It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at another company that we have previously covered in this series. CACI International recently reported its Q4 2023 results and below we will provide a brief analysis of the contractor’s latest performance.

Key points:

* Government contracting share in 2023 unchanged Y/Y at 94.8%, with growth in Department of Defense revenue (+11.2% Y/Y) offsetting weakness at Federal Civilian Agencies (-1% Y/Y).

* 3.7% Y/Y revenue growth in Q4. Initial 2024 outlook seen at +5.9%.

* $5.30/share in Q4 EPS, +16.7% Y/Y, and $18.83/share for the full year, +5.7% Y/Y. Growth in 2024 anticipated at +4.5%.

* Only $282 million in free cash flow for 2023, down 59.4% Y/Y. 40% rebound forecasted in 2024 to over $400 million.

* Stronger H2 2024 relative to H1 2024 expected as new contracts take time to fully ramp up operations.

CACI International Q4 2023 Results Overview

CACI International has a fiscal year ending in June. We previously covered the company's Q3 2023 results in part 31 of our Top Government Contractors series here. Below we will highlight the progress achieved by the company in Q4 2023 and its plans for fiscal 2024.

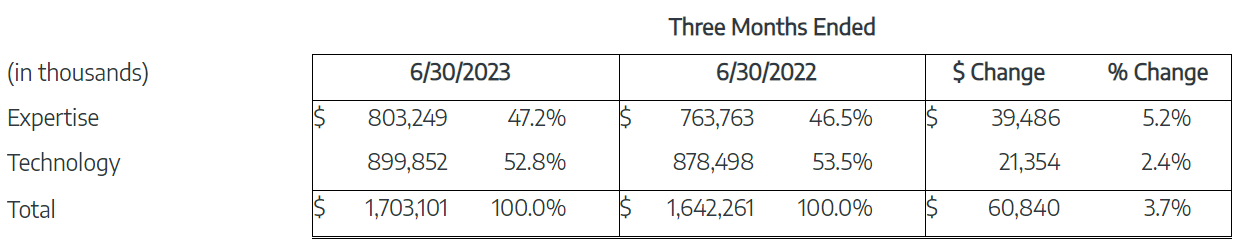

CACI reports results in two main business segments – Expertise (Consulting, Business analysis, Software development and Operations support) at 47.2% of Q4 2023 revenues and Technology (Data platforms, AI, Networks, Cyber security) at 52.8% of Q4 2023 revenues:

Figure 1: CACI Q4 2023 Results by Segment

Source: CACI International Q4 2023 Earnings Release

Operational Overview

Expertise revenue grew 5.2% Y/Y in Q4, below the fiscal 2023 growth rate of 7.7%. For reference, growth was negative in both 2022 (-3.5%) and 2021 (-1%).

Technology sales increased 2.4% Y/Y in Q4, again below the year-to-date growth rate of 8.3%. Q4 delivered the weakest growth rate going back to 2022 (8.5%) and 2021 (13%).

On a company level, revenue grew 3.7% Y/Y in Q4, well below the 8% growth rate in 2023 (2022 +3%). The adjusted EBITDA margin was 9.6% in Q4, again worse than the 10.7% 2023 full year result (2022 10.3% margin). Adjusted EPS was $5.30/share in Q4, +16.7% Y/Y, and $18.83/share year-to-date, +5.7% Y/Y. The strong Q4 performance was helped by a lower tax rate and a reduced share count.

Free cash flow was $282 million in 2023, down 59.4% relative to 2022, driven by non-recurring items and changes to the capitalization of R&D expenditures.

