Key points:

- In 2021, the U.S. Government (70%) and foreign government buyers (10%) accounted for 80% of General Dynamics consolidated sales;

- With a backlog of $88.8 billion and a revenue run-rate of about $40 billion, coupled with strong free cash flow generation and low-debt capital structure, General Dynamics is a conservative but growing investment opportunity;

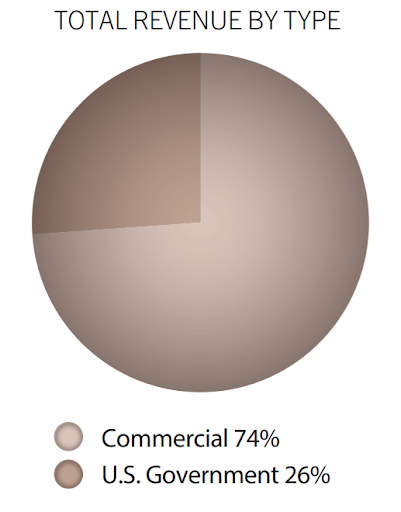

- Commercial buyers accounted for 76.7% of Textron's 2022 YTD sales, while the U.S. Government purchased the remaining 23.3%;

- Government business is set to grow following the award of a contract to build a new long-range attack helicopter to Bell Textron.

General Dynamics (NYSE: GD)

Importance of Government Contracting for General Dynamics

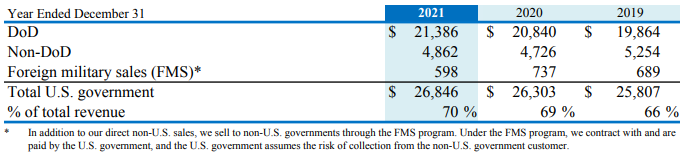

General Dynamics is a vital supplier to defense departments across the world. As per the 2021 annual report, 70% of the company's consolidated revenue was from the U.S. government and 10% was from foreign government customers. The remaining 20% were commercial customers, split 12% for U.S. commercial customers and 8% for foreign buyers. The share of the U.S. government has increased by 4% since 2019:

Figure 1: General Dynamics Evolution of U.S. Government sales 2019-2021

Source: General Dynamics Form 10-K for 2021

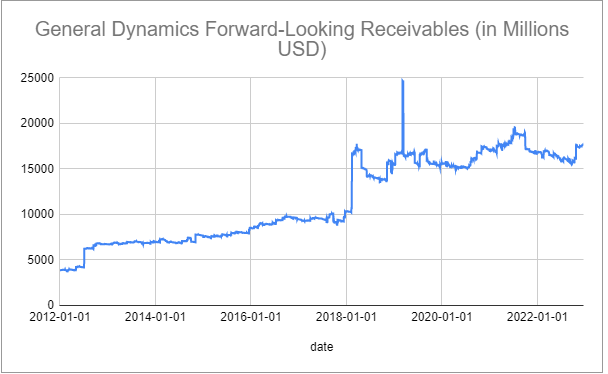

This is also evident from the data on forward-looking receivables from Tender Alpha:

Figure 2: Evolution of forward-looking receivables for General Dynamics, 2012-2022

Source: Tender Alpha

General Dynamics Q3 2022 Financial Results

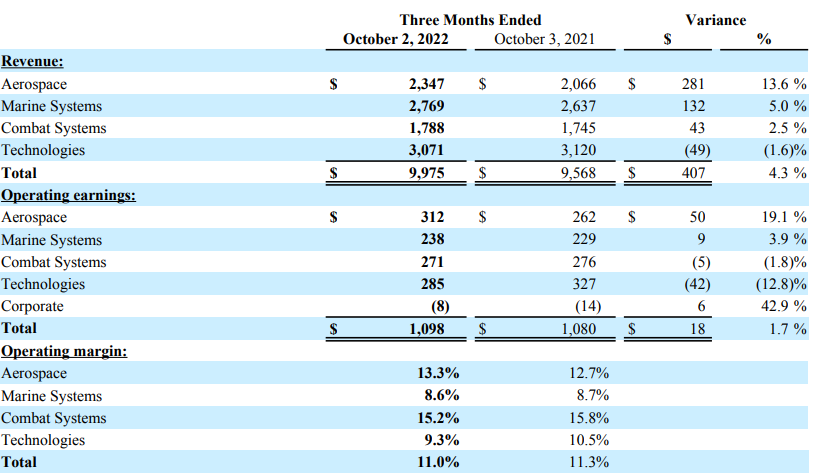

General Dynamics reports results in four main segments, namely Aerospace at 23.5% of Q3 2022 revenues, Marine Systems at 27.8%, Combat Systems at 17.9%, and Technologies at 30.8%:

Figure 3: General Dynamics Q3 Results by Segment

Source: General Dynamics Q3 Earnings Release

Quarterly revenue was up 4.3% Y/Y to nearly $10 billion, driven by the Aerospace segment which marked its best YTD performance in over a decade.

