It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

In Part 21 of our blog series, we will present you the latest results of Siemens.

Key points:

* 10% revenue growth in Q1, below the 16% achieved in 2022; strength in Digital Industries and Smart Infrastructure.

* EPS of 2.08 EUR/share in Q1 (2022 5.47EUR/share). Partial reversal of 2022 Siemens Energy write-off to boost Q2 results by 1.99 EUR/share.

* 2023 revenue outlook boosted by 1% to 7-10% growth. EPS guidance up 2.3% to 8.90-9.40 EUR/share.

* Book-to-bill of 1.25 in Q1 and 1.24 for 2022. Record backlog of 102 billion EUR.

* Activities in low- to high-voltage motors, geared motors, medium-voltage converters and motor spindles to be spun out in new company Innomotics with annual revenue of 3 billion EUR.

Siemens Q1 2023 Results Overview

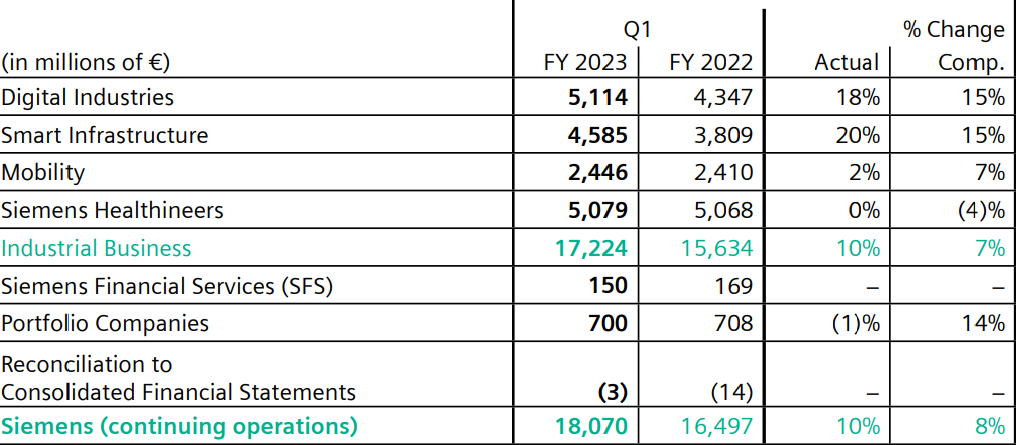

Siemens has a fiscal year ending on September 30. Thus, below we will highlight the company's Q1 2023 results for the period ending December 31, as well as post period-closing developments. The company's core Industrial Business (95.3% of Q1 2023 revenue) is subdivided into Digital Industries at 28.3% of Q1 2023 revenue, Siemens Healthineers at 28.1%, Smart Infrastructure at 25.4% and Mobility at 13.5% of fiscal Q1 2023 revenue:

Figure 1: Q1 2023 Siemens segment revenues

Source: Siemens Q1 2023 Earnings Release

The largest contributor outside the Industrial business is the Portfolio companies reporting line (3.9% of revenue), which comprises businesses delivering customized and application-specific products and services.

Operational Overview

Digital Industries delivered 18% Y/Y revenue growth in Q1, in line with the 18% increase recorded in fiscal 2022. The profit margin improved to 22.5%, up Y/Y (Q1 2022 21.8%) and relative to 2022 (19.9%).

Siemens Healthineers was the weakest segment in the quarter, with sales growth stagnating at 0% Y/Y in Q1, a sharp deceleration from the 21% increase in 2022. The profit margin of 12.5% disappointed as well, down Y/Y (Q1 2022 16%) and compared to 2022 (15.5%).

Smart Infrastructure outperformed all other segments in the quarter, with revenue up 20% Y/Y, an acceleration to the 16% growth achieved in 2022. The profit margin gained 2.7% Y/Y to 15.3%, again outperforming the full year result (12.8%).

Mobility saw its Q1 sales increase by 2% Y/Y, slightly below the 5% growth achieved in 2022. Despite increasing sales, the profit margin was down 1.3% Y/Y to 8%, below the 8.2% for the full year.

