It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Booz Allen Hamilton recently reported its Q1 Fiscal 2024 results and below we will provide a brief analysis of the company’s performance between April and June of this year.

Key points:

* 98% of all sales to U.S. government, up 1% Y/Y;

* 18% Y/Y revenue increase in Q1, with broad-based growth across segments. Full-year outlook maintained at 9% in light of budget uncertainty;

* Adjusted Diluted EPS of $1.47/share in Q1 (+30.1% Y/Y). Full-year outlook unchanged at about $4.88/share, up 6.9% Y/Y;

* Net cash provided by operating activities is now expected to plummet 65% Y/Y to $210 million due to a $377.5 million settlement with the Department of Justice;

* The backlog is up 9.4% Y/Y in Q1 while the trailing twelve month book-to-bill stands at 1.24.

Booz Allen Hamilton Q1 Fiscal 2024 Results Overview

We previously covered Booz Allen Hamilton's Q4 2023 results (the company has a fiscal year ending in March) in part 37 of our Top Government Contractors series here. Below we will highlight the progress achieved in the first quarter of fiscal 2024.

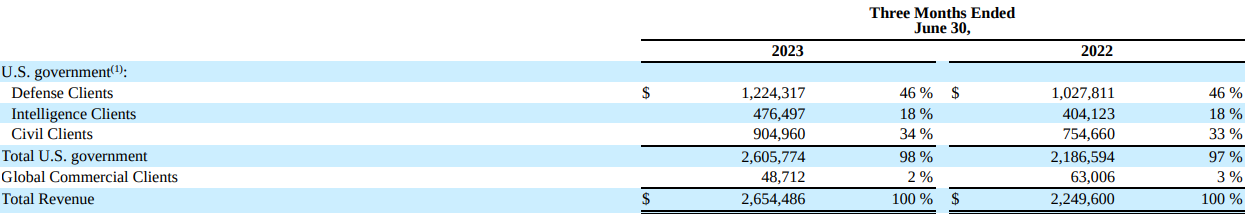

Booz Allen Hamilton reports revenues in three main customer segments, namely Defense Clients at 46% of Q1 2024 revenue, Intelligence Clients at 18% and Civil Clients at 34% of Q1 2024 revenue:

Figure 1: Booz Allen Hamilton segment revenues for Q1 of fiscal 2024. All amounts in thousands

Source: Booz Allen Hamilton Form 10-Q for Q1 fiscal 2024

Overall, 98% of sales were made to the U.S. government, up 1% Y/Y, partially the result of a business disposal in commercial customers.

Operational Overview

Defense Clients was the second-best performing segment in Q1 2024, growing revenues 19.1% (2023: +6.6%).

Intelligence Clients was the weakest segment on a relative basis, delivering 17.9% top-line growth in Q1 2024 (2023: +7.3%). The company expects the segment to continue to underperform in 2024, driven by tough Y/Y comparables and the roll-off of a large classified contract.

Civil Clients was the top performing segment in Q1 2024, registering a 19.9% revenue increase (2023: +19.4%). Growth was driven by cloud and digital transformation, especially in health agencies.

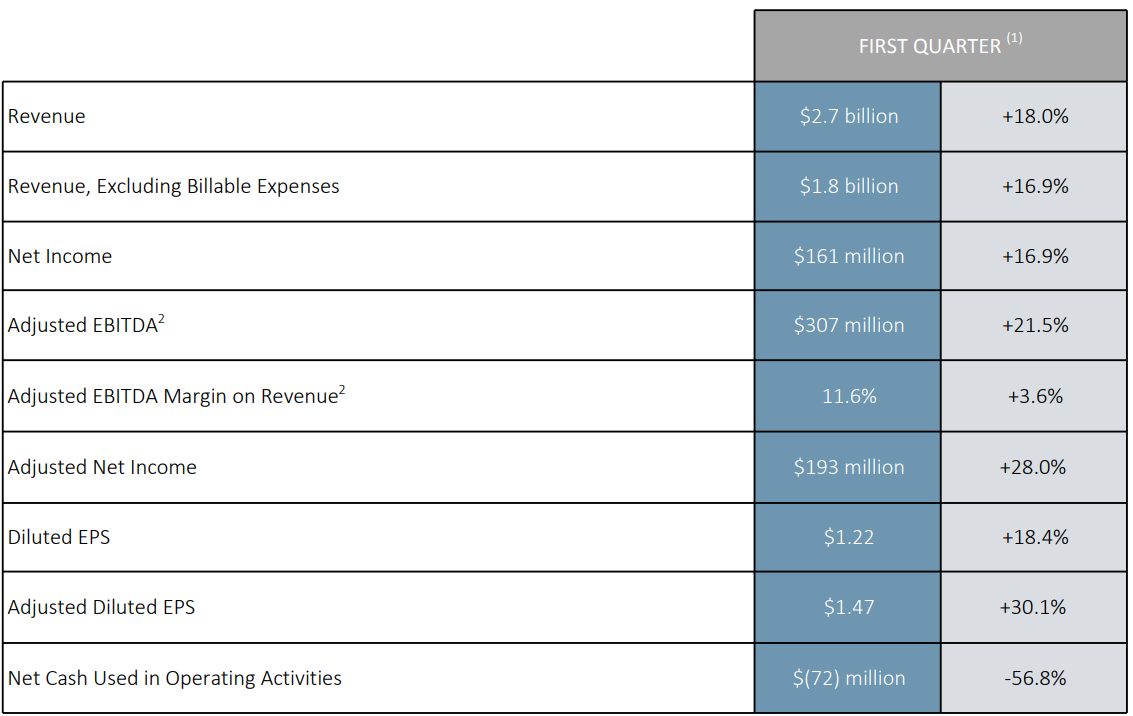

On a consolidated basis, sales increased 18% Y/Y in Q1 2024 (2023: +10.7%):

Figure 2: Booz Allen Hamilton Q1 2024 key performance indicators

Source: Booz Allen Hamilton Results Presentation for Q1 2024

- Adjusted EBITDA grew 21.5% in Q1 (2023: +8.4%), with the adjusted EBITDA margin improving 0.4% Y/Y to 11.6%.

