Key points:

* Axon Enterprise’s revenues and stock price have significantly increased since 2020.

* While international sales have continued to grow, their overall significance for the company has decreased amid faster U.S. revenue growth.

* In contrast to recent years, 2024 sales growth was driven by the TASER segment.

* The company still only captures a small amount of its $77 billion total addressable market.

Introduction

Back in 2021, we covered Axon Enterprise’s push into international markets, driven by Canada (contract by the Toronto Police Service for the digital evidence management solution Axon Evidence), Ukraine (contract by the Department of National Police for TASER), as well as the United Kingdom and Brazil.

We also did a deep dive into a landmark contract with the Drug Enforcement Administration (DEA), which, on the surface, seemed insignificant given its low absolute amount.

However, we correctly anticipated that Axon’s DEA contract award would open new market segments by utilizing the company’s advanced technological solutions.

Since then developments have vindicated our optimism for Axon Enterprise, with the company’s technology offering delivering the highest revenue growth rates among Axon’s businesses.

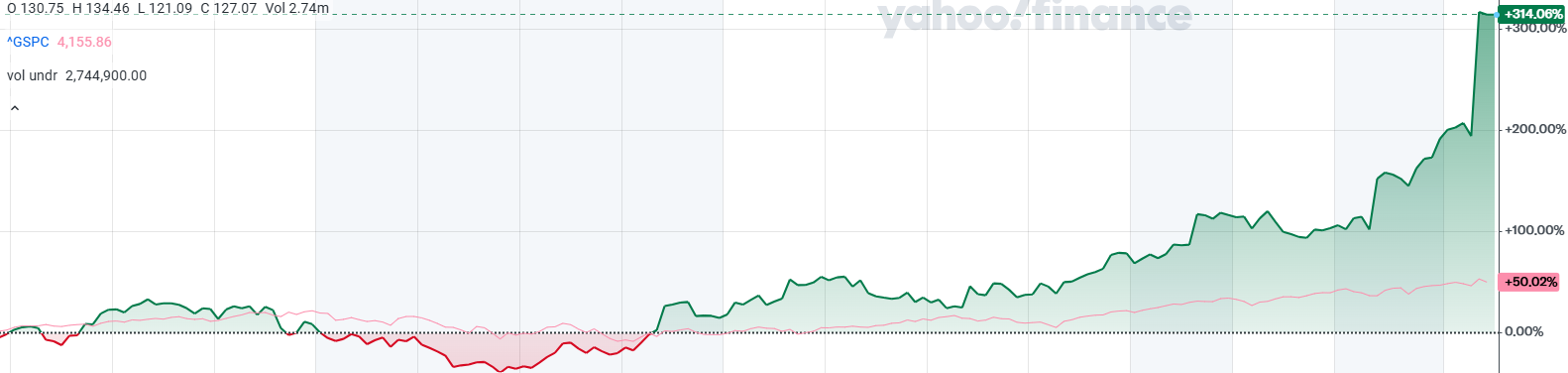

The stellar sales growth has resulted in the company’s share price increasing more than threefold since 2021, significantly outperforming the 50% gain for the S&P 500:

Figure 1: Growth of Axon Enterprise share price relative to the S&P 500 since our initial article

Source: Yahoo Finance

In today’s article, we will focus on the company’s structure, its operational results and key growth drivers, as well as trends in its customer base.

Company Overview (NASDAQ: AXON)

Axon Enterprise, known for its non-lethal TASER devices, has diversified its product offering in recent years, growing in markets such as cloud services and body cameras.

