It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

In the eighth article of our new blog series, we will present you the latest results of Textron – a company that recently won a $1.3 billion contract from the U.S. Army, which made up more than 40% of its Bell division’s revenues in 2022.

Key points:

* Strong Q4 Y/Y sales growth in Aviation (16.4%) and Industrial (16.1%). Temporary weakness in Bell (-4.9%);

* Overall revenue up 9.5% in Q4 and 3.9% in 2022. 2023 sales growth seen at 8.5% driven by Aviation and Bell;

* Manufacturing cash flow of $1.2 billion in 2022, up 2.5% Y/Y. 2023 cash flow seen down 19.4% to $0.95 billion;

* Net debt down $0.13 billion to $1.5 billion in 2022. $867 million spent on buybacks in 2022;

* Total backlog up 31.1% to $13.3 billion, with Aviation up 55%.

Textron Q4 2022 Results Overview

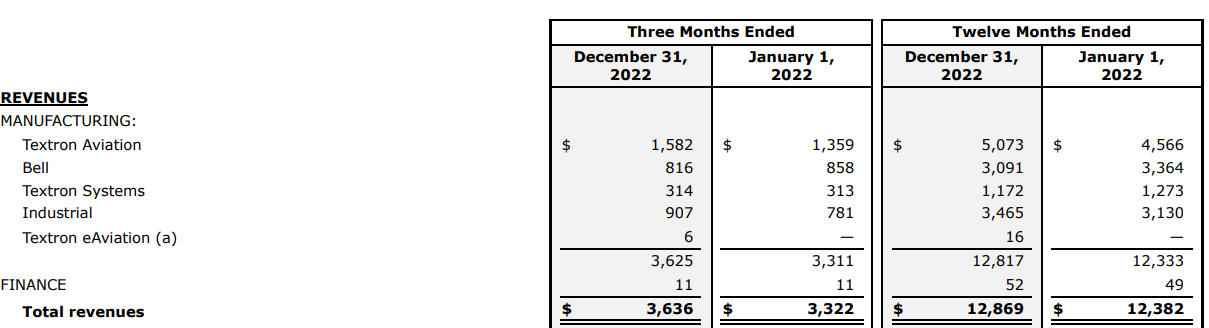

Textron reports results in four main manufacturing segments, namely Textron Aviation at 43.5% of Q4 2022 revenues, Industrial at 24.9%, Bell at 22.4%, and Textron Systems at 8.6%.

Figure 1: Q4 2022 Textron segment revenues

Source: Textron Q4 2022 Form 8-K

Textron Operational Overview

Textron Aviation delivered 16.4% Y/Y revenue growth in Q4, above the 11.1% for the full year. Growth was driven by higher commercial aircraft deliveries.

Bell was the only segment to register a sales decline in Q4, down 4.9% Y/Y. On a brighter note, the decline was smaller than the 8.1% for the full year. The poor overall performance was due to weakness in military sales despite strong commercial momentum. As discussed on the conference call, the outlook for the division is bright:

"In December, U.S. Army announced the Bell's V-280 Valor was selected as the winner of the future long range assault aircraft program competition. This award is a testament to the hard work of the Bell team that designed, built and flew V-280 prototype over the last 10 years in support of this win. The initial flyer contract award of up to $1.3 billion over the first 19 months with an initial funding of $232 million for engineering and manufacturing development related activity is currently on hold pending the outcome of protest was filed at year-end by the competing vendor."

The $1.3 billion contract is equivalent to 41.9% of Bell's 2022 revenues.

Textron Systems saw flat Y/Y sales in Q4, despite a 7.9% decrease for the full year.

Industrial sales grew 16.1% Y/Y in Q4, an acceleration to the 10.7% in 2022. The strong results were the result of strength in specialized vehicles and Kautex (the division that produces blow-molded fuel systems, selective catalytic reduction systems, clear vision systems, engine camshafts and plastic industrial packaging solutions).

On a group level, revenue was up 9.5% in Q4, well above the 3.9% full year growth rate:

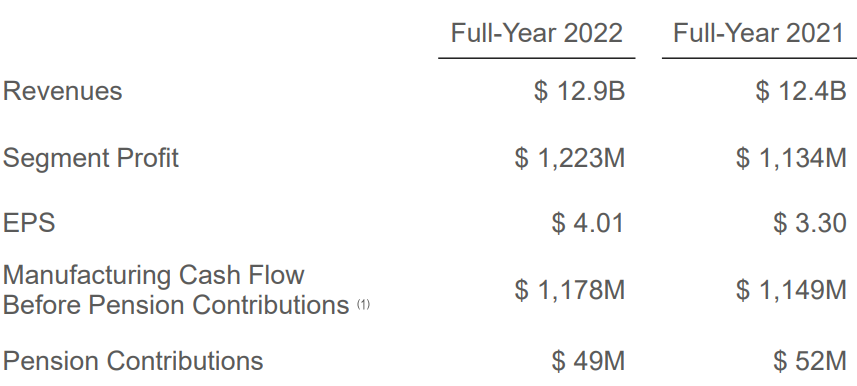

Figure 2: Textron 2022 Results Overview

Source: Textron Q4 2022 Results Presentation

Earnings per share grew 15.1% Y/Y in Q4 to $1.07, below the 21.5% full year growth rate to $4.01/share in 2022. Manufacturing cash flow before pension contribution grew 2.5% in 2022 to $1,178 million.

