updated 2024 Guidance

Source: Science Applications International Q4 2024 Results Presentation

Revenue is seen at $7.05-7.2 billion, down 7.5% on a reported basis, with underlying business momentum only partially compensating the Logistics & Supply Chain management business exit.

The adjusted EBITDA margin is set to improve by 0.5% to 9.2-9.4%, partially due to the above-mentioned business disposal.

Adjusted diluted EPS is expected at $6.80-7.00/share, down 8.6% Y/Y due to a normalized tax rate.

Free cash flow is the anticipated to improve by 2.8% to a range of $460-480 million.

Investor Day 2023

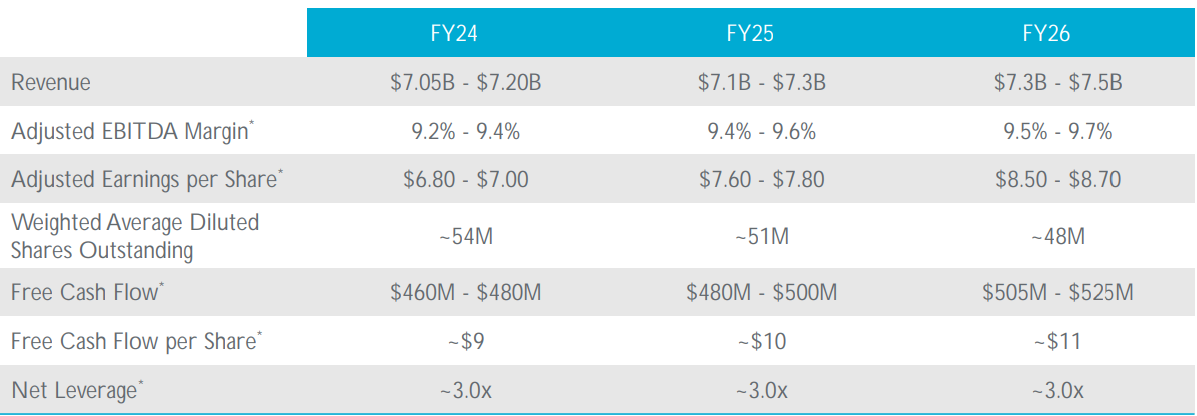

Looking beyond the mixed fiscal 2024, SAIC issued three-year guidance at its Investor Day held on April 11. For fiscal 2026, the company expects:

Figure 3: Science Applications International Fiscal 2024-2026 Outlook

Source: Science Applications International Investor Day presentation

Revenue is expected to continue growing at 2-4% organically, reaching $7.3-7.5 billion. Free cash flow growth is set to accelerate to 4.1% annually and land at about $505-525 million. Adjusted EBITDA is set to grow 1.6% annually to $700-725 million. Adjusted EPS growth is forecast at about 4.4% annually to $8.50-8.70/share.

Backlog

Total backlog was down 1.2% Y/Y to $23.8 billion at the end of fiscal 2023. The book-to-bill ratio was 1.00 for the year, impacted by Q4 weakness of 0.7. Despite the weak end of the year, the outlook is promising, as highlighted on the conference call:

It is important to note that our book-to-bill, backlog and revenue results in fiscal year '23 do not include any contribution from two strategically significant new program wins, DCSA which was recently re-awarded and T-Cloud which remains in protest. Combined, we believe these two programs can ultimately contribute at least three points of growth for SAIC once both are fully ramped up. Given the still uncertain timing of these program starts, our fiscal year '24 revenue guidance for roughly 3% of pro-forma organic growth does not include any material contribution from either program. We look forward to being able to deliver value to both customers once these programs clear the typical post-award process.

Capital Structure

SAIC ended fiscal 2023 with a net debt of $2.3 billion. Against a market capitalization of 5.9 billion, the debt position is the most elevated out of the companies we have covered so far. The logistics & supply chain management business disposal should bring the net debt to $2 billion, still an elevated level relative to peers.

In fiscal 2023 SAIC spent $245 million on share buybacks. The company expects to execute buybacks worth $350-400 million in each of the next three fiscal years. Against the current market capitalization, SAIC will be able to retire some 6.4% of outstanding shares each year.

Conclusion

Fiscal 2024 is set to be a year of deleveraging, which will cloud ongoing underlying improvements. With a strengthened balance sheet and stable revenue sources, the company's reported performance is set to accelerate in fiscal 2025 and beyond.

Medium term growth drivers will be continued organic revenue growth, margin improvement and accretive buybacks.

In light of the fact that 98% of SAIC sales were to the U.S. government in each of the last three fiscal years, monitoring SAIC’s public procurement activity also remains a smart move that can provide key insights into the company’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy SAIC or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.