It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Textron recently reported its Q1 2023 results and below we will provide a brief analysis of the company’s performance in the first 3 months of the year.

Key points:

* U.S. government purchases made up 22.1% of all Q1 revenue. Government share expected to creep back to 30% long-term as new programs start;

* Q1 revenue growth of 0.7% Y/Y, with Bell segment(-25.5% Y/Y) significantly underperforming due to timing of revenue from the new attack helicopter program;

* Q1 adjusted EPS up 8.2% Y/Y to $1.05/share. 2023 outlook of $5-5.2/share confirmed(+14.6%);

* Manufacturing cash flow before pension contribution outlook of $0.9-1 billion (-19.4% Y/Y);

* Net debt of $1.75 billion as company expects to repurchase 5-6% of total shares in 2023.

Textron Q1 2023 Results Overview

We originally covered Textron's Q4 2022 results in part 8 of our Top Government Contractors series here. Below we will review the progress achieved by the company in Q1 of 2023.

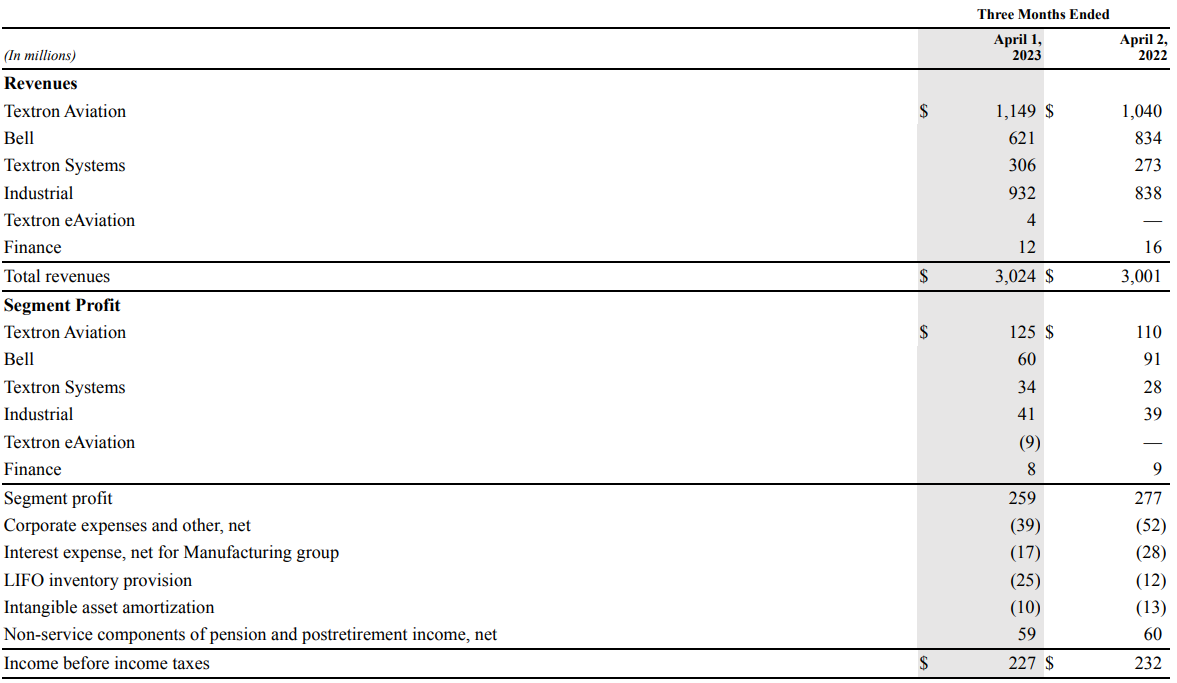

Textron reports results in four main manufacturing segments, namely Textron Aviation (aircraft and aftermarket parts and services) at 38% of Q1 2023 revenues, Industrial (fuel systems and functional components; golf cars and specialized vehicles) at 30.8%, Bell (helicopters, tiltrotor aircraft and related services) at 20.5% and Textron Systems (drones, defense specialty vehicles) at 10.1% of Q1 2023 revenues:

Figure 1: Q1 2023 Textron segment results

Source: Textron Q1 2023 Form 10-Q

Operational Overview

Textron Aviation grew sales 10.5% Y/Y in Q1 (2022 +11.1%). Growth was driven by both higher pricing and volume, with strength in defense and aftermarket volume. The profit margin increased 0.3% Y/Y to 10.9%. Overall, segment profit was up 14% Y/Y.

Bell was the weakest segment in the quarter, with revenue down 25.5% Y/Y in Q1 (2022 -8.1%). The decline was entirely due to weakness in defense (-36% Y/Y), as the production of the old models winds down and the program transitions to the support stage.

As we highlighted in our previous article, in December 2022, Textron was awarded the U.S. Army's Future Long Range Assault Aircraft Program (FLRAA). Post quarter end, the Government accountability office denied Lockheed Martin's protest and work on the new program has resumed.

On top of the sales weakness, the profit margin dropped 1.2% Y/Y to 9.7%. Overall, segment profit dropped 34% Y/Y.

Textron Systems was the best performing segment in Q1, growing 12.1% Y/Y (2022 -7.9%). Sales were primarily driven by higher volumes. The profit margin also expanded by 0.8% Y/Y to 11.1%. Summing up both effects, segment profit grew 21% Y/Y.

Industrial revenue expanded 11.2% Y/Y in Q1 (2022 +10.7%), with strength in specialized vehicles (+19% Y/Y). The profit margin was down by 0.3% Y/Y to 4.4%. Overall, segment profit grew just 5% Y/Y.

