It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

In Part 15 of our blog series, we will present you the latest results of Humana.

Key points:

* 82% of Humana's total premiums and services revenue in 2022 were derived from contracts with the federal government;

* 6.6% Y/Y revenue growth in Q4 and 11.8% Y/Y for 2022. 11.7% increase expected for 2023;

* Adjusted EPS up 30.6% Y/Y in Q4 and 22.3% for 2022. 10.9% growth anticipated for 2023;

* Operating cash flow of $4.6 billion in 2022 and $4.5 billion expected for 2023. Capex seen at $1.2 billion;

* Some $2 billion in surplus capital at year-end, with a debt-to-total capitalization ratio of 42%. 96% of investment portfolio ranked investment grade.

Humana Q4 2022 Results Overview

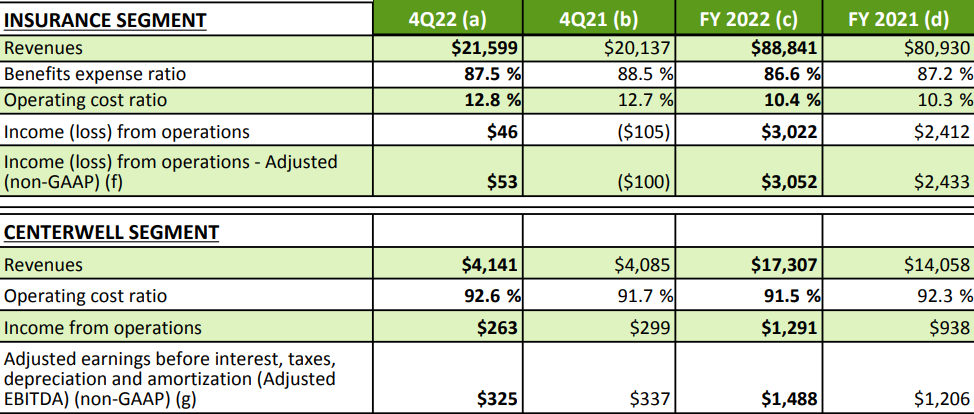

In December 2022 Humana realigned its businesses in two distinct segments, Insurance at 83.9% of Q4 revenues (comprised of products serving Medicare and state-based contract beneficiaries sold on a retail basis to individuals including medical and supplemental benefit plans, as well as group commercial insurance) and CenterWell at 16.1% of Q4 revenues (incorporates payor-agnostic healthcare services offerings, including pharmacy dispensing services, provider services, and home services):

Figure 1: Q4 2022 Humana segment revenues

Source: Humana Q4 2022 Results Release

It should be noted that due to inter-company eliminations, consolidated reported revenues were $22.44 billion in Q4 and $92.87 billion in 2022.

Operational Overview

Insurance grew revenues 7.3% Y/Y in Q4, below the 9.8% Y/Y increase in the full year. The benefits expense ratio (which shows insurance benefits paid in relation to insurance premiums received, i.e. lower is better) stood at 87.5% in Q4, an improvement to the 88.5% in Q4 '21 but a deterioration to the 86.6% in 2022.

CenterWell eked out 1.4% Y/Y sales growth in Q4, materially below the 23.1% increase in fiscal 2022. The operating cost ratio of 92.6% (same logic as benefits expense ratio above) deteriorated both Y/Y and relative to 2022 (91.5%).

On a consolidated basis, revenues increased 6.6% Y/Y in Q4, below the 11.8% Y/Y growth rate in 2022. Adjusted EPS was $1.62/share in Q4, up 30.6% Y/Y, and $25.24/share in 2022, up 22.3% Y/Y. The benefits expense ratio was 87.3% in Q4, better Y/Y but worse than the 86.3% in 2022. Operating cash flows were negative at $5.1 billion in Q4 but positive in 2022 at $4.6 billion.

Humana 2023 Outlook

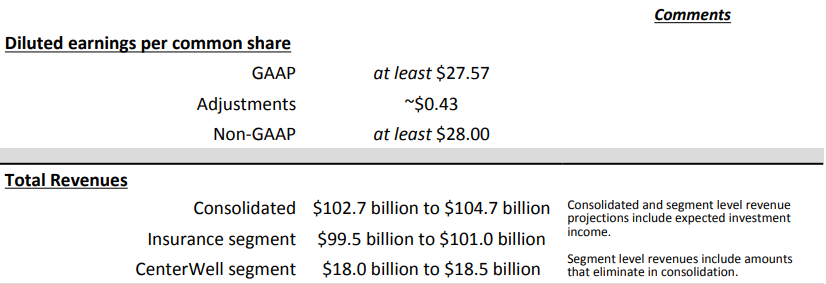

Humana expects further top-line and bottom-line growth – consolidated revenues are expected to reach about $103.7 billion, up 11.7% Y/Y, while Adjusted EPS is seen at or above $28/share, up 10.9% Y/Y:

Figure 2: Humana 2023 Outlook

Source: Humana Q4 2022 Results Release

The company highlighted on the conference call that the EPS guidance overcomes a $0.92/share hit (or 3.6%) from the divestiture of a 60% interest in Kindred Hospice in August 2022. Humana retains a 40% minority interest.