The operating margin declined by 0.3% to 11% due to weakness at the Technologies segment, which was the only one to record a Y/Y revenue decline of 1.6%, hampered by supply chain issues:

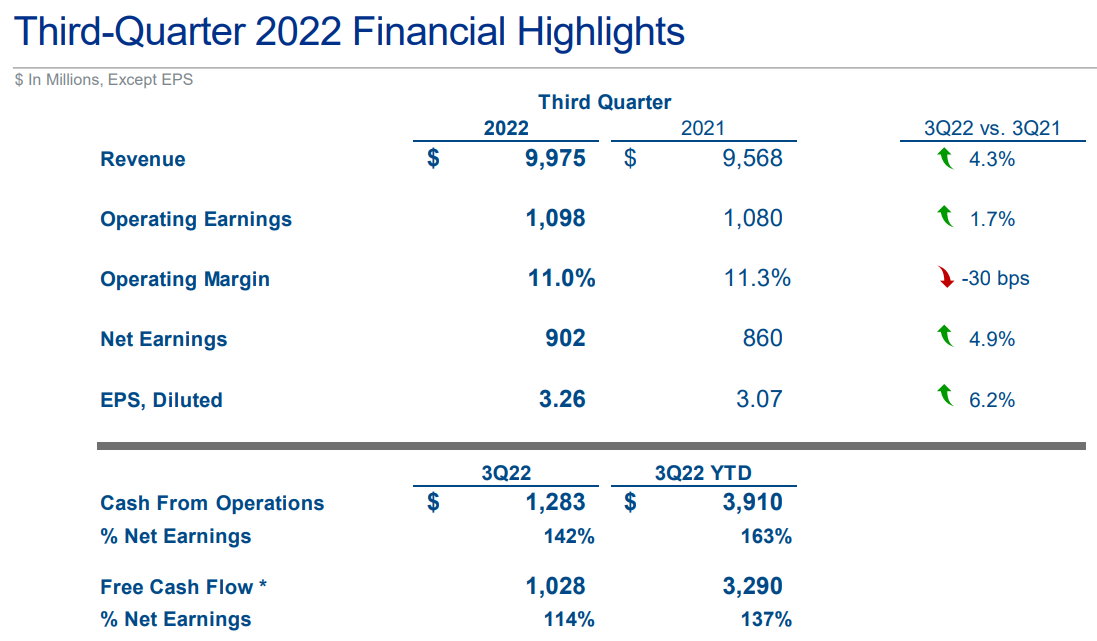

Figure 4: General Dynamics Q3 Results Overview

Source: General Dynamics Q3 Results Presentation

The company continued to generate strong free cash flow, at 114% of net earnings in Q3, and is on track to deliver a free cash flow conversion at or above 100% of net income for 2022, despite no action from legislators on the treatment of research & development expenses. Perhaps the current treatment of R&D expenses, namely to capitalize and depreciate them over time, will change in 2023 in favor of outright expensing.

The backlog was $88.8 billion, up 1.4% versus the 2021 year-end value of $87.6 billion. Total potential contract value, including options and indefinite delivery, indefinite quantity (IDIQ) contracts was $125.8 billion – more than three times the annual sales run-rate.