On a group level, revenue was up 0.7% Y/Y (2022 +3.9%):

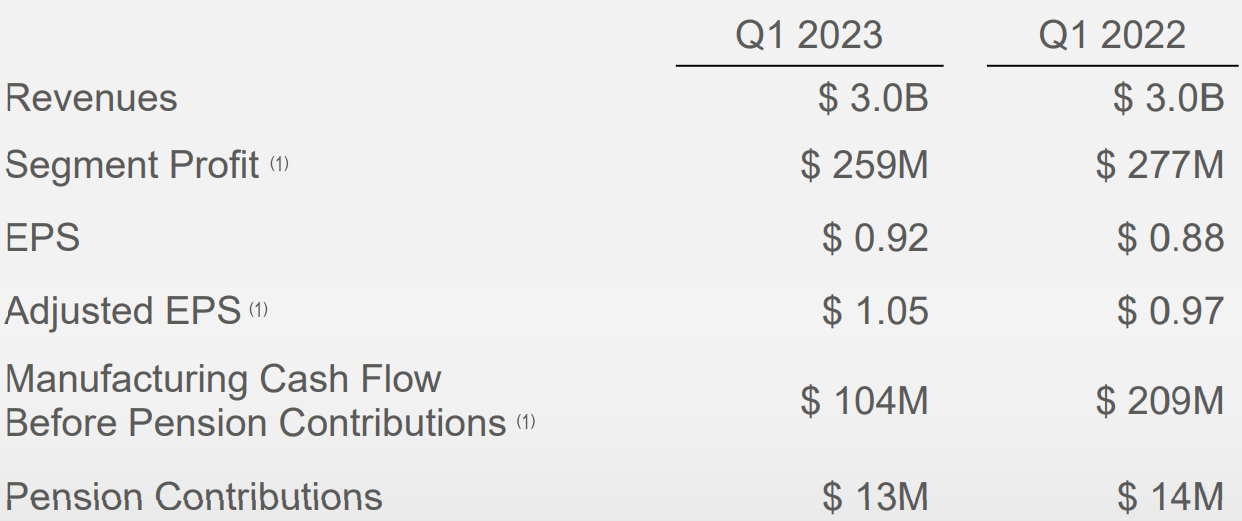

Figure 2: Textron Q1 2023 Results Overview

Source: Textron Q1 2023 Results Presentation

Adjusted Earnings per share grew 8.2% Y/Y in Q1 to $1.05/share. Manufacturing cash flow before pension contribution was very weak, down 50% Y/Y to $104 million in Q1 (2022 $1,178 million).

2023 Outlook

Despite weak top-line performance in Q1, Textron reiterated its full year outlook:

Adjusted EPS should grow 14.6% to $5-5.2/share.

Manufacturing cash flow before pension contribution is expected to drop 19.4% to $0.9-1 billion.

Bell performance likely hit a trough in Q1 and should materially improve going forward thanks to the resumption of the FLRAA program. However, the new program is expected to be executed at a lower margin compared to its predecessor.

Aviation profitability is expected to remain resilient thanks to the substantial backlog, which cushions Textron from temporary drops in demand during times of market stress, such as the recent period at Silicon Valley Bank.

Textron Backlog

Total backlog declined 1% Q/Q to $13.1 billion, with Aviation growth of 2.1% offset by Bell and Textron Systems weakness. A notable win for the Aviation segment was highlighted on the call:

In the quarter, Aviation received an initial award on the U.S. Navy Multi-Engine Training System contract for 10 King Air 260 aircraft and associated support equipment. This contract includes options for up to 64 aircraft with deliveries in 2024 through 2026. Textron Aviation's fleet utilization remained strong in the quarter, contributing to aftermarket revenue growth of 9% as compared to last year's first quarter.

Capital Structure

Textron ended Q1 2023 with a net debt of $1.75 billion, up $0.25billion Q/Q. The capital structure is fairly conservative, with a market capitalization of $13 billion.

In the quarter, Textron returned $377 million to shareholders through share repurchases (2022, $867 million). Company expects to repurchase 5-6% of total shares in 2023.

Customer Dynamics

From an end customer perspective, Commercial customers Q1 revenue grew 8.5% Y/Y to 77.9% of total Q1 sales. U.S. government purchases were down 19.5% Y/Y and now account for 22.1% of total Q1 revenue.

Textron expects defense to move back to about 30% revenue contribution as new programs kick in over the coming years. That said, CEO Scott Donnelly cautioned there had been no substantial revenue impact from the war in Ukraine:

We're not in that sort of munition space. I mean there has been some dialogue around some land vehicles, but they're largely EDA things that are in surplus in the army that would come out being refurbished and put over there. There's some talk of different UAS systems. So, there's some -- there are -- we've had nothing so far. And there's probably some relatively speaking, smaller opportunities going forward, but it's not going to be a material impact to us.

Conclusion

Textron confirmed its guidance for the year, with all divisions performing in line with initial expectations. The new attack helicopter award will bring a consistent revenue stream at Bell, albeit with a slightly lower margin.

As Bell returns to growth in the coming quarters, top-line performance should improve and the company may well reach its 8.5% revenue growth target in 2023, despite achieving only 0.7% in Q1.

Given the substantial impact major contract awards can have at niche businesses such as Bell, monitoring the company’s public procurement activity remains a smart move that can provide key insights into Textron’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Textron or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.