It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our Government Receivables as a Stock Market Signal white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Booz Allen Hamilton recently reported its Q4 Fiscal 2024 results and below we will provide a brief analysis of the company’s recent performance.

Key points:

* Booz Allen Hamilton has consistently derived over 96% of its revenue from the U.S. government since 2019.

* The company delivered 15% Y/Y revenue growth in fiscal 2024, boosting adjusted EPS by 21% Y/Y.

* However backlog and staff grew by 7-8% Y/Y, indicating a slower underlying pace of growth.

* As a result, in fiscal 2025, revenue and EPS are expected to expand by 8-9%.

* The company is the largest artificial intelligence supplier to the U.S. government, with AI accounting for 6% of total revenue.

Booz Allen Hamilton Q4 Fiscal 2024 Results Overview

Booz Allen Hamilton, or BAH for short, has a fiscal year ending in March. We previously covered BAH’s Q1 2024 results in part 53 of our Top Government Contractors series here. Below we will highlight the progress achieved by the company in the final quarter and full year of fiscal 2024.

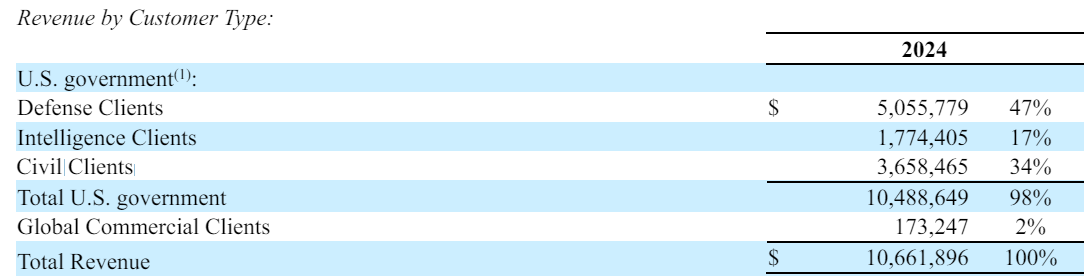

Booz Allen Hamilton reports revenues in three main customer segments, namely Defense Clients at 47% of fiscal 2024 revenue, Intelligence Clients at 17%, and Civil Clients at 34% of fiscal 2024 revenue:

Figure 1: Booz Allen Hamilton segment revenues in fiscal 2024

Source: Booz Allen Hamilton Form 10-K for 2024

Due to the small size of the commercial business, at just 2% of revenues, going forward, the company will no longer report it separately.

Operational Overview

Defense Clients was the fastest-growing segment in fiscal 2024, with revenue up 20% Y/Y. Intelligence Clients delivered the weakest performance as sales only grew 5% Y/Y in 2024. Civil Clients performance was more robust, producing an 18% Y/Y revenue growth in 2024.

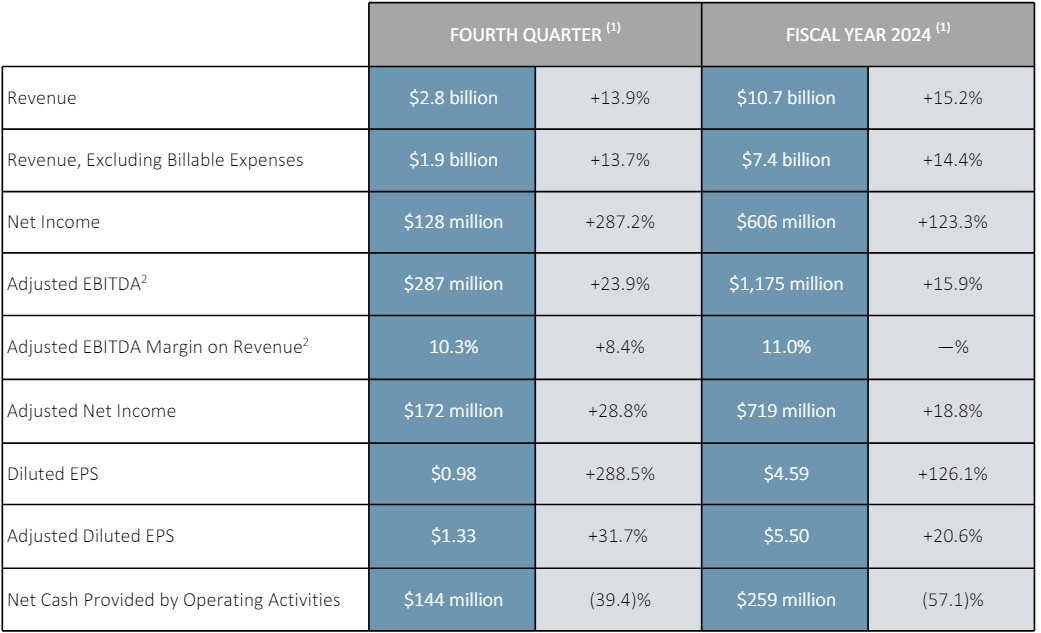

On a consolidated basis, sales increased 15% Y/Y in fiscal 2024 (2023: +11%). Adjusted EBITDA grew 16% Y/Y. Adjusted EPS was $1.33/share in Q4 and $5.50/share for the full year, up 32% and 21% Y/Y respectively:

Figure 2: Booz Allen Hamilton Q4 and full-year 2024 result highlights

Source: Booz Allen Hamilton Q4 2024 Results Presentation

2024 Outlook

While Q4 2024 performance was generally in line with the robust full-year performance, BAH expects a marked slowdown going into fiscal 2025:

Figure 3: Booz Allen Hamilton fiscal 2025 outlook

Source: Booz Allen Hamilton Q4 2024 Results Presentation

- Revenue is seen 8-11% higher Y/Y.

- Adjusted EBITDA is likewise expected to rise 9% Y/Y.

- Adjusted EPS is expected to grow 8% Y/Y.

As a whole, the outlook is based on a stronger H1 2025 result driven by the momentum of 2024 and a more uncertain path following the presidential election on November 5.

Backlog Developments

Backlog performance was nuanced - Booz Allen Hamilton ended fiscal 2024 with a backlog of $33.8 billion, up 8% Y/Y. Impressive in itself, the company’s backlog actually registered a second consecutive quarter of declines. This is visible from the book-to-bill ratio, which stood at 0.82 in Q4 but 1.25 for the trailing twelve months.

The company’s slower underlying growth is also evident from its hiring pace, with total staff up 7% relative to the prior year, with a similar increase forecast for 2025. That said, CFO Matt Calderone noted on the conference call that “our fiscal year 2025 qualified pipeline is robust, standing at $63.8 billion or 38% higher than a year ago. This includes a number of exciting opportunities across the portfolio as well as some accelerated recompetes in our civil and defense businesses”.

Capital Structure

Booz Allen Hamilton ended fiscal 2024 with a net debt of $2.9 billion, implying that net debt accounts for just 12% of the company’s enterprise value, making it one of the least indebted companies in our top government contractors series. In 2024, the company deployed cash primarily towards dividends (37% of discretionary cash deployment), buybacks (60%), and strategic M&A (only 3%).

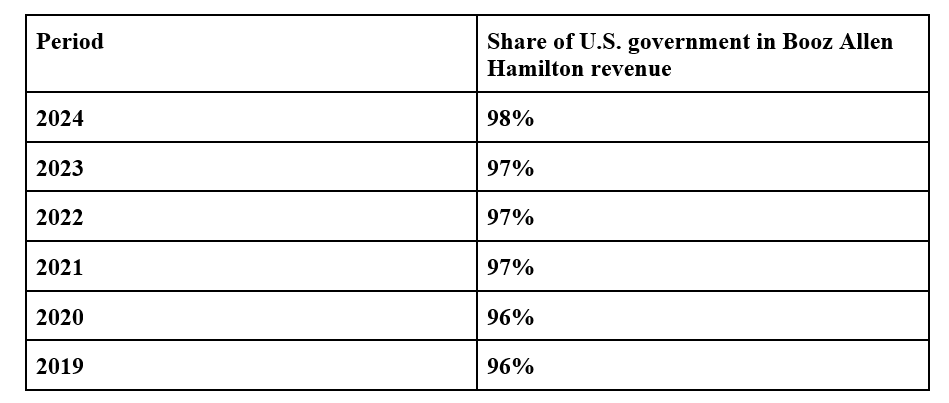

Government Contracting Exposure

Booz Allen Hamilton has consistently relied on the U.S. government for 97-98% of its revenue over the past three fiscal years.

Figure 4: Booz Allen Hamilton U.S. Government Contracts Evolution

Source: Booz Allen Hamilton Company Filings

Going back to 2019, we observe that the significance of the U.S. government for BAH revenue has increased by 2% since the COVID-19 pandemic.

Booz Allen Hamilton also highlighted on its conference call that it was recognized as the leading provider of artificial intelligence (AI) services to the U.S. government by Deltek’s 2024 report. BAH reported some $600 million in AI-related revenue in 2024 (about 6% of total company revenue), with expectations for an increase to $1 billion in the next couple of years.

Conclusion

After delivering a low-double digit gain in both revenue and earnings per share, BAH expects growth to moderate in 2025, with the early signs already visible in the company’s backlog developments and hiring pace. As such, a high-single digit increase in revenue and EPS is the company’s objective for fiscal 2025.

The significance of the U.S. government, at 98% of Booz Allen Hamilton revenues, has grown over the past years, and the company will no longer report commercial activities separately going forward. Evidently, BAH is targeting squarely the government contracting market in its future growth strategy.

In light of the fact that government customers account for almost all of Booz Allen Hamilton’s revenue, monitoring the company’s public procurement activity appears to be a smart move that can provide key insights into its financial health.

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Booz Allen Hamilton or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.