- In a study conducted by Penn State and TenderAlpha, green contract awards show a significant 5.6% return when tested in a 3-day event study analysis using market-adjusted CARs.

- TenderAlphaGlobal Green Public Procurement Contracts and Unified Global Government Contracts Data Feeds were used to analyze the impact of green contracts awards on stock price.

- Study conducted by Mihail Velikov, Assistant Professor of Finance and Han Xiao, PhD student in Finance of Penn State University.

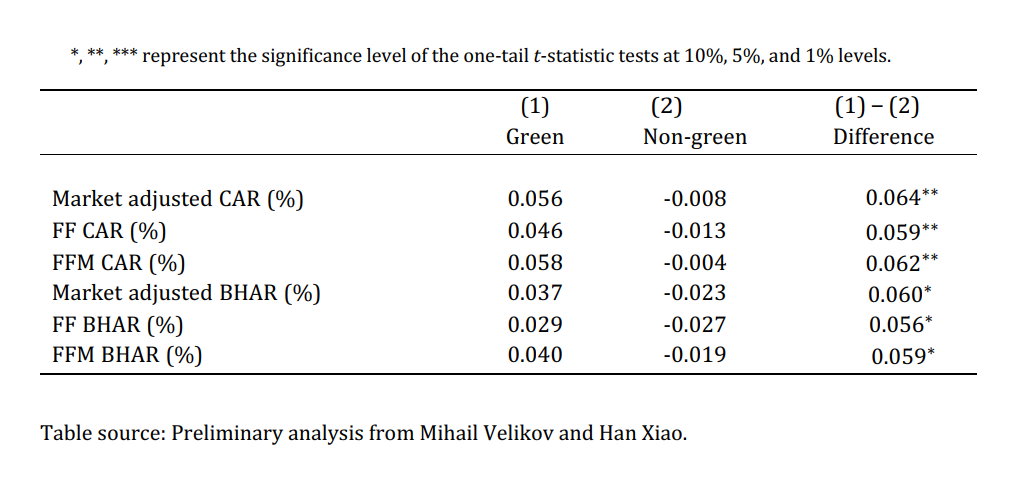

The preliminary analysis provided to TenderAlpha consisted of studying the differential response of stock prices to government procurement contract awards, with a particular emphasis on the difference between awards of “green” contracts compared to all other contracts. Table 1 below documents the average returns around “green” (around 4% of contracts) and non-green contracts. This preliminary evidence finds that on average the market responds positively to green contract awards, while its response to contract awards that are not green is slightly negative, though much closer to zero. The difference between the average returns to both types of contracts is robustly statistically significantly different from zero.

Table 1. Difference in Means Test for Stock Response to Green and Non-Green Contract Awards

This result appears to be robust to using both CARs and BHARs, and to various benchmark models used for estimating the abnormal returns. For example, using market-adjusted CARs, they find that the average green contract award sees a significant 5.6% stock price response, while the average non-green contract award yields an insignificant -0.8% stock price response.

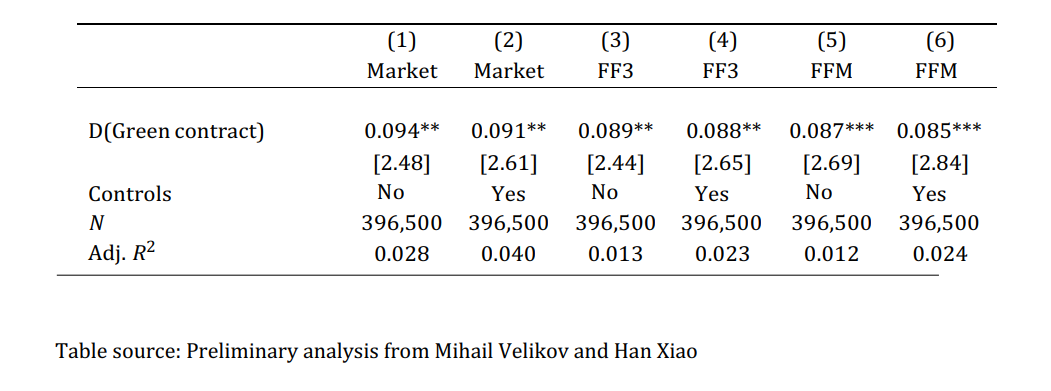

Table 2. Cumulative abnormal returns

CARi,d,m = α + βD(Green contract)i,d,m + Xi,m−1γ + ci,d,m

where CAR is the 3-day cumulative abnormal returns based on different adjustments, Market, FF3, and FFM. The dummy D(Green contract) equals to one if a given contract is classified as a green contract and zero otherwise. d represents the contract dispatching date in month m. X includes all control variables. All variables are winsorized at 0.5% level. Regressions include industry and date fixed effects. t-statistics are reported in the bracket based on standard deviations clustered at the industry and date levels. *, **, *** represent the significant level at 10%, 5%, and 1% levels. The sample is 2009 to 2019 and includes 1,588 unique firms with 396,534 firm-day (events) observations.