2024 Outlook

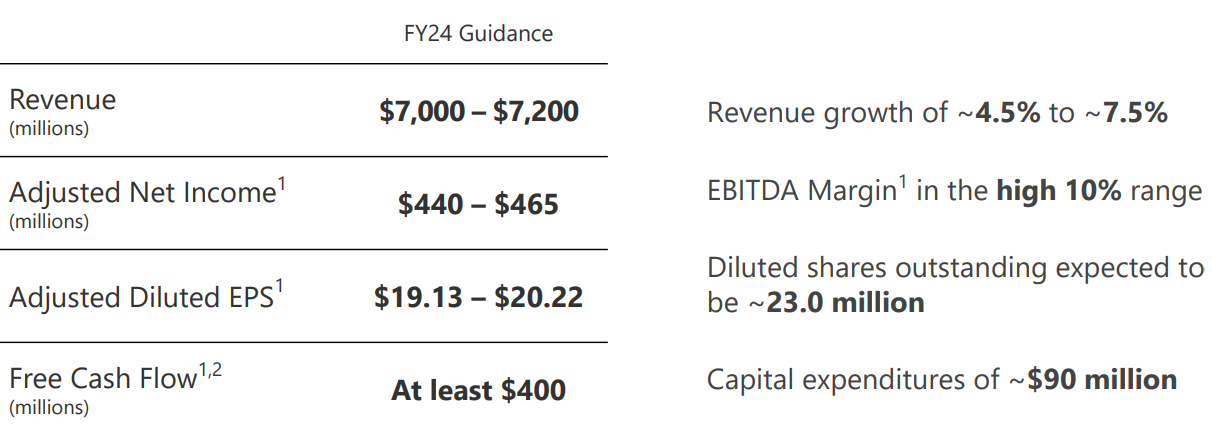

Despite the slowdown in top-line performance in Q4, CACI's initial 2024 guidance envisages an acceleration in revenue growth:

Figure 2: CACI Initial 2024 Guidance

Source: CACI Earnings Presentation for Q4 2023

Taking the midpoint of each key performance indicator:

- Revenue is seen 5.9% higher relative to 2023.

- EPS is expected to grow 4.5% from the prior year.

- Free cash flow should improve by at least 40% to over $400 million

Capital expenditures are seen some 20% higher in 2024 as CACI continues to build capacity to meet increased customer demand.

In 2024, the company expects 84% of its revenue to come from existing programs, 10% from recompetes and about 6% from new business.

Backlog

While revenue growth was arguably weak in Q4, backlog growth re-accelerated to 11% Y/Y and now stands at $25.8 billion, with a trailing twelve-month book-to-bill ratio of 1.5.

Contract awards were $2.3 billion in Q4 (+53.3% Y/Y), with 70% representing new business for the company. The largest single contract was a seven-year single-award indefinite delivery indefinite quantity (IDIQ) mission technology contract, called Spectral, with a $1.2 billion ceiling for the U.S. Navy’s Naval Information Warfare Systems Command (NAVWAR).

Capital Structure

CACI ended Q4 with a net debt of around $1.6 billion, down 6% Q/Q. With a return to free cash flow growth and an increasing share price (the market capitalization stands at $7.8 billion), the capital structure is gradually shifting in a conservative direction with less debt. That said, in light of hedging its interest rates at around 4.6%, CACI will prioritize M&A and share repurchases when allocating its free cash flow.

Shares outstanding were 22.8 million as of July 27, 2023, with CACI factoring in a 23 million share count for its 2024 EPS outlook, notwithstanding the $0.5 billion remaining on its latest share repurchase authorization.

