What is the value of information?

In modern-day investing information is the biggest advantage an investor can hold. And with the advent of alternative data, one has loads of varied intelligence to look at. Nowadays, there are countless sources of alternative data that exist that could be incorporated into a quantitative strategy by investors in search of greater alpha generation.

For example, social media sentiment is being more and more recognized as a potential indicator of the emergence of new consumer trends or product popularity.

Yet, it is web scraping that remains the number one alternative data source. The aggregation of open information available on the Internet such as company data, SEC filings data, company news, or even government contracting data enables a deeper and, more importantly, faster access to information that is critical for the investment decision-making process.

In fact, alternative data has been called “the deepest, least utilized alpha source in the world today” by the NASDAQ platform for alternative data, Quandl.

According to a study by Grand View Research, the global alternative data market size was valued at USD 7.2bn in 2023 and is projected to expand at a CAGR of 52.1% from 2023 to 2030.

It is no wonder then that investors and funds are determined to maximize its potential. They are demonstrating a growing interest in testing a wide range of strategies involving the use of alternative data as an alpha generator.

Below we highlight three different quantitative strategies that have shown significant stock returns.

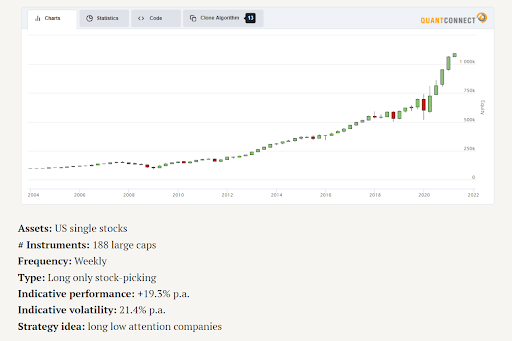

1) Google Search Volume Strategy

Quantpedia - a platform that has collected a database of 700+ quantitative strategies based on academic research - includes some 100 strategies based on alternative data.

One of these is based on Google Search. The strategy encompasses buying stocks when there is low attention attached to them and selling them when they start to pick up higher search traffic. The premise is that:

- these stocks are underpriced

- therefore, they are associated with lower risk

Below are details and results this quantitative strategy has yielded.

Source: Quantpedia

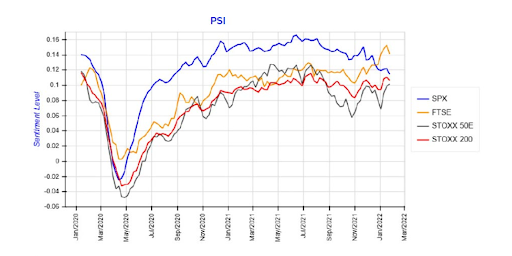

2) Media Sentiment as an Investment Signal

In a white paper published by Refinitiv titled ‘The value of alternative data: The case for media sentiment’, the financial market data provider uses backtesting to compare the performance of portfolios when using Refinitiv Media Sentiment as a standalone investment signal, versus a traditional multi-factor strategy or the S&P500 benchmark.

The study showed that using the alternative data set of media sentiment as a single-factor investment strategy achieved results across return, volatility and the Sharpe ratio on a par with those achieved when using a multi-factor strategy.

For long-only investors, both the multi-factor and sentiment-only strategies delivered between 2% and 2.5% excess return over the S&P benchmark.

When tested on long-short portfolios, the sentiment-only strategy even began to outperform the multi-factor model.

Source: Refinitiv

In another key finding, the alternative data strategy delivered excess returns over the S&P benchmark of between 3% and 5.5% for long-short portfolios (compared to 2% and 2.5% for long-only).

Furthermore, when the portfolios were made up of 50% or more short positions, the sentiment-only strategy began to outperform both the benchmark and the multi-factor strategy.

In this case, the higher the short percentage, the higher the returns – and the more beneficial the sentiment-only strategy over the multi-factor model and benchmark.

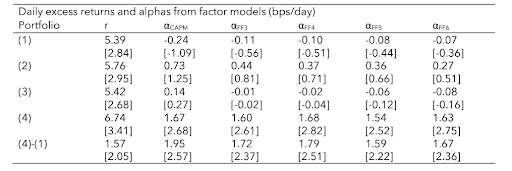

3) Forward-Looking Government Receivables Strategy

Government procurement data, while publicly available, is difficult to process by investors, but as a TenderAlpha study found, there is strong evidence that information about a firm’s receivables from US federal government contract awards can be used to predict its stock returns.

