Table of Contents:

1. The Impact of Government Contracts on Lockheed Martin

2. Lockheed Martin 2022 Q2 Results Overview

3. Lockheed Martin as a Government Bond Proxy

4. Conclusion

Key points:

* Lockheed relied on government spending for 99% of its 2021 revenue, with 71% coming from the US government, while international customers made up the remaining 28%

* Lockheed kept its free cash flow guidance of USD 6bn intact despite a dip in sales on the back of strong operating margins

* Geopolitical tensions have spurred client interest and the company is expanding production capacity to meet expected higher demand in the coming years

* Lockheed with likely experience a period of above-average growth with free cash flow reaching around USD 8bn in 2025

* Key risk remains that elevated client interest does not translate into actual contracts

* After a 23% YTD rally the stock has already priced in positive developments; investors may want to consider the company’s longer-dated bonds as a good alternative

The Impact of Government Contracts on Lockheed Martin

When it comes to government-dependent companies, few match the definition as closely as Lockheed Martin (LMT). As per the company’s 2021 annual report:

In 2021, 71% of our USD 67bn in net sales were from the US Government, either as a prime contractor or as a subcontractor (including 62% from the Department of Defense (DoD)), 28% were from international customers (including foreign military sales (FMS) contracted through the US Government) and 1% were from US commercial and other customers.

Lockheed Martin often occupies the top position in terms of government contracts awarded to a single company (as measured by absolute dollar contract value), as per TenderAlpha’s federal contracts data. LMT is among the top suppliers to the Department of Defense, the US Navy, the US Air Force, etc. Thus, keeping track of the incoming orders and contract updates is vital to assessing the direction the company is headed.

Case in point, Lockheed Martin was recently awarded USD 7.6bn for the Lot 15 of the F-35 program.

Before diving into government spending data, it is important to note that LMT reports its results with a financial year ending on December 31st, while the fiscal year of the US government runs from October 1st to September 30th. For simplicity, below we will use monthly data to illustrate the importance of government orders.

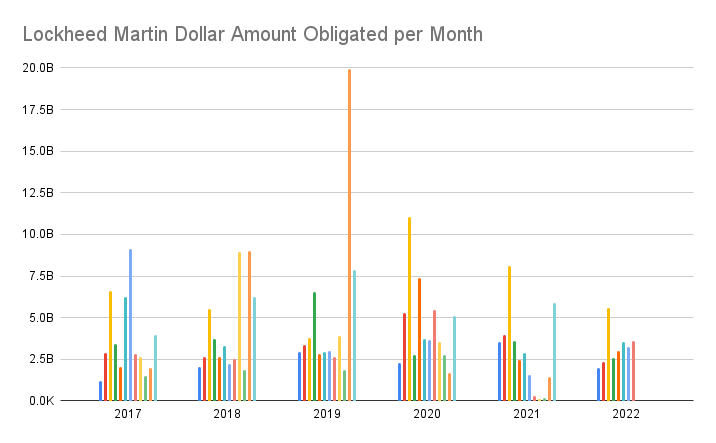

Looking at the trend in government contracts awarded to Lockheed Martin (on a monthly basis) over the past few years, we see a strong correlation between government contract awards and stock performance.

For example, the circa USD 20bn awarded in November 2019 saw the stock appreciate by around 3.7%, in line with the Dow Jones Industrial Average gain of 3.7%. In March 2020, another strong month for contract awards, LMT lost 8.4% while the DJI dropped 13.7%.

Source: tenderalpha.com

Comparing Lockheed’s performance with the sector S&P Aerospace and Defense ETF, trading under the ticker ITA, we see that LMT underperformed in November 2019 but outperformed in March 2020:

| Stock/Index/ETF | November 2019 | March 2020 |

|

LMT |

3.7% | -8.4% |

| DJI | 3.7% | -13.7% |

| ITA | 5.1% | -28.3% |

Source: Author's calculations

Overall, it is fair to say government contract awards have a significant impact on LMT stock. Furthermore, the market perceives Lockheed as a lower-risk defensive position and the company is seen as a safe haven in times of turbulence thanks to its stable government business.

