It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

In Part 22 of our blog series, we will present you the latest results of TotalEnergies.

Key points:

* Adjusted net operating income growth of 13% Y/Y in Q4 and 90% in 2022. Marked deceleration in Q4 relative to Q3 set to continue throughout 2023;

* EPS of $2.97/share in Q4(+17% Y/Y) and $13.94/share in 2022(+209% Y/Y). Free cash flow of $5.2 billion in Q4 (+11% Y/Y) and $34 billion in 2022 (+206%);

* Just $8.6 billion in net debt at year-end. AA credit rating targeted in 2023 (current A+);

* Integrated Gas, Renewables & Power segment to be split in two in Q1 2023 to show increasing importance of the Integrated Power segment (25% of capex);

* Spin-off of Canadian exploration&production assets in H2 2023; go-ahead for $10 billion Iraq project.

TotalEnergies Q4 2022 Results Overview

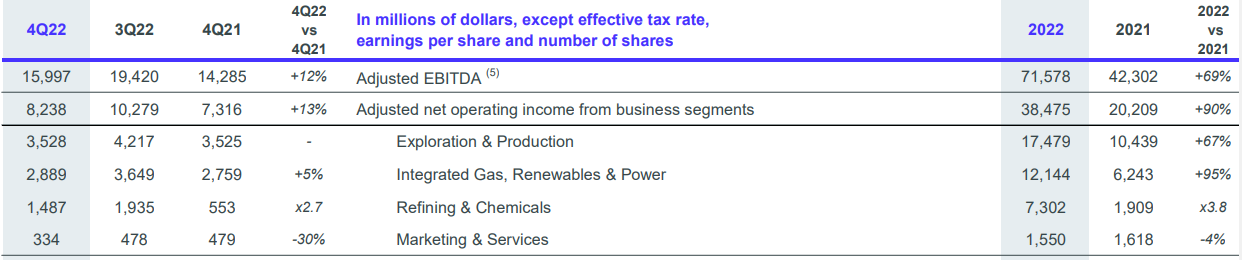

TotalEnergies reports results in four main business segments, namely Exploration & Production at 42.8% of Q4 adjusted net operating income, Integrated Gas, Renewables & Power at 35.1%, Refining & Chemicals at 18.1% and Marketing & Services at 4.1% of Q4 adjusted net operating income:

Figure 1: Q4 2022 TotalEnergies segment revenues

Source: TotalEnergies Q4 2022 Results Press Release

Operational Overview

Exploration & Production delivered flat Y/Y adjusted net operating income (NOI) in Q4, a sharp deceleration from the 57% growth achieved in 2022.

Integrated Gas, Renewables & Power was the second-best segment in Q4, with adjusted NOI growing 5% Y/Y. For the full year, adjusted NOI increased 95%.

Refining & Chemicals achieved the best results both in Q4 (+269% Y/Y) and 2022 (+383% Y/Y).

Marketing & Services was the only segment to register a decline, with adjusted NOI down 30% in Q4 and 4% for the full year.

As a general note, performance at all business segments was below levels achieved in Q3 2022.

On a consolidated basis, adjusted net operating income grew 13% Y/Y in Q4 and 90% in 2022. Adjusted EPS was $2.97/share in Q4, up 17% Y/Y, and $13.94/share in the full year, up 209%. Free cash flow was $5.2 billion in Q4(+11% Y/Y) and $34 billion in 2022 (+206%).

Again, we can conclude that all key performance indicators above registered a Q4 decline relative to Q3 2022.

TotalEnergies 2023 Outlook

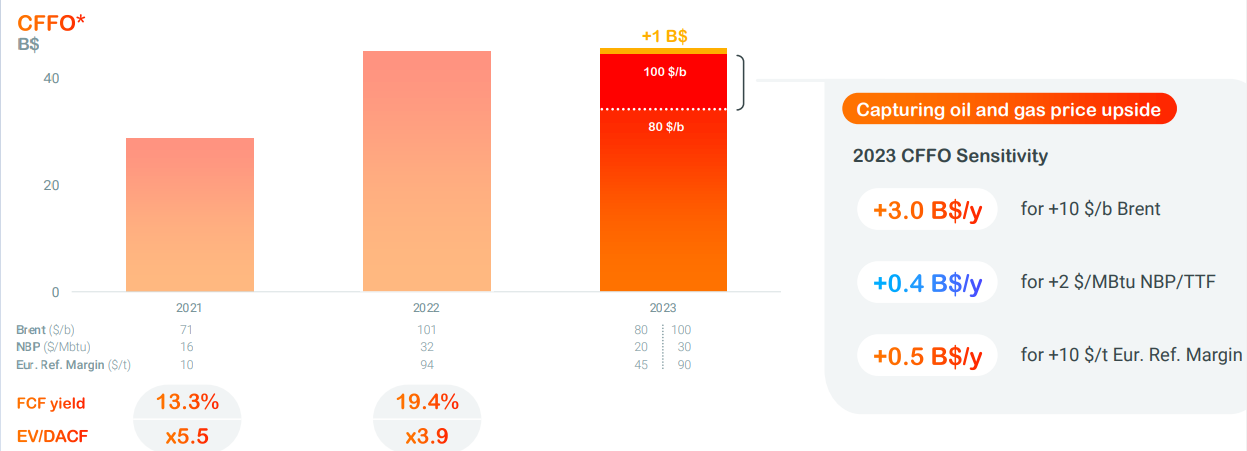

Against the backdrop of decelerating performance observed in Q4, it is likely that TotalEnergies will experience tough Y/Y comparisons, at least in Q1-Q3. As a result, cash flow from operations is expected to decrease in 2022 due to lower oil and gas prices, as well as a reduced refining margin:

Figure 2: 2023 TotalEnergies operating cash flow outlook

Source: TotalEnergies Q4 2022 Earnings Presentation

Should Brent crude average below $100/barrel for the remained of the year (in Q1 2023 it moved between $71-87.5/barrel), cash flow from operations should decrease relative to 2022, but still outperform 2021 results.