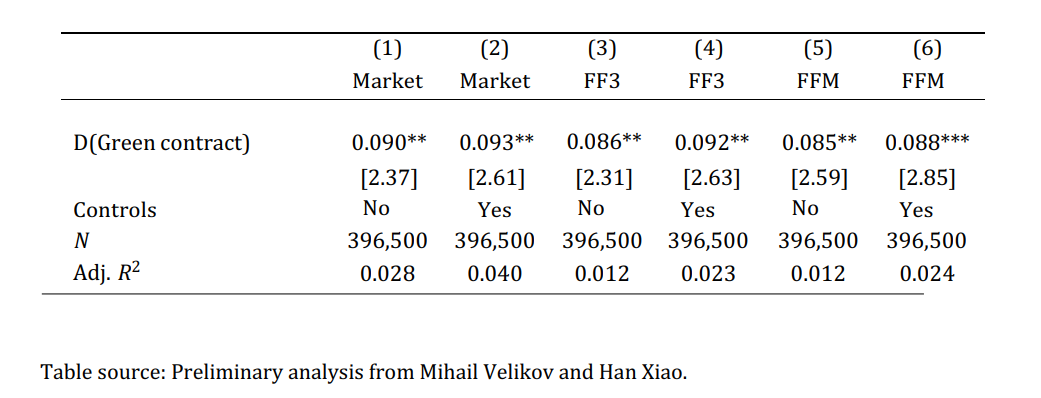

Table 3. Buy-and-Hold Abnormal Returns

BHARi,d,m = α + βD(Green contract)i,d,m + Xi,m−1γ + ci,d,m

where BHAR is the 3-day buy-and-hold abnormal returns based on different adjustments, Mar- ket, FF3, and FFM. The dummy D(Green contract) equals to one if a given contract is classified as a green contract and zero otherwise. d represents the contract dispatching date in month m. X includes all control variables. All variables are winsorized at 0.5% level. Regressions include industry and date fixed effects. t-statistics are reported in the bracket based on standard deviations clustered at the industry and date levels. *, **, *** represent the significant level at 10%, 5%, and 1% levels. The sample is 2009 to 2019 and includes 1,588 unique firms with 396,534 firm-day (events) observations.

Tables 2 and 3 show their preliminary results. The conclusion here remains similar. “Green” contract awards to firms are associated with economically and statistically significantly higher stock returns around their announcements relative to non-green contract awards. For example, using market-adjusted CARs, they estimate a coefficient of 0.091 on the green contract dummy, which is more than two standard errors above zero. Like the difference tests above, the regression results are robust to using BHARs or other benchmark models for returns.