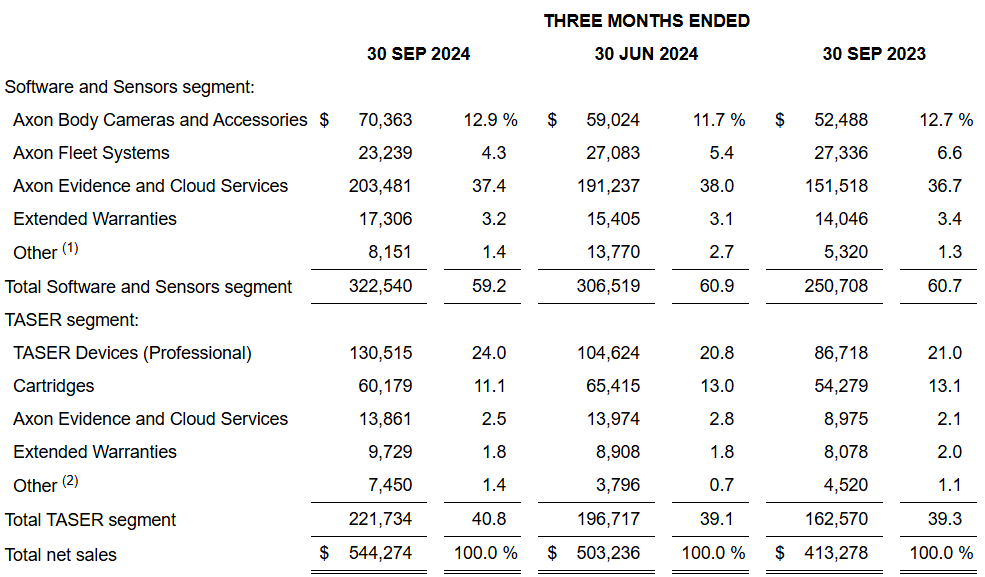

The company reports results in two main segments - Software and Sensors at 59.2% of Q3 2024 revenue and TASER at 40.8%:

Figure 2: Sales breakdown between segments

Source: Axon Enterprise Q3 2024 Results Press Release

While the significance of the TASER segment has marginally increased over the past year, since 2020 its importance for the company’s topline has declined.

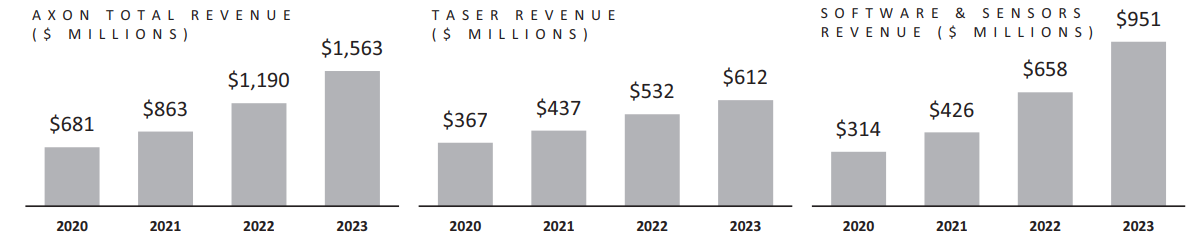

Back then, TASER accounted for 54% of Axon sales. Even so, we observe that both segments have delivered robust growth in every year since 2020, with 2023 sales increasing 130% relative to 2020:

Figure 3: Revenue evolution in the period 2020-2023

Source: Axon Enterprise 2023 Annual Report

The company has an enterprise value of $45 billion and sits on a small net cash position.

Operational Overview

Software and Sensors sales grew 28.7% Y/Y in Q3 2024, driven by the Cloud & Services subsegment. Margin performance was more nuanced, improving to 75.2% in Cloud & Services (+1.5% Y/Y) while Sensors & Other margins were down 3.2% to 43.3% due to the non-recurrence of a one-off positive effect in the prior-year quarter.

TASER revenue increased 36.4% Y/Y in Q3 2024 driven by the core TASER Devices subsegment. Margin performance improved by 0.2% to 63% helped by automation and cost reduction initiatives.

On a consolidated basis, Q3 2024 sales increased 32% Y/Y while margins improved by 0.5% to 63.2%. Adjusted EBITDA increased by 54% Y/Y, resulting in $68 million free cash flow for the quarter ($117 million year-to-date).

Increased 2024 Outlook

The robust performance in the third quarter prompted Axon to increase its full-year guidance. The company now expects to achieve:

- Revenue growth of 32%.

- Adjusted EBITDA of $510 million, up 55% relative to 2023.

For Q4 2024, sales are forecast to increase by 30% Y/Y, which is below the 33% year-to-date 2024 run rate, potentially pointing to some growth moderation in 2025.

Axon Enterprise's Government Revenue Exposure

Axon Enterprise sells its products and services to four main customer groups:

- U.S. federal government

- U.S. state and local governments

- International government customers

- Commercial customers

No single customer accounts for more than 10% of company sales.

As we highlighted in our previous articles, the international business has been growing in recent years, but its relative importance for the company has decreased given the faster growth in the U.S. market:

Table 1: Sales split between the U.S. and other countries, 2020-2024

| Year/Sales Region | United States | Other Countries |

| 2020 | 79% | 21% |

| 2021 | 80% | 20% |

| 2022 | 83% | 17% |

| 2023 | 86% | 14% |

| 9M 2024 | 86% | 14% |

Source: Axon Enterprise forms 10-K and 10-Q

From Table 1 above we observe that the significance of the U.S. market has increased from 79% of sales in 2020 to 86% in 9M 2024.

On the one hand, the importance of the core U.S. market is likely to keep growing as international sales only increased by 18% Y/Y in 9M 2024, below the 36% jump observed in the U.S. market.

We anticipate that the election of President Trump will further boost demand for Axon’s products in the U.S. given a renewed focus on border security and immigration.

This will likely lead to increased confrontation between police and illegals, with Axon’s non-lethal weapons focus a key factor driving future demand.

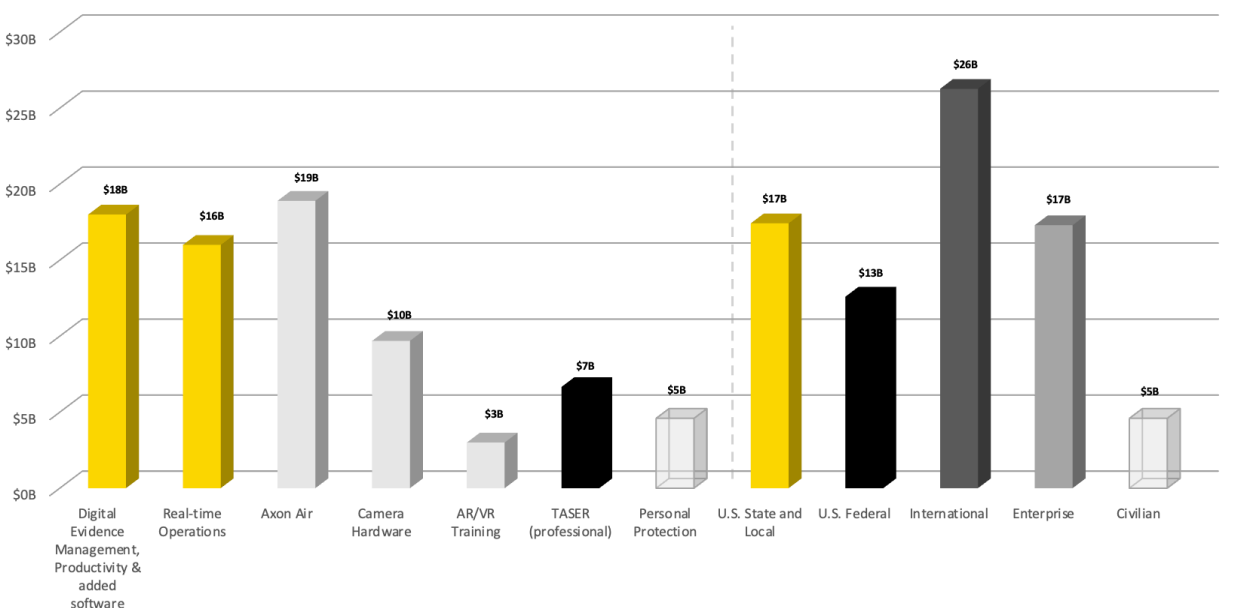

On the other hand, the international market represents 34% of the company’s total $77 billion total addressable market /TAM/, providing room for future growth:

Figure 4: Breakdown of Axon Enterprise’s $77 billion total addressable market

Source: Axon Enterprise November 2024 Presentation

From Figure 4 above we observe that the top 3 markets for Axon outside International are Axon Air (25% of TAM), U.S. State and Local governments (22%), and Enterprise customers (22%).

Considering the company’s current revenue run-rate of about $2.1 billion, Axon only captures 2.7% of its TAM, indicating the stellar growth is likely to continue in the future.

Axon Enterprise recently highlighted an award by the Royal Canadian Mounted Police for body-worn cameras and digital evidence management system Axon Evidence, strengthening its international growth pipeline.

Conclusion

Axon Enterprise has seen its sales double since we first monitored its performance in 2021, resulting in the company significantly outperforming the S&P 500.

With a TAM of $77 billion, Axon’s double-digit revenue growth looks set to continue in the years ahead.

The company has expanded its product offering well beyond its iconic TASER, serving a diverse pool of customers ranging from state and local governments, the U.S. federal government, international governments, as well as commercial customers.

On the one hand, this vast customer base is a clear positive as it results in no large single customer exposure, diversifying Axon’s revenue streams.

On the other hand, it makes tracking the company’s government awards somewhat difficult and time-consuming.

This is where TenderAlpha comes in - our proprietary global government contract awards data feed allows users to quickly and efficiently track Axon’s government contract awards throughout the world, thus gaining key insights into whether the company can maintain its growth in the years ahead.

The data feed enables an easy analysis of Axon’s performance in different geographies, whilst the derivative Forward-Looking Receivables feed gives you the opportunity to monitor the outstanding amount the company is yet to receive under all contracts it has been awarded by the US federal government, thus helping you predict its future revenue and shedding light on its cash flow.

Get in touch now and start monitoring the top government contractors to discover lucrative investment and partnership opportunities!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Axon Enterprise or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.