It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

In Part 19 of our blog series, we will present you the latest results of Skanska.

Key points:

* Revenue in Swedish Krona down 9% Y/Y in Q4 but up 9.5% in 2022, driven by strength in Construction and declines in Residential & Commercial property development.

* EPS of 7.28 SEK/share in Q4 (-2.3% Y/Y) and 18.62 SEK/share in 2022 (-6% Y/Y). Quarterly results boosted by provision releases.

* Construction order backlog up 11% Y/Y to a record 229.8 billion SEK. 12-month book-to-build of 1.04. Adjusted net cash position of 12.1 billion SEK boosts net income amid higher interest rates.

* Mixed construction outlook for 2023 amid strength in the civil market, offset by weakness in commercial/residential construction activity.

* 45% of 2022 Construction revenue earned in the U.S. but 58% of 2022 operating income from Nordics.

Skanska Q4 2022 Results Overview

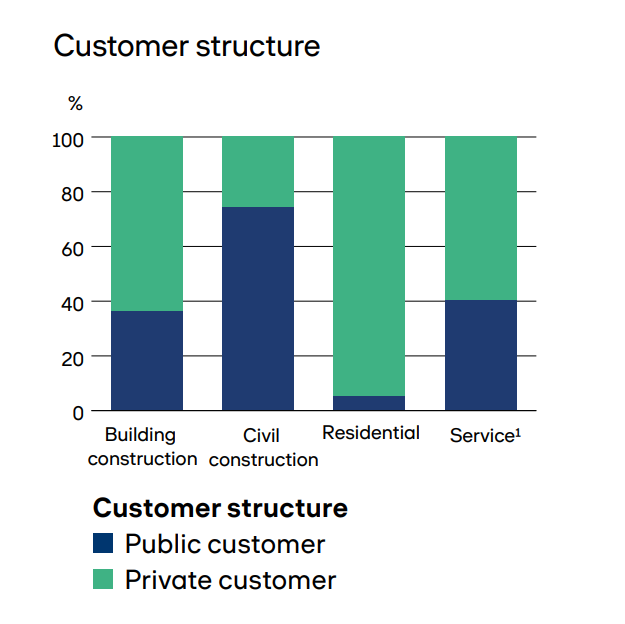

Skanska reports results in four main segments, namely Construction at 91% of Q4 2022 revenues, Residential Development at 1.6%, Commercial Property Development at 7.3% and the newly established Investment Properties segment at less than 0.1% of Q4 2022 revenues:

Figure 1: Skanska Q4 2022 segment revenues

Source: Skanska Q4 2022 Interim Report

Despite being based in Sweden, the U.S. is the biggest market for Skanska, contributing 45% of total 2022 Construction segment revenue, followed by the Nordics at 38% and Europe at 17%. From a profitability perspective, the Nordics contributed 58% of total 2022 group operating income, followed by the U.S. at 26% and Europe at 16%.

Operational Overview

Construction was the strongest segment both in Q4 (revenue +13.6% Y/Y) and in 2022 (+17.7% Y/Y). The operating margin was 5.4% (+1.2% Y/Y) in the quarter and 3.7% (-0.1%) in the full year.

Residential Development was the weakest segment in Q4 (revenue -78.7% Y/Y) and 2022 (-34.1%). The operating margin nosedived in Q4 to just 0.6% from 11.5% in the prior-year quarter. In 2022 the margin stood at 10.7% (2021 13.8%).

Commercial Property Development revenue decreased 48.5% Y/Y in Q4. At the same time strength early in the year drove 2022 revenue up 22.1%. Operating income was down 22.8% Y/Y in Q4 and 11.1% for the full year.

Investment Properties now manages three properties valued at 3.8 billion SEK with a target of growing the portfolio to 12-18 billion SEK.

On a consolidated basis, revenue in Swedish Krona declined 9% Y/Y in Q4 but grew 9.5% Y/Y in 2022. In local currency, revenue was down 19% in Q4 and flat for the full year. EPS was 7.28 SEK/share in Q4 (-2.3% Y/Y) and 18.62 SEK/share in 2022 (-6% Y/Y). Quarterly profits were positively impacted by provision releases. Operating cash flow before dividends and strategic investment/divestments was negative in 2022 at -2.3 billion SEK. The company expects some further deterioration in its cash position given the need to invest working capital in ongoing projects.

Skanska 2023 Outlook

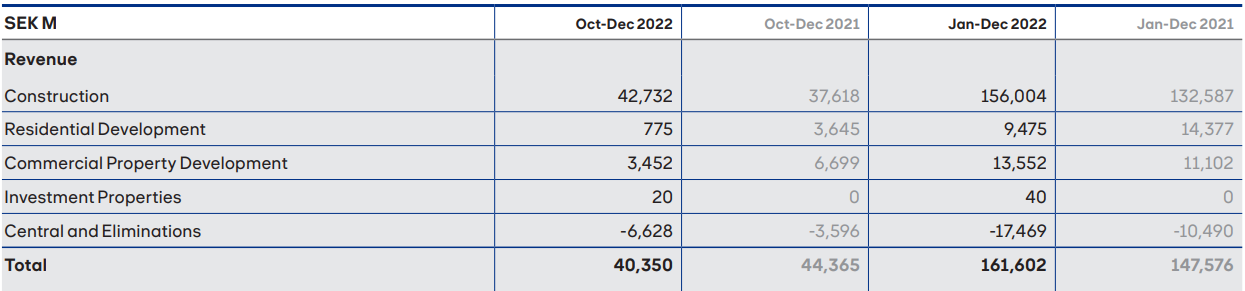

Skanska's market outlook envisages a continuation of trends observed in Q4. In Construction, stable activity is forecast for the civil market where close to 80% of the demand comes from public customers:

Figure 2: Customer Structure in Construction, 2022

Source: Skanska 2022 Annual Report

On the other hand, Building construction, where more than 60% of demand comes from private customers, is seen on a weaker footing.

On a more positive note, the company highlights that availability of building materials is improving, with costs for some materials leveling out.

Residential Development and Commercial Property Development will continue to under-perform. The former will be affected by low activity in the housing market and weak consumer confidence. The latter will suffer from hesitant investor behavior, low transaction volumes and a feeble leasing market recovery.

Backlog

Construction order backlog finished 2022 at a record level, increasing 11% Y/Y to 229.8 billion SEK. The backlog covers 17 months of production. On a rolling 12-month basis, the book-to-build ratio was 104%.

Capital Structure

Skanska is in an ideal position to weather the downturn in residential and commercial construction. The company ended 2022 with an adjusted net cash position of 12.1 billion SEK. As per the 2022 annual report, adjusted net cash is reported as “Interest-bearing net receivables/net debt excluding restricted cash, lease liabilities and interest-bearing net pension liabilities.” For reference, the market capitalization is around 64 billion SEK.

The net cash position is also beneficial given higher interest rates – financial income increased 276% Y/Y and is now a contributor to earnings.

Conclusion

Skanska enjoys a record backlog and a fortress balance sheet which will allow it to ride out the cyclicality of the residential & commercial property markets. What is more, the company is entering the investment property market amid a gloomy industry outlook. This will allow Skanska to negotiate favorable capitalization rates. Furthermore, the company is in an ideal position to take part in the re-purposing of office space for alternative use, given the consensus view of a structurally oversupplied office market.

In light of the increasing importance of public customers for Skanska amid a pull-back in demand from private customers, monitoring the company’s public procurement activity also remains a smart move that can provide key insights into Skanska’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Skanska or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.