Alternative data has been labeled “the deepest, least utilized alpha source in the world today” by the NASDAQ platform for alternative data, Quandl. Unsurprisingly, then, in 2019 EY found that 70% of hedge fund managers and 56% of private equity funds currently use or plan on using alternative data to support their investment decisions.

However, an even more recent statistics reveal that 85% of market-leading hedge fund managers use two or more alternative data sets, while over 54% of the hedge fund managers use seven or more alternative data sets.

Another study by Greenwich Associates revealed that nearly 30% of quantitative funds attribute at least 20% of their alpha to alternative data. Furthermore, 42% of all asset managers reported they believed the alpha edge they achieved by using alternative data lasts for at least four years.

In parallel with the growing demand for alternative data, the number of providers of such data has also increased dramatically over the past decade or so, reaching the figure of 445 - a threefold increase since 2010 - as the graph from alternativedata.org shows.

In the following article, the TenderAlpha team aims to present an overview of the market for alternative data, discussing what exactly this type of data involves, who uses it, what its benefits are, and what prospects lie ahead of it.

What is Alternative Data?

Various definitions have been given as to what alternative data is. As the name suggests, this type of data differs from traditional data sources, i.e. from those that come directly from a company such as financial statements, SEC filings, press releases, and marketing presentations.

In contrast, alt data is gathered from external sources, which may include POS and credit card transactions, website usage, app usage, cell phone data, satellite images, social media posts, or online browsing activity, to mention but a few.

Leading names in the financial world have described alternative data as “data that draws from non-traditional data sources, and when analysed yields additional insights that complement information already available from traditional sources” (Krishna Nathan, CIO of S&P Global) and as “differing from conventional data sources like Bloomberg, by being far less easily accessible and structured” (Gene Ekster, CEO of AltDG).

In an attempt to put everything together, the Alternative Investment Management Association came up with the following definition: “alternative data comes from unconventional information, mostly in an unstructured form, is not broadly distributed within the industry and is being used to deliver both investment alpha and operational alpha” (AIMA, 2020).

Who Uses It?

Investment banks and hedge funds are among the largest consumers of alt data, as investors seek new data sources to enable faster insight for better decision-making.

In recent years, the fields of private equity, valuations, credit underwritings, and insurance have also begun to adopt alternative data in conjunction with traditional data. Major corporations like Google and Facebook are also exploiting alternative data and it is likely that smaller firms’ uptake will also grow, due to the fact that alternative data is gradually becoming easier to access, store, and analyze.

Alt Data Types & Categories

Broadly speaking, there are three main ways to generate alternative data:

- Individuals

- Businesses

- Sensors

Any action we perform on the Internet as individuals - be it a Google search or hitting the ‘like’ button of an Instagram post - creates alternative data. The challenging aspect here is that data generated by individuals is often hard to gather and analyze.

Then, businesses produce alt data that is also known as ‘exhaust data’, as it is usually a derivative of other business processes. It is characterized by the fact that it is generated by the business but gathered and disseminated by others. Examples could include credit card transactions and data from government agencies.

Finally, sensor-generated data is the capture of signals sent from one device to another. Such signals could be geolocation, satellite images, shipping data, or POS transactions.

Alternative Data Trends in 2024

The meteoric growth in the alternative data space has spurred alternative data providers to find the most efficient ways to accommodate customer needs. This can explain the rise of specialized alternative data providers, whose capabilities in collecting, cleaning and analyzing very specific types of data opens up niche opportunities in the market, whilst at the same time reduces the resources required from businesses to work with alternative data.

Secondly, technology is advancing to facilitate the processing of the ever-expanding volumes of data. Data providers who make the most of the emerging technologies in data analytics and machine learning are at the forefront of the alternative data market thanks to their ability to achieve higher quality and reliability with their products and services.

Market Size and Predictions

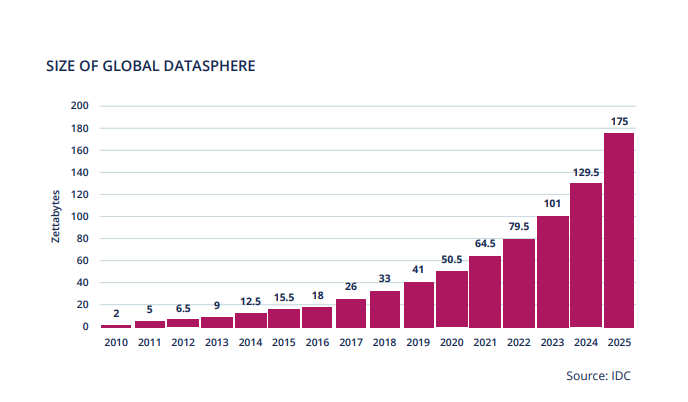

Datasphere as a whole has grown immensely over the past few years. The International Data Corporation (IDC) estimates that it will reach 175 zettabytes by 2025, a fourfold increase from 2019. Being an inextricable part of this universe, alternative data is also set to grow.