The benefits expense ratio is seen at about 86.8%, a deteriorated relative to the 86.3% in 2022.

Cash flows from operations is estimated at $4.5 billion (flat Y/Y) and capex at $1.2 billion (2022 $1.1 billion).

From a segment perspective, Insurance is seen growing at 12.8% while CenterWell should deliver 5.5% of sales growth.

Capital deployment in 2023 will focus on organic growth, as well as opportunistic M&A to grow the CenterWell business (particularly in Primary Care and home businesses).

Capital Position

As disclosed in the annual report for 2022, Humana has some $2-2.9 billion in excess capital at the end of the year:

“Our state regulated insurance subsidiaries had aggregate statutory capital and surplus of approximately $11.3 billion and $9.6 billion as of December 31, 2022 and 2021, respectively, which exceeded aggregate minimum regulatory requirements of $8.4 billion and $7.6 billion, respectively. The amount of ordinary dividends that may be paid to our parent company in 2023 is approximately $1.8 billion in the aggregate.”

The debt-to-total capitalization ratio (which measures what percentage of the balance sheet is funded by debt as opposed to equity) improved to 42% from 43.7% in the prior year, although on a quarterly basis it deteriorated as a result of share buybacks. Overall, the company spent $2 billion on buybacks in 2022.

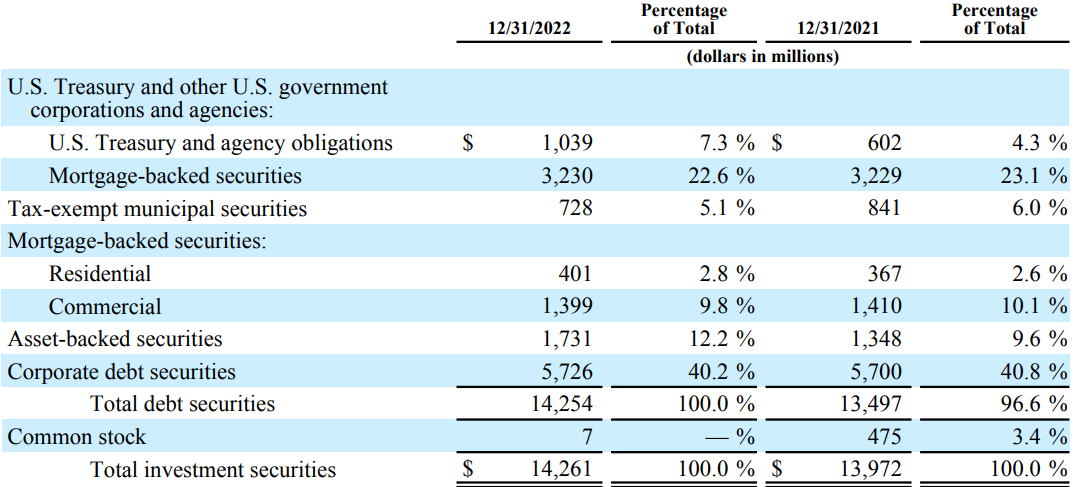

Humana Investment Portfolio

At the end of 2022, 96% of Humana's investment securities portfolio was investment-grade, with a weighted average credit rating of AA- by S&P:

Figure 3: Humana Investment Portfolio Composition

Source: Humana 2022 Annual Report

As discussed on the conference call, higher rates are a net benefit for the company:

"Touching now on investment income and interest expense. We anticipate investment income will increase approximately $450 million in 2023, resulting from the higher interest rate environment, coupled with the impact of approximately $100 million in realized losses experienced in 2022 that are not expected to recur. From an interest expense perspective, while the majority of our debt is fixed rate, we do expect interest expense to increase approximately $110 million year-over-year."

Conclusion

Humana is enjoying strong market tailwinds which allow it to target double-digit revenue and EPS growth in 2023. This puts the company on a strong footing to reach its 2025 aspiration of $37/share in Adjusted EPS.

Humana pins its strategy in growing the Medicare Advantage market while selectively losing customers in other segments deemed low margin or lacking sufficient scale.

In light of the fact that 82% of Humana's total premiums and services revenue in 2022 were derived from contracts with the federal government, monitoring Humana’s public procurement activity remains a smart move that can provide key insights into the company’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Humana or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.