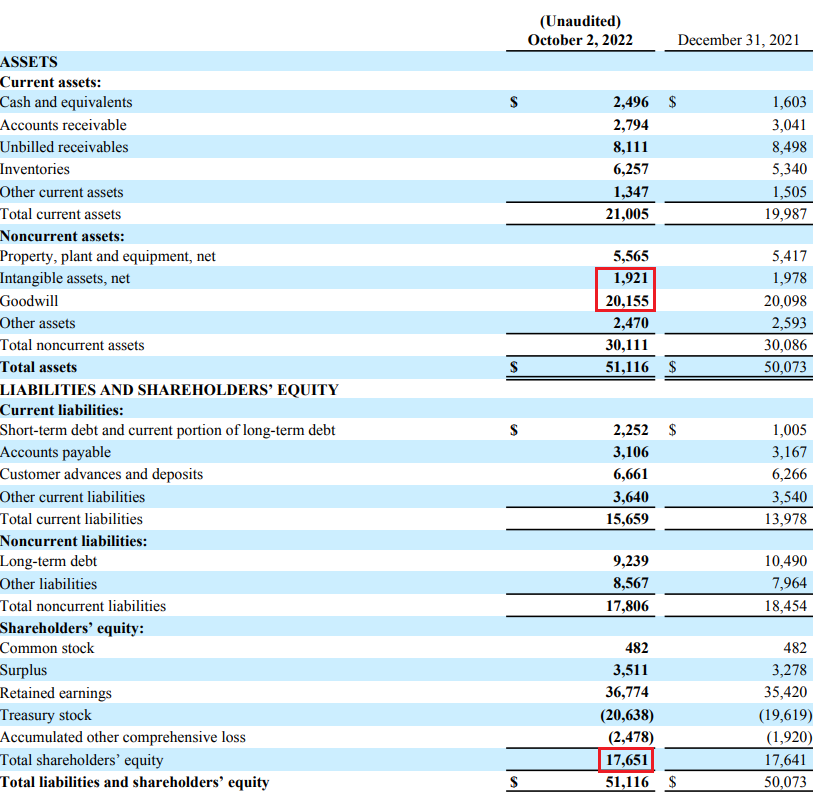

The capital structure is fairly conservative, with a market capitalization of around $67.5 billion and $9 billion in net debt. Management expects to pay down $1 billion in debt in Q4 and then evaluate 2023 maturities. The company has $22 billion of goodwill and intangibles on the books, above the $17.7 billion in shareholders' equity.

Figure 5: General Dynamics Q3 Consolidated Balance Sheet

Source: General Dynamics Q3 Earnings Release

Given the balance sheet structure, it is appropriate to value the company on free cash flow basis. With about $4 billion in free cash flow expected for 2022 (General Dynamics expects a slight pickup in capital expenditure in Q4 to its long-term target of 2.5% capex of sales), the current free cash flow yield is a very healthy 5.9%.

Textron (NYSE: TXT)

Importance of government contracting for Textron

Among defense manufacturers, Textron has a relatively large commercial exposure, with 74% of 2021 sales coming from business customers, and 26% U.S. government exposure:

Figure 6: Textron 2021 customer mix

Source: Textron 2021 Annual Report

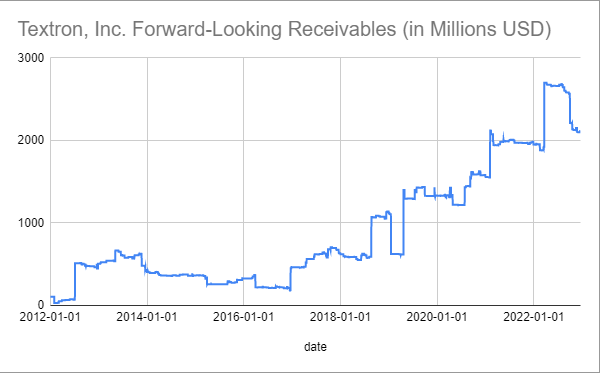

On a YTD basis in 2022, the U.S. Government accounted for 23.3% of sales. Overall, though, government business has been increasing in the last decade, as evident from TenderAlpha’s forward-looking government receivables data:

Figure 7: Evolution of forward-looking receivables for Textron, 2012-2022

Source: Tender Alpha

In confirmation of the above, in December 2022, the U.S. Army awarded Bell Textron the development contract for the new long-range attack BELL V-280 VALOR helicopter which will replace the iconic Black Hawk.