Lockheed Martin 2022 Q2 Results Overview

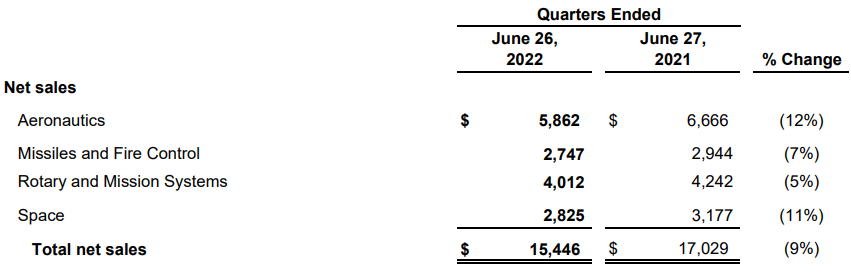

Lockheed Martin reports results in four key segments, namely Aeronautics at 38% of Q2 2022 net sales, Missiles and Fire Control at 18% of Q2 2022 net sales, Rotary and Mission Systems at 26% of Q2 2022 net sales and Space at 18% of Q2 2022 net sales:

Source: Lockheed Martin Form 10-Q for Q2 2022

Lockheed reported a 9.3% drop in sales year-over-year, citing supply chain issues and the timing of a key F-35 contract as the main culprits behind the sales decrease. On the other hand, operating margins were better, improving to 11% from 10.4% in the prior year quarter. Overall, operating profit decreased by 3.7% Y/Y.

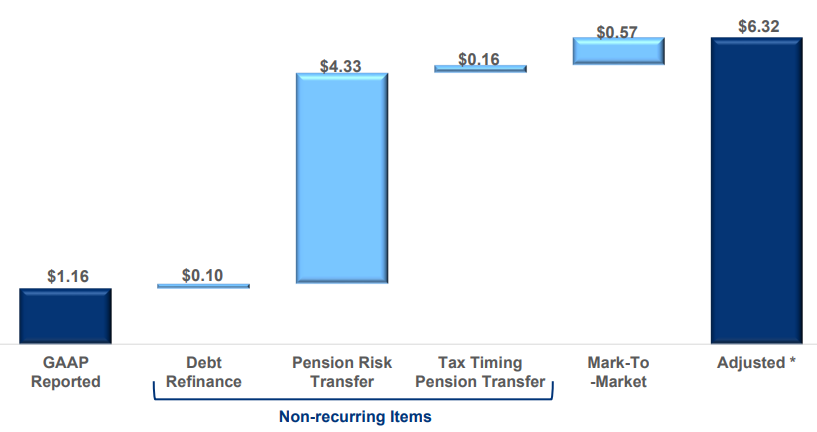

Earnings per share were heavily impacted by a Pension Risk Transfer charge of $4.33 and came in at $1.16 on a GAAP basis, or $6.32 adjusted:

Source: Lockheed Martin Q2 2022 Results Presentation

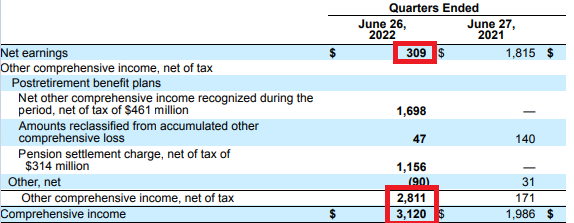

Taking the USD 266.7m in weighted average diluted shares outstanding, we see that the Pension Risk Transfer charge came in at about USD 1.15bn, which is less than the USD 2.8bn positive other comprehensive income booked in the quarter:

Source: Lockheed Martin Form 10-Q for Q2 2022

All things considered, we can say that pensions were a net benefit for LMT in the quarter.

Highlights from the conference call include a more detailed F-35 production schedule until 2025, namely that production will run slightly below the 156 long-term objective. Given the war in Ukraine, inquiries for military equipment purchases have increased across the board, but it remains to be seen what percentage of these intentions of interest translate into actual orders:

The reality is today, none of it is under contract. And so we are trying to get a better understanding of the timing, of which of these will come into contract and then getting a better understanding of our supply chain capability to determine when we can actually deliver. But I can say with some level of reasonable confidence that our orders and backlog outlook over the next two years will be better than it was a year ago. But that will still take some time to convert to revenues beyond that time period.

Source: CFO Jay Malave on the Q2 2022 conference call

Management also reiterated their intention to return 100% of free cash flow to investors via dividends and buybacks, positioning the company with a lower share count for the period of revenue growth expected in the years ahead.

The backlog was marginally up to USD 134.6bn (Q1 USD 134.2bn), with 59% expected to be realized over the next 24 months.

Lockheed Martin as a Government Bond Proxy

For investors, approaching Lockheed Martin from a pure cash flow point of view seems to be the right way to value the company.

