Key Points:

* Amazon Web Services (AWS) accounted for 74% of Amazon's operating income in the first three quarters of 2023;

* The AWS segment has grown its government receivables significantly in recent years, with over $61m yet to be received under ten contracts it has been awarded in Q3 2023;

* In December 2023 AWS received a government contract from UK’s Home Office valued at £450m ($568.64m).

Amazon’s Q3 2023 Overview

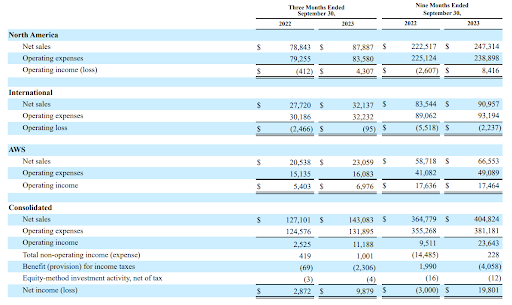

Amazon reports results in three main segments, namely North America at 61.4% of Q3 2023 net sales, International at 22.4% of Q3 2023 net sales and AWS at 16.1% of Q3 2023 net sales.

Figure 1: Amazon Net Sales Breakdown Q3 2023

Source: Amazon Form 10-Q for Q3 2023

In this article we will focus on the AWS segment. Although it accounts for the smallest total net sales amount, it has grown 12.3% Y/Y. It has also increased its share among the Amazon segments as a whole, having stood at 14.5% of Q3 2022 net sales.

Amazon’s Government Business Increase

Amazon's main exposure to government contracting is through AWS.

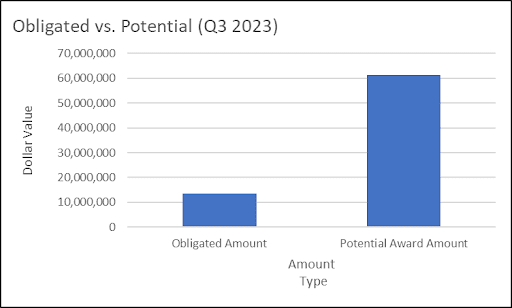

At the time of writing (January 2024), AWS has yet to receive $61.3m of payments under ten government contracts it has been awarded solely during Q3 of 2023 (between 1 July and 1 October 2023).

So far, AWS has received around $13.5m or only 18% of the total potential award amount for the entire duration of its awarded government contracts.

The remaining payments are yet to be made over different time periods that could reach up to five years.

The data has been retrieved from TenderAlpha’s Forward-Looking Receivables Data Feed, which shows the government receivables up for obligation by over 3000 ticker-mapped publicly-listed government suppliers from the US federal government.

Figure 2. AWS Outstanding Forward-looking Receivables Under Government Contracts Awarded in Q3 2023

Source: TenderAlpha.com

Later on, we will mention some of the heftiest federal government awards AWS has won in the past couple of years. We will also take a look at the latest major contracts the service provider secured with the UK Government.

It is safe to say that the amount of government contracts and the overall AWS sales should only grow in future years as AWS is the biggest player in the cloud services space, at around 32%, followed by Mircosoft's Azure at circa 23% and Google Cloud with 11% (data from Synergy Research Group as of Q3 2023).

Examples of Recent Government Contract Awards Won by Amazon

Major US Federal Government Contracts

On 7 December 2022 The Pentagon selected four providers to fulfill a cloud-computing contract for the U.S. Department of Defense’s (DoD) Joint Warfighting Cloud Capability (JWCC).

Amazon, alongside Google, Oracle, and Microsoft were tasked with the delivery of a contract that can reach as high as $9 billion in total through 2028.

December 2022 also saw AWS win the U.S. Navy’s Commercial Cloud Environment contract valued at $724 million that will run until 2028.

Success in UK Government Contracting

Amazon also signed three 36-month contracts with three different UK government departments on the same day (1 December) at the end of 2023.

The largest of the three, worth £450m involves the provision of AWS public cloud hosting services to the Home Office.

Then, there is a £350m contract with HM Revenue and Customs and another worth £94m with the Department for Work and Pensions (DWP).

The three contracts are all part of the UK Government’s G-Cloud procurement framework. Their total value of £894m is higher than the £757.7m AWS has made from government contracts in the previous ten-plus years of participation in G-Cloud.

This is another signal that Amazon can benefit greatly from doing business with the government, as the period coincides with the growth in the cloud services space market.

Final Remarks

Given the growing significance of AWS for Amazon's bottom line and operating income and the company’s recent increase in government business, monitoring public procurement becomes a valuable move that can give an advantage when predicting the segment's future performance.

In TenderAlpha's 'Government Receivables as a Stock Market Signal' white paper we propose that government contract awards can also have a positive impact on the awardees’ stock prices. We posit that information about government contracts awards is not immediately incorporated into stock prices and can be used to construct trading signals to purchase shares of major suppliers to the US government.

If you want to know all about the government receivables the largest federal contractors ought to receive, get in touch now!

This article was originally published in November 2022 and was updated in January 2024.

It was written by members of TenderAlpha's team and does not serve as a recommendation to buy Amazon or any other stock mentioned in the article.