It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

In this article, we will present you the Q4 results of Raytheon – an aerospace and defense conglomerate, whose government sales traditionally make nearly half of its revenue.

Key points:

* Strong recovery in commercial aviation led to 6.2% revenue growth in Q4. Sales are seen accelerating in 2023 to a growth rate of about 7.5-9%;

* Adjusted EPS came in at $4.78/share in 2022. It is expected to grow slower than sales in 2023 to $4.90-5.05/share;

* $3 billion in buybacks coupled with about $3.1 in dividends should outpace free cash flow generation in 2023 ($4.8 billion). Excess cash on hand may limit the need to draw on additional debt;

* 2025 free cash flow seen at about $9 billion;

* Backlog grew 12.8% to 175 billion, leaning more to commercial (60.6%) than defense (39.4%) orders.

Raytheon Q4 Overview

Together with its Q4 results, Raytheon announced a reorganization of its business lines:

"The three focused business segments will be Collins Aerospace, Pratt & Whitney, Raytheon Intelligence & Space, and Raytheon Missiles & Defense. The company plans to implement the reorganization during the second half of 2023 and will provide additional updates on its progress over the coming months."

Source: Raytheon Technologies Form 8-K for Q4 2022

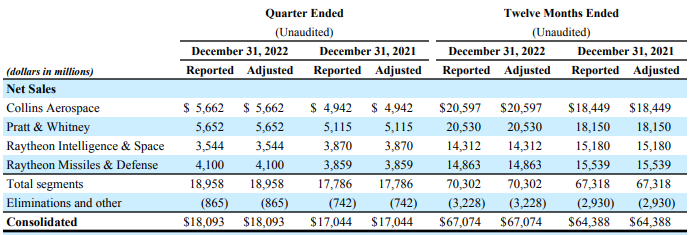

With that in mind, the four current business segments of the group are Collins Aerospace Systems at 29.9% of Q4 2022 net sales, Pratt & Whitney at 29.8%, %, Raytheon Missiles & Defense (RMD) at 21.6%, and Raytheon Intelligence & Space (RIS) at 18.7%:

Figure 1: Sales breakdown between segments

Source: Raytheon Technologies Form 8-K for Q4 2022

Operational Overview

Collins Aerospace saw the highest segment revenue growth of 15% Y/Y in Q4, driven by strength in the commercial market. The adjusted operating margin, also referred to as return on sales (ROS), was up to 13.1%, above the 12.5% achieved in 2022 and the 9.8% in 2021.

Pratt & Whitney delivered 10% Y/Y revenue growth in Q4. Strength in commercial sales offset a modest decline in military sales. While improving on a Y/Y basis, the adjusted ROS came in at 5.7%, below the 6.1% achieved in 2022 but above the 2.7% in 2021.

Raytheon Intelligence & Space (RIS) was the only segment to register a Y/Y sales decline of 8% in Q4. Excluding the effect of business divestitures in 2021 and FX, the drop was 5%. Nevertheless, the adjusted ROS of 7.8% in Q4 was down both Y/Y (year-end 2021 10.5%) and from 2022 levels (9.4%).

Raytheon Missiles & Defense recorded 6% Y/Y revenue growth. However, due to unfavorable program mix and inefficiencies, the ROS came in at 10.2% in Q4, down from 10.6% in 2022 and 12.9% in 2021.

On a group level, sales grew 6.2% Y/Y in Q4, above the 4.2% annual growth to $67 billion recorded in 2022. Likewise, adjusted EPS grew 18% in Q4 and 12% to $4.78/share in 2022.

Free cash flow saw strong growth of 71% in Q4, partially due to a 10.4% drop in capex from the prior-year period. Comparing 2022 with 2021, the result is just the opposite – free cash flow was down marginally by 3%, while capex was up by 7.2%.

Raytheon 2023 Outlook

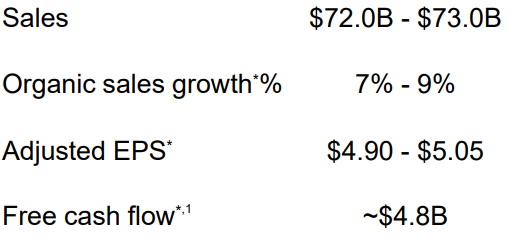

Naturally the main point of attention after the Q4 results was the new 2023 outlook:

Figure 2: Raytheon Technologies 2023 Outlook

Source: Raytheon Technologies Conference Call Presentation for Q4 2022

The sales outlook is quite upbeat, with an increase in the 7.5-9% range seen for the full year. Pensions, taxes and higher interest rates will drag down adjusted EPS growth to 2.5-5.5%. Against this positive backdrop, the free cash flow guidance of $4.8 billion is less encouraging. The figure is essentially flat on 2022, and marginally down from 2021 ($5 billion). The only positive here is that capex will grow in line with sales, at about 8.7% to $2.5 billion.

Turning to performance across divisions, Raytheon envisages a continuation of the trends observed in Q4 2022. Collins Aerospace and Pratt & Whitney should see sales increase by low double digits. RMD sales are forecast to increase low to mid-single digits, while RIS revenues are seen flat.

The company is also planning an Investor Day to update on its 2025 targets on June 19 at the Paris Air Show. The prior $10 billion free cash flow target envisaged a different treatment of R&D amortization (namely that R&D spending could be expensed for tax purposes, thus reducing the tax burden). As the company now has to pay higher taxes upfront, the new free cash flow target may be around $9 billion.

Capital Structure

Raytheon ended 2022 with $6.2 billion in cash and equivalents. Total debt was about $31.9 billion, resulting in a net debt position of $25.7 billion. The company spent $2.8 billion on stock buybacks, which coupled with $3.1 billion spent on dividends exceeded the free cash flow of $4.9 billion. However, the difference was largely compensated by holding less cash on the balance sheet rather than substantially increasing the debt position. Overall, against a market capitalization of about 147 billon the capital structure remains fairly conservative.

Looking into 2023, the company expects $3 billion in buybacks and may have to further reduce its cash and cash equivalents position.

Backlog

Despite the moderate 4.2% annual sales growth rate, the backlog grew at an even faster 12.8% Y/Y. Totaling $175 billion, the backlog is split 39.4% for defense and 60.6% for commercial aerospace. With the recovery in the commercial aviation sector the defense backlog has shrunk in significance. In 2020, defense accounted for 45% of the total backlog. In 2021 the figure was 41%.

Conclusion

Raytheon sees a full commercial air traffic recovery to 2019 levels by the end of 2023. What's more, the $858 billion U.S. defense budget is up 10% from 2022. Thus, the company will benefit from above-trend growth both on the commercial as well as the defense side.

That said, strong topline growth will not fully flow to the company's bottom line, with pensions, taxes and higher rates affecting adjusted EPS. Notwithstanding the near-term difficulties, the company is increasing capex to reach its 2025 goals with free cash flow seen in the $9 billion range.

In light of the fact that defense orders account for about 39.4% of Raytheon Technologies' backlog, public procurement activity remains an important factor to assess a company’s prospects. For more insights on Raytheon’s and other large companies’ government business, get in touch now.

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Raytheon or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.