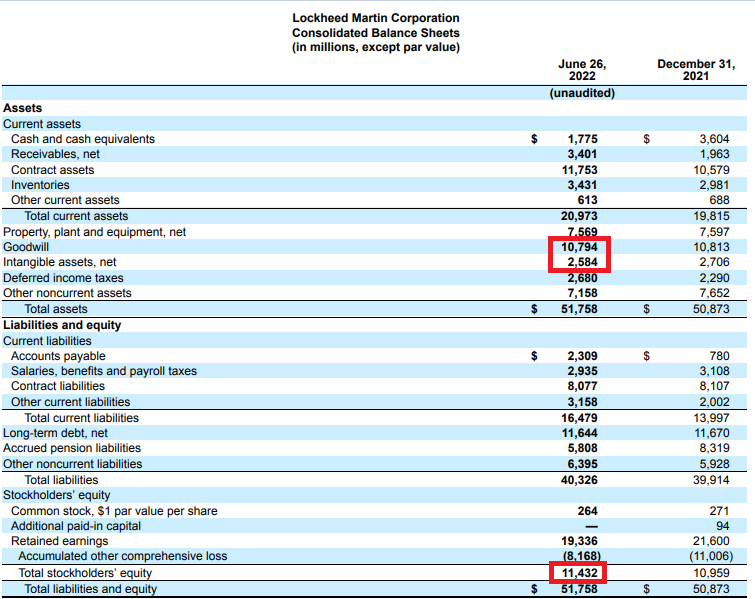

Looking at the balance sheet, we see that as of June 26th 2022 LMT had a stockholders’ equity of USD 11.43bn which included USD 10.8bn in goodwill and USD 2.6bn in net intangible assets:

Source: Lockheed Martin Form 10-Q for Q2 2022

In essence, if you discount the goodwill and other intangible assets, Lockheed Martin has no tangible stockholders’ equity after you take liabilities into account. Thus, the current valuation of circa USD 115bn is based entirely on the earnings generation capacity of the company rather than some tangible assets. Therefore, forward-looking government receivables data that TenderAlpha can offer could prove to be a strong indicator of the company’s future performance.

Lockheed’s current payout for dividends out of the expected USD 6bn in free cash flow is around 50%. While the dividend yield of around 2.6% is unimpressive in itself, its growth prospects are solid in the medium term.

We can expect LMT to experience a brief period of above-trend growth driven by the current geopolitical situation. It is fair to assume that tensions would ease and growth would be in line with that of GDP. A risk in that de-escalation scenario is that there is actually a drop in military equipment demand, i.e. the currently expected revenue bump might be followed by a sales slump down the line.

If free cash flow grows by 10% per year over the next three years, it may well reach the USD 8bn discussed by analysts during the conference call. In that scenario the 2025 free cash flow yield against the current market cap would be around 7% which, coupled with a 3% general economy growth rate (which is also what the military spending growth rate is widely seen as), should take the post-2025 expected return to around 10%.

Taking the free cash flow growth and upcoming buybacks, it is not inconceivable that the 2025 dividend yield is around 3.5% against the current share price.

An alternative way to take a position in Lockheed would be to consider the company’s 3.8% 2045 bonds currently trading around 92% of par. The current yield is 4.1% and you get a nice principal protection by buying below par. The bonds were trading in the 115-120% of par range just last year, and if yields dropped the 2045 issue offers excellent capital growth potential, arguably with very limited downside given the strong price performance of the common stock recently.

Source: Boerse Berlin

Conclusion

Keeping track of contract awards is key to assessing Lockheed Martin’s short and long-term prospects as the company relies on government spending for 99% of its revenues. With defense spending set to increase in the coming years due to the war in Ukraine and growing geopolitical tensions, LMT is in a favorable position to remain stable even in turbulent times.

The prospects for the company have improved materially and investors have taken notice, pushing the stock price up some 23% year-to-date.

This has frontloaded returns to a large extent, and created a situation where a more attractive way to take position in the company could be through long-dated bonds. It can be argued that their current price does not reflect the improved business prospects of LMT making them an attractive investment for anyone looking to gain exposure to the company.

Still, if events developed largely as expected, free cash flow should improve materially in the coming years and LMT would be able to achieve significant dividend growth, in excess of that offered by US government bonds.

Lockheed Martin is a solid example of a company whose stock performance is positively influenced by government contract awards.

Contracts data with full project history about LMT and more than 9000 other ticker-mapped publicly-listed companies is available in TenderAlpha’s data feeds. Our data allows for a dynamic analysis of stock prices of companies involved in the public procurement sector.

See for yourself how our data can help your company. Reach out to receive a free data sample!