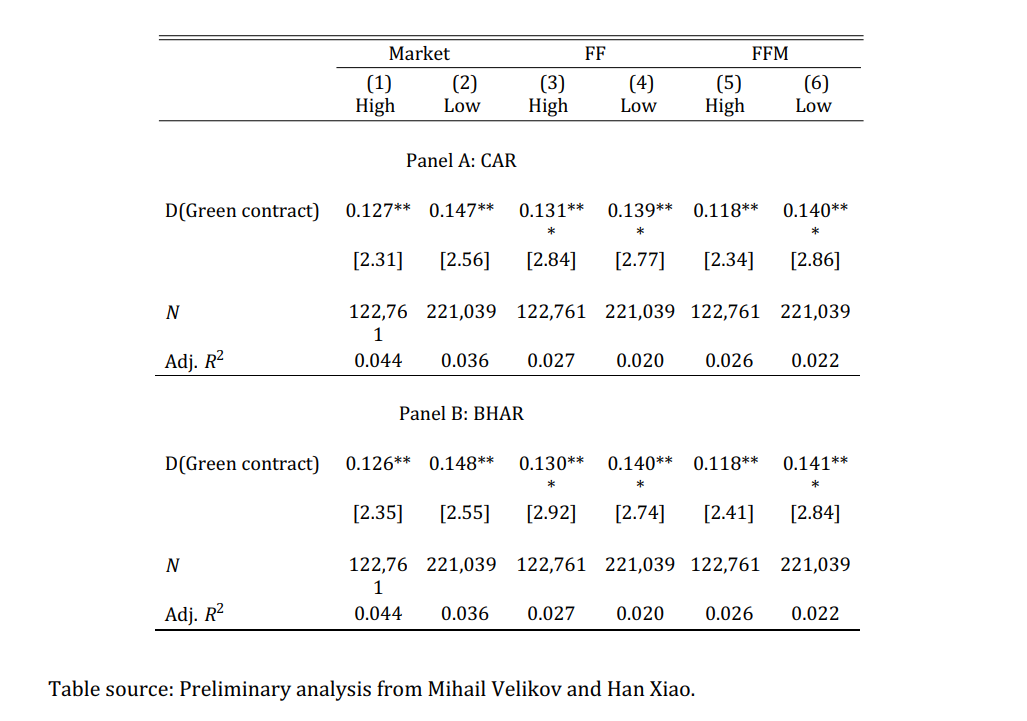

Table 4. Climate change risk

We test climate change risk effect using the Crimson Hexagon’s negative sentiment climate change news index from Engle et al. (2019). We separate the sample based on whether the AR(1) of the negative sentiment climate change news index is greater (High) or lower (Low) than the sample mean. The sample is monthly from 2009 to 2018.

The research team has also examined whether the documented difference varies based on the perception of climate change risk. To this end, they utilize the Crimson Hexagon’s negative sentiment climate change news index from Engle et al. (2019) and split their sample based on whether the AR(1) of the negative sentiment climate change news index is greater or lower than its sample mean. Table 4 shows their preliminary results. We can observe that the differential response to “green” contract awards exists both for periods with high and low climate change risk.

About TenderAlpha Global Green Public Procurement Contracts Data Feed

The research team utilized two of TenderAlpha’s products – the Global Green Public Procurement Contracts Data Feed and the Unified Global Government Contracts Data Feed. The “green” feed is the world’s first global green procurement data product specifically designated for ESG analysis. It offers monitoring of sustainable public projects as a proxy of ESG performance of more than 4000 publicly listed and over 300 000 private companies acting as government suppliers in North America and Europe regarding their participation in “green” public procurement.

The “green” contract designation comes from a proprietary, discretionary methodology created by the TenderAlpha team. The Green Contract Detection Methodology detects “green” procurement contracts defined as sustainable purchasing and environmentally based supplier choice. It features categorization of the “green” contracts (in 9 categories) and scoring (0-100) for the level of actual sustainability effect of the works/services performed under the contract and the potential impact of the contract performance (due to the selection criteria/performance clauses/type of works and services performed).

The green contracts categories, as determined by TenderAlpha, are the following:

- Generally defined as green contracts (including environmental education, compliance, public awareness services)

- Environmental life-cycle cost analysis

- Agricultural and natural resources preservation

- Energy and resource efficiency

- Renewable energy

- Recycling and waste reduction

- Reduced emissions

- Eco labels / Standards

- Green as per Legislature eco clauses (EU and US)

As an add-on to the Green Contracts Data Feed, TenderAlpha also offers The Green Company Supplement, which includes the relative weight of green procurement contract awards as a share of all procurement activity.

The relative weight is a key factor in establishing the level of dedication to environmentally sustainable projects by companies. It is calculated as a percentage data point: % of green contracts as compared to all contracts for each company. The percentage is updated dynamically with each ongoing delivery.

The Green Company Supplement is a particularly important add-on because it provides clients with an immediate extra layer of comparative analysis that would otherwise be difficult to obtain as one would only have the green activity of companies in absolute terms (and not compared to their overall activities).

Conclusion and Further Research

While the evidence so far is preliminary, it is nevertheless very promising and shows that “green” contract awards are associated with significantly more positive market response, on average. As part of the complete study, our team will also examine the following:

- The effect of green contract awards on companies with various ESG score (High, Medium, Low). The expectation there is to observe a significant positive influence on the stock price of companies with lower ESG score following a green contract award.

- The impact of different categories of green contracts as determined by TenderAlpha™ (Environmental, Recycling, Renewable Energy, etc.) on the awarded company’s stock price

TenderAlpha believes that the growing interest in ESG investment will propel more companies to pursue a “greener” approach to their operations in order to attract investors. As this is happening, however, the latter will need reliable sources of information to get a clear picture of the true sustainability efforts performed by a company.

In fact, as there is little verification of what businesses report with regards to their environmental performance, there are often instances of greenwashing, or the process of conveying a false impression or providing misleading information about how a company's products are more environmentally sound.

TenderAlpha’s Green Public Procurement Contracts Data Feed could be a useful tool in tackling the greenwashing issue as it makes use only of official government data that is open to public. In other words, the data is not self-reported by the companies. Instead, it shows which businesses are the most successful in delivering environmentally friendly products and services to the government.

In addition, TenderAlpha’s Green Contracts Data Feed can be beneficial for investors thanks to the high frequency of its updates. New public tenders are added daily, enabling investors to monitor the awarding of “green” contracts almost in real-time thus providing them with early information of contract awardees.

We may conclude that the investment signal we have discovered, will remain strong over time. As more “green” tenders are procured, it is reasonable to expect that the scope of companies will also widen. This will lead to more business opportunities for companies who want to participate in green government contracting, as well as for investors who will have a larger pool of potential investment options.