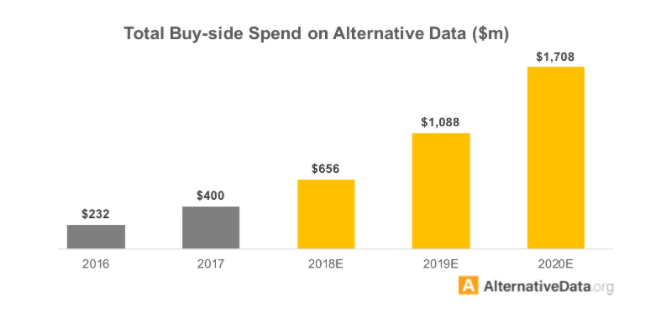

In fact, the figures for the estimated total buy-side spend on alternative data between 2016 and 2020 are a testament to the burgeoning interest in alt data on investors’ part. Whilst it was just USD 232 million that was spent on such data in the first year of the covered period, five years later, this figure was calculated to approximate USD 1.7 billion, or a 639% increase.

The global alternative data market size is expected to reach USD 11.1 billion by 2026, rising at a market growth of 44% CAGR during the forecast period, according to ResearchandMarkets.com.

However, as of early 2024, the alternative data market has already been valued at approximately USD 11bn, having expanded by USD 1.7bn in the space of just 12 months.

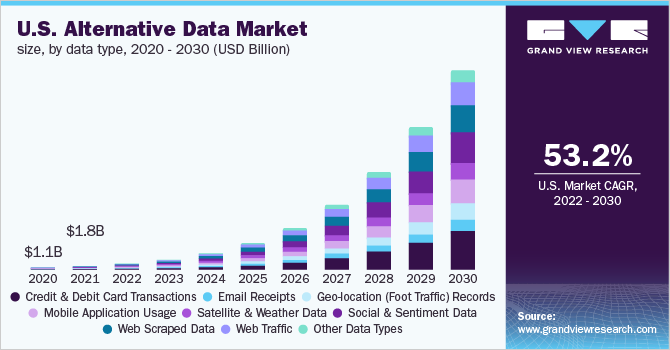

The segment related to the transactions with credit and debit cards is expected to show the highest CAGR from 2020 to 2026, particularly due to the high precision of the data type and the high demand from asset administrators.

Furthermore, the social and sentiment data and mobile application usage segments are estimated to witness a significant growth rate over the forecast period. The retail companies utilize smartphone usage data to analyze the user’s e-commerce application usage patterns.

The retailers are also increasingly using sentiment data from social media websites to understand user interests from various groups and regions. The geolocation data from satellite images are gaining popularity, too, as they can help analyze the customer store visits on particular times and days, thereby supporting the setting up of operational strategies for running the store.

A more recent report, prepared by Grand View Research, estimates that the global alternative data market size will reach USD 143.3bn by 2030, with the market expected to expand at a CAGR of 54.4% from 2022 to 2030.

North America dominated the market, accounting for a revenue share of more than 67% in 2021, and the region is expected to extend its dominance over the forecast period.

On the other hand, Asia Pacific is predicted to emerge as one of the fastest-growing regional markets. This is due to rising use cases of alternative data in BFSI, retail, automotive, and telecommunication industries. The use of alternative data for investments and risk assessment, particularly from companies in emerging economies, such as India and China, is also expected to boost the regional market growth.

The graph from Grand View Research below illustrates the forecast development of each alt data segment in the US up until 2030. As evident, credit and debit card transactions, social and sentiment data, and web scraped data will be the sources that will have the largest share at the end of the forecast period. Nevertheless, it transpires that there will be a balanced use of all data types and no particular alt data type will be dominant.

Reasons for Growth

The key drivers of market expansion include the significant increase in the types of alternative data sources over the last decade. Web scraping and financial transactions may remain the most common sources of alt data, but emerging sources like mobile devices, social media, satellites, sensors, IoT-enabled devices, and others, are gaining wider popularity.

Moreover, the rising demand for alternative data from hedge funds is expected to further boost market growth. In 2021 alone, the hedge fund operators segment dominated the market for alternative data and accounted for a revenue share of around 70%.

This segment is also expected to register a steady growth rate over the forecast period from 2022 to 2030 due to the increasing need for various sources to analyze the industries and find lucrative investment opportunities.

The Benefits of Alt Data

The real-time information alternative data can provide is one of the biggest advantages this type of data offers. Much of the traditional data sources consist of historical data. Inevitably, there is value in this data, but if you are looking to gain a competitive edge, the more up-to-date the data, the better.

