It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

In Part 17 of our blog series, we will present you the latest results of Honeywell.

Key points:

* Revenue grew 6.1% Y/Y in Q4 and 3.1% in 2022. 2.9% increase expected in 2023, with all divisions except Safety and Productivity solutions contributing;

* Adjusted EPS of $8.76/share in 2022, up 9% Y/Y. 2.7% growth expected in 2023, dragged down by pension expenses;

* $4.9 billion in free cash flow in 2022, down 14% Y/Y. 16.3% decrease anticipated in 2023, impacted by asbestos settlements;

* 6.8% Y/Y growth in total backlog to $29.6 billion. Aerospace segment top contributor;

* 9.7% of all sales to U.S. government in 2022, primarily through Aerospace.

Honeywell Q4 2022 Results Overview

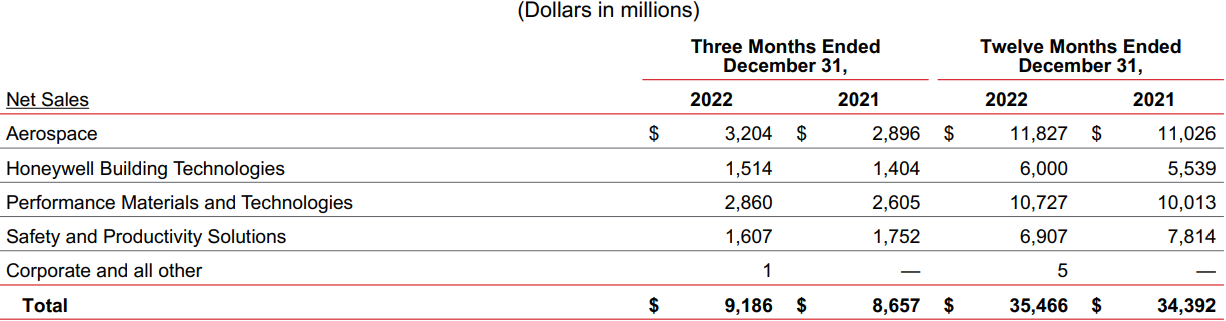

Honeywell reports results in four main segments, namely Aerospace at 34.9% of Q4 2022 revenues, Honeywell Building Technologies at 16.5% of Q4 2022 revenues, Performance Materials and Technologies at 31.1% of Q4 2022 revenues and Safety and Productivity Solutions at 17.5% of Q4 2022 revenues:

Figure 1: Q4 2022 Honeywell segment revenues

Source: Honeywell Q4 2022 Earnings Release

Honeywell Operational Overview

Aerospace delivered the strongest performance in the quarter, with revenue up 10.6% Y/Y in Q4, ahead of the 7.3% increase in 2022. The robust performance was due to strength in Commercial Aviation (revenue up 23% Y/Y in Q4) while Defense & Space was down 3% Y/Y.

Honeywell Building Technologies (HBT) saw sales jump 7.8% Y/Y in Q4, below the 8.3% increase for the full year.

Performance Materials and Technologies (PMT) recorded a 9.8% Y/Y revenue increase in Q4, an acceleration to the 7.1% growth in 2022.

Safety and Productivity Solutions (SPS) was the only segment to register a Y/Y sales decline in the quarter (-8.3% Y/Y), a slight improvement to the 11.6% drop for the full year. The silver lining is that segment margins improved materially Y/Y in Q4 (+9.4%).

On a consolidated basis, revenue grew 6.1% Y/Y in Q4 and 3.1% in 2022. Adjusted EPS was $2.52/share in Q4 (+21% Y/Y) and $8.76/share in 2022 (+9% Y/Y). Free cash flow was $2.1 billion in Q4 (-18% Y/Y) and $4.9 billion for the full year (-14%). The segment margin improved both in Q4 (+1.5% to 22.9%) and for the full year (+0.7% to 21.7%).

