After providing in-depth analyses of some industrial companies in our Top government contractors series (such as General Electric in part 48 here) we decided to take a sector approach and observe what trends drove Industrial company performance in the first half of H1 2023, potentially looking into the second half of the year as well. In our following articles, we plan to highlight top government contractors in the defense, healthcare and information technology/services sectors.

Key points:

* Revenue at some of the largest government contractors in the industrial sector grew 10.2% on average in H1, with a median growth of 9.7%, significantly outperforming the S&P 500.

* Revenue expectations for H2 are mixed, with acceleration at some companies offset by loss of momentum at others.

* Industrial conglomerates such as Siemens, General Electric and Honeywell delivered strong margin improvement but weak backlog growth, as improving supply chains allowed them to catch up on delivery times.

* Construction companies registered the best backlog increase in our sample, up 10% Y/Y. Margin performance was nuanced among the group.

* Energy companies had mixed performance in H1 2023, with low fossil fuel prices offsetting strong demand and backlog growth for renewables and electrification.

Revenue Developments

Industrial companies enjoyed a strong first half from a revenue perspective, with supply chains improving relative to 2022:

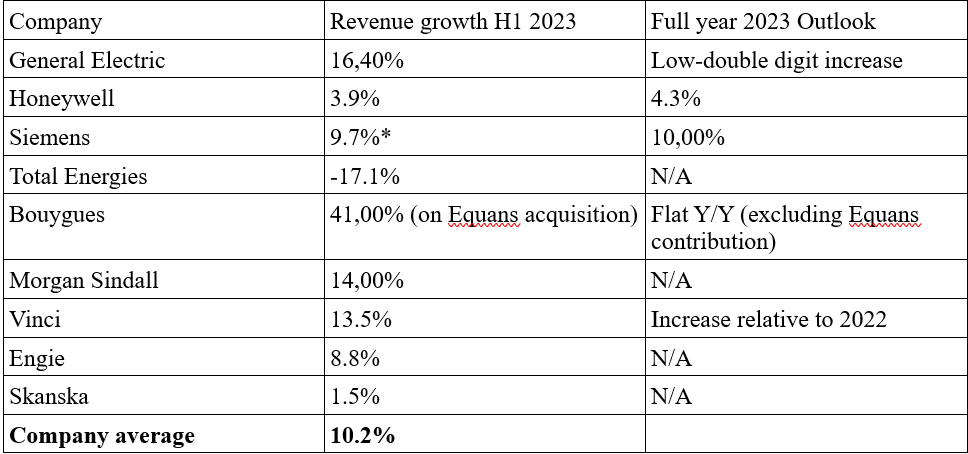

Figure 1: Year-over-year revenue trends at select large government contractors

Source: Company disclosures for H1 2023. *Siemens Q1-Q3

Across the nine companies in our list, top-line growth came in at 10.2% on average, or 9.7% taking the result of Siemens as a median.

Looking at sub-sectors, we can conclude that:

- Growth was strongest in Construction (Bouygues, Vinci, Morgan Sindall, Skanska), with an average of 17.5%, or 13.75% taking the median.

- Industrial Conglomerates (Siemens, General Electric, Honeywell) saw 10% of top-line growth, or 9.7% if we take Siemens as a median.

- Energy companies (Engie, Total Energies) performed in the bottom of the Industrials range, with revenues down on average, as low fossil fuel prices offset growth in renewables and electrification.

Net Income Developments

Net income margin developments were generally positive as well, although the dispersion in performance was significantly more pronounced:

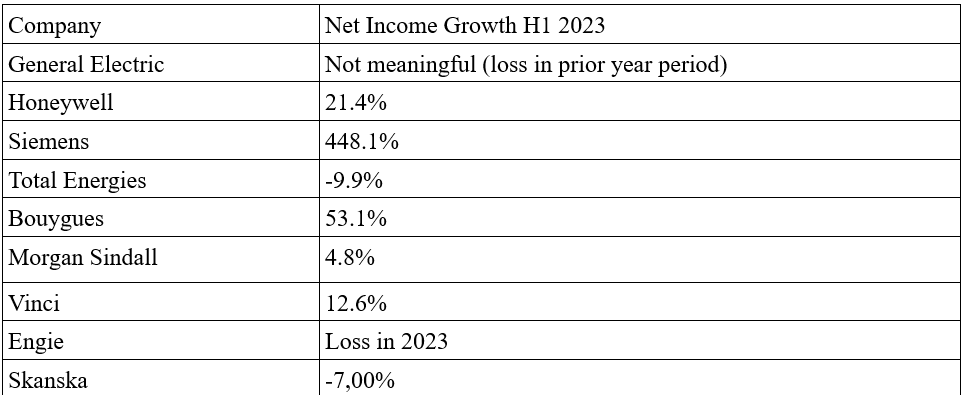

Figure 2: Year-over-year net income trends at select large government contractors

