It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

In Part 11 of our new blog series, we will present you the latest results of L3Harris Technologies.

Key points:

* 5.2% Y/Y revenue growth in Q4; 4.2% decrease in 2022. 2.9% increase seen in 2023 driven by the Communication Systems segment, boosted by the Tactical Data Link acquisition;

* Aerojet Rocketdyne purchase expected to close in 2023;

* 5% backlog growth in 2022. 30% increase expected in 2023 post Aerojet Rocketdyne closing;

* Net debt of $6.2 set to double post acquisitions unless share buybacks scaled down;

* 2 billion in free cash flow in 2022; over 2 billion expected for 2023 as well.

L3Harris Technologies Q4 2022 Results Overview

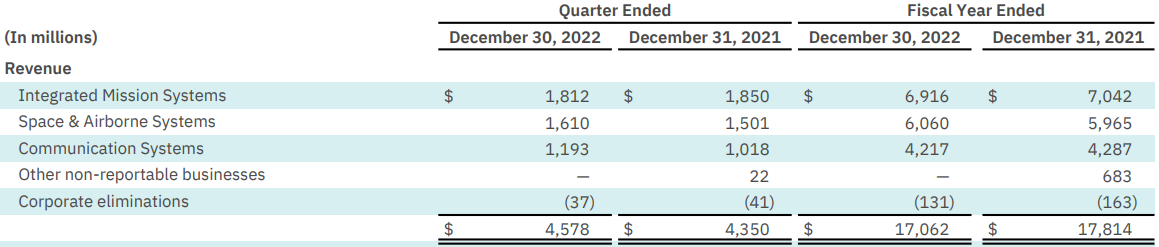

L3Harris Technologies reports results in three main segments, namely Integrated Mission Systems (IMS) at 39.6% of Q4 2022 revenue, Space & Airborne Systems (SAS) at 35.2% of Q4 2022 revenue and Communication Systems (CS) at 26.1% of Q4 2022 revenue:

Figure 1: Q4 2022 L3Harris segment revenues

Source: L3Harris Q4 2022 Form 8-K

Operational Overview

Integrated Mission Systems was the only segment to register a revenue decline in both Q4 (-2.1%) and the full year (-1.8%). The Q4 operating margin was 9.8% in Q4 and 6.1% in 2022. The full year results were impacted by goodwill impairments in Q3.

Space & Airborne Systems delivered sales growth of 7.3% in Q4, ahead of the 1.6% increase achieved for 2022. The Q4 operating margin was 12.2%, in line with the 12.1% achieved in the full year.

Communication Systems was the top performer in the quarter, with sales up 17.2%. However, this was insufficient to compensate weakness early in the year, with revenues down 1.6% for 2022. The operating margin was 24.9% in Q4, ahead of the 15.8% for 2022, with a Q3 goodwill impairment again weighing on full year results.

On a consolidated basis, revenues were up 5.2% in Q4 but down 4.2% in 2022. The segment operating margin was 14.6% in Q4 and 15.4% for 2022. Adjusted EPS was $3.27/share in Q4 and $12.9 for the full year. Free cash flow was $0.7 billion in Q4 and 2 billion in 2022.

Acquisitions

On January 3, L3Harris closed on a $2 billion debt-funded acquisition of Tactical Data Link which should boost Communications segment revenues by about $400 million, or 9.5%. The operating margin was 20%+.

L3Harris is also moving ahead with its $4.7 billion acquisition of Aerojet Rocketdyne, with closing still expected in 2023. The company ended 2022 with sales of $2.2 billion, up 2.3% from 2021. The segment margin was 11.3%. The transaction is expected to be non-GAAP EPS accretive in year one, and free cash flow positive in year two.

L3Harris Technologies 2023 Outlook

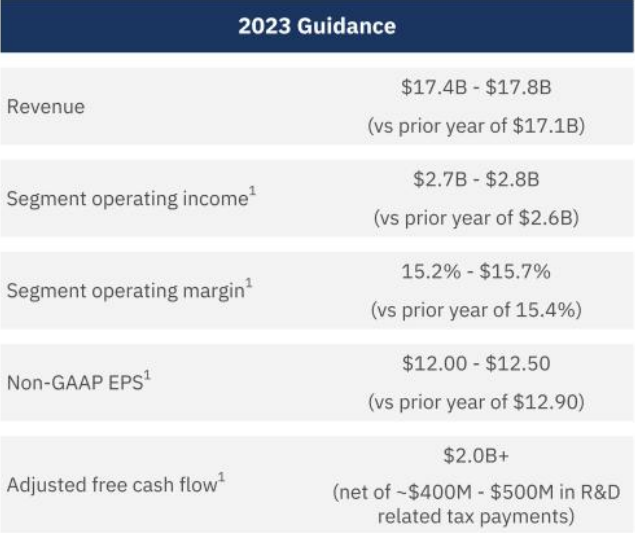

Following strong operating momentum in Q4, L3Harris expects further improvement in 2023:

Figure 2: L3Harris 2023 Outlook

Source: L3Harris Q4 2022 Form 8-K

Revenues are seen up 2.9% Y/Y, driven primarily by CS (boosted by the Tactical Data Link acquisition), while IMS & SAS are seen stagnating. Segment operating margin is seen largely flat in 2023, despite greater contribution from the high-margin Communications Systems segment. Free cash flow is seen at above $2 billion. Non-GAAP EPS is expected to decline 5% to about $12.25/share.

Overall, the company expects a slightly stronger H2 compared to H1 in 2023.

Backlog

The book-to-bill ratio was 1.00 in Q4 and 1.08 for 2022. The total backlog expanded 5% in 2022 to end at about $22.2 billion and is set to increase by over 30% to nearly $30 billion following the Aerojet Rocketdyne acquisition.

Capital Structure

The company ended 2022 with a net debt of $6.2 billion. With a market capitalization of $40.4 billion the capital structure is conservative, especially in light of strong free cash flow generation. However, the Tactical Data Link and Aerojet Rocketdyne acquisitions are set to double the net debt position, unless L3Harris prioritizes debt repayments.

In 2022 the company spent $864 million on dividends and $1.1 billion on share buybacks.

Conclusion

2023 is set to be a year of inorganic growth for L3Harris. Free cash flow generation is set to remain subdued this year, impacted by tax payments, acquisition costs, higher interest expenses and inflation headwinds. Looking further ahead, the company is set to realize operational synergies from the executed M&A transactions. This should allow L3Harris to deliver strong growth in the years to come.

Following the Aerojet Rocketdyne purchase the company is expected to organize an investor day and outline its plans for the combined entity.

In light of L3Harris’ long-standing success in government contracting, monitoring its public procurement activity remains a smart move that can provide key insights into the company’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy L3Harris Technologies or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.