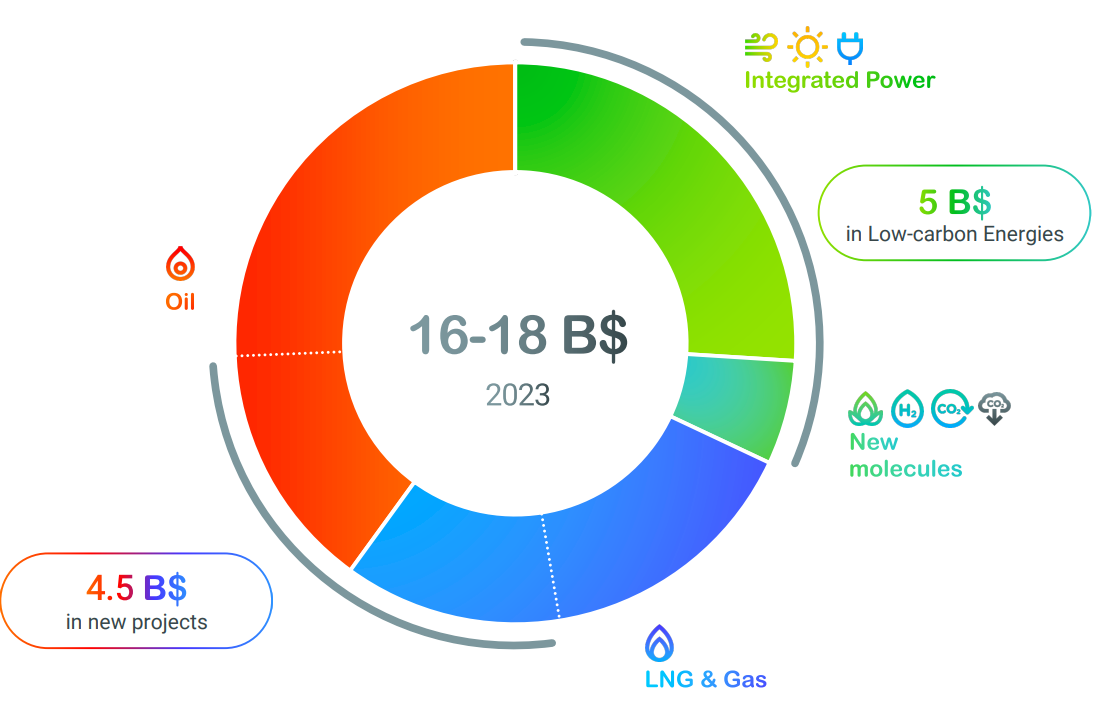

Capital expenditures are seen in a range of $16-18 billion (2022 $16 billion). Some 5 billion are set to be deployed in low-carbon energies, with the remaining majority going to the traditional oil&gas segment:

Figure 3: 2023 TotalEnergies capex outlook

Source: TotalEnergies Q4 2022 Earnings Presentation

Capital Structure

TotalEnergies ended 2022 with a net debt of $8.6 billion, a negligible amount in light of the strong free cash flow generation and its market capitalization of $154 billion.

In 2023, the company targets an AA credit rating, up from the current A+. In line with its 35-40% of cash payout policy, the final 2022 and interim 2023 dividends are up 7.25% and $2 billion in buybacks were executed in Q1 2023.

International Developments

In H2 2023, TotalEnergies plans to list its exploration & production assets in Canada on the Toronto Stock Exchange. TotalEnergies shareholders are to receive the shares as a distribution in kind, while TotalEnergies will retain a 30% stake initially. The Canadian assets contributed 3.2% of 2022 operating cash flows.

On April 4, TotalEnergies reached an agreement with the Iraqi government for it to take a 30% stake in the Gas Growth Integrated Project in the country. The $10 billion project will be split between TotalEnergies (45% stake), Basrah Oil Company (30%) and QatarEnergy (25%).

Integrated Power Growth

Against the backdrop of declining oil & gas prices on a year-over-year basis, the Integrated Power segment should continue to grow. While it contributed only 2.2% of 2022 operating cash flows, the result is set to increase both on an absolute and relative basis, thanks to installed electricity generation capacity up 24% Y/Y in 2023 and electricity generation increasing at least 21%.

As a result of the increasing importance of the Integrated Power segment, starting in Q1 2023 the current Integrated Gas, Renewables & Power will be split into two new separate segments. As a stand-alone segment, Integrated Power will gain greater visibility, in light of the fact 25% of the company's capex is deployed in the segment.

Conclusion

TotalEnergies exited Russian operations ($14.8 billion impairment) and delivered record 2022 results. While 2023 will be a tough year compared to the high water marked achieved last year, the company is slowly building its non-oil & gas portfolio which will drive returns long-term.

At the same time, oil demand, at 101.7 million barrels a day in 2023, is set to make a new record high, surpassing 2019 levels (100.6 million barrels a day). Thus, TotalEnergies is in an ideal position to benefit given its low sub $25 all-in sustaining cost.

In light of the increasing importance grids and power will play for TotalEnergies, monitoring the company’s public procurement activity also remains a smart move that can provide key insights into TotalEnergies’ financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy TotalEnergies or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.