2023 Outlook

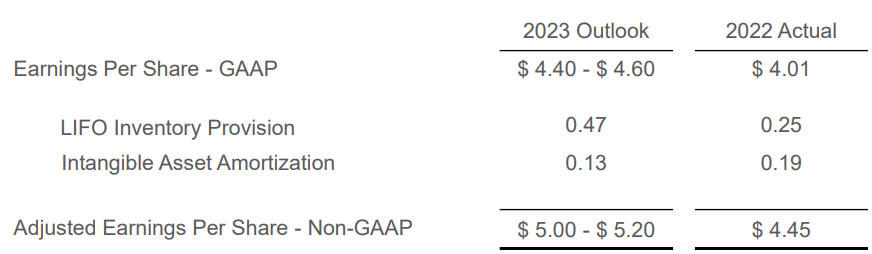

The company expects revenue of about $14 billion, up 8.5% from 2022. As explained in the Form 8-K for Q4 2022, Textron will make changes to how it reports earnings, bringing its reporting in line with defence industry practice:

For 2023, Textron will begin reporting earnings per share on an adjusted basis to exclude LIFO inventory provision and intangible amortization expense, both non-cash items, effective with the first quarter 2023 financial results.

Figure 3: Textron EPS Bridge 2022-2023

Source: Textron Q4 2022 Results Presentation

Overall, adjusted EPS should grow 14.6% to $5-5.2/share. Manufacturing cash flow before pension contribution is expected to drop 19.4% to $0.9-1 billion. Pension contributions should be in line with recent years at $50 million.

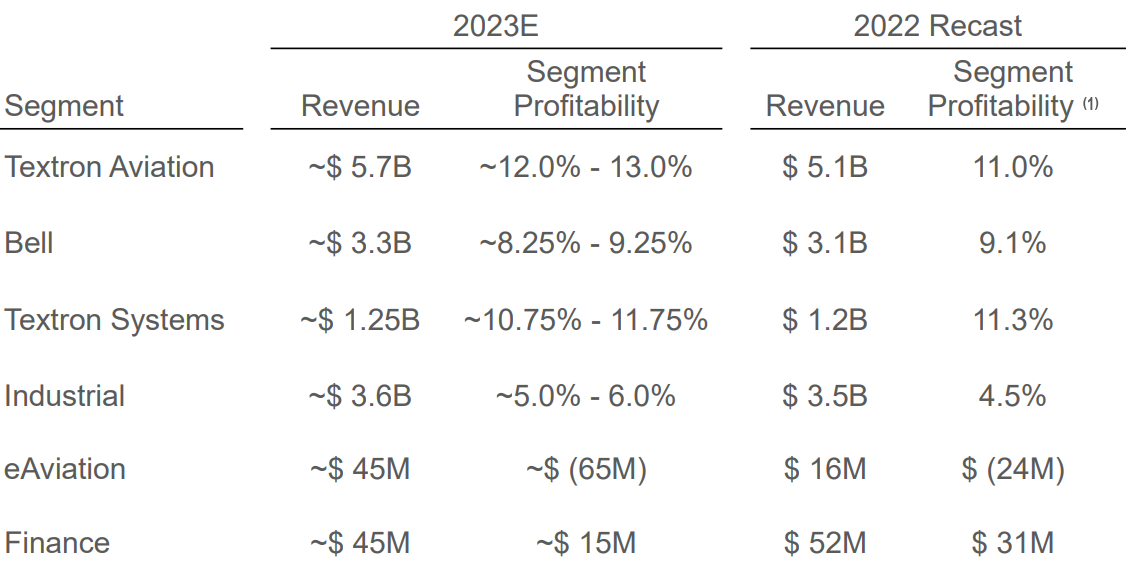

As detailed on the conference call, the outlook across divisions is:

At Aviation, we are projecting growth driven by increased deliveries across all product lines and higher aftermarket volume. At Bell, we are projecting revenue growth in 2023 on higher military revenues from the FARA program and higher commercial revenues. At Systems, we're expecting mid-single-digit revenue growth across our businesses. At Industrial, we're expecting revenue growth at specialized vehicles and Kautex.

Figure 4: Textron 2023 Segment Outlook

Source: Textron Q4 2022 Results Presentation

Textron Backlog

Total backlog grew 31.1% to $13.3 billion, driven by Aviation which grew 55% to 6.4 billion at year end. Management expects Aviation waiting times to remain at current levels and the company to operate with a substantial backlog going forward, in line with the pre-2009 model.

Capital Structure

Textron ended 2022 with a net debt of $1.5 billion, down $0.13 billion Y/Y. The decrease was primarily in the Finance Group division which helps finance aircraft and Bell helicopters. The capital structure is fairly conservative, with a market capitalization of $15.6 billion.

In the quarter, Textron returned $228 million to shareholders through share repurchases. Full year 2022 share repurchases totaled $867 million.

Conclusion

Textron should see continued revenue and margin tailwinds in 2023, primarily in the Aviation segment. The new attack helicopter award will bring a consistent revenue stream at Bell, albeit with a slightly lower margin.

Major contracts such as the $1.3-billion one from the U.S. Army indicate that monitoring Textron’s public procurement activity remains a smart move that can provide key insights into the company’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy IBM or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.