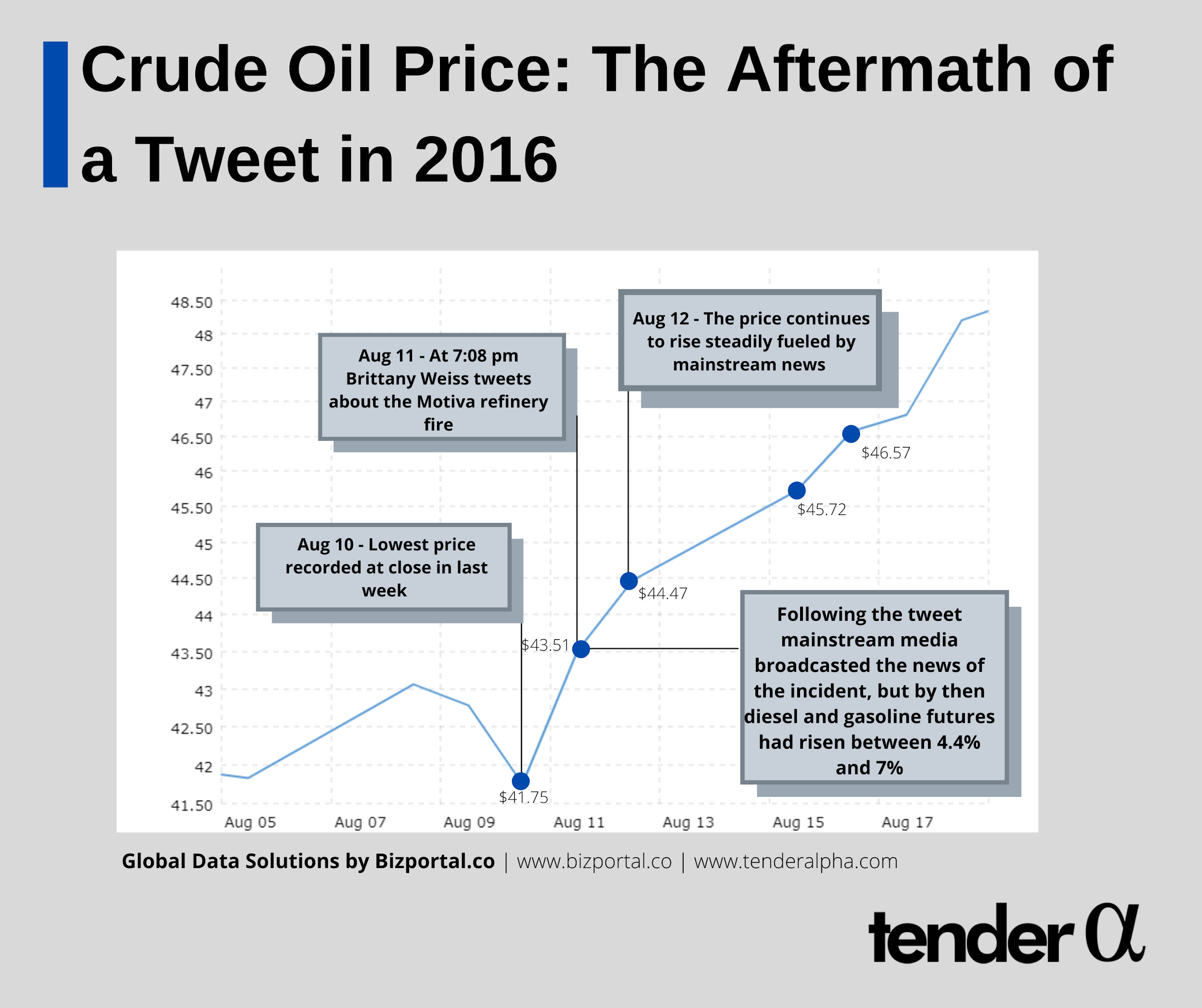

An example of this benefit is an event that took place on August 11, 2016. It was then that a fire at the Motiva oil refinery broke out. Reporter Brittany Weiss tweeted about the fire hours before mass media mentioned the news. Revealing such piece of information in a timely manner allowed institutional investors to profit as it led to a 4.8% gain in ultra-low sulfur diesel futures, a 4.4% rise in gasoline futures, and an increase of over 7% in the diesel crack spread (Oracle, 2019).

Another major advantage for alt data users is that they can make the most of their vendors’ capabilities to provide specific insights, thus saving them time and money. Instead of having to go through all the data all by themselves, the investors may focus only on the areas that are of interest to them and that have the potential to bring them fresh profit.

Closely associated with the previous point, alternative data can also be a source of new investment ideas. The insights that can be gleaned from analyzing the data may expand the horizon ahead of traders by revealing lucrative opportunities that would have taken much longer to discover should slower, more traditional data sources have been used.

Conclusion

The unprecedented digitization of the economy in recent years has led to the production of enormous amounts of data that can be tapped into by investors and asset managers. The numbers back this claim - 90% of the world’s data today has only been produced in the last two years. The staggering pace at which data is being generated highlights the diverse opportunities opening up before investors.

It remains to be seen, though, how they will channel their efforts, so that they can make the most of this data. Alt data is usually unstructured and often volatile, meaning that much work and care need to be put into utilizing it in the most efficient manner.

It is a game of small margins in the market and every little advantage has to be used. Therefore, traders and investors are eager to find and utilize only the most reliable data sources, which, alas, are not necessarily easy to discover and structure.

TenderAlpha.com operates the world’s largest database of government contracts data, containing information about government tenders from more than 100 countries from the last 14+ years. The platform gathers its data only from official government sources, which verifies its accuracy and trustworthiness. To find out more about how TenderAlpha works, request a demo now.