2023 Outlook

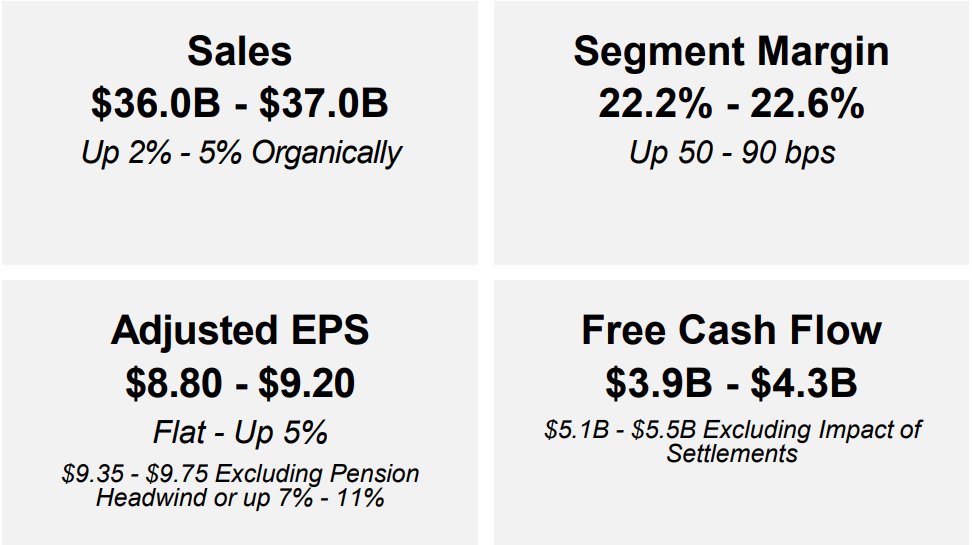

Honeywell envisages further underlying operating improvement, with sales (+2.9% Y/Y) and margins (+0.7% Y/Y) building on progress achieved in 2022:

Figure 2: Honeywell 2023 Outlook

Source: Honeywell Q4 2022 Earnings Presentation

Adjusted EPS is still expected to increase by about 2.7%, albeit growth will be impacted by pensions expenses.

Free cash flow will take a hit from a $1.2 billion net payment for legacy asbestos liabilities settlement. Thus, free cash flow is expected to decrease by about 16.3% to $3.9-4.3 billion.

Looking at segment performance, 2023 will see a clear continuation of trends observed in 2022. Sales growth will continue to come from Aerospace, HBT and PMT. On the other hand, the SPS segment will continue to underperform, as highlighted on the conference call:

Turning to Safety and Productivity Solutions. That will be the business most impacted by the macroeconomic environment in 2023. Decreased investment in new warehouse capacity will continue to limit near-term opportunities in our long-cycle projects business with the trough and demand likely coming this year before returning to growth in 2024.

In total, we expect SPS sales to be down mid to high single digits for the year.

From a timing perspective, Q1 is expected to be marginally weaker than the full year average, with growth in sales, margins and Adjusted EPS below the 2023 targets.

Backlog

Honeywell ended the year with a record backlog of $29.6 billion, up 6.8% Y/Y. Growth was driven primarily by Aerospace (up 20% Y/Y) and PMT. Supply chain constraints (primarily in semiconductors) have started to ease but remain an issue. They will still be visible in Q1 but are expected to improve as 2023 progresses.

Capital Structure

Honeywell's net debt position at the end of 2022 was about $6.8 billion, very conservative against its $123 billion market capitalization. On the one hand, it will deteriorate in Q1 due to asbestos settlement payments before improving later in the year as free cash flow is delivered organically. On the other hand, the increased visibility arising from the asbestos settlement will allow the company to deploy capital more efficiently.

CEO Darius Adamczyk highlighted 2022 capital use on the conference call:

Capital deployment for 2022 was $7.9 billion in total, in addition to the $4.2 billion in share repurchases, which lowered our weighted average share count by 2.5%. We deployed $800 million to high-return capital expenditures and $200 million on closing the acquisition of US Digital Designs.

Finally, we maintained our dividend growth policy, paying out $2.7 billion and raising our dividend for the 13th time in 12 years.

The US Digital Designs acquisition was finalized on January 18, 2022 and is now part of the HBT segment.

Conclusion

Just as the foreign exchange headwind on sales is set to fade into 2023 (in 2022, organic sales growth was 6% versus the 3% reported in USD), new temporary challenges emerge for Honeywell in the form of asbestos legacy payments and elevated pension expenses. Nevertheless, the company continues to show business improvement, both in terms of revenue growth and margin expansion, which will fully materialize in 2024 and beyond.

Honeywell plans to hold an investor day on May 11 to discuss its strategy and longer-term targets.

Honeywell's government business is primarily conducted through the Aerospace segment. Therefore, monitoring the company’s public procurement activity remains a smart move that can provide key insights into Honeywell’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Honeywell or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.