Government Contracting Trends

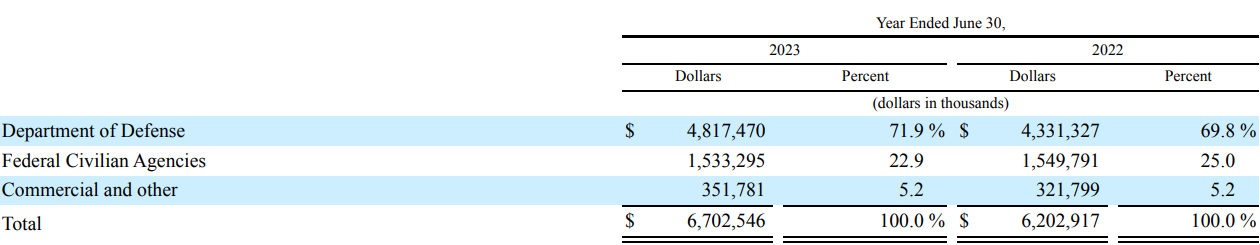

From a customer standpoint, CACI has the greatest exposure to the Department of Defense at 71.9% of 2023 revenues, Federal Civilian Agencies at 22.9% and Commercial and other at just 5.2% of 2023 revenues:

Figure 3: CACI 2023 Customer breakdown

Source: CACI International Form 10-K for Q4 2023

Relative to 2022, the overall government contracting share in 2023 remained unchanged at 94.8%, with growth in Department of Defense revenue (+11.2% Y/Y) offsetting weakness at Federal Civilian Agencies (-1% Y/Y).

Conclusion

CACI should see revenue accelerated from the rate achieved in Q4 2023, with the company forecasting a stronger H2 2024 relative to H1. This is due to some of the new contract wins having a smaller revenue contribution initially, with the usual design and planning stage weighing on revenue recognition.

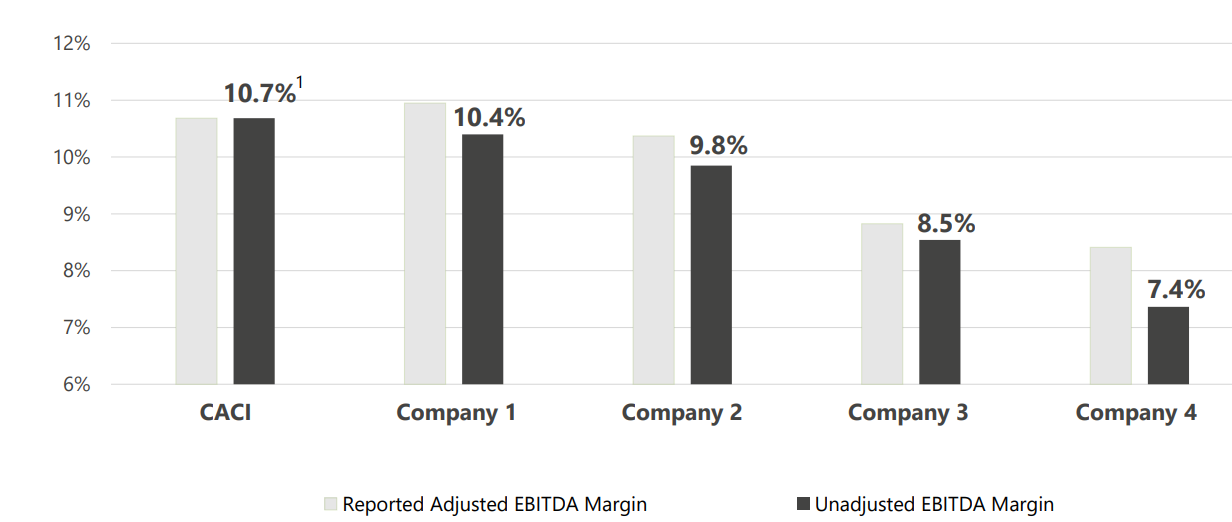

The margin profile of the business is set to remain stable, with 2024 being a peak year for capital expenditures as CACI builds its photonics production capabilities. That said, even a stable margin is an achievement given the leading position CACI occupies in the sector:

Figure 4: CACI EBITDA margins relative to competition

Source: CACI Earnings Presentation for Q4 2023

In light of the fact that around 95% of CACI's revenues over the past 3 years have been from the Department of Defense and Federal civilian agencies, monitoring its public procurement activity remains a smart move that can provide key insights into its financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy CACI or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.