Source: Company disclosures for H1 2023. *Siemens Q1-Q3

While some companies managed to swing to a profit in 2023, others were impacted by margin weakness or idiosyncratic events. Looking at sub-sectors, we can conclude that:

- Net income growth was strongest at Industrial Conglomerates.

- Performance in the Construction sector was mixed, with companies split 50/50 between improving and deteriorating margins.

- The Energy sector was impacted by idiosyncratic events (Engie) but Total Energies actually saw an improvement in margins.

Backlog

We will now highlight backlog developments in our sample:

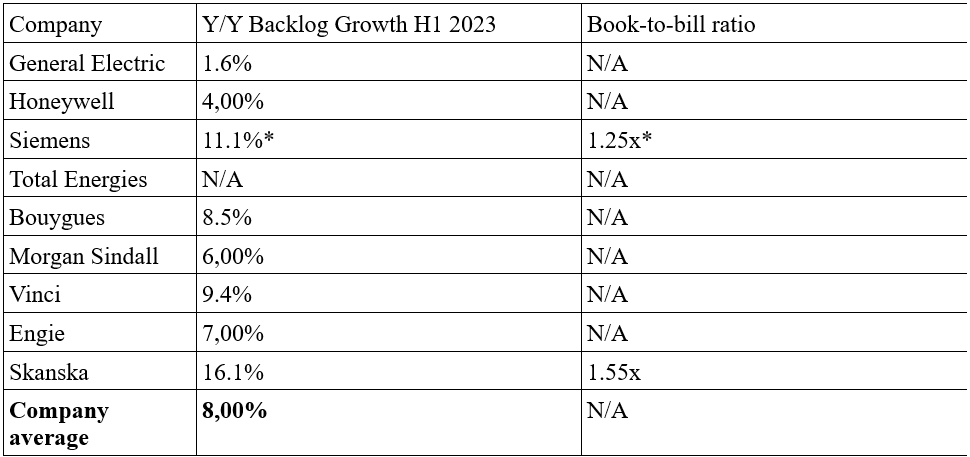

Figure 3: Year-over-year backlog trends at select large government contractors

Source: Company disclosures for H1 2023. *Siemens Q1-Q3

Among the companies reporting a backlog, the increase was 8% on average. Looking at sub-sectors, we can conclude that:

- Construction saw the highest backlog growth of 10%.

- Energy was the second-best performer.

- Industrial Conglomerates reported the weakest backlog growth of only 5.6%.

Supply Chain Comments

Along with generally positive revenue, net income and backlog developments, companies broadly reported improving supply chain conditions and material availability on their latest conference calls:

General Electric

And the supply chain challenges that we've talked about and everyone talks about certainly applied to Defense. I think we've had some particular issues that have challenged us, especially so with the first quarter numbers. I think we're really encouraged by what we have seen recently, not only with the T700, but with a host of platforms where our material flow in our own facilities is better. We are improving yields in a number of key operations that allows that flow to take place.

Honeywell

Supply chain constraints continue to moderate our overall growth rate. However, we continue to record sequential improvements in Aero output as expected and are reducing our past due backlog across our short cycle businesses.

As a result, the weak backlog growth at Industrial Conglomerates can be partially explained by improving supply chains and on-time product delivery.

Conclusion

Top government contractors in the industrial space have significantly outperformed the S&P 500 in terms of revenue growth (+10.2%), with the leading US benchmark delivering top-line growth of only 0.4% Y/Y in Q2 2023.

Net income developments at companies in our coverage were also generally favourable, although not as pronounced as revenue growth.

Backlog grew marginally below sales, with improving supply chains allowing some companies to improve delivery times and work through their significant remaining performance obligations.

Given the significant impact government contract wins can have on company financials, monitoring companies’ public procurement activity remains a smart move that can provide key insights into their financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy any stock mentioned within. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.