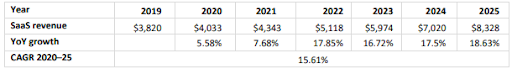

A 2021 study commissioned by the Computer & Communications Industry Association shows that the total addressable market (TAM) of software as a service (SaaS) for the US government is expected to grow by a high teens percentage in the period 2022-2025:

Figure 1: SaaS US Government market size, 2019-2025($m)

Source: Omdia

Technology giant Microsoft is in an ideal position to capture a significant percentage of the expected growth, given its leading position in several areas:

As of 2021, Microsoft held a 85% share in the office productivity software market for U.S. government institutions.

It also held a 21% market share in the cloud services space in Q1 2022 through its Azure cloud offering.

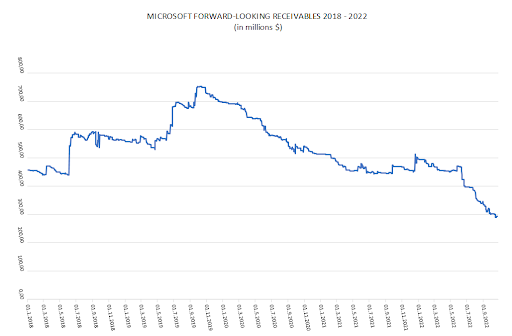

Figure 2 below shows Microsoft’s forward-looking government receivables.

Figure 2: Forward-looking receivables outstanding

Source: TenderAlpha.com

Given Microsoft’s current position in this particular market, as well as the expected growth in orders from the US Government for SaaS products and services, we think that monitoring Microsoft’s public procurement activity could be a strong indicator of the company’s performance.

Moreover, success in public procurement, measured by increase in forward-looking government receivables, could have a positive impact on the contractor’s stock price, as examined by TenderAlpha’s 'Government Receivables as a Stock Market Signal' white paper.

General Performance & Outlook

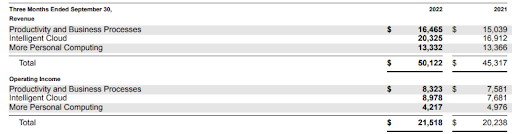

On a company level, Microsoft continues to expect double-digit revenue and operating income growth in fiscal 2023 on a constant currency (CC) basis. The company's growing Intelligent Cloud & Productivity and Business Processes segments will more than offset PC market weakness in the More Personal Computing segment.

The Intelligent Cloud segment went up in revenue 20% Y/Y, or 26% in CC for Q1 2023, while Productivity and Business Processes saw revenue growth of 9%, or 15% in CC, ahead of expectations with better-than-expected results in Office commercial and LinkedIn.

Figure 3: Microsoft Q1 2023 Results by segments

Source: Microsoft Form 10-Q For Q1 2023

In the immediate future, the company will also benefit from a higher Federal funds rate due to its sizable ($58bn) net cash position, investing the money in Activision just as interest rates are expected to drop later in 2023 and 2024.

Free cash flow for the quarter was $16.9bn, down 10% Y/Y due to a tax benefit in the prior-year quarter. Adjusted for the benefit, free cash flow was flat Y/Y.

At the end of the quarter Microsoft is sitting at a net cash position of around $58bn which should boost earnings in fiscal 2023, albeit temporarily, as the Federal Reserve is expected to start cutting rates later in 2023 and to return to its long-term neutral rate of 2.5% in 2024-2025. The closing of the Activision acquisition (currently projected in fiscal 2023) should also limit the extra interest income.

Turning to the outlook, Microsoft sees FX headwinds impacting revenues disproportionately more than costs, with a 5% hit to revenue growth partially offset by a 3% decrease in operating expenses growth. Across segments the expectations for Q2 2023 are as follows:

Figure 4: Microsoft Q2 2023 Segments Outlook

|

Segment |

Growth outlook in USD |

| Productivity & Business Processes | Up 4-6% |

| Intelligent Cloud | Up 16-18% |

| More Personal Computing | Down 15-17% |

Source: Microsoft Q1 2023 earnings transcript and author calculations

Final Remarks

Against the backdrop of an expected recession in 2023, continued partnership with the government indicates that Microsoft may enjoy the predictability of its own cash flow, which, in turn, will improve its prospects in the market as well as potentially increase its share price.

To learn more about the ways in which TenderAlpha can provide you with insightful forward-looking public procurement data, get in touch now!