On a consolidated basis, revenue grew 10% Y/Y in Q1, well below the 16% growth achieved in 2022. The industrial business profit margin was 15.6% in the quarter, up from 15.1% in 2022. EPS pre PPA (defined as basic earnings per share from net income adjusted for amortization of intangible assets acquired in business combinations and related income taxes) was 2.08 EUR/share in Q1, down 7% Y/Y. For comparison, in 2022 and 2021 EPS pre PPA was 5.47 and 8.32 EUR/share respectively. EPS in 2022 was impacted by a 2.7 billion EUR impairment of Siemens's 38.1% stake in Siemens Energy. Free cash flow of 0.1 billion EUR was down 92% Y/Y in Q1; nevertheless, management expressed confidence for substantial improvement for the rest of the year:

We expect a material catch-up in free cash flow performance already in the second quarter and another strong performance for full fiscal 2023. With this tight grip on working capital, we are very confident to continue our deleveraging path driven by excellent cash conversion.

Increased 2023 Outlook

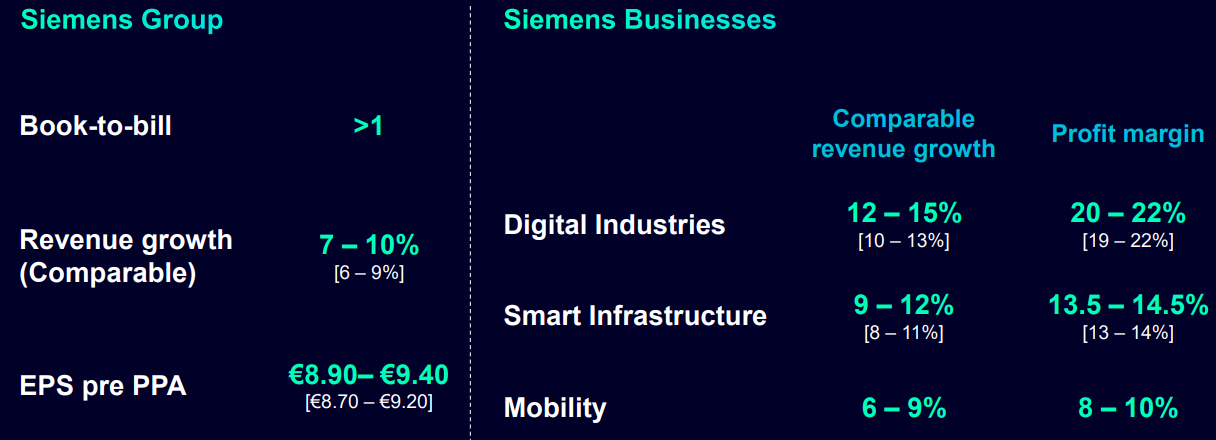

Given the strong start of fiscal 2023, Siemens increased its full-year guidance:

Figure 2: Updated 2023 Guidance

Source: Siemens Q1 2023 Earnings Presentation

Revenue growth is seen 1% higher than in Q4, in a range of 7-10%. EPS pre PPA guidance was also boosted by 2.3% to a new range of 8.90-9.40 EUR/share.

The stronger expectations are underpinned by outperformance in the Digital Industries and Smart Infrastructure segments, relative to initial expectations.

Backlog

Siemens continues to increase its backlog, with a Q1 book-to-bill ratio of 1.25, in line with the 1.24 recorded in 2022. As a result, the backlog swelled to a record 102 billion EUR. Thanks to easing supply chain issues, Siemens expects to recognise 40 billion EUR of backlog revenue in the remainder of fiscal 2023. For reference, total revenue in 2022 was 72 billion EUR.

Capital Structure

Net debt was 37.1 billion EUR at the end of Q1, of which 27.6 billion EUR was debt held in Siemens Financial Services (the segment offers equipment and project financing for Siemens customers). As a result, Industrial net debt was just 11.8 billion EUR. This is a very manageable amount against a market capitalization of about 114 billion EUR and 8.1 billion EUR in free cash flow in 2022.

Post Closing Developments

On March 31 the company announced it would book a 1.59 billion EUR gain as a result of impairment reversal of its Siemens Energy stake. Naturally, the anticipated gain of about 1.99 EUR/share is not part of the aforementioned EPS outlook.

On March 1 Siemens announced it would spin out its business activities in the areas of low- to high-voltage motors, geared motors, medium-voltage converters and motor spindles. The new company is called Innomotics, with around 3 billion EUR in annual revenue.

Conclusion

Siemens benefits from secular growth trends of digitalization, energy efficiency and sustainability. At the same time the company continues to optimize its corporate structure to highlight the value of its businesses.

In light of the continuing corporate spin-offs and close cooperation with public sector payers to advance the green agenda, monitoring Siemens’ public procurement activity also remains a smart move that can provide key insights into the company’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Siemens or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.