Textron Q3 2022 Financial Results

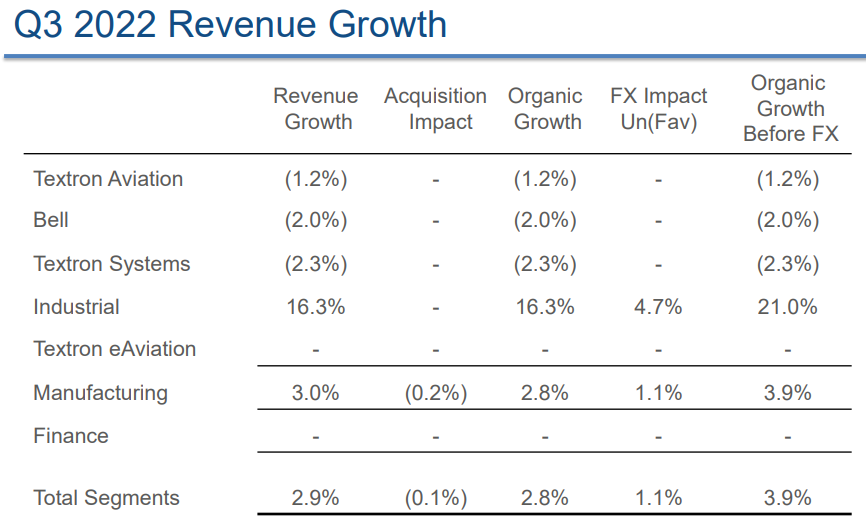

Textron reports results in four main manufacturing segments, namely Textron Aviation at 37.9% of Q3 2022 revenues, Industrial at 27.6% of Q3 2022 revenues, Bell at 24.5% of Q3 2022 revenues and Textron Systems at 9.5% of Q3 2022 revenues.

Figure 8: Q3 2022 Textron revenue developments by segment

Source: Textron Q3 2022 Results Presentation

Revenue was up 2.9% Y/Y driven by strength at the Industrial segment, with strong demand for Kautex (a lightweight, customizable battery housing solution). The other segments recorded negative Y/Y revenue growth, mainly on the back of supply chain issues. Case in point, on a YTD basis, the backlog is up 30.5% across the company.

Aside from the manufacturing operations (the four main segments above, the so called “Manufacturing Group”), Textron has a subsidiary providing financial services (“Textron Financial Corporation” helps finance aircraft and Bell helicopters).

Although negligible from a revenue and earnings contribution perspective, it holds a sizable portion of Textron's net debt – 18.6% of the company's $1.68 billion net debt. Overall, though, the capital structure is fairly conservative, with a market capitalization of about $14.8 billion. Shareholders' equity was $6.8 billion and included $2.26 billion of goodwill.

As with General Dynamics, a valuation based on free cash flow is most appropriate. Textron boosted its 2022 manufacturing free cash flow before pension contributions target to a new range of $1.1-1.2 billion, up $0.3 billion from the previous guidance. Pension contributions are seen at about $50 million, in line with 2020 & 2021. Capital expenditures are seen flat relative to 2021, at $375 million.

Taking the midpoint of the free cash flow guidance ($1.15 billion) and subtracting pension contributions ($50 million), the free cash flow yield amounts to 7.4%, well above General Dynamics.

Naturally, manufacturing free cash flow has been very volatile in recent years, ranging from $0.6 billion in 2020 to $1.15 billion in 2021. Even if cash flow conversion is not as robust next year (GAAP earnings are seen at about $0.83 billion for 2022), Textron should still meet its aspiration to be able to repurchase about 5% of its shares annually.

General Dynamics vs. Textron Comparison

It is fair to say that both General Dynamics and Textron experienced exceptional net income to free cash flow conversion in 2022.

The capital structure will be almost identical following the repayment of the $1 billion in debt at General Dynamics.

The backlog is also very substantial for Textron, albeit bigger at General Dynamics given its heavier reliance on government orders (80% vs 26% at Textron in 2021).

Thus, we think that, although quite similar from a valuation perspective, General Dynamics is the safer bet as far as a recessionary environment is concerned, considering its greater reliance on government contracting.

Textron offers a slightly higher free cash flow yield but may be hit harder in a commercial downturn, although the substantial order backlog should limit any near-term impact. The company will also grow its government business going forward following the attack helicopter contract award mentioned above.

Key Takeaways

Government purchases are set to increase given the need to replenish stocks sent to Ukraine. Considering the already sizable backlog at General Dynamics, the company will need to coordinate order priorities with defense departments.

At the same time, there are indications that Textron will also see a boost to its government business in the long term.

Monitoring public procurement activity remains a smart, yet lesser-known move that can give an advantage when assessing the financial health of a company. Companies that win government contracts are known to be more stable in uncertain times and – as examined in TenderAlpha's Government Receivables as a Stock Market Signal white paper – their stock price can go up as a result of success in public procurement.

Want to verify this statement yourself? Contact us now to test our government contracts data!