- Adjusted Diluted EPS was $1.47/share in Q1 (+30.1% Y/Y), compared to $4.56/share in full year 2023 (+8.3% Y/Y). E

- Free cash flow was negative 82 million in Q1 2024.

Updated 2024 Outlook

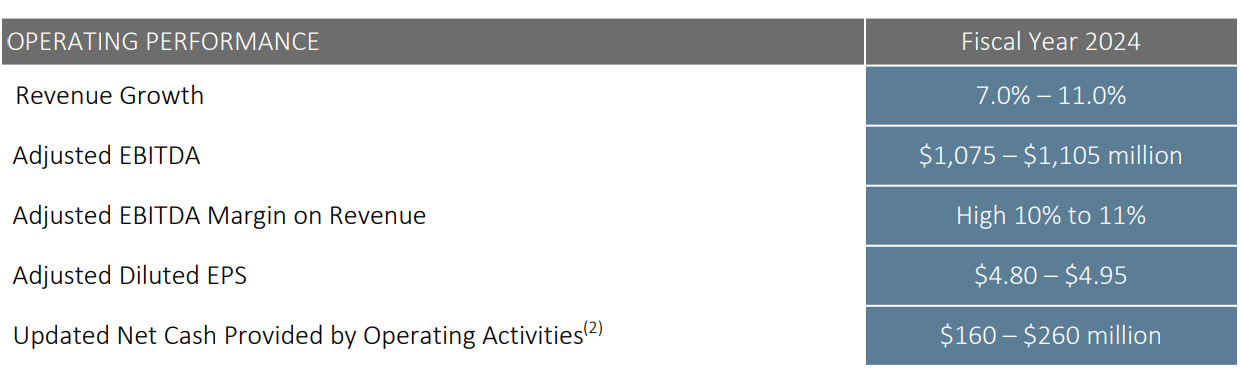

Despite the stellar performance in Q1, Booz Allen Hamilton kept its full-year guidance largely unchanged, with the only update being a significant 60% cut to net cash provided by operating activities:

Figure 3: Booz Allen Hamilton 2024 Guidance

Source: Booz Allen Hamilton Q1 2024 Results Presentation

- Revenue is expected to increase by 9% Y/Y.

- Adjusted Diluted EPS is seen at about $4.88/share, up 6.9% Y/Y.

- Adjusted EBITDA is set to rise to $1,090 million, + 7.5% Y/Y, with a goal of $1,250 million in fiscal 2025.

- Net cash provided by operating activities is now expected to plummet 65% to $210 million. The reduction is due to a $377.5 million settlement with the Department of Justice on an investigation into cost accounting in the 2011-2021 period.

Backlog

Despite stellar revenue growth, the backlog only grew 0.3% Q/Q in Q1 to $31.3 billion, with a book-to-bill ratio of 1.03 in the quarter. The backlog is up 9.4% Y/Y while the trailing twelve-month book-to-bill is 1.24.

Capital Structure

Booz Allen Hamilton ended Q1 with a net debt of about $2.7 billion. Net debt is set to expand to about $3 billion following the $377.5 million settlement with the Department of Justice (which was paid in Q2). This compares with a market capitalization of $14.6 billion. In Q1 2024, the company spent:

- $63 million on dividends.

- $112.4 million on buybacks.

- $4 million on M&A.

The low level of M&A is probably set to continue, as highlighted by CEO Horacio Rozanski on the conference call:

While strategic acquisitions continue to be a priority, our pipeline of opportunities is more limited than we expected. On balance, this probably means that we will reach our multiyear targets through greater organic contribution while simultaneously retaining increased flexibility to deploy capital in response to market conditions.

Government Contracting Dynamics

Booz Allen Hamilton placed specific emphasis on Q2 contract wins, with CEO Horacio Rozanski elaborating the opportunities and threats relating to the company's government procurement activity:

Our portfolio, as you've known us for a long time, it used to be so many small contracts and very few large ones. And now the portfolio has still a lot of small contracts and a lot of small task orders into the thousands and a significant share of really large programs.

On the large program side, we - those when they get recompeted, each - any one of those can move the needle some. What we're seeing there is that recompetes come in generally a larger scope and even larger ceiling than the original programs. So that's obviously a source of upside, and it's a source of increased competition because they attract more attention.

Conclusion

Booz Allen Hamilton started fiscal 2024 on a strong footing but uncertainty around the Federal budget kept it from increasing its full year outlook. Nevertheless, the company is laying the foundation for sustainable growth, increasing client-facing staff by 12.5% Y/Y in Q1.

With revenue growth of 18% Y/Y in the first quarter (16.9% without billable expenses), Booz Allen Hamilton had its strongest ever growth as a public company. This puts it in a strong position to outperform its 7-11% full year growth outlook.

In light of the fact that 98% of Booz Allen Hamilton sales are to the U.S. government, monitoring the company’s public procurement activity remains a smart move that can provide key insights into its financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Booz Allen Hamilton or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.