A variety of quantitative trading strategies has been backtested using federal government receivables as a data source. All of them have generated excess returns.

For example, utilizing the ‘unexpected government receivables’ (UGR) signal, a market-cap weighted version of a trading strategy that goes long in stocks that are in the highest tercile of UGR and short stocks with no government receivables, and equally weights stocks within the long and short portfolios, achieves alpha ranging from 5.4% to 7.1% per year depending on the factor model used.

Source: TenderAlpha

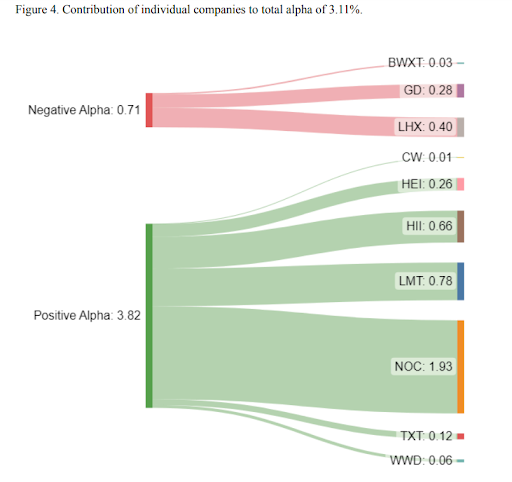

In 2024, TenderAlpha created a new case study on the topic, conducting two separate backtests involving:

- 10 prominent aerospace and defense government suppliers

- 13 large government contractors in the IT, Industrial, Construction, Healthcare, Insurance, and Services sectors

The first backtest compared the performance of ten US Defense and Aerospace stocks against the performance of the SPDR S&P Aerospace & Defense ETF (trading symbol XAR).

The results showed that over the January 2012 - September 2022 period, TenderAlpha’s strategy had produced 4,856 buy signals in the Aerospace & Defense sector, with an average alpha per trade of 3.11%.

Source: TenderAlpha

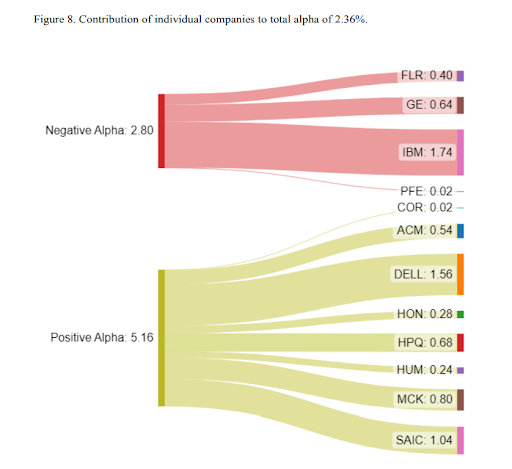

For the second backtest, the performance of 13 large government contractors operating in the IT, Industrial, Construction, Healthcare, Insurance, and Services sectors was compared against the performance of the SPDR S&P 500 ETF Trust (trading symbol SPY).

The strategy produced 5,836 buy signals among large government contractors, with an average alpha per trade of 2.36%.

Source: TenderAlpha

[Request TenderAlpha's alternative data for free testing HERE]

Concluding Remarks

There are a couple of considerations to take into account when discussing alternative data and how it can be leveraged to enhance your quant strategies.

First of all, in order to get the most out of it, it is important to combine different datasets so that you gain detailed knowledge and connect a variety of insights into a more complete overview of a business.

Secondly, you have to make sure that your alternative data is of the highest quality possible. Sometimes this could mean doing some data cleaning or normalization yourself to get accurate data. With TenderAlpha, however, there is no need to worry about the data validation processes as our public procurement data is cleaned, properly matched and mapped to ticker symbols for ease of use, guaranteeing that each record contains valuable information.

Finally, you need to remember that any alt data type that becomes popular quickly loses its outperformance advantage, therefore, there is a constant need of discovering new alt data sources to get back the competitive edge. That being said, you should be keeping an eye for new opportunities at all times.

At TenderAlpha, we provide dynamic, daily updates to our global public procurement database for investors to access the most recent and relevant information from verified alternative data sources. Looking to enhance your own quantitative strategies with our insights? Get in touch now!

This article was originally published in July